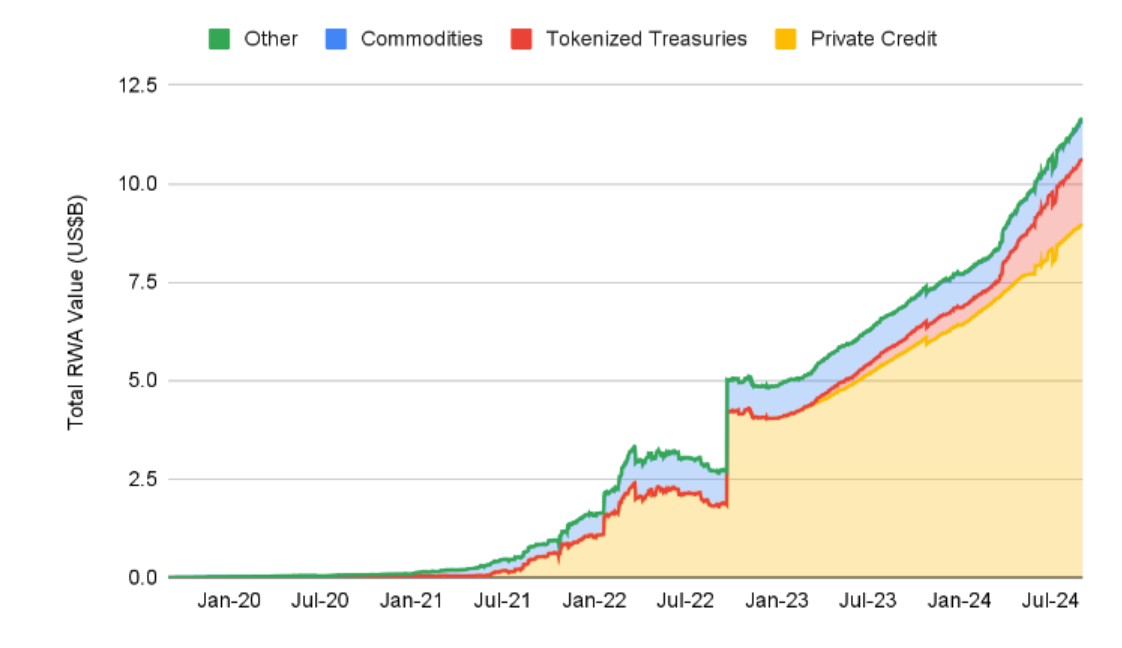

The total amount of on-chain RWA has reached 12 billion US dollars, not including the 175 billion US dollar stablecoin market.

Author: Deep Tide TechFlow

The RWA sector has been quietly making a fortune in this atypical bull market.

