Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

In June of this year, during the market downturn, "VC Coin" was pushed to the forefront and was blamed for the market's decline. After that, Binance stopped Launchpool following the IO (io.net) incident.

Until August, Binance reopened Launchpool, including TON and DOGS from the TON ecosystem, but the yield was far lower than at the beginning of the year.

Yesterday, Binance once again launched HMSTR (Hamster Kombat) on Launchpool. How is the price estimated this time? What changes have occurred in the operation strategy and data characteristics of Launchpool compared to the beginning of the year? Odaily will answer these questions in this article by digging deep into the data from the past 18 periods.

Preview of Core Questions and Answers

Since the main text involves a large amount of data and charts, this section will summarize the core questions and related conclusions. Readers who are not interested in the specific process can directly view the answers:

HMSTR Price Estimation

While maintaining the average annualized yield of 108% over the past 18 periods, the dream price is estimated to be 0.0593 USDT, with an initial circulating market value of 38.17 billion US dollars and a fully diluted valuation (FDV) of 59.3 billion US dollars;

While maintaining the average annualized yield of 46.8% over the past 5 periods, the ideal price is estimated to be 0.0256 USDT, with an initial circulating market value of 16.48 billion US dollars and an FDV of 25.6 billion US dollars;

Referring to the initial circulating market value of DOGS, the reasonable price is 0.0104 USDT, with an initial circulating market value of 6.71 billion US dollars and an FDV of 10.4 billion US dollars.

Is the Current BNB Price Reasonable Based on the Annualized Yield?

Even based on the initial circulating market value calculation of 6.71 billion US dollars, the absolute yield of HMSTR in this period is only 0.36%, corresponding to an annualized yield of 19%, far below the previous average of 108%.

Taking into account the time interval of Launchpool, BNB's passive income has declined to the level of stablecoins such as USDT.

In a situation where BNB burning is unrelated to Binance's profits, the Launchpool yield is the only objective measure. If similar "low Launchpool, high circulation" low-yield tokens continue to be listed, there is a risk of overvaluation for BNB itself.

Does BNB Still Have the Launchpool Effect on Price?

The Launchpool effect has disappeared. After the announcement of Launchpool, there will be no direct price increase, and in most cases, there may even be a slight decline;

It is more profitable to buy after an hour from the announcement compared to buying immediately after the announcement.

Is the Pure Mining Strategy Still Effective?

Is the strategy of "buying in after the announcement to participate in Launchpool and selling at the end" still effective during the bull market?

It is ineffective. Buying after the announcement will only result in losses. It is more suitable for long-term holding, or at least choosing hedging or borrowing for short-term mining.

HMSTR Price Estimation

Absolute yield = Reward token amount × closing price after one hour ÷ (BNB staked amount × BNB price at the start of mining), annualized yield = absolute yield ÷ mining duration × 365 days.

