AI Grid Features

Grid trading, as an automated trading strategy, has a unique operating mode. It builds buy and sell orders within a specific price range, leveraging market volatility to gain price difference income. Its core operating principle can be summarized as "buy low, sell high."

In the field of quantitative trading, grid trading is the lowest threshold type. According to AICoin's related backtesting data, the monthly profit of some grid trading can reach 300% or more. Users can easily obtain stable returns by reasonably setting price ranges, grid numbers, and operating funds without the need for complex operations.

Note: Backtesting profits do not represent future returns and are for reference only.

Concept Principle

Generally, a grid strategy will include several key parameters, including:

Price Range: The price range in which the strategy operates

- Lowest price: The lower limit of the price range for strategy operation. When the price is lower than the lowest price in the range, the program will no longer execute orders outside the range.

- Highest price: The upper limit of the price range for strategy operation. When the price is higher than the highest price in the range, the program will no longer execute orders outside the range.

Grid Number: The number of orders placed in a specific price range, with two modes: arithmetic progression and geometric progression

- Arithmetic grid: Divides the price range equally, with equal price differences for each grid

- Geometric grid: Divides the price range proportionally, with equal price difference rates for each grid

Investment Amount: The funds used when running the strategy

Active Order Quantity: The number of active orders is less than or equal to the grid number. Setting the number of active orders can reduce asset occupation.

Moving Grid: When the moving grid is enabled, as the average price rises, the upper and lower limits of the grid range will automatically move upward.

Grid Trigger: After creating the strategy, grid trading will only start when the latest price reaches the trigger price.

Termination Trigger: Setting for taking profit and stop loss. When the price reaches the set take profit or stop loss price, the strategy will stop.

For example:

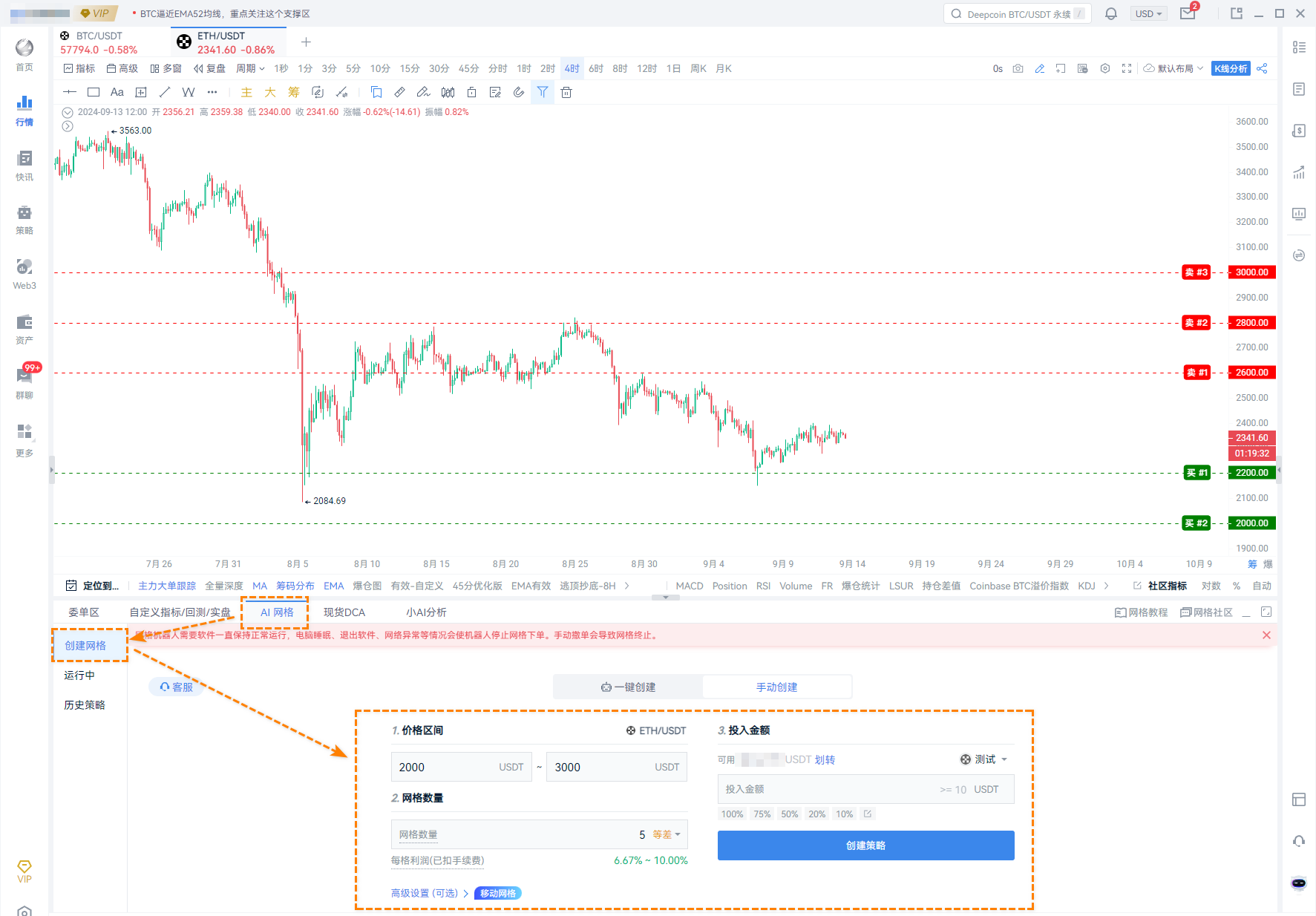

Taking the ETH/USDT spot trading pair as an example, the parameters are set as follows:

Lowest price: 2000 USDT

Highest price: 3000 USDT

Grid number: 5 (arithmetic mode)

Investment amount: 1000 USDT

ETH price at the time of strategy creation: 2341 USDT

In this setting, the entire price range is divided into 5 grids, with a price difference of (3000-2000)/5=200 USDT for each grid.

At the start of the strategy, the program will automatically place initial buy and sell orders near the current price of 2341 USDT, placing buy orders below the current price and sell orders above the current price, as shown in the figure below.

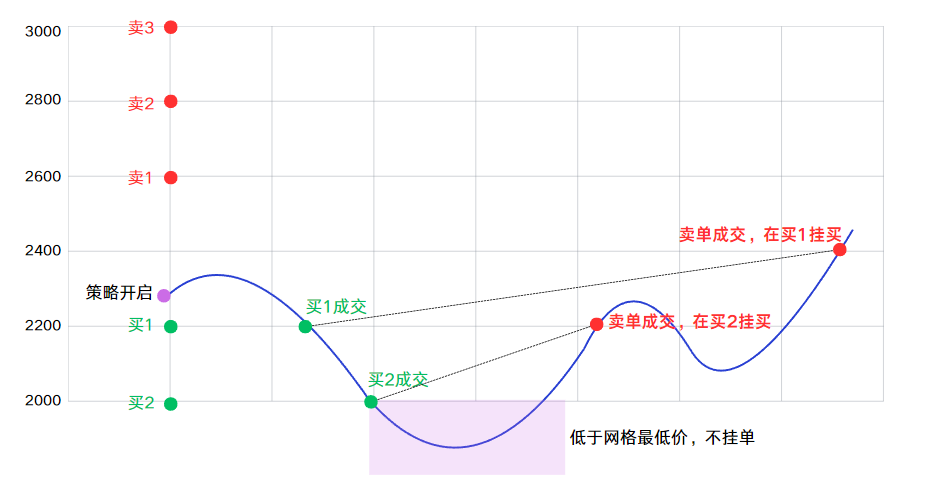

When the price drops to 2200 USDT, the buy order is executed (buying low), and the program will automatically place sell orders in the range of 2200~2400 USDT, i.e., sell at 2400 USDT (selling high). Subsequently, when the price rises to 2400 USDT, the sell order is executed, and the program will correspondingly place buy orders below, thus repeating the cycle, as shown in the figure below.

Advantages of AI Grid

Various grid strategy tools continue to emerge in the market. In comparison, AICoin's AI grid tool exhibits many significant advantages.