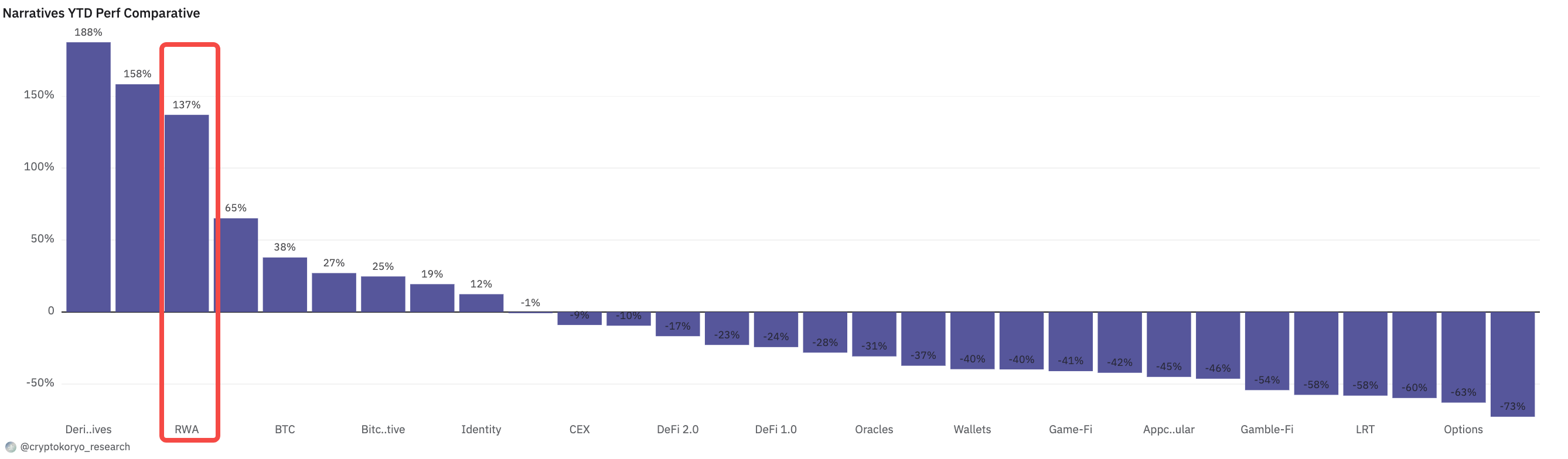

When everyone's emotions are easily influenced by memes, if you carefully look at the data, you will find that the performance of tokens in the RWA track this year may be better than most other token tracks.

When US Treasury bonds become the largest RWA, the trend of the track being affected by macroeconomic factors will become more obvious.

Recently, Binance Research released a lengthy report "RWA: A Safe Haven for Onchain Yields?" on the landscape, projects, and performance of the RWA track.

Deep Tide TechFlow has interpreted and distilled the report, with the key points as follows.

Key Points

The total amount of on-chain RWA has reached 12 billion US dollars, not including the 175 billion US dollar stablecoin market.

The main categories in the RWA field include tokenized US Treasury bonds, private credit, commodities, stocks, real estate, and other non-US bonds. Emerging categories include aviation rights, carbon credit limits, and artwork.

Institutions and traditional finance ("TradFi") are increasingly involved in RWA, with BlackRock's BUIDL tokenized national debt product leading the category (market value > 500 million US dollars); Franklin Dampson's FBOXX is the second largest tokenized national debt product.

6 projects that the report focuses on: Ondo (structured financing), Open Eden (tokenized national debt), Pagge (tokenized, structured credit, aggregation), Parcl (synthetic real estate), Toucan (tokenized carbon credit), and Jiritsu (zero-knowledge tokenization).

Unignorable technical risks: centralization, third-party dependencies (especially for asset custody), robustness of oracles, and whether the complexity of system design is worth pursuing for returns.

