Bear market reveals who the real users are, Ethereum L2 solutions are growing rapidly but with varying performance, institutional support and trading activity become key factors.

Author: @stacy_muur

Translation: Blockchain in Plain English

The bear market is the ultimate stress test for protocols, revealing where the real users are. This is my in-depth research on the current situation of Ethereum L2, including some visual on-chain data analysis.

Since 2023, new L2 layer solutions for Ethereum have emerged rapidly, with @l2beat currently tracking 74 L2 and 30 L3 data. However, only a few general-purpose Rollups have gained mainstream attention, attracting a large amount of TVL and users. This research will focus on the nine largest in scale.

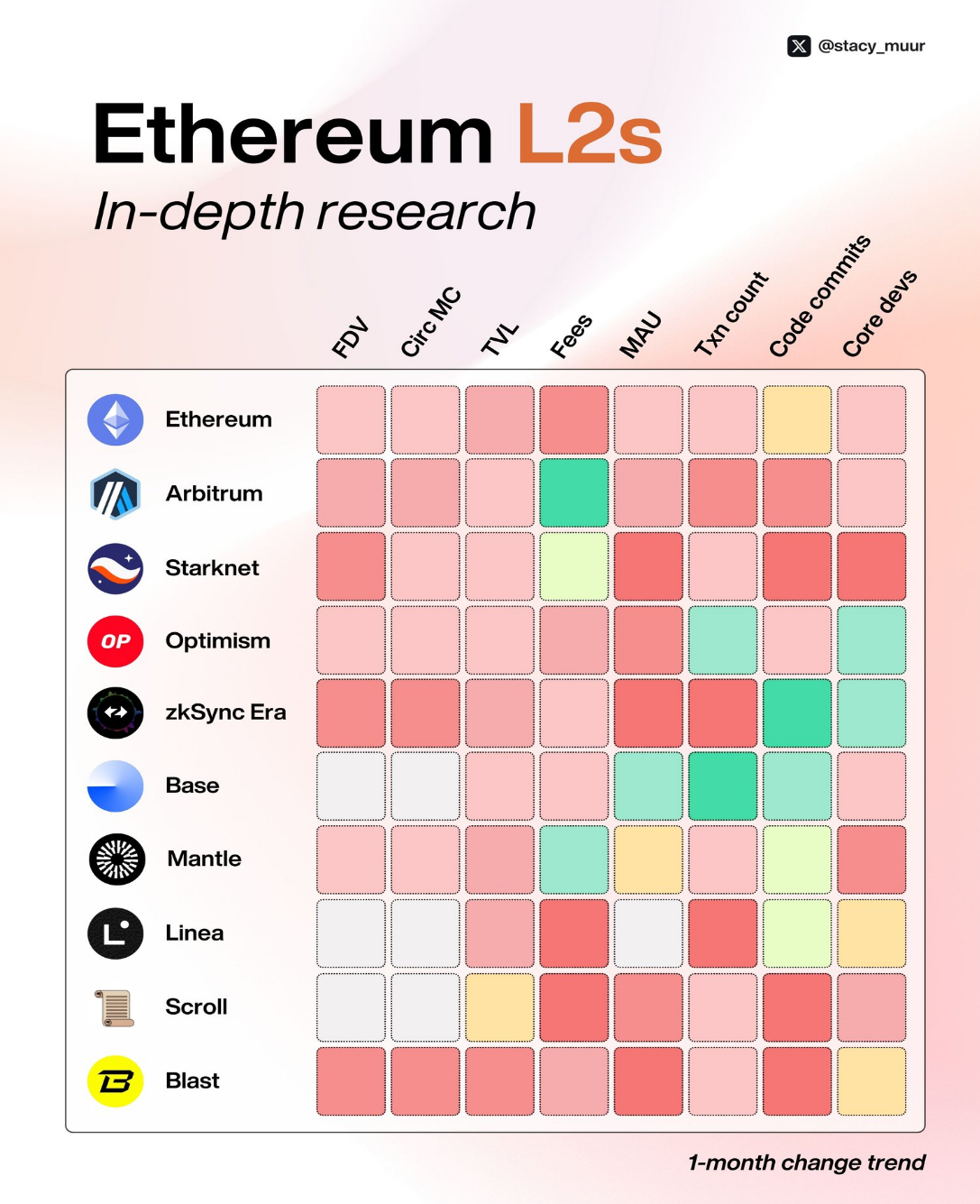

