As cryptocurrencies perform strongly, the market is closely watching tomorrow's Federal Open Market Committee meeting, where the Federal Reserve is expected to announce its first interest rate cut since 2020.

By BitpushNews

On the day before the Federal Reserve interest rate decision, the cryptocurrency market saw a general rise.

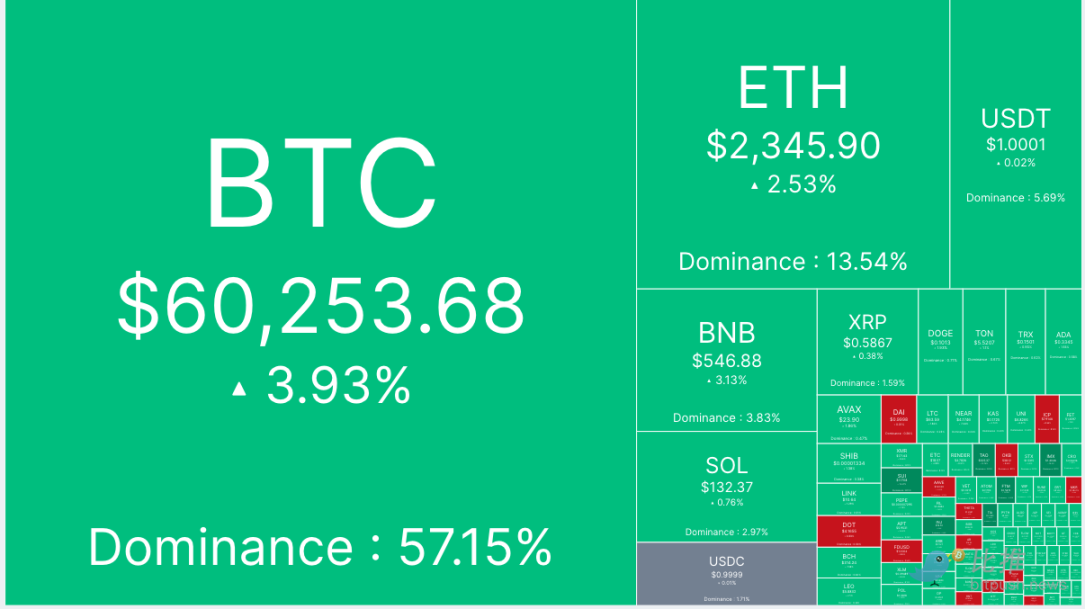

Data from Bitpush shows that Bitcoin surged to $61,000 during Tuesday's trading, marking the largest intraday gain since August 8. Mainstream currencies such as Ethereum, Dogecoin, and Solana also rose, with gains ranging from 2% to 4%. At the time of writing, the trading price had fallen to around $60,253, with a nearly 4% increase over 24 hours.

In terms of altcoins, most tokens within the top 200 by market capitalization experienced gains. Dymension (DYM) saw the largest increase, rising by 24.1%, followed by Immutable (IMX) and Celestia (TIA) with gains of 15.6%. Trust Wallet Token (TWT) experienced the largest decline, dropping by 12.5%, while Helium (HNT) fell by 5.3% and Theta Network (THETA) by 1.7%.

The overall market capitalization of cryptocurrencies is currently $2.08 trillion, with Bitcoin's market share at 57.1%.

Mixed performance in US stocks, with the Nasdaq index closing up 0.2%, the Dow Jones index down 0.12%, and the S&P index remaining flat.

Focus on Interest Rate Cut

As cryptocurrencies perform strongly, market observers are closely watching tomorrow's Federal Open Market Committee (FOMC) meeting, where the Federal Reserve is expected to announce its first interest rate cut since 2020.

Steven Lubka, head of Swan Private at Swan Bitcoin, stated that regardless of the extent of the interest rate cut, the fourth quarter is expected to be positive for the cryptocurrency asset class.

In a report, he stated, "If the Federal Reserve cuts rates by 50 basis points, the price of Bitcoin may rise, but if the market sees it as an emergency measure, this may offset the increase. A 25 basis point cut will bring more uncertain results, and not cutting rates may lead to short-term selling. Looking ahead to the fourth quarter of 2024, we expect Bitcoin to perform strongly, benefiting from improved liquidity conditions. In addition, the expected bankruptcy of FTX is expected to return $16 billion to investors, providing them with liquidity for asset repurchases."

According to CME's "FedWatch," the probability of a 25 basis point interest rate cut by the Federal Reserve in September is 37.0%, while the probability of a 50 basis point cut is 63.0%.

Bitcoin's Future Looks to $90,000 in the Next Year

TradingView analyst TradingShot stated, "Bitcoin today broke through the 1D MA50 (blue trend line in the chart below) with strength, and slightly broke through the top of the triangle pattern since July (lower high trend line). After rebounding for the second time in just 1 month from the 1W MA50 (red trend line), the buying pressure is strong. If the 1D candle closes above the lower high point, we will receive a strong breakout buy signal for the remainder of this year at least."

TradingShot added, "In this case, we see a similar upward channel to that before March 2024, which indeed has the potential to test a 6-month resistance area before the US election, then a technical pullback before the election, and then resume the upward trend for the remaining year, with a target of at least the 2.0 Fibonacci extension level, which is $90,000."

Independent analyst Jelle stated in a post on September 17, "The local structure of Bitcoin has turned bullish here, with the closing price above the previous high in September and locking in higher lows."

Jelle mentioned that the recent high for Bitcoin was $60,670, set on September 13, higher than the high of $59,830 on September 3. According to the analyst, this trend indicates sufficient market strength to overcome the $65,000 resistance level, stating, "From the BTC/USD 12-hour chart, it looks likely to break through $65,000—then set a new all-time high."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。