Original | Odaily Planet Daily ( @OdailyChina )

Author | Wenser ( @wenser2010 )

Despite the recent poor performance of the Ethereum market, Ethereum's "spiritual leader" Vitalik has already entered the "Next Level".

On September 11, when Vitalik discussed the value of ENS with former core contributor Brantly.eth, he once again showed his "rebellious side" - he first sarcastically created a commentary tweet, stating "You see, Mr. Buterin. Here are those who think only PoW is decentralized. Here are those who do not appreciate your support for synthetic uterus. Here are those who do not like vaccines. What will happen when they all try to cancel you together?" (Odaily Planet Daily note: The accompanying picture is a satirical diagnosis scene from "The Simpsons" S11-EP12). After X platform users commented "What A D*ck," "Brave Little V" unapologetically countered with "No, it's a d*ck," accompanied by a picture of a duck holding a sign that reads "PoS is more decentralized than PoW."

It has to be said that after the completion of milestone events such as the "10th anniversary birthday" and the approval of Ethereum spot ETF, as a blockchain network ecosystem with a market value of nearly $284 billion, Ethereum inevitably began to face its own "minor crisis" - can the Ethereum ecosystem continue to thrive? What are the current problems? How to solve the existing problems?

Odaily Planet Daily will start this article from the perspective of the "seven sins" and discuss the "whereabouts" of Ethereum for readers' reference. (Note: This article is the first in the series)

Ethereum also has "seven sins": when the price performance is poor, everything said is wrong

Everything has to start with "price".

The reason why Ethereum has been criticized by various parties in recent months, and even many loyal supporters of Ethereum have spoken little, is limited to the weak price performance - on January 1 this year, the price was around $2280, and since then, Ethereum has risen to nearly $4000 on March 13 as Bitcoin broke through a new high. Then came the well-known decline, and on September 7, the price fell to around $2223, and is now priced at around $2360, with a year-to-date increase of only 3.5%.

The current situation is mainly due to the following reasons (Note: The following "charges" are only for ridicule, do not escalate to personal attacks):

Coingecko data interface

Sin One: Greed - Ethereum Foundation frequently dumps tokens

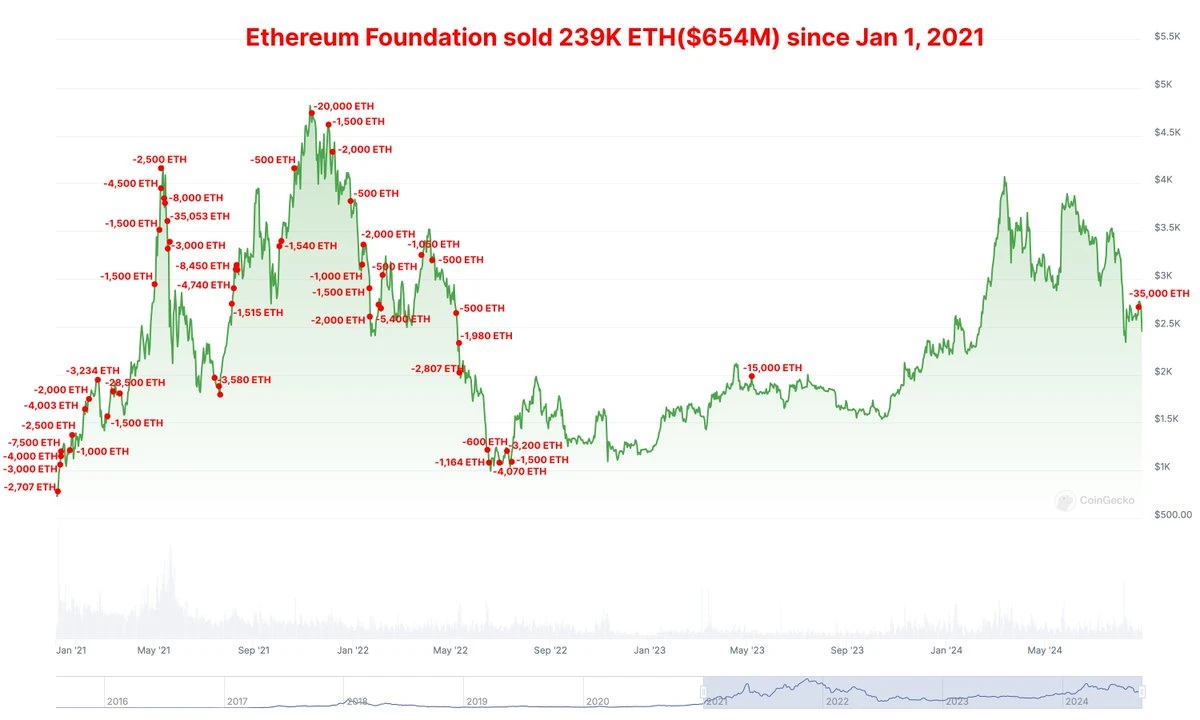

As a cryptocurrency second only to Bitcoin in market value, the promoter of the ICO craze, and one of the most successful cryptocurrency projects in history, Ethereum has grown into a towering tree in the cryptocurrency industry, followed by the Ethereum Foundation as the "official organization" with a large amount of ETH tokens and a "orthodox" discourse power. However, the Ethereum Foundation did not behave as many people expected - like traditional equity companies being cautious about selling stocks, but instead, the "dumping action" during the bull and bear cycles is the most eye-catching, and it is a necessary operation to "brush presence".

