Most of last week, the market remained stable. However, by Friday, the market's expectation of a 50 basis point rate cut in September suddenly surged from around 15% to about 50%, with almost no clear explanation for this change. Economic data largely met expectations and was not a contributing factor. Additionally, the Federal Reserve remained silent, leading market participants to speculate that this repricing may have been triggered by comments from former Fed officials and journalists.

First, Timiraros of The Wall Street Journal quoted Jon Faust, a former senior advisor to Powell, as saying he is "slightly inclined to start with 50 basis points" and believes "there is a good chance the FOMC will do so." Furthermore, he mentioned that the Fed could use "a lot of verbal explanation to alleviate… signs that a substantial rate cut would not be a concern," in order to manage investors' concerns about a larger rate cut. He suggested that if the Fed instead chooses to start with a small 25 basis point cut, it could lead to "awkward problems."

Next, the Financial Times of the UK also published an article stating that the Fed faces a very difficult decision in whether to cut rates by 25 or 50 basis points in September. Finally, former New York Fed President Dudley made stronger comments, stating "I think there are strong reasons to support a 50 basis point rate cut, whether they will do so or not," and added that considering the current federal funds rate is nearly 200 basis points above the neutral rate, "so the question is: why not start cutting rates now?"

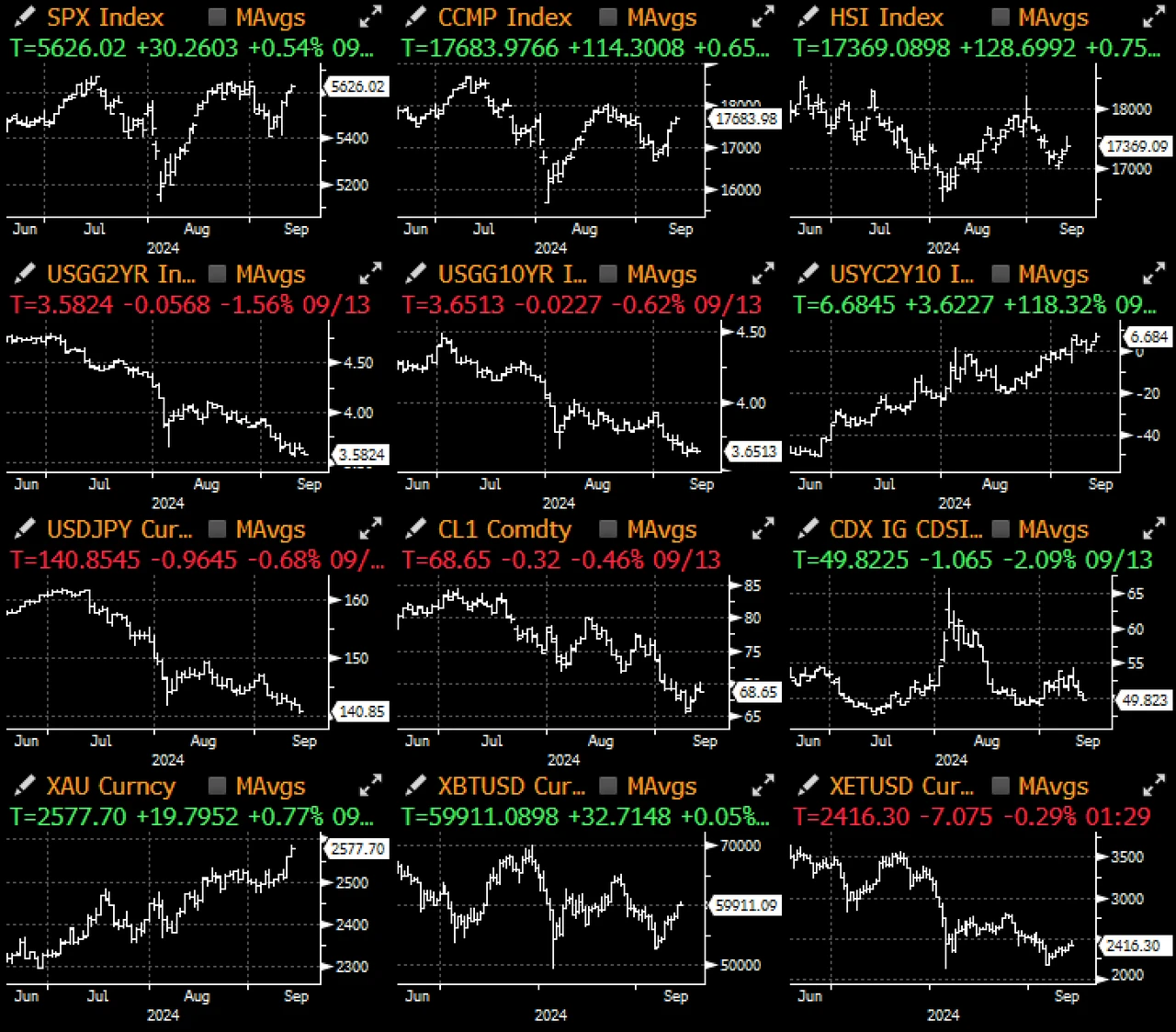

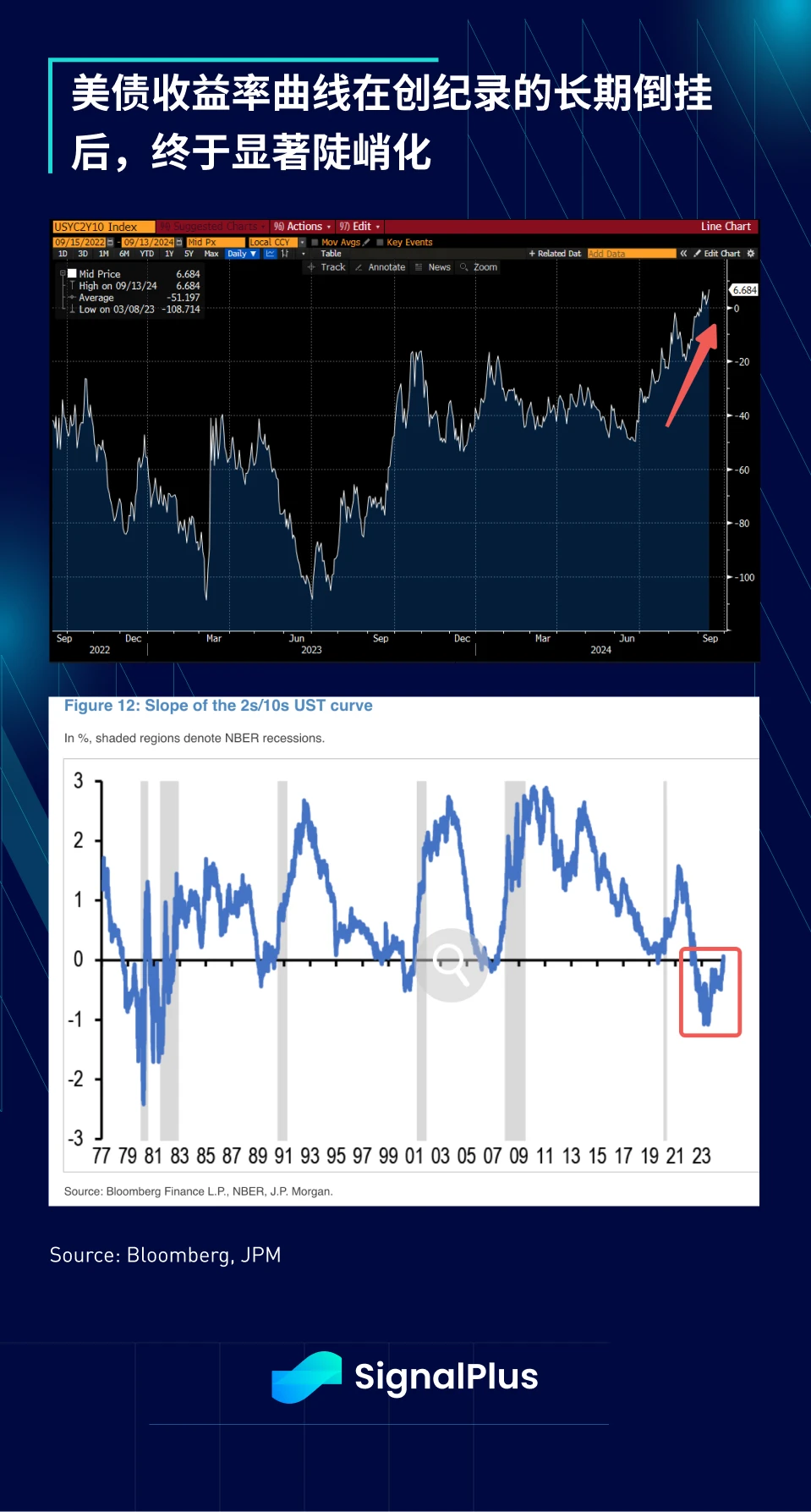

Due to the repricing of interest rates, the US bond yield curve continued its steep bull run, with the 2/10s rising by 4.5 basis points, bringing the curve to its steepest level in 2 years, and returning to positive territory after a long period of inversion (since 2021).

We have discussed the "policy shift" of the Fed towards a more accommodative stance on multiple occasions, which is evident from the continued steepening of the yield curve and the return of the negative correlation between bonds and stocks.

Over the past year, stocks and bonds have moved almost in sync, both reflecting the market's one-way bet on Fed policy. However, since the "flash crash" in August, the market has once again begun to focus on the economic trajectory rather than just the Fed's stimulus measures, leading the movements of these two asset classes back to a risk-diversification mode.

