Focusing on the weakening trend of the US dollar and the expectation of a rate cut by the Federal Reserve, a thorough analysis is conducted on the different impacts of defensive and recessionary rate cuts on economic data, as well as the effects of rate cuts on the US dollar, the USD/CNY currency pair, and BTC holders. Measures such as diversified investment and increased allocation to hedge assets are provided for different asset holders, emphasizing the need for investors to closely monitor policy changes and market dynamics and to flexibly adjust investment strategies.

Authors: Sylvia / Mat / Darl / WolfDAO

Editor: Punko

Preface

First, let's focus on the latest interest rate cut schedule. We have compiled a list of important time releases before and after the interest rate cut in September 2024. For more timely news, please follow our Twitter account;

2024 Cryptocurrency Important Events - Source: @10xWolfDAO Compilation

The weakening trend of the US dollar has emerged, and with the expected rate cut by the Federal Reserve (Fed), the trend of the US dollar against major currencies has weakened.

Since 2022, the US dollar has strengthened due to interest rate hikes, but recently, the expectation has shifted towards easing, leading to the depreciation of the US dollar against currencies such as the euro, pound, and yen. Although the Federal Reserve may cut interest rates, the policy direction of other central banks such as the European Central Bank and the Bank of Japan and economic factors may affect the trend of USDT. In addition, the risks of a weakening US dollar include political uncertainty and global economic recession. In the long term, the US dollar is more influenced by productivity growth and the performance of US stocks.

Defensive vs. Recessionary Rate Cuts

In the upcoming rate cut cycle, different types of rate cuts will have different impacts on economic data.

- Preventive rate cuts are mainly aimed at preventing a rapid slowdown in economic growth, and economic data remains relatively strong. During this stage, the valuation pressure on US stocks may be alleviated in the short term, but the fundamentals still need to be observed.

- Recessionary rate cuts are used to address economic recession by stimulating economic recovery through significant interest rate cuts. In the context of recessionary rate cuts, the fundamentals of US stocks deteriorate, and investors may be more inclined to increase their allocation to gold and bonds to hedge risks.

In the current context, how should different asset holders respond to the risks of future rate cuts?

Impact of Rate Cuts on the US Dollar

Anticipated Realization of Rate Cut Expectations

Although in most rate cut cycles, the US dollar typically remains stable or declines before the first rate cut, the US dollar is currently at a low point, so there is limited room for further decline. Since July, the expectation of a rate cut has gradually narrowed from a two-cut expectation to a one-cut expectation, supported by positive economic data, further stabilizing the price of the US dollar and showing signs of a rebound from the bottom. It is important to focus on whether this rebound can re-establish itself above the m360 moving average, thereby determining how long the trend of a weak US dollar can continue.

US Dollar Index Fluctuation - Source: Tradingview Compilation by @10xWolfDAO

Reference Response Measures

1. Diversified Investment

First, investors can reduce their excessive dependence on US dollar assets through diversified investment. Specific measures include increasing the proportion of assets denominated in other currencies, such as the euro, pound, yen, and even digital currencies like Bitcoin. This can hedge risks during US dollar depreciation. For example, if investors convert some assets into euro-denominated bonds or stocks, the relative value of these non-US dollar assets may rise when the US dollar depreciates, offsetting some of the losses.

2. Increased Allocation to Hedge Assets

During a period of rate cuts and US dollar depreciation, safe-haven assets such as gold and silver often perform well. This is because during global economic turmoil, investors tend to turn to safer investment choices. Investors may consider increasing their holdings of gold and silver, as these precious metals typically have a higher value preservation effect during currency depreciation. For example, historical data shows that during multiple financial crises or currency depreciation periods, the price of gold usually rises, making it a powerful tool for hedging risks. (Gold assets ahead of rate cuts)

International Gold Futures Index Fluctuation - Source: Tradingview Compilation by @10xWolfDAO

3. Adjusting Bond Portfolios

With the expected rate cut by the Federal Reserve, the bond market usually undergoes some changes. Generally, rate cuts push up bond prices, especially long-term bonds. Investors may consider shifting funds to long-term bonds or increasing their holdings of higher-yielding corporate bonds, which typically perform better in a rate cut environment. For example, certain high-rated corporate bonds not only provide higher yields during rate cuts, but are also relatively safe, making them an ideal choice.