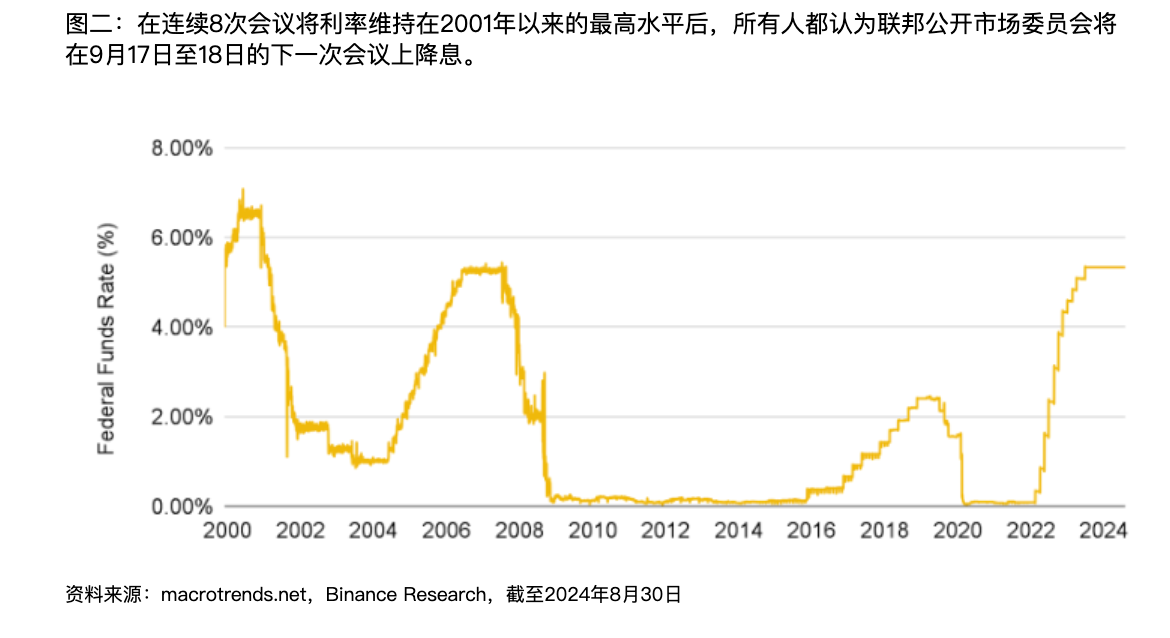

From a macroeconomic perspective, we are about to begin a historic interest rate cut cycle in the United States, which may have an impact on many RWA protocols, especially those focusing on tokenized US Treasury bonds.

Fundamental Data of RWA

Summarized RWA definition: tokenized on-chain versions of tangible and intangible non-blockchain assets, such as currency, real estate, bonds, commodities, etc. A broader category of assets includes stablecoins, government debt (dominated by US government bonds, i.e., national debt), stocks, and commodities.

The total amount of on-chain RWA has reached a historical high, exceeding 12 billion US dollars (not including the 175 billion US dollar stablecoin market).

Key Category 1: Tokenized National Debt

2024 experienced explosive growth, increasing from 769 million US dollars at the beginning of the year to 2.2 billion US dollars in September.

The growth may be influenced by the US interest rates reaching a 23-year high, with the federal funds target rate remaining stable at 5.25 - 5.5% since July 2023. This has made the yield of US government-backed national debt a popular investment tool for many investors.

Government endorsement - US Treasury bonds are widely considered one of the safest yield assets in the market, often referred to as "risk-free".

The Federal Reserve is expected to start an interest rate cut cycle at the September FOMC meeting later this month, so it will be important to monitor how the RWA yield evolves as interest rates begin to decline.