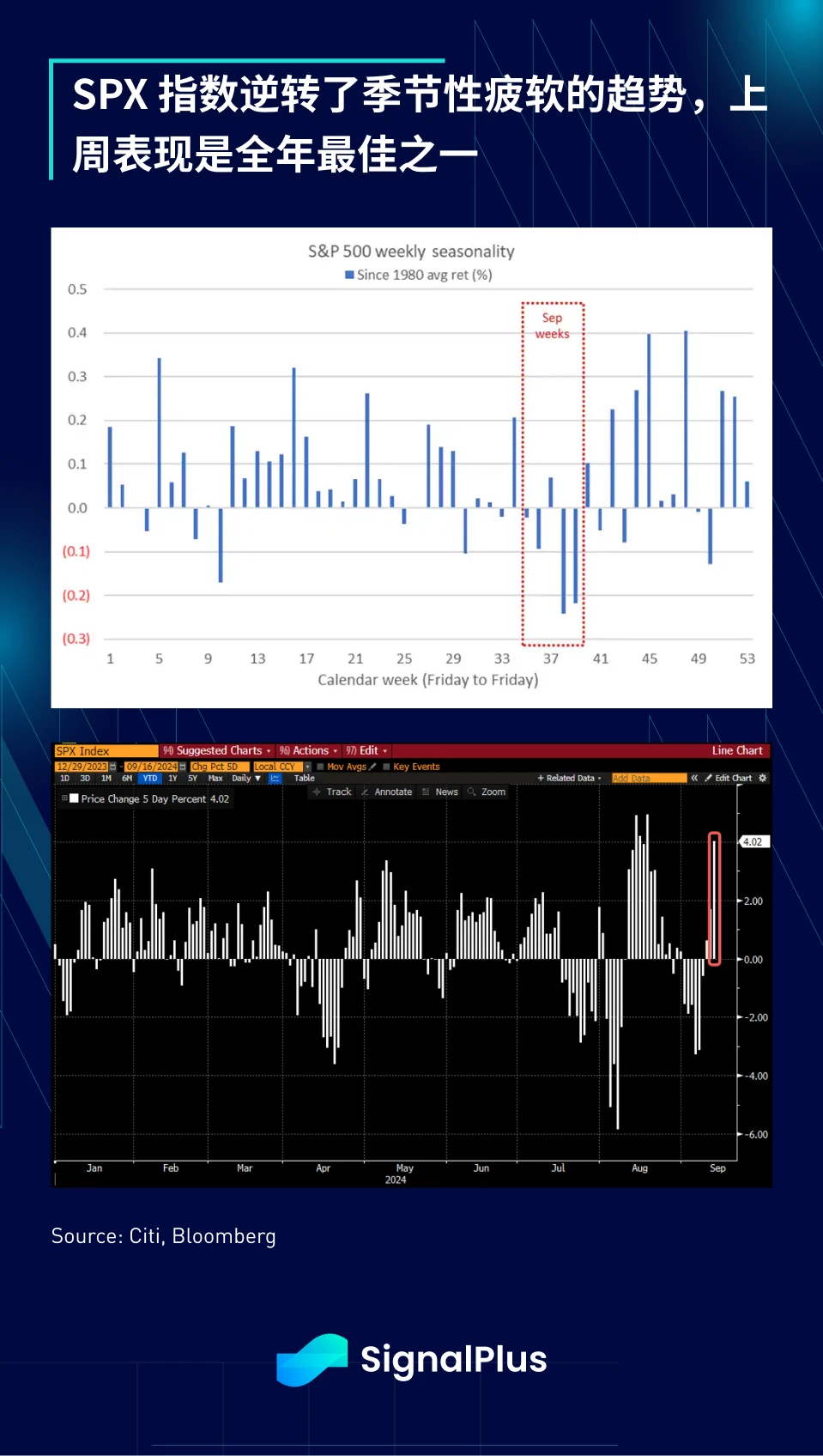

As US interest rates once again become the focus of the market, the foreign exchange market has also reacted accordingly, with the US dollar index (DXY) and the USD/JPY both fluctuating in sync with yields, hovering around the key technical levels of 100 and 140, respectively. On the other hand, the US stock market has at least temporarily reversed its seasonal weakness trend, with the SPX's performance last week being one of the best of the year.