4. Using Hedging Tools

During periods of high market volatility, hedging tools can help investors mitigate risks. Using forex options, forward contracts, and other tools to hedge against the risk of US dollar depreciation is an effective method. For example, investors can protect themselves from the impact of a US dollar decline by purchasing put options on the US dollar, or lock in future exchange rates through forward contracts to ensure trading at a specific price in the future.

5. Monitoring Policy Changes and Market Dynamics

Closely monitoring the policy direction of the Federal Reserve and changes in the global economic situation is crucial. The Federal Reserve's rate cut decisions often trigger chain reactions in the market, and these changes may have a significant impact on investment portfolios. Therefore, investors should remain flexible and adjust their strategies in a timely manner to respond to the constantly changing economic environment.

6. Monitoring Technical Adjustments

From a technical perspective, investors can also adjust their strategies by observing market trends. For example, when the market rebounds and then falls after touching important technical indicators (such as m360), investors can choose to short USDT to lock in a higher exchange rate, or short the USD/JPY currency pair to capture short-term market fluctuations. In technical analysis, m360 is often used as a reference point for long-term trends, and if the price shows a reversal signal near this point, it may be a good time to adjust positions.

Impact of Rate Cuts on the USD/CNY Currency Pair

For investors interested in entering the cryptocurrency market, they can focus on the USD/CNY currency pair to find suitable entry opportunities.

August Market Review

USD to CNY Exchange Rate Fluctuation - Source: Tradingview Compilation by @10xWolfDAO.com

Decline in US Economic Data: On August 2, the US non-farm payroll data for July fell short of expectations, with only 114,000 new jobs added and the unemployment rate rising to 4.3%, increasing market expectations for a September rate cut by the Federal Reserve. On August 23, the US Bureau of Labor Statistics further revised the data, lowering the number of non-farm jobs in March 2024 by 818,000, intensifying expectations for a rate cut.

Dovish Signals from Powell's Speech: On August 23, Federal Reserve Chairman Powell, at the Jackson Hole Global Central Bank Annual Symposium, stated that the timing and pace of rate cuts would depend on economic data and risk balance, and pointed out that the labor market had significantly cooled from its previous overheated state. This was interpreted by the market as a strong signal for a rate cut, deepening expectations for a September rate cut by the Federal Reserve.

Buffett's Investment Behavior: Berkshire Hathaway, under Buffett's leadership, significantly reduced its holdings of US stocks by $76 billion in the second quarter, while increasing its holdings of US bonds by $81 billion, reflecting concerns about the future prospects of the US economy. This investment strategy has caused market unease about the future trend of the US economy, leading to a decline in the US dollar index and further pushing up the exchange rate of the Chinese yuan.

Looking ahead to September 2024, the exchange rate of the Chinese yuan against the US dollar is expected to fluctuate widely within the range of 7.03 to 7.20. The main influencing factors include:

Expectations of Fed Rate Cuts: Powell's speech at the Jackson Hole Symposium has strengthened market expectations for a rate cut in September. The market widely expects a 25 to 50 basis point rate cut by the Federal Reserve in September. However, considering the current performance of US economic data, some analysts believe that there is no urgent need for a rate cut in the US economy. The annualized real GDP growth rate in the second quarter was 3.0%, higher than the previous quarter's 1.3%; retail sales in July increased by 1.0% month-on-month, also higher than the expected 0.3%. Therefore, there is still uncertainty about whether the Federal Reserve will actually take action in September.

Impact of Global Economic Conditions: Compared to the US, the eurozone has a more urgent need for rate cuts, but the European Central Bank has maintained a cautious attitude and is not in a hurry to further cut interest rates. The eurozone's unemployment rate was 6.4% in July, higher than that of the US; the year-on-year CPI growth in August was 2.2%, and the core CPI grew by 2.8%, indicating relatively low inflation pressure. The policy stance of the European Central Bank and the decision-making direction of the Federal Reserve will also have an impact on the future exchange rate of the Chinese yuan.