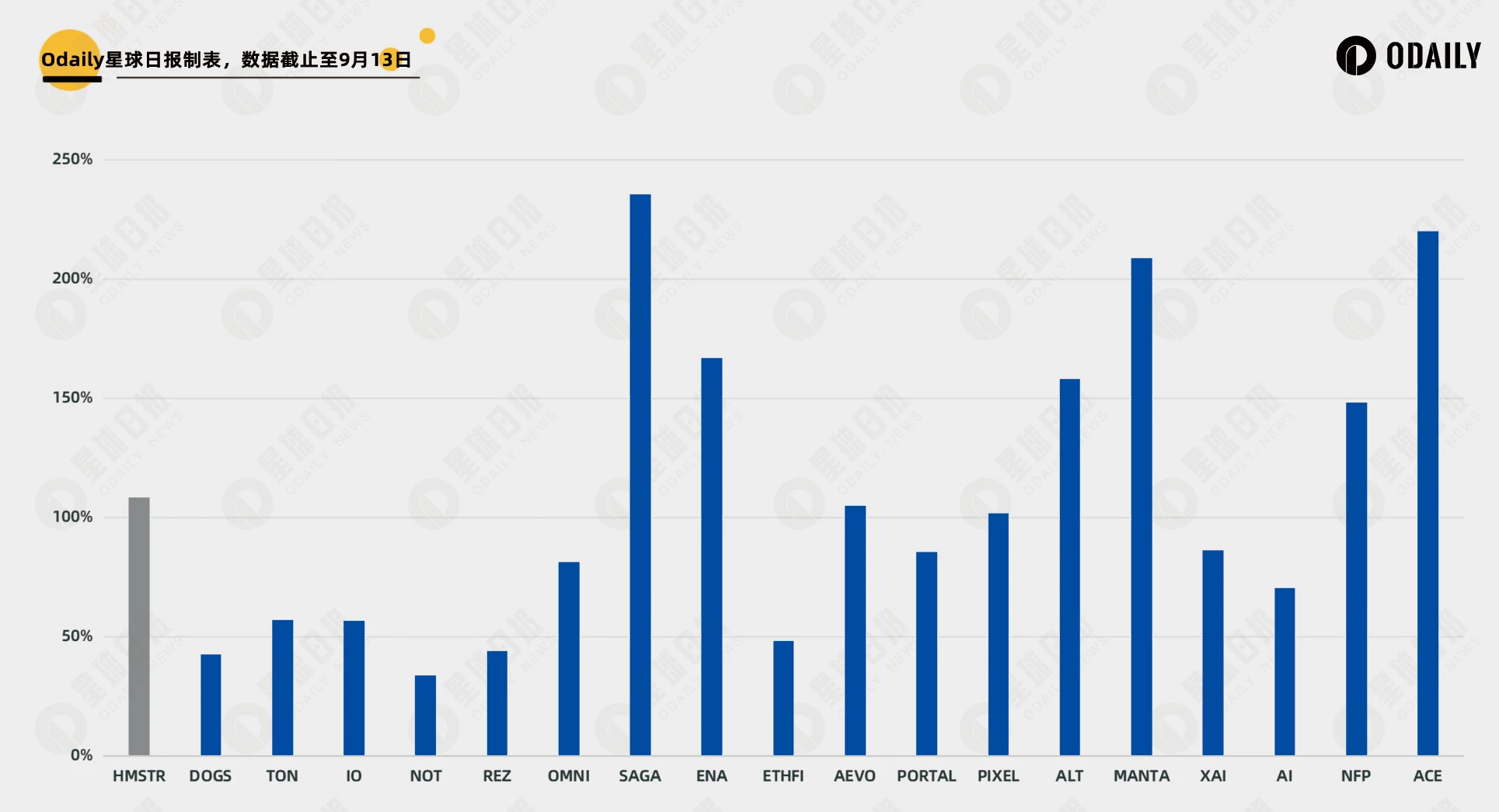

The annualized yield over the past 18 periods is shown in the following figure, clearly indicating a significant decline in the annualized yield in recent periods.

Therefore, the average annualized yield over the past 18 periods (108%) is taken as the dream value, and the annualized yield over the past 5 periods (46.8%) is taken as the ideal value, resulting in a dream price of 0.0593 USDT and an ideal price of 0.0256 USDT.

At the dream price, the initial circulating market value is 38.17 billion US dollars, and the FDV is 59.3 billion US dollars;

At the ideal price, the initial circulating market value is 16.48 billion US dollars, and the FDV is 25.6 billion US dollars.

Even based on the ideal price, the initial circulating market value ranks only 52nd among all tokens, which is very unreasonable. From a rational perspective, the estimated annualized yield must be significantly reduced.

The reason for this unconventional value is that the initial circulation ratio of HMSTR is 64.38%, but only 3% is in Launchpool. To maintain the yield, a circulating market value far exceeding the conventional level is required. However, DOGS has set a precedent with an initial circulation ratio as high as 93.95%, but only 4% entered Launchpool. Therefore, DOGS had a high initial circulating market value of 6.71 billion US dollars at the time of listing, and HMSTR may have the potential to "create miracles".

If calculated based on the equivalent initial circulating market value of DOGS, the price should be 0.0104 USDT, with an FDV of 10.4 billion US dollars.

Does BNB Still Have the Launchpool Effect on Price?

Previously, every time Binance announced the launch of Launchpool, BNB would "rise" either before or after the announcement. Does this effect still exist now?