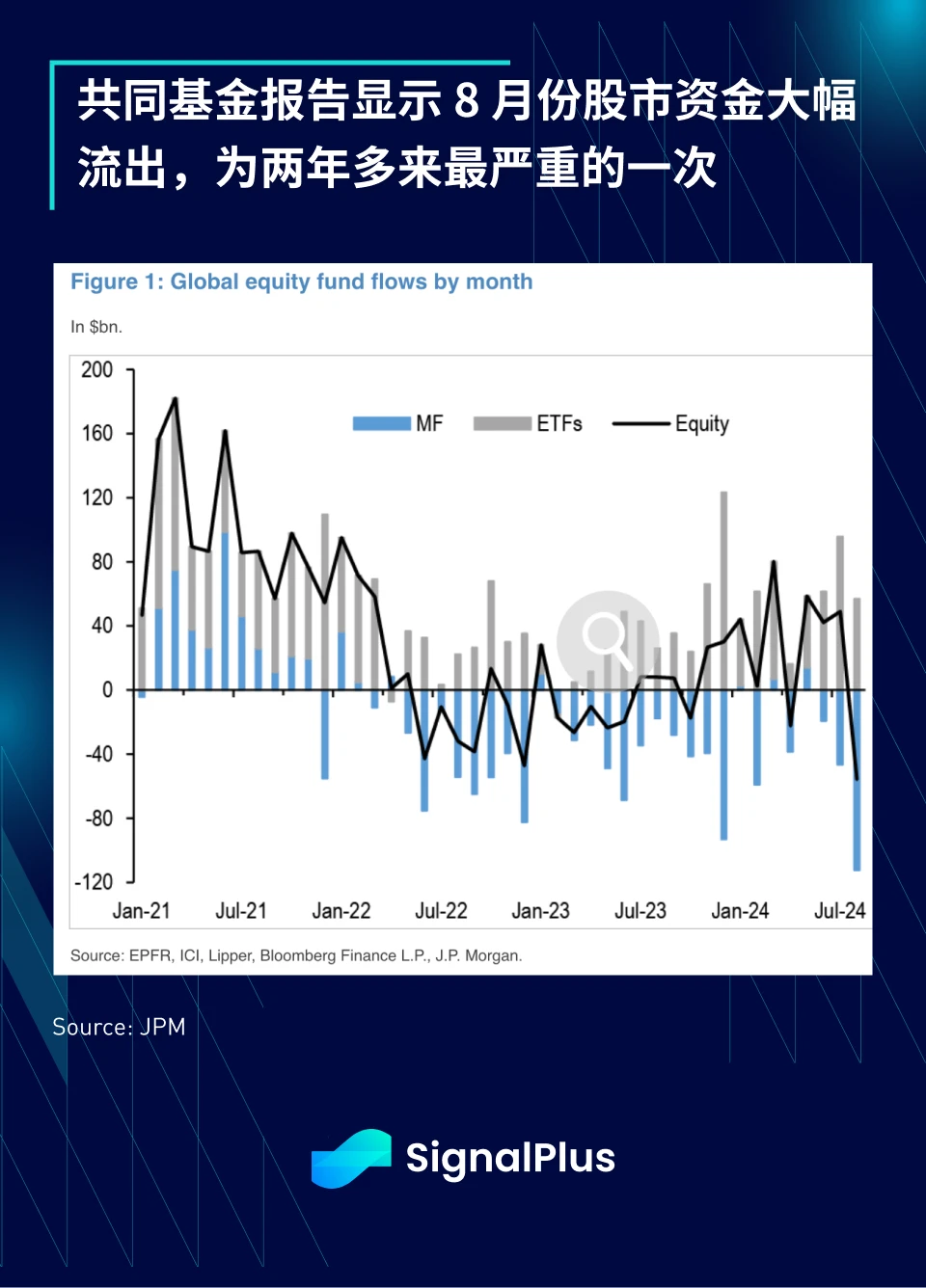

Part of the reason for the strong rebound may be the pursuit of returns by fund managers. According to a report by JPMorgan, equity mutual funds saw outflows of $55 billion in August, the most severe since 2022. As we approach the end of September, whether or not there will be a significant reversal in this situation, regardless of whether there is a 50 basis point rate cut?

In the cryptocurrency space, as macro sentiment continues to dominate price movements and there are no significant developments on-chain, the correlation between BTC and the SPX has risen to near historic highs. Due to a temporary improvement in market sentiment, the price of BTC has risen to the $58-60k range, and BTC ETFs saw inflows of $263 million last Friday. Even outflows from ETH ETFs have temporarily ceased, and as traders continue to lean towards selling covered call options for profit, implied volatility has decreased.

However, despite the temporary relief, there are still medium-term resistance and challenges. ETH continues to face difficulties, with ETH/BTC falling to a 5-year low, and there is currently no end in sight.