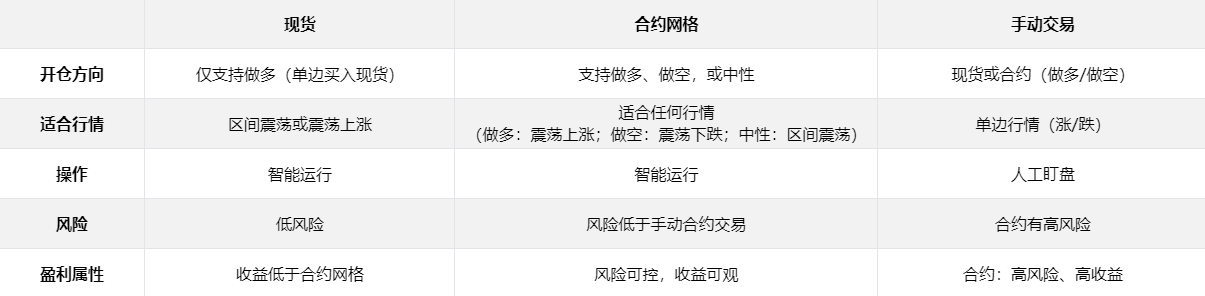

1. Widely adaptable to various market environments:

AICoin's grid strategy supports two major types: spot and contract, and is not afraid of bull or bear markets.

- Spot market: Especially suitable for oscillating markets, providing investors with a stable operating space.

- Contract market: Long positions are suitable for bullish markets, short positions are suitable for bearish markets, and neutral long and short positions perform well in oscillating markets.

2. Low threshold and easy operation

It only takes 2 steps at the fastest: ① Input amount; ② Create strategy. For specific operations, please refer to the following content.

3. Free to use, zero cost burden

AICoin's grid strategy tool is freely available to all users, without the need to pay any additional fees, and without any cost burden.

4. Data visualization

Based on intelligent algorithm backtesting, AICoin provides clear parameters and intuitive profit data for currency pairs, trading types, and operating durations, contributing to users' investment decisions.

5. Low-cost investment

It can be operated with small amounts of funds, avoiding the risk of investing a large amount of funds at once.

6. Unlimited parallel multiple strategies

AICoin's grid strategy has no upper limit on the number of strategies that can be run simultaneously.

7. Fully automated, no need to monitor the market

The strategy is completely executed by the robot, without the need for constant human monitoring. However, it is important to ensure that the AICoin client is running normally and the network is unobstructed. Additionally, the strategy robot only runs on local software, and the computer entering sleep mode will cause the robot to pause work.

How to Operate

Step 1: Install and update the AICoin PC client

Installation link (open the link using a VPN): https://www.aicoin.com/download

Step 2: Authorization. AICoin's grid tool supports trading on OKX, Binance, Bitget, Gate, HTX, and Pionex platforms.