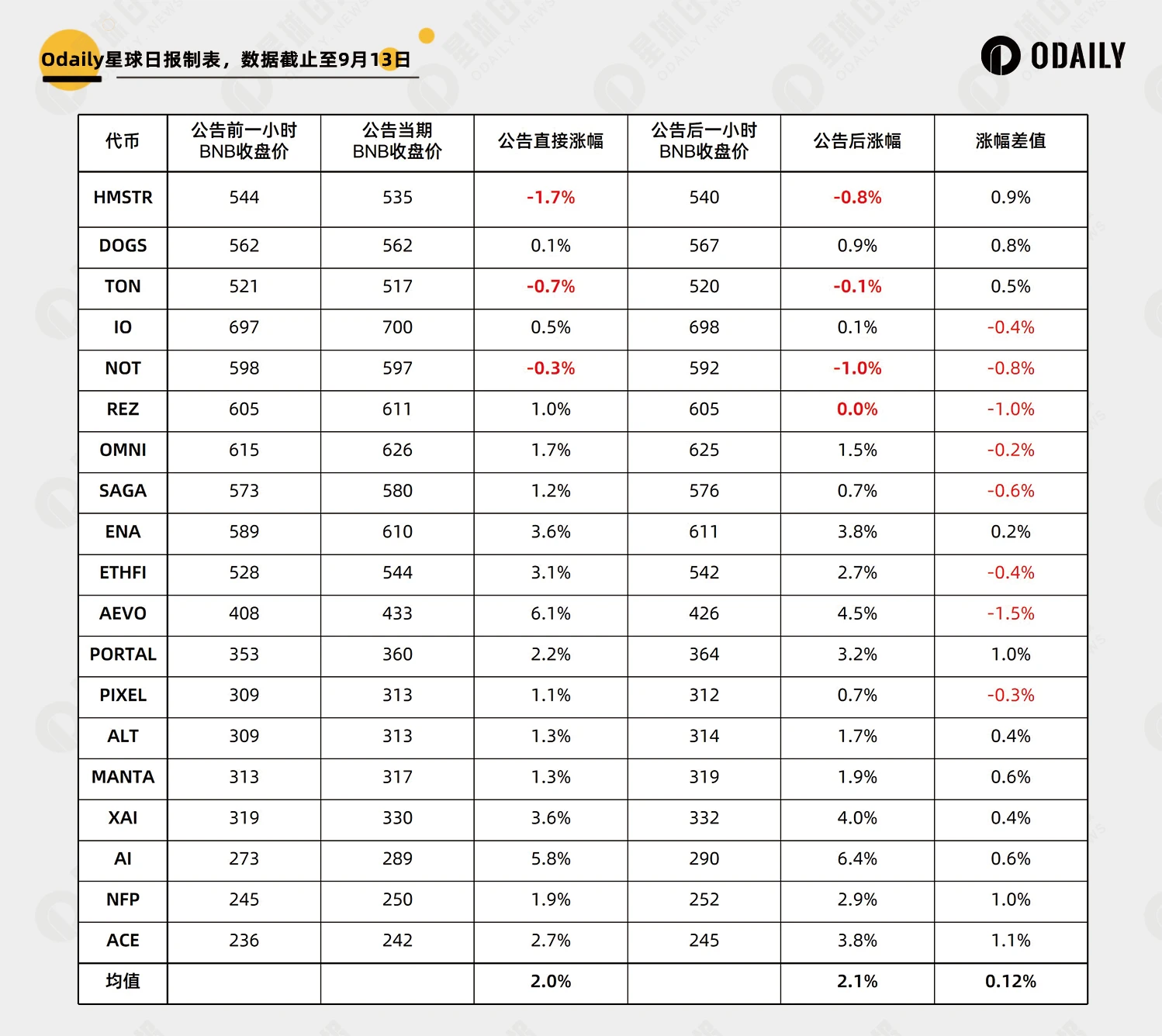

Assuming the listing announcement was made at 14:25 (or any time at 14:00), the corresponding calculation time points are defined as:

The price at 14:00 (closing price of BNB one hour before the announcement), the price at 15:00 (closing price of BNB at the time of the announcement), and the price at 16:00 (closing price of BNB one hour after the announcement);

Immediate increase after the announcement (price at the time of the announcement - price one hour before the announcement), increase after the announcement (price one hour after the announcement - price at the time of the announcement);

Difference in increase (increase after the announcement - immediate increase after the announcement). A negative value may indicate a lack of market confidence in the new token or profit-taking based on "insider" information, while a positive value indicates relatively strong market confidence.

