A rate cut of 50 basis points has brought short-term boost to the market, but the market's expectations for the future economic prospects of the United States are seriously divided. Some investors are optimistic about an economic soft landing, while others remain vigilant about inflation and geopolitical risks.

By BitpushNews

On Wednesday afternoon local time, Federal Reserve Chairman Jerome Powell announced a 50 basis point cut in the benchmark interest rate to a range of 4.75% - 5.0%, marking the beginning of a loose monetary policy cycle in the United States.

In addition to announcing the first rate cut in over four years, the latest FOMC forecast shows that the Fed will cut interest rates twice more in 2024, with most officials expecting a total of 100 basis points of cuts by the central bank this year. It is expected that the interest rate will further decrease in 2025, with a projected value of 3.4%, and the long-term rate will bottom out at 2.9%. This usually helps stimulate the market, as traders tend to allocate risk assets in anticipation of the return of loose monetary policy.

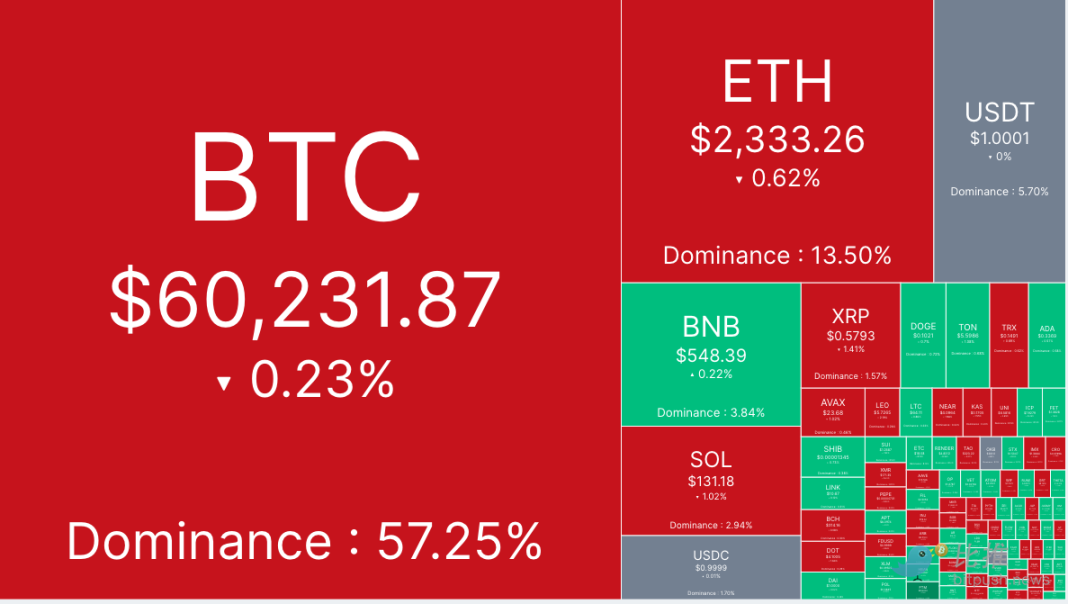

Bitcoin data shows that Bitcoin quickly surged and retraced during the day, soaring from a support level of $60,000 to an intraday high of $61,357, and then returning to a support level near $60,000. At the time of writing, the trading price of Bitcoin is $60,231, with a 24-hour volatility of less than 1%.

The response in the altcoin market varied. Among the top 200 tokens, ZetaChain led the way with a 20.6% increase, followed by Saga (SAGA) and Nervos Network (CKB), which rose by 13.7% and 11% respectively. KuCoin Token (KCS) was the biggest decliner, falling by 6.1%, while OriginTrail (TRAC) fell by 5% and Echelon Prime (PRIME) fell by 4.3%.

The current overall market value of cryptocurrencies is $2.09 trillion, with Bitcoin's market share at 57.2%.

In the traditional markets, after the announcement of the rate cut, the US stock market surged significantly and then fell back. At the close, the S&P, Dow Jones, and Nasdaq indices all fell by 0.29%, 0.25%, and 0.31% respectively. Spot gold broke through $2,600 per ounce for the first time during Powell's press conference, but then gave back its gains, with the trading price at the time of writing at $2,557.30 per ounce, a decrease of 0.46% for the day.

Expectations for increased volatility

Joel Kruger, market strategist at LMAX Group, stated in a report, "The Fed has met the market's demand by cutting rates by 50 basis points. Now that the market has priced in loose policy to such an extent, the next concern will be whether the market can continue to be optimistic about risk assets under the Fed's future loose policy."

From a technical perspective, analysts at Secure Digital Markets pointed out that on Tuesday, BTC's attempt to break through $61,000 failed, and the price fell after Wall Street closed. The daily chart shows a clear bearish rejection at the 100-day moving average, and a continued low trend over the past month.

Arthur Hayes, co-founder of BitMEX and Chief Investment Officer of Maelstrom, also issued a warning about the outlook for asset prices after the first rate cut, stating that it could trigger a significant decline in risk assets.

He said, "I think the Fed's rate cut is a huge mistake, because the US government is printing and spending the most money in peacetime, although I think many people are expecting a rate cut, which means they think the stock market and other things will get more chaotic, but I think the market will collapse a few days after the Fed's rate cut."

Although historically, a loose liquidity cycle has been favorable for BTC, Hayes warned that this move could exacerbate inflationary pressures and push up the Japanese yen (JPY), leading to widespread risk aversion. He stated, "The rate cut is a mistake now, because inflation remains a long-term problem for the United States, driven primarily by government spending. Cheaper borrowing will only add fuel to inflation."

He also stated that the potential rate cut could lead to a market decline, as it would "narrow the spread between the dollar and the yen" (previously in early August, a large number of investors closing out yen-based arbitrage trades triggered a crash, with BTC briefly retreating below $50,000).

Eamonn Gashier, founder and CEO of Block Scholes, also issued a warning about the impact of the newly announced rate cut on the market and yen arbitrage trades.

In a report, Gashier stated, "A 50 basis point rate cut indicates that the Fed is more concerned about deteriorating labor market conditions than a second inflation event. Further rate cuts will weaken the dollar and may lead to a slight rise in the yen/dollar. While it is expected that the Bank of Japan will pause its rate hikes, a softening dollar may lead to another round of yen arbitrage trade closures and may impact risk assets."

He pointed out, "Given the correlation between Bitcoin and the US stock market since the launch of the Bitcoin ETF, the performance of the S&P 500 index in past rate cut cycles can serve as a useful indicator for future expectations. Historically, recession cycles triggered by a 50 basis point rate cut have started against a backdrop of widespread concerns about macroeconomic weakness, leading to a prolonged downturn in risk assets. However, this rate cut may be different, as it can be seen as the Fed taking additional measures to strengthen the labor market."

A rate cut of 50 basis points has brought short-term boost to the market, but the market's expectations for the future economic prospects of the United States are seriously divided. Some investors are optimistic about an economic soft landing, while others remain vigilant about inflation and geopolitical risks. Therefore, in the short term, the market trend may be more complex and volatile.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。