Cryptocurrency News

September 18th Hot Topics:

1. BlackRock and Microsoft to launch a $30 billion artificial intelligence investment fund

2. Jamie Dimon, CEO of JPMorgan Chase, stated that the Federal Reserve will cut interest rates by 25-50 basis points tomorrow

3. SEC accuses NanoBit and CoinW6 of involvement in cryptocurrency-related investment fraud

4. Galaxy Digital discusses the future of cryptocurrency asset management on The Scoop

5. Coinbase's Base Layer 2 breaks records, completing over 4.5 million transactions in a single day

Trading Insights

The mindset of "poor people" in trading cryptocurrencies often leads to losses! Do you feel it? Every sentence hits home! Trading cryptocurrencies doesn't necessarily result in losses, but with a "poor people" mindset, it often does. For example, if you currently have ten million yuan in hand, just from the perspective of wealth, you would know that you are not "poor." However, if you want to turn this ten million into twenty million in a very short time, or obtain high returns of one hundred thousand to two hundred thousand yuan per day through cryptocurrency investment, then your mindset belongs to that of "poor people." And this mindset will definitely lead to losses in investment. When "poor people" invest in cryptocurrencies, why do many people think they will definitely lose money? It's because there are significant differences between them and wealthy people when investing in cryptocurrencies. Firstly, many "poor people" trading cryptocurrencies want to achieve the dream of getting rich quickly, but for wealthy individuals, entering the cryptocurrency market and trading cryptocurrencies is just a way to preserve and increase their assets. Therefore, when "poor people" invest in cryptocurrencies, if the price rises, they are reluctant to sell, and when the price starts to fall, they are reluctant to cut losses. As a result, not only do they miss the opportunity to make money, but they also miss the chance to reduce losses. In the cryptocurrency market, "poor people" chase after rising prices and sell when prices fall, not only contributing a lot to exchanges and brokerages, but also losing a lot of money. It's important to note that the more trades you make in cryptocurrency, the easier it is to increase your error rate. Once you make a mistake, it's very likely that one mistake could wipe out the profits from ten successful trades, or even lead to more serious consequences. Secondly, wealthy individuals can use leverage for cryptocurrency investment, continuously expanding their position returns. And if the cryptocurrency market is not doing well, or if a certain position is no longer viable, they can use their financial advantage to engage in new position activities. However, "poor people" do not have abundant funds and do not have the qualifications for leverage. Even if they want to open new positions, they have to rely on borrowing. Thirdly, wealthy individuals not only have financial advantages in cryptocurrency investment, but also have a significant advantage in information sources within the cryptocurrency market. Wealthy individuals generally have a wide circle of friends, so it's not too difficult for them to obtain accurate information in relevant areas. When "poor people" invest in cryptocurrencies, it's difficult for them to obtain accurate information, so they can only follow the trend. Sometimes, even if they obtain insider information, it may have been passed through several people, and such information is better off not being heard. If they blindly follow the trend and chase after rising prices after hearing the information, they may easily get trapped at high prices, making it very difficult to get out of the situation. This is why there is a saying that "poor people" investing in cryptocurrencies will most likely lose money. The fact is, without the right direction, no matter how skilled you are, it's useless. Without the right direction, no matter how much effort you put in, it's ineffective. After experiencing a significant decline in the cryptocurrency market for a period of time, all retail investors are thinking about buying at the lowest point, but there is always a lower point. It's important to remember that the bottom is a point, while the trend is a long line. If you don't buy at the bottom, you will at most lose the profit from a point. If you buy at the wrong bottom, you will bear the loss of a line. Why compare the length of a point and a line? However, you still need to buy at the bottom, but it's not absolute, it's relative to the low! The cryptocurrency market is full of uncertainty and challenges, but it also contains potential opportunities. When investors participate in cryptocurrency investment, they should fully understand the related risks, maintain a calm and rational mindset, and respond to market changes with a steady strategy!

LIFE IS LIKE A JOURNEY ▲

Below are the real trading signals from the Da Bai Community this week. Congratulations to the friends who followed. If your operations are not going well, you can come and give it a try.

The data is real, and each signal has a screenshot taken at the time.