Similar changes apply to other announcement times, resulting in the following data:

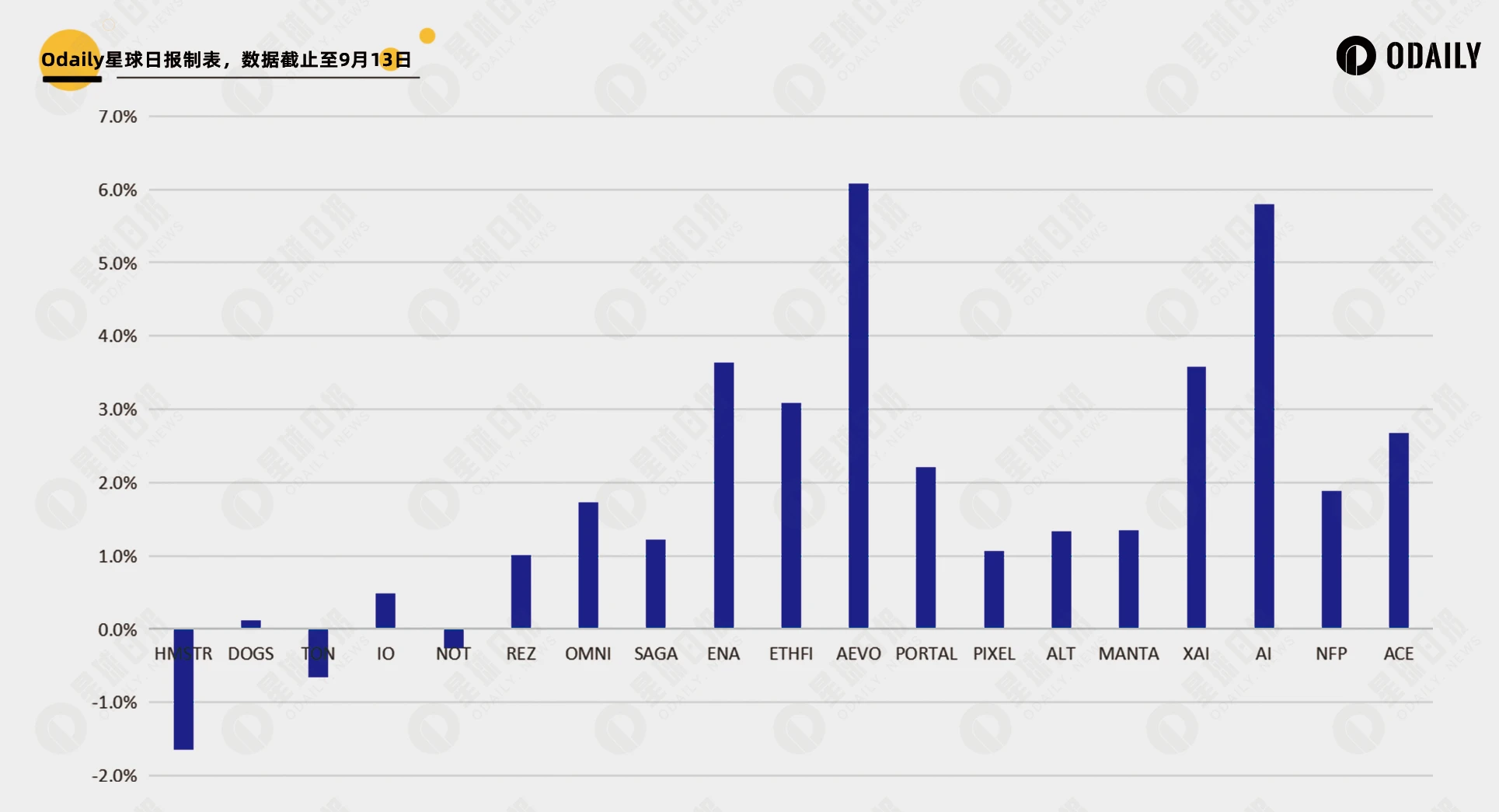

The bar chart below shows the "immediate increase after the announcement". Based on the comprehensive table, it can be seen that BNB no longer has the Launchpool effect, as there will be no direct price increase after the announcement, and in many cases, there may even be more profit-taking based on "insider" information.

In addition, one hour after the announcement, the trend has changed from an increase to a decrease since the beginning of the year. If one did not make a purchase in advance, it would be more profitable to buy after waiting for some time after the announcement.

