Continue to submit homework. Although the turnover rate on Monday increased compared to the weekend, there is essentially no difference. Many people who bought the dip around $60,000 last Friday have cut their losses and left today. There are still many who chase after rises and short the market when it falls. At this stage, if you want to do short-term trading, you must be more sensitive to macro information.

The matter of 50 and 25 has been discussed many times. Now it is the silence period of the Federal Reserve. The only way to get direct news from the Federal Reserve is to wait until the 19th, or to see if Nick will come out to explain. Even today, I see that the information channels in the United States are very fragmented. Goldman Sachs believes that there will only be a 25 basis point rate cut, BlackRock believes that the initial rate cut by the Federal Reserve will not be too high, while users of CME and Polymarket believe that the probability of a 50 basis point cut is greater. There is even a proposal by Elizabeth Warren for a 75 basis point cut.

The market will have significant fluctuations because of the differences in opinions. As the saying goes, the more the initial rate cut in the long run, the better. But from the recent trend, 25 may be the safest choice.

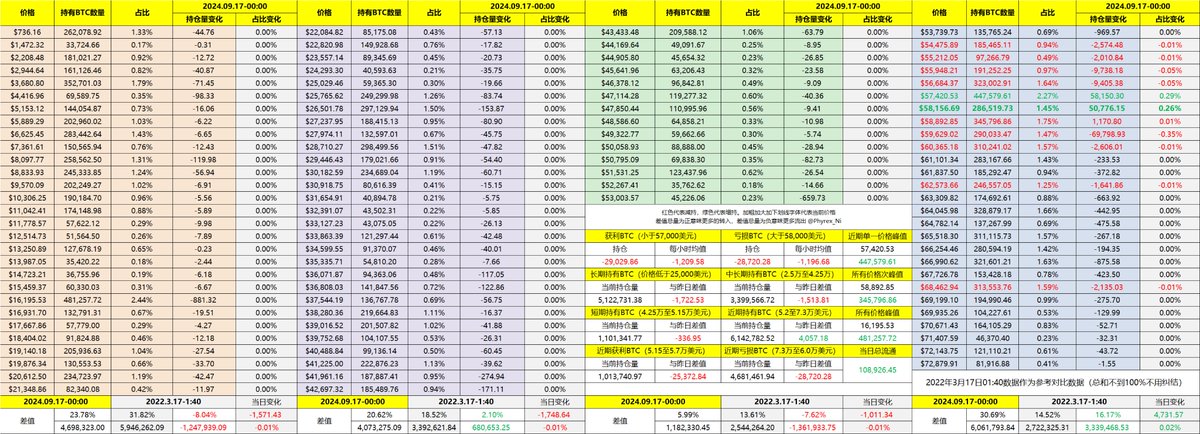

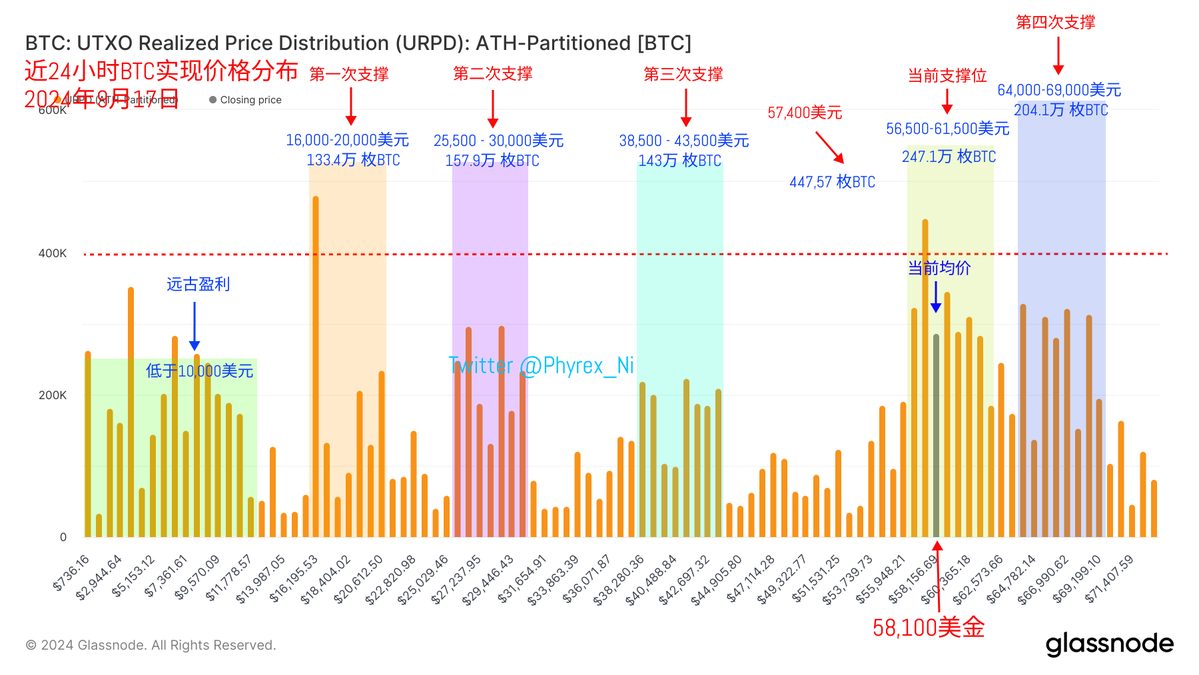

Returning to the data of #BTC, it can be seen that apart from short-term investors who bought in the past week, early investors are still in a wait-and-see mode and have not participated in the turnover. The current chips are still concentrated between $56,500 and $61,000. Looking at it from another angle, this position is very likely to become a new support level. It is also obvious that there is almost no selling off at $64,000 to $69,000, or even higher prices.

This indicates that investors at this stage have been washed out for the most part, and the remaining ones are almost not aiming for short-term holdings.

The data has been updated, link: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。