Search for the public account: Da Bai Lun Bi

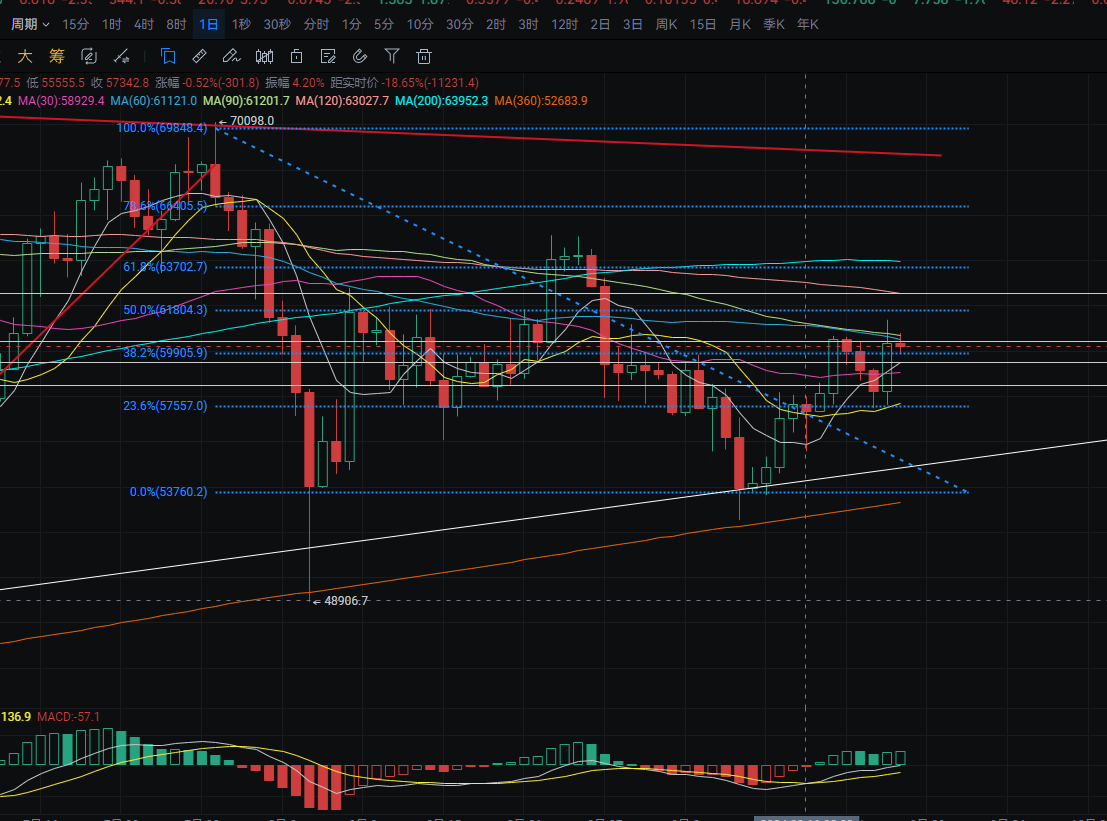

BTC

Analysis

Bitcoin gave a long entry near 58080 on the 16th, and has now successfully reached the profit target near 59000, with a maximum price difference of about $1000. The daily chart showed a rally from around 57600 to near 61350, closing at around 60300. The support is located near the MA7 moving average. A retracement can be considered for long positions near this level. There have been multiple tests near the MA14 moving average at the bottom. The resistance is near the MA120 moving average. A short position can be considered near 60400-62400. A rebound to 62430-62900 can be considered for a short position, with the target near 61700.

ETH

Analysis

On the daily chart, Ethereum rebounded from around 2260 to near 2395, closing at around 2340. The resistance is near the MA14 moving average. A breakthrough can lead to the top MA30. There have been multiple tests near 2225, forming support. A retracement can be considered for long positions near this level. The support is near the MA7 moving average. A short position can be considered near 2223-2180, with the target near 2290-2335.

Disclaimer: The above content is for personal reference only and does not constitute specific operational advice, nor does it bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If there is anything you don't understand, feel free to ask for advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。