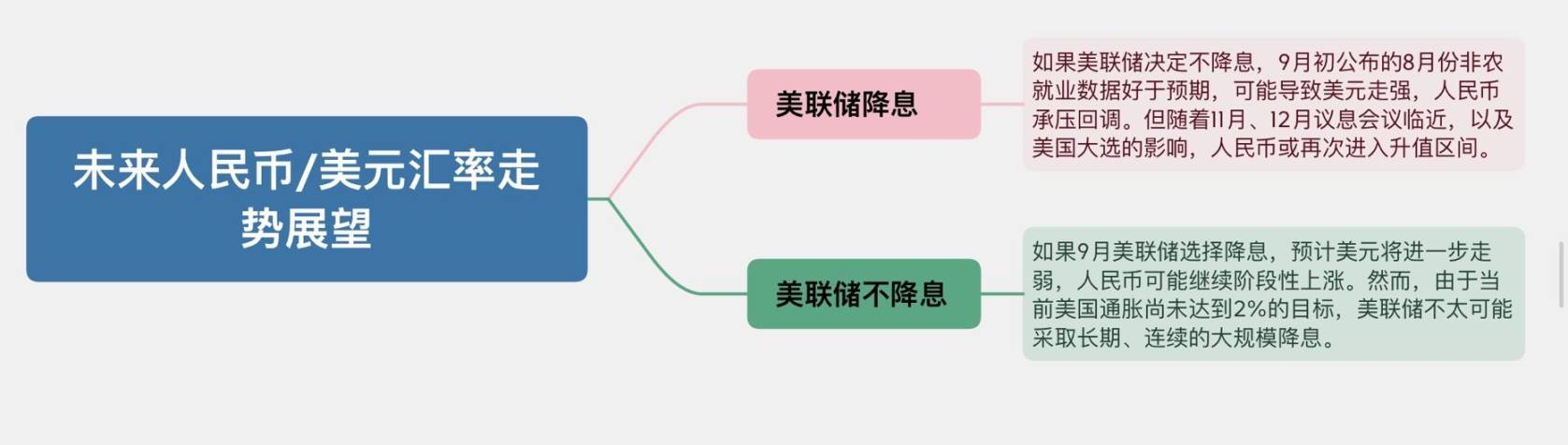

Possible Scenarios and Response Measures for the Yuan's Trend

The future trend of the Chinese yuan may develop in two scenarios:

8月人民币对美元的升值受到美国就业数据、鲍威尔的讲话和巴菲特的投资行为的共同影响。展望未来,人民币汇率将主要受美联储政策动向的影响,可能出现宽幅波动。投资者应密切关注美联储政策走向、美国经济数据及全球经济环境的变化,灵活调整投资策略。短期内可能需增持避险资产如黄金,中长期应关注全球经济和政策的动态变化。

Impact of Rate Cuts on BTC Holders

Nature of BTC (Risk or Hedge Asset)

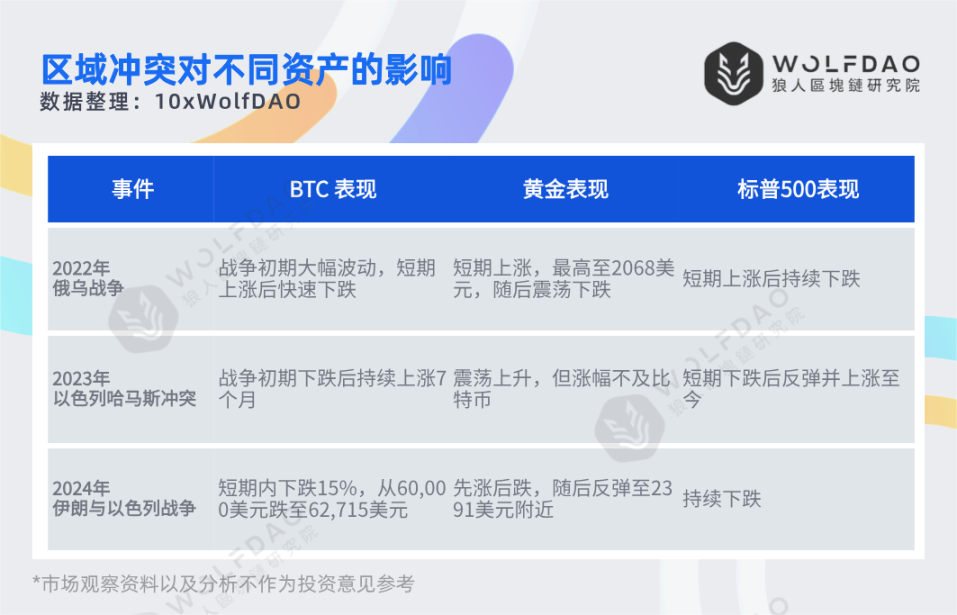

As a decentralized, highly anonymous digital currency with a fixed supply and not subject to government control, Bitcoin can be considered a hedge asset to some extent, especially during times of war due to its high acceptability as an important channel for fund transfer during regional conflicts. Therefore, BTC may experience higher volatility during regional conflicts.