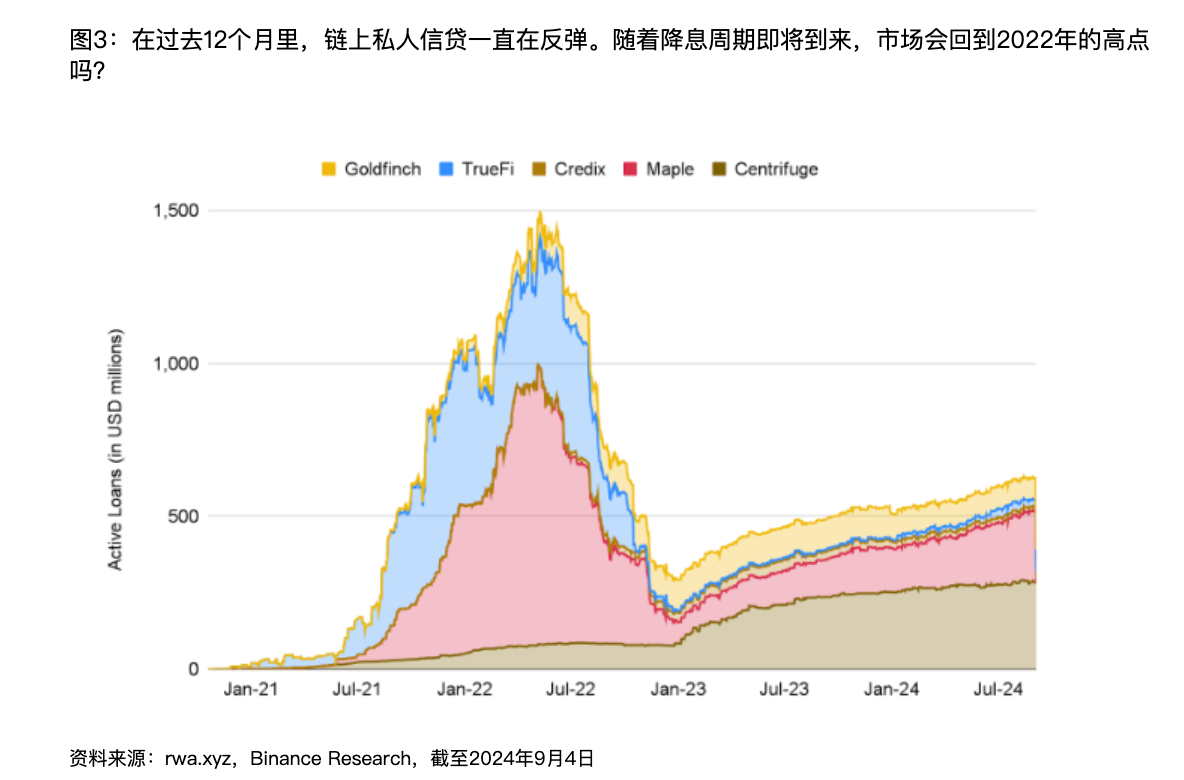

Key Category 2: On-chain Private Credit

Definition: Debt financing provided by non-bank financial institutions, usually for small and medium-sized companies.

The IMF estimates that the market space for this sector exceeded 21 trillion US dollars in 2023, with on-chain accounting for only about 0.4%, or around 90 billion US dollars.

On-chain private credit is growing rapidly, with active loans growing by about 56% over the past year.

The majority of the growth comes from the Figure project, which provides credit lines secured by home equity.

Other major participants in the on-chain private credit market include Mongolge, Maple, and Goldfinch.

Despite recent growth, the total amount of active loans has decreased by about 57% compared to the same period last year. This aligns with the Federal Reserve's aggressive interest rate hikes, with many borrowers affected by increased interest payments (especially for private credit loans using floating rate agreements), leading to a corresponding decrease in active loans.

Key Category 3: Commodities (Gold)

The leading two tokens, Paxos Gold ($PAXG) and Tether Gold ($XAUT), hold about 98% of the market share in a market of around 970 million US dollars.

However, gold ETFs are very successful, with a market value exceeding 110 billion US dollars. Investors are still reluctant to further increase their gold holdings on-chain.

Key Category 4: Bonds and Stocks

The market is relatively small, with a market value of about 80 million US dollars.

Popular tokenized stocks include Coinbase, NVIDIA, and S&P 500 trackers (all issued by Backed).

Key Category 5: Real Estate, Clean Air Rights, etc.

Although not yet widely adopted, this category still exists.

The concept of Renewable Finance (ReFi) accompanies it, attempting to combine financial incentives with eco-friendly and sustainable outcomes, such as tokenizing carbon emission quotas.

Key Components of RWA

Smart Contracts:

Utilize token standards such as ERC 20, ERC 721, or ERC 1155 to create digital representations of off-chain assets.

A key feature is the automatic income accumulation mechanism, which distributes off-chain income on-chain. This is achieved through rebase tokens (such as stETH) or non-rebase tokens (such as wstETH).

Oracles:

Key trend: RWA-specific oracles. Legal compliance, accurate valuation, and regulatory supervision are issues that general oracles may not be able to fully address.

For example, in private credit, lenders may issue on-chain RWA collateralized loans. Without high-quality oracles to convey the use of funds, borrowers may not comply with loan agreements, take on risks, or even default.