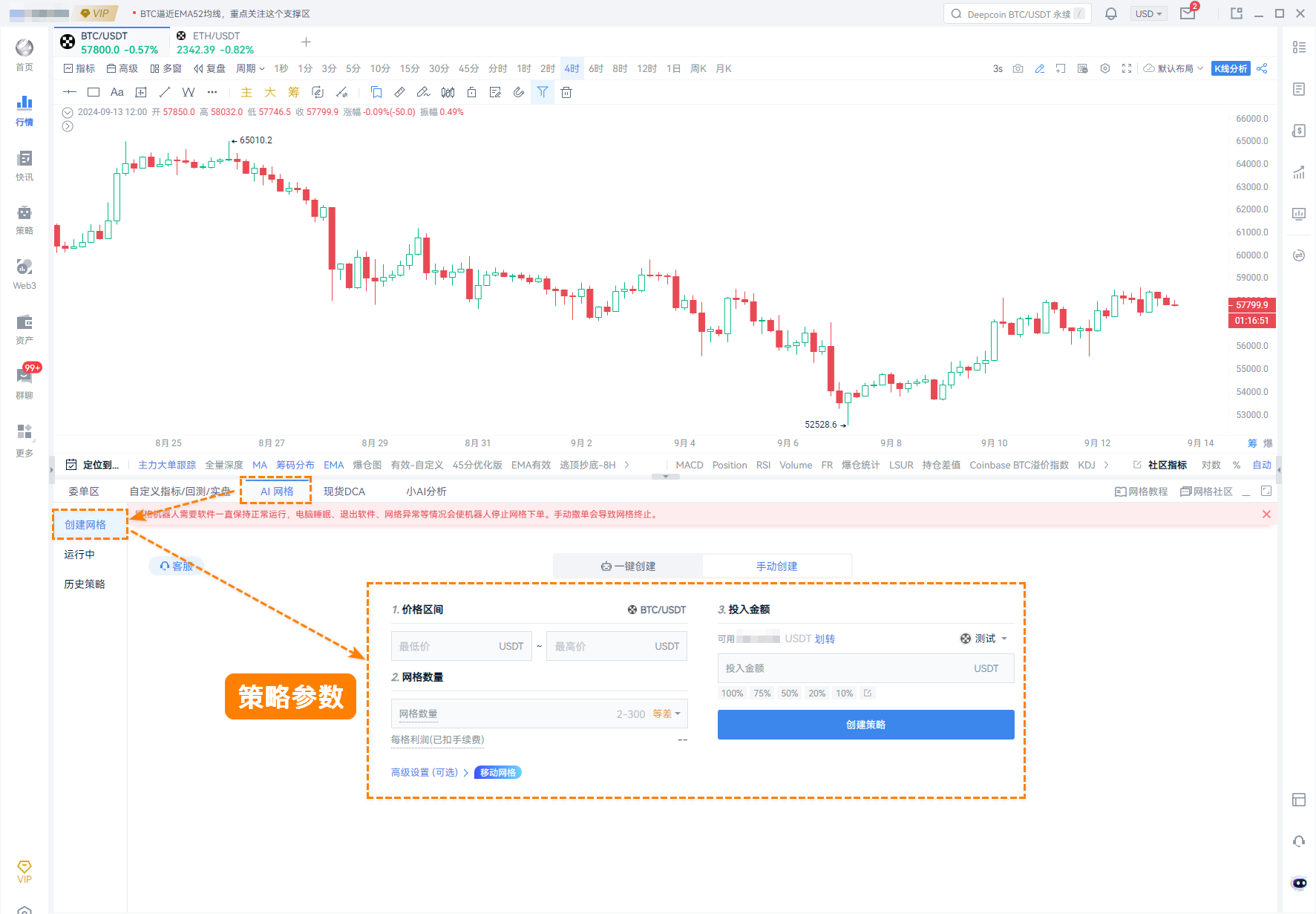

Step 3: Select the trading pair and strategy type (spot or contract).

Step 4: Set the price range, grid number, investment amount, etc.

Step 5: Start the strategy, and the robot will automatically execute trades based on the settings.

Manual creation tutorial: https://www.aicoin.com/zh-Hans/article/360449

Risk Avoidance

Grid strategies can automatically profit in volatile markets, but they also have certain risks, especially in the case of extreme or strong one-sided market trends. Here are some methods to avoid the risks of grid strategies:

Set take profit and stop loss: Set clear take profit and stop loss prices to prevent losses from extreme market trends (contract grid trading carries the risk of liquidation, so take profit and stop loss settings must be properly configured!!!)

Low leverage: Especially in contract trading, use low leverage and maintain sufficient margin.

Active order quantity: Set a reasonable number of active orders to prevent excessive fund dispersion.

Isolated margin: Isolate grid funds from the trading account to avoid the risk brought to the overall position by the liquidation of individual positions.

Choose appropriate price ranges: Choosing appropriate price ranges for trading can reduce the risk brought by the market breaking through the range. It is preferable to select obvious oscillating ranges, as the more frequent the oscillations, the greater the opportunity for grid profit.

For more detailed logic and operational explanations, you can subscribe to AICoin's official YouTube videos or consult customer service in the group chat:

Tutorial video: https://www.youtube.com/watch?v=Y6cLey8qnqU

Contact customer service: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。