Despite the significant increase in the cryptocurrency market and alternative coins, many new projects have performed poorly due to the proliferation of new tokens and diluted attention, making institutional support a key factor for success.

Author: @ysiu

Translation: Plain Blockchain

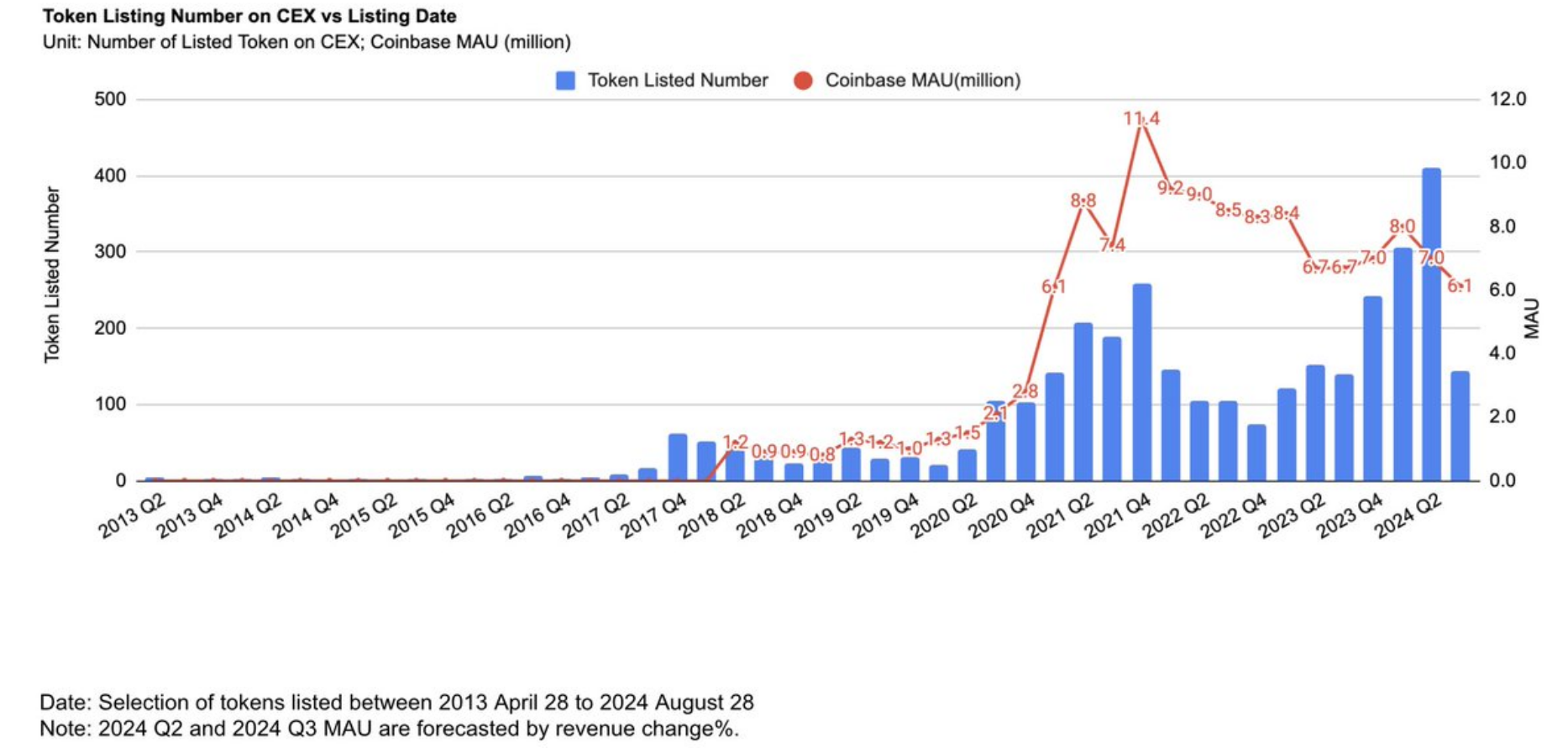

The overall cryptocurrency market has grown by over $2 trillion year-on-year, with alternative coins collectively rising by 70%. So, why have many recently launched projects performed poorly? The main reason is diluted attention, as millions of new tokens were launched in 2024.

@pumpdotfun alone was responsible for the launch of over 2 million Memecoins, greatly diluting overall attention. For the network, institutional involvement has become more critical than ever, as evidenced by the launch of the Bitcoin ETF.

Does the increase in token listings indicate a focus on quantity rather than quality?

Users may feel overwhelmed by the choices, leading to reduced activity on platforms like Coinbase. Due to market volatility, regulatory issues, or a lack of compelling use cases, they may feel fatigued or uninterested in new tokens.

Institutional support is one of the reasons why tokens such as $MOCA, $SOL, $BNB, and $TON have performed well. As @blockchaingmg stated, "MOCA Token from @animocabrands is the only bright spot, with a 51% increase from its issuance price."

@animocabrands is now expanding its investments to include listed tokens, focusing on their portfolio. In this competitive market, Web3 projects that can attract institutional attention will have an easier time standing out, partially alleviating the issue of diluted attention.

Various viewpoints have been thoroughly analyzed by @hosseeb and other experts, with one of the most notable reasons being high FDV. While there are many influencing factors, the conclusion is that these issues are not fundamental.

Currently, the rate of alternative coin launches far exceeds the growth of Web3 network participants, similar to the launch of websites, message boards, and chat rooms during the internet bubble era, or the launch of smartphone apps in 2010-2012.

Unlike the approximately 80% institutional participation in the US stock market, digital assets currently only attract 5% of institutional funds, mainly concentrated in Bitcoin, indicating significant room for growth.

While community building and network expansion remain crucial and are at the core of project products and services, in my view, projects that can attract institutional participation will have a competitive advantage in the current market environment.

Original article link: https://www.hellobtc.com/kp/du/09/5420.html

Source: https://x.com/ysiu/status/1835998204443406600

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。