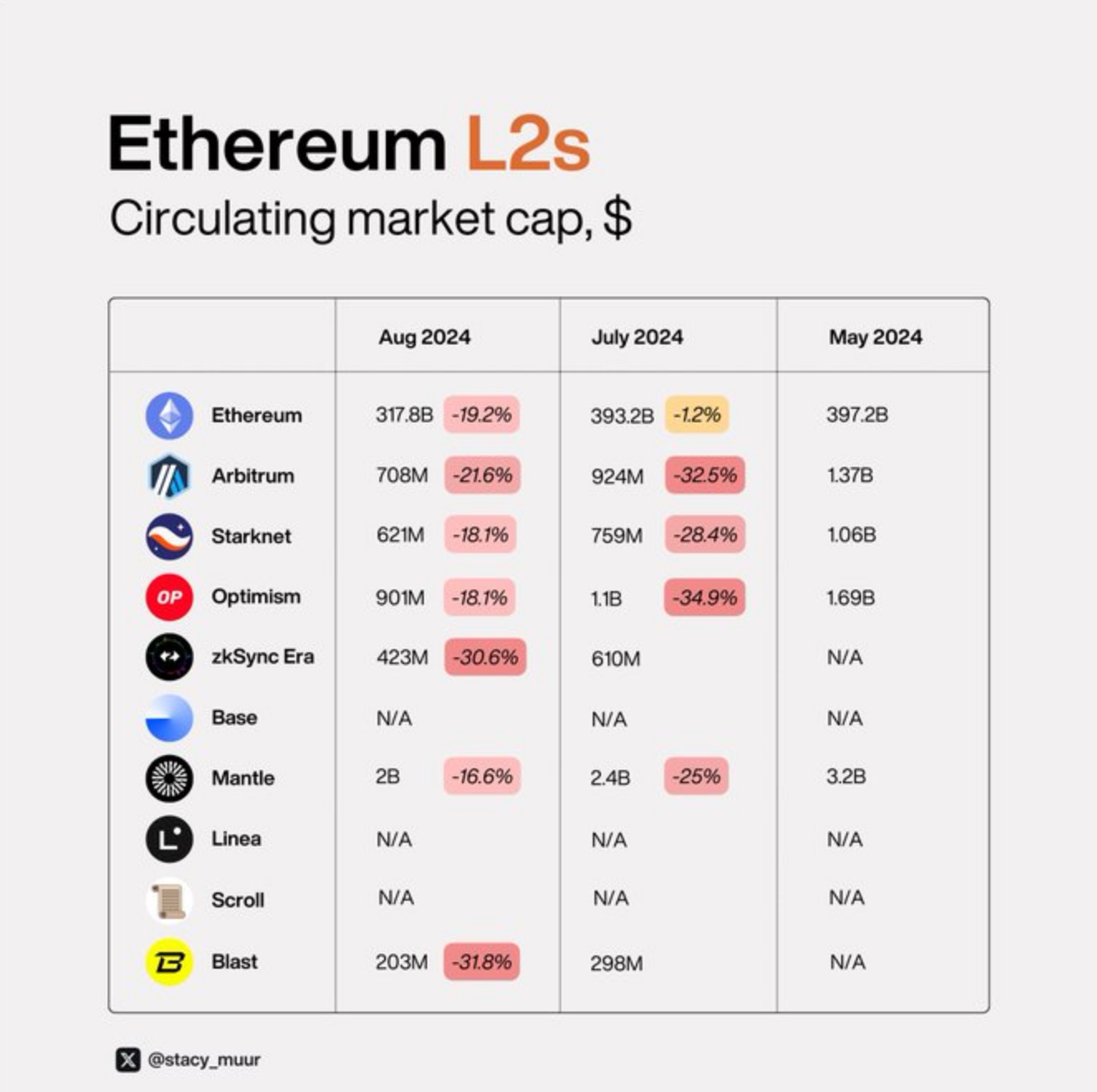

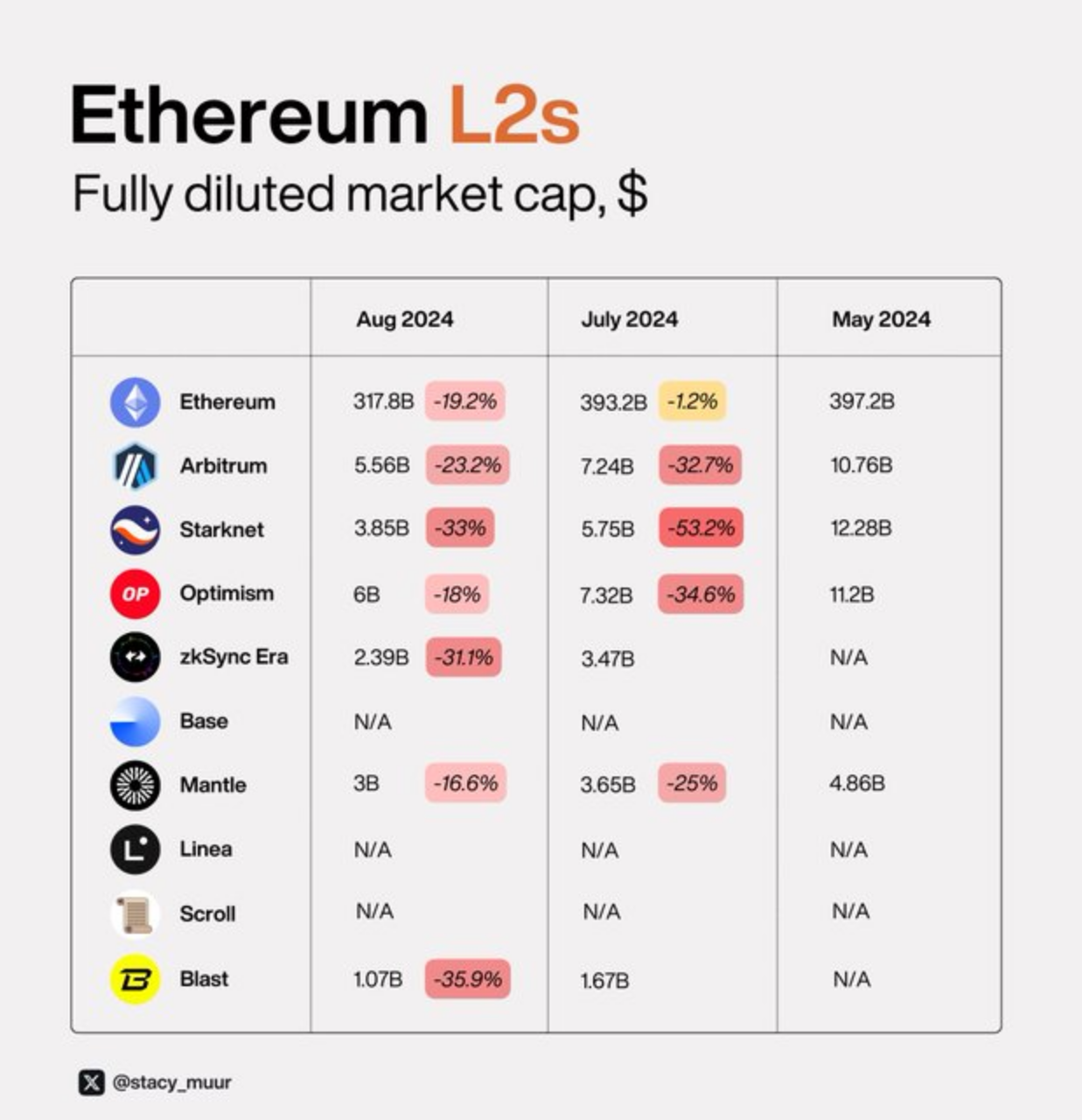

1. Market Value: Circulating Market Value and Fully Diluted Valuation (FDV)

Most L2s currently have a fully diluted valuation (FDV) of several billion dollars, but their circulating market value is less than $1 billion, indicating that a large portion of their tokens are still not in circulation.

The only exception is @0xMantle, whose token supply has unlocked 52%, becoming the only L2 with a circulating market value exceeding $1 billion.

High FDV and low circulation have been key reasons why many recent airdrops have failed to meet user expectations. Estimating current valuations is challenging, and there is also uncertainty about potential downward trends in the future.