(Source of the images: original report, compiled and translated by Deep Tide TechFlow)

- Projects working on dedicated oracles: Chronicle Protocol, Chainlink, DIA, and Tellor

Identity/Compliance

- Emerging technologies for identity verification, such as Soul-Bound Tokens ("SBT"), while Zero-Knowledge SBT ("zkSBT") provides a promising way to verify identity while protecting sensitive user information.

Asset Custody

Management through a combination of on-chain and off-chain solutions:

On-chain: Secure multi-signature wallets or Multi-Party Computation ("MPC") wallets for managing digital assets. Off-chain: Traditional custodians holding physical assets follow legal integration to ensure proper ownership and transfer mechanisms.

Entry of Traditional Financial Institutions

BlackRock (AUM $10.5 trillion)

The USD Institutional Digital Liquidity Fund ("BUIDL") is the market leader, with over $510 million.

Launched only in late March and quickly became the largest product in the field.

Securitize is an important partner of BlackRock in BUIDL, serving as a transfer agent, tokenization platform, and distribution agent.

Additionally, BlackRock is the largest issuer of spot Bitcoin and spot Ethereum ETFs.

Franklin Templeton (AUM $1.5 trillion)

Their on-chain US government currency fund ("FOBXX") is currently the second-largest tokenized national debt product, with a market value exceeding $440 million.

BlackRock's BUIDL runs on Ethereum, but FOBXX is active on Stellar, Polygon, and Arbitrum.

The blockchain-integrated investment platform Benji has added more features to FOBXX, allowing users to browse tokenized securities while also investing in FOBXX.

WisdomTree Investments (AUM $110 billion)

- Originally a global ETF giant and asset management company, they have further launched multiple "digital funds". The total AUM for all these RWA products is over $23 million.

Project Analysis

The report focuses on analyzing the projects Ondo (structured financing), Open Eden (tokenized national debt), Pagge (tokenized, structured credit, aggregation), Parcl (synthetic real estate), Toucan (tokenized carbon credit), and Jiritsu (zero-knowledge tokenization).

The business models and technical implementations of each project are detailed in the report, but are not elaborated here due to space limitations.

The comprehensive comparison and characteristics of each project are as follows:

(Source of the images: original report, compiled and translated by Deep Tide TechFlow)

Overall Results and Outlook

- RWA can bring returns, but whether the technical risks outweigh the returns is subjective. Technical risks include:

Centralization: Higher levels of centralization in smart contracts or overall architecture, which is inevitable considering regulatory requirements.

Third-party dependencies: Heavy reliance on off-chain intermediaries, especially asset custody.

- Some new technological trends:

The emergence of Oracle protocols specific to RWA. Established companies like Chainlink are also increasingly focusing on tokenized assets.

Zero-knowledge technology is becoming a potential solution to balance regulatory compliance with user privacy and autonomy.

- Does RWA need its own chain?

Benefits: Easier launch of new protocols on these chains without the need to establish their own KYC framework and cross regulatory barriers, promoting the growth of more RWA protocols; traditional institutions or Web2 companies hoping to adopt certain blockchain functionalities can ensure that all their users are KYC/compliant.

Drawbacks: Facing the "cold start" problem; difficult to bootstrap new chains with liquidity and ensure sufficient economic security; higher barriers to entry, users may need to set up new wallets, learn new workflows, and familiarize themselves with new products.

- Outlook for the expected interest rate cut

The market expects the next meeting of the Federal Reserve on September 18 to start an interest rate cut cycle, what does this mean for RWA projects that have thrived in a high-interest rate environment?

While the yields of some RWA products may decrease, they will continue to offer unique benefits such as diversification, transparency, and accessibility, which may continue to position them as attractive choices in a low-interest rate environment.

- Concerns about the legal environment

Many protocols still maintain significant centralization, and various technologies, including zk, have a lot of room for improvement.

Decentralization while still maintaining regulatory compliance; this may also require some changes to traditional compliance systems to recognize new forms of verification.

Most RWA protocols still have a long way to go before truly reserving financial products for professional investors and achieving permissionless access.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。