However, as the market value of BTC continues to expand and with the push for ETF approval, it is also closely linked to the trend of the Nasdaq, making it also considered a risky asset. Therefore, we will compare the impact of rate cuts on BTC to the impact on US stocks.

Trends in US Stocks After Rate Cuts

After the Federal Reserve's monetary policy meeting on July 31, although interest rates remained unchanged, Chairman Powell expressed an "open attitude" towards a rate cut in September. Powell has hinted multiple times that the Federal Reserve may start cutting rates before inflation reaches the 2% target, and is monitoring signs of cooling in the labor market, with the market expecting the earliest rate cut by the Federal Reserve to be in September.

However, historical data shows that stock markets do not necessarily experience a significant increase after the first rate cut. The price of BTC may also experience low volatility if influenced by US stocks.

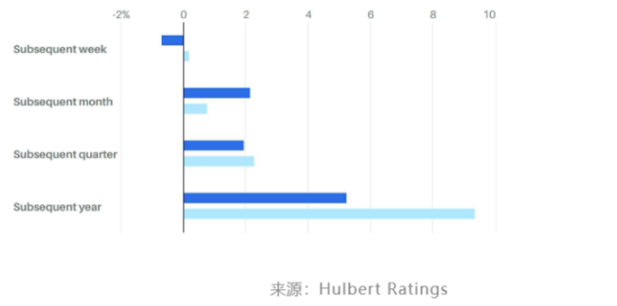

Analysis since 1994 shows that the S&P 500 index's performance after the first rate cut is usually below average, reflecting different interpretations of the Federal Reserve's rate cut motivation and communication strategy. If investors believe that the rate cut indicates a weak economy, the stock market may perform poorly; but if the market believes that the Federal Reserve has achieved a "soft landing," the stock market may rebound.

Source: Hulbert Rating @10xWolfDAO Compilation

Time Period: Average Return of the S&P 500 Index in the Selected Time Period Since 1994

- Blue: Average return of the S&P 500 index one week, one month, three months, and one year after the first rate cut since 1994

- Green: Average return of the S&P 500 index in all selected time periods since 1994

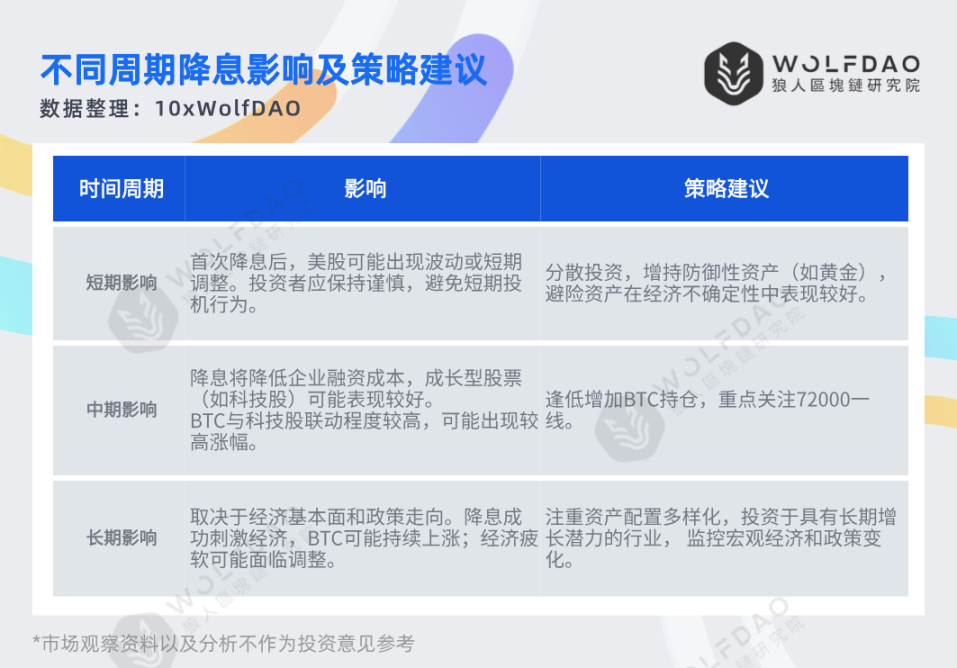

Nevertheless, due to the limited number of historical samples, investors should remain cautious when speculating on market reactions. In addition, other influencing factors need to be considered to support the view that the stock market will rise after a rate cut. Therefore, the impact of rate cuts will have different effects on the market in the long, medium, and short term:

Source: @10xWolfDAO Compilation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。