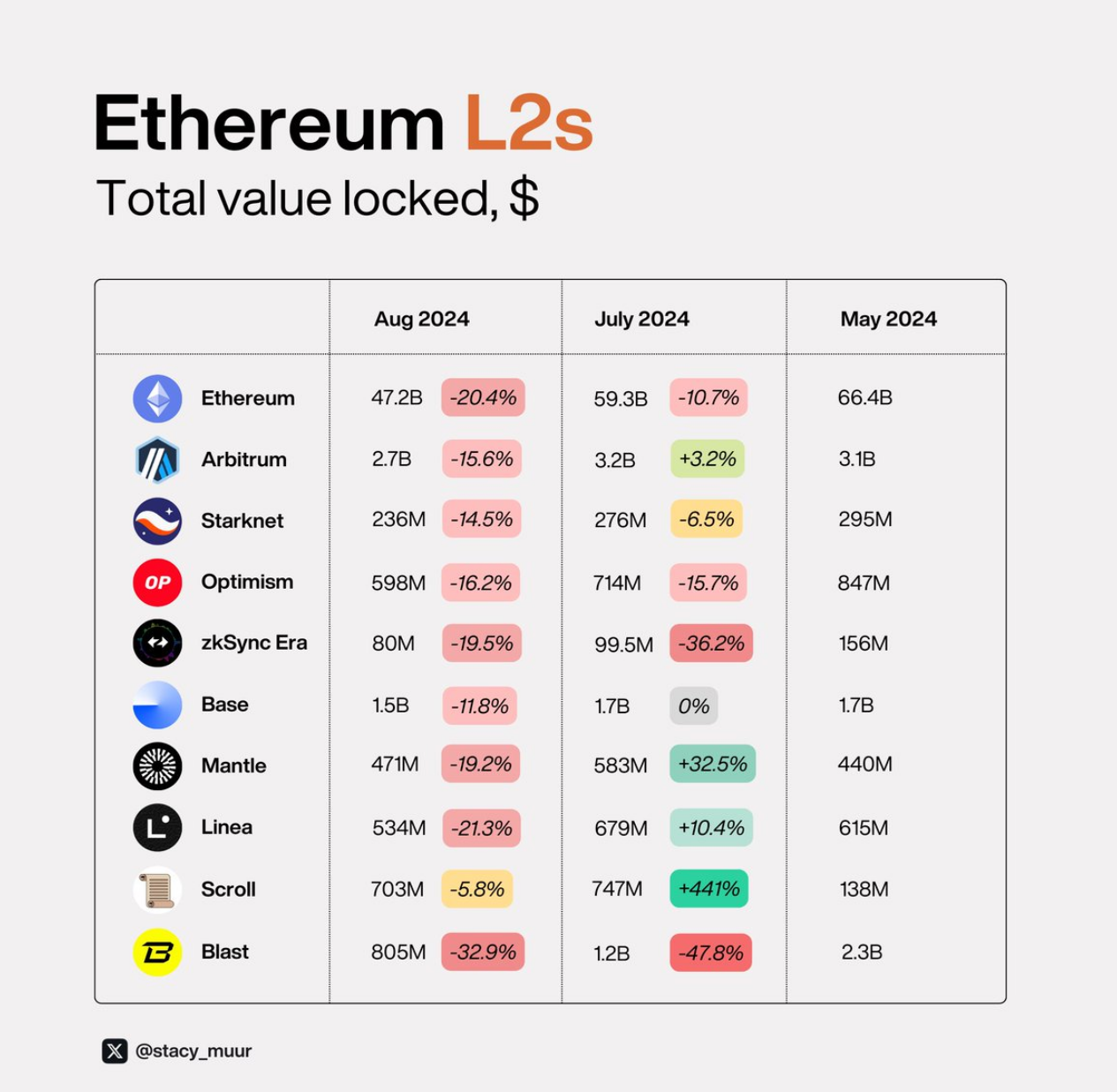

2. Total Value Locked (TVL)

In terms of TVL, all chains except those with incentive programs like @Scroll_ZKP, @LineaBuild, and @0xMantle have experienced a tough summer.

However, Linea's airdrop program has been ongoing for nearly a year, and community interest in it has declined compared to recently announced programs, such as Scroll's.

In the bear market, @zksync and @blast have been most affected, as these two chains have just issued tokens this year, leading to liquidity moving to more attractive destinations.