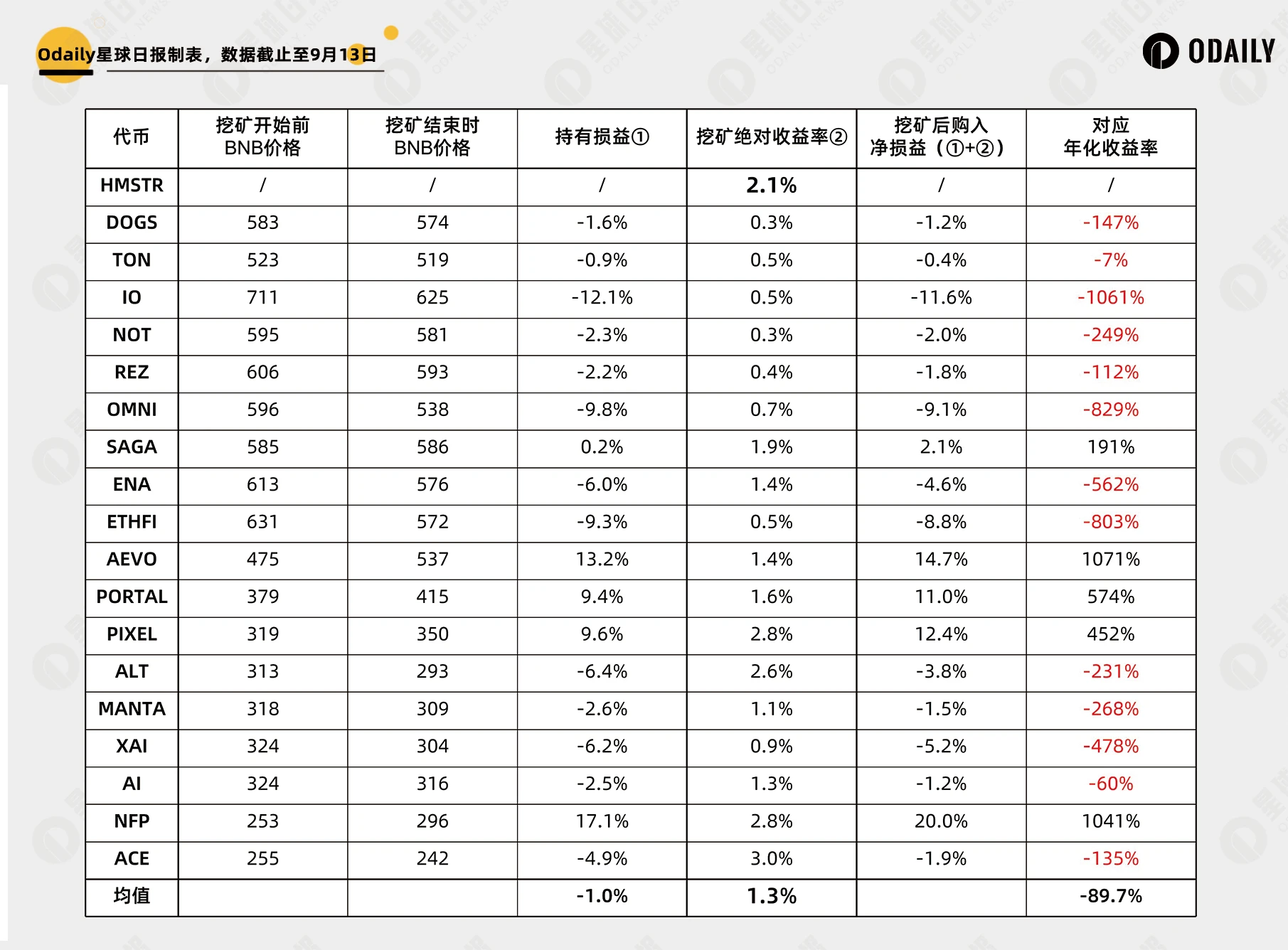

Is the Short-Term Pure Mining Strategy Still Effective

Is the strategy of "buying in after the announcement to participate in Launchpool and selling at the end" still effective during the bull market?

Buying after the announcement and holding BNB results in a decline in most cases (72%), and even with mining income to compensate, the overall loss is very significant. Therefore, it is not recommended to purchase BNB for short-term mining. It is more suitable for long-term holding, or at least choosing hedging or borrowing for short-term mining.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。