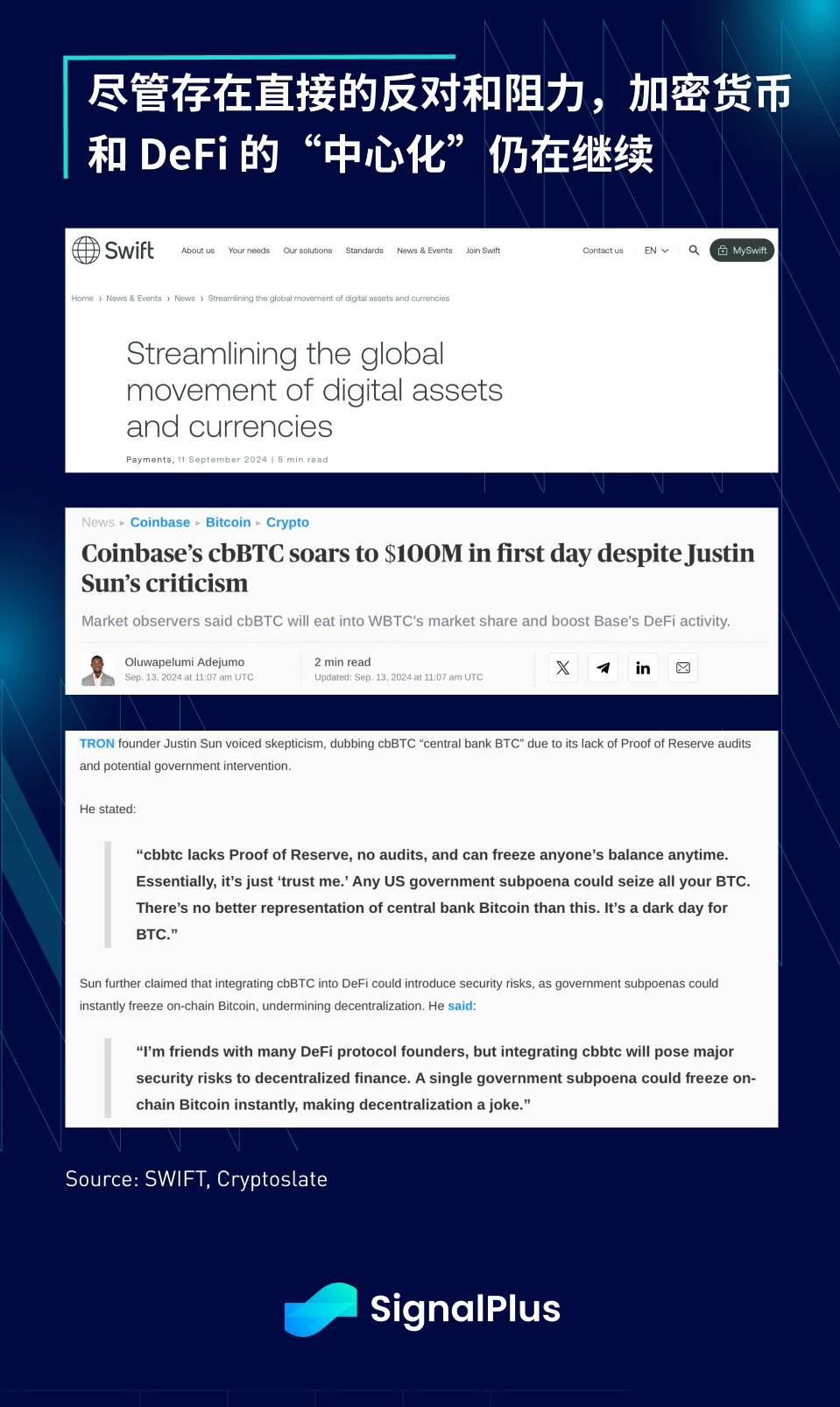

In terms of news, Coinbase announced the launch of its own wrapped BTC (cbBTC), and SWIFT announced plans for tokenizing asset transfer infrastructure, intensifying concerns about the increasing centralization of digital assets. However, as traditional finance (TradFi) continues to exert influence in the cryptocurrency space, this trend may continue.

This week will be filled with central bank activities, including meetings from the Federal Reserve, Norway, Japan, the UK, Brazil, South Africa, Thailand, Taiwan, and Indonesia. In terms of economic data, attention will be on China's credit supply and retail data to understand the ongoing economic slowdown. The US retail sales data on Tuesday should be the most important data before the FOMC meeting, potentially influencing the final decision on a 25 or 50 basis point rate cut.

Good luck to everyone, and the SignalPlus team looks forward to further discussions with you at this week's Token 2049 event!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and engage with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。