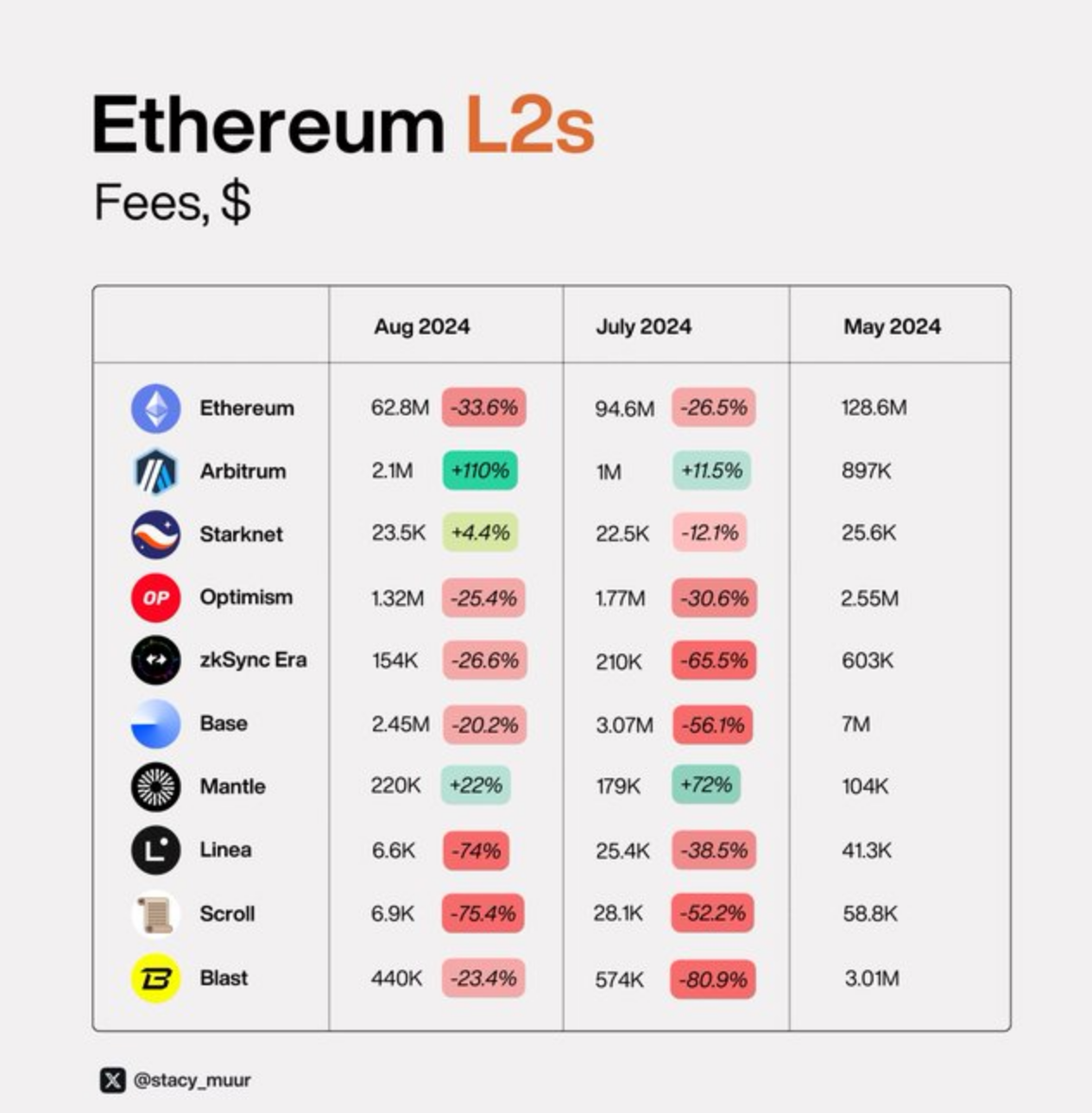

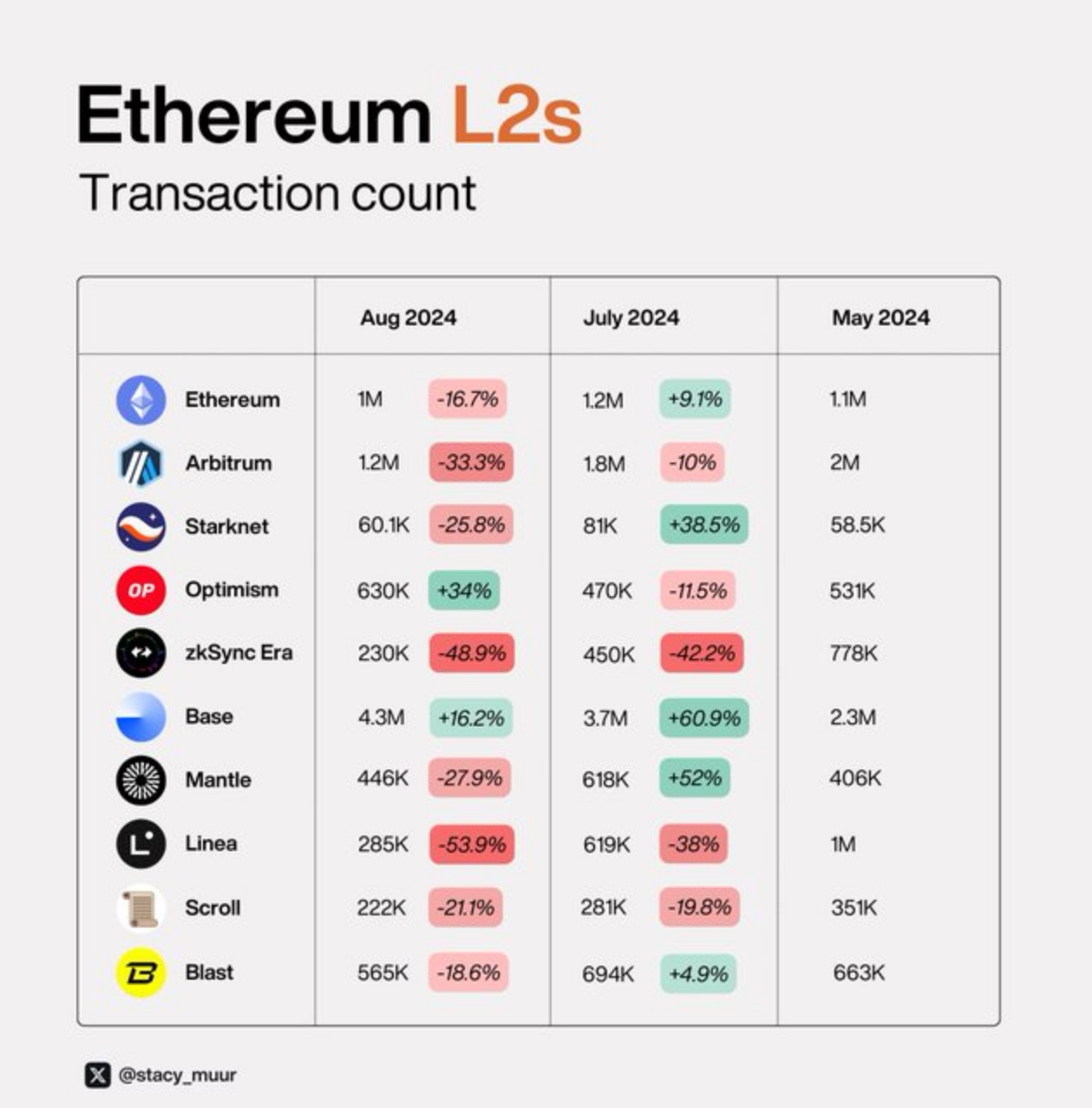

3. Fees and Trading Activity

After the Dencun upgrade, data availability (DA) no longer significantly drives the Ethereum economy, affecting fees on Ethereum and L2. Therefore, studying the relationship between fee dynamics and trading activity has become particularly important.

Here, driven by speculation and as the preferred platform for new memecoin issuance on Ethereum L2, @base has shown strong growth, with trading volume continuing to increase.

In contrast, despite @LineaBuild still having incentive programs, @zksync and the unexpected Linea have performed poorly.

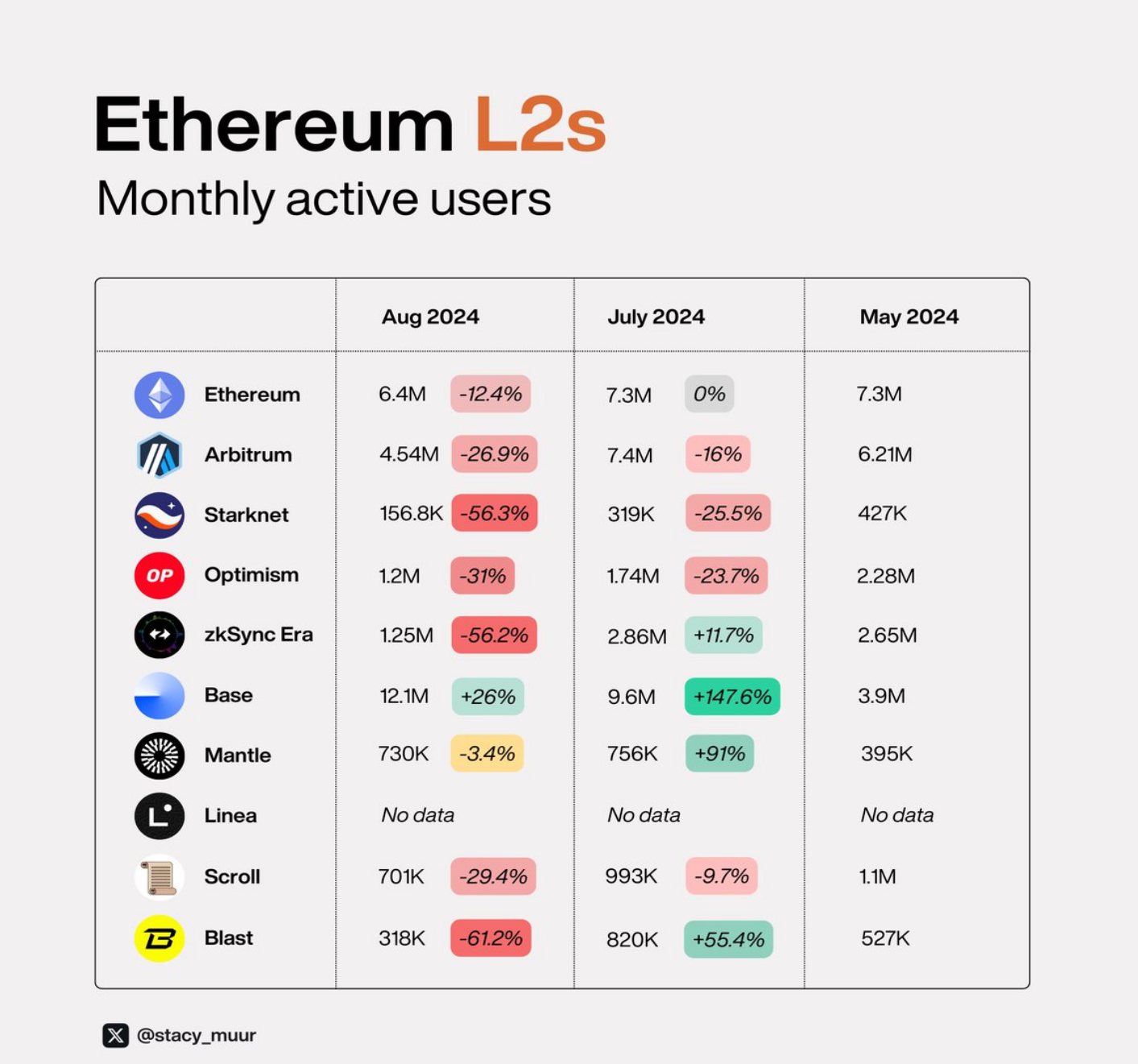

4. Monthly Active Users (MAU)

MAU dynamics, as a key indicator for evaluating user retention on chains, show similar trends. @0xMantle and @base perform the best, while @StarknetFndn, @zksync, and @blast lag behind.

Comparing MAU data with FDV, it is evident that Starknet is significantly overvalued compared to Arbitrum, Optimism, and even ZKsync.

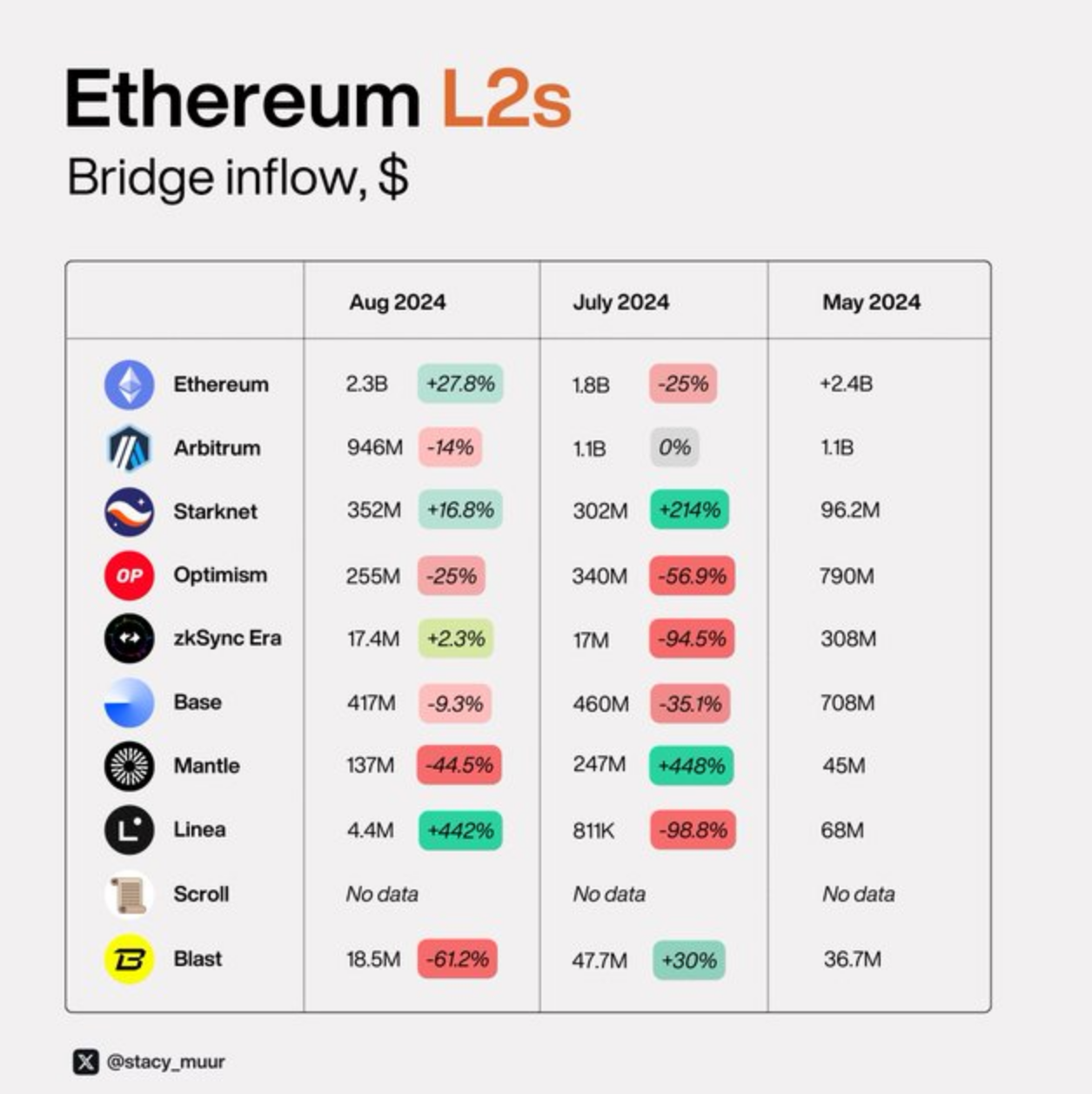

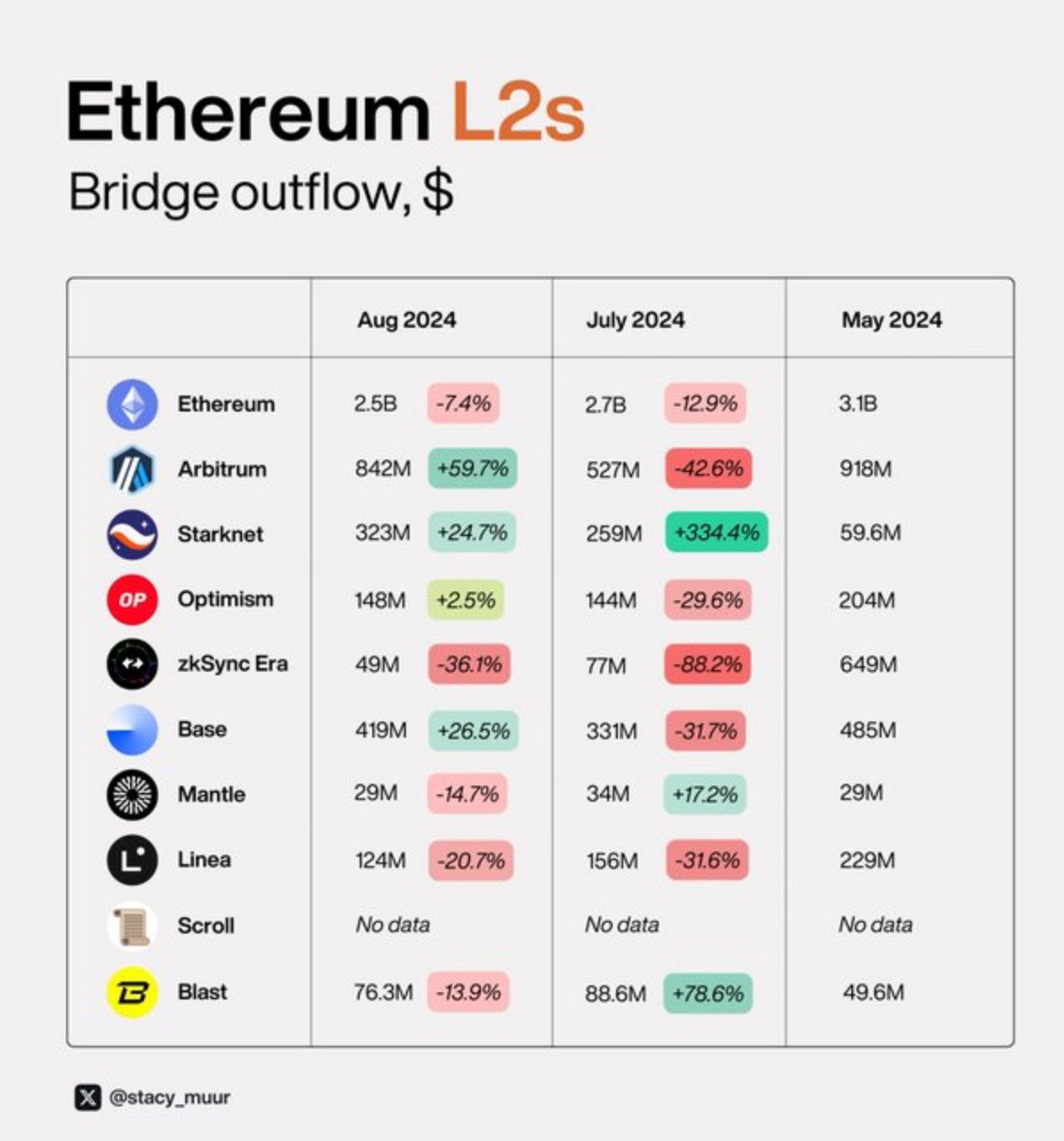

5. Bridge Fund Inflows and Outflows

Net bridge flow is a key indicator for evaluating new users and fund inflows. In L2, chains with positive net flow (more funds flowing in than out) include @Arbitrum, @StarknetFndn, @Optimism, @base, and @0xMantle, with the latter having the largest disparity between inflow and outflow.

In contrast, @LineaBuild, @zksync, and @blast show negative net flow.

The most surprising case here is @blast, which now has over 300 core developers (while most L2s typically have only 30-50 people). This large team is still making a lot of code commits. What are they up to? There is currently no information available.

Original article link: https://www.hellobtc.com/kp/du/09/5419.html

Source: https://x.com/stacy_muur/status/1834171767495295331

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。