According to statistics from LookonChain earlier, as of the end of August this year, the Ethereum Foundation has sold 239,000 ETH since January 1, 2021, worth about $654 million. According to Spot On Chain's monitoring at the end of August, ETH experienced two large declines in the past month (a cumulative decline of 23.5%). Among them, a single entity of the Ethereum Foundation sold 35,400 ETH (about $95 million), and still held 275,000 ETH (about $677 million).

Subsequently, the "dumping" continued, with the most recent operation on September 9, when the Ethereum Foundation sold another 450 ETH (worth about $1.03 million). This single address has sold a total of 3066 ETH (worth about $8.68 million) on the chain over the past eight months, with an average selling price of $2830.

It has to be said that despite the "support for ecosystem development" and other "noble reasons," such exaggerated dumping actions still make people sigh: how can the Ethereum Foundation be so greedy?

Ethereum Foundation's "dumping" record

Sin Two: Arrogance - Ethereum's development roadmap is "designated" and ignores the vitality of ecosystem development

The current state of Ethereum today is somewhat related to the arrogance of the "official forces," including co-founder Vitalik and the Ethereum Foundation, and it is somewhat "a helpless situation of success and failure."

The specific manifestation of this point, in addition to the "L2 development roadmap" designated by Vitalik and the core developers of Ethereum, also has clues in the recent 12th AMA of the Ethereum Foundation. In response to the question "If blob fails to reach the target average, should the target be lowered to ensure price discovery?" during the AMA, Ethereum's core researcher Dankrad Feist stated: "Ethereum is currently creating a new market for rollups - the data availability (DA) market. Many alternative solutions hope to take market share from Ethereum - Celestia, Eigenlayer, Avail, etc. But they cannot compete on security, so they hope to compete on price."

For the already flourishing Ethereum ecosystem, perhaps it has always been in a state of "neglect."

Not only that, Vitalik's lack of "attention" to the DeFi track is also a major reason. He had previously expressed concern about the use cases of DeFi in cryptocurrency, believing that DeFi would lead to people excessively pursuing financial speculation and speculative value. In response, Arthur Cheong, the founder and CEO of DeFiance Capital, stated, "The worst view, the founder of the largest L1 public chain does not truly understand the use cases and industry that drive ETH's price and market value to reach $330 billion. The price of ETH may be at $0.03."

Arrogance may indeed be the original sin of progress.

Arthur openly criticizes Vitalik

Sin Three: Envy - Ethereum Foundation researchers "Restaking" themselves

In the still barbaric world of crypto, sometimes, holding a high position does not necessarily mean being able to make a lot of money. Everyone needs to eat and drink, and making money is not embarrassing.

Perhaps this is also one of the reasons why some Ethereum Foundation researchers choose to "Restake" themselves in a specific project - after all, compared to the more academic atmosphere of the Ethereum Foundation, a project that can directly receive salary and token rewards may be a better choice.

In May of this year, Ethereum Foundation researcher Dankrad Feist, following Justin Drake, became an advisor to the Ethereum re-staking project EigenLayer, emphasizing "joining as an individual does not represent the Ethereum Foundation, focusing on risk and decentralization." He also stated, "I did receive a large number of tokens from EigenLayer, but I do not believe this will change or affect my position on the core protocol development. If EigenLayer is completed by highly trustworthy people, it will bring significant benefits to Ethereum. I believe the current leaders intend to do this and plan to help them take responsibility for it. If I believe the situation is no longer the case, I will not hesitate to speak out and resign."

Listen, what a stern expression? He even has a way out, saying "I joined because I believe the project is beneficial to Ethereum, and if not, I will resign immediately!"

Sin Four: Anger - Ethereum Foundation transparency frequently questioned

The internal management, personnel changes, and expense expenditures of the Ethereum Foundation have always lacked effective ways to display.

As early as 2019, EthHub founder Eric Conner raised concerns about the transparency of the Ethereum Foundation to the community. At that time, Ethereum Foundation researcher Justin Drake responded, "The foundation has about 100 employees and spends about $20 million a year." Vitalik also stated, "Doubts about Ethereum governance did not delay the development of Ethereum 2.0," which now seems to be a bit of a concept switch and a trivialization.

Recently, the Ethereum Foundation's protocol support team added two new employees responsible for funding support work, marking the team's first recruitment, and the source of this news was a personal tweet from Ethereum core developer Tim Beiko.

In August, regarding the Ethereum Foundation's address depositing 35,000 ETH into Kraken, Ethereum Foundation Executive Director Aya Miyaguchi stated, "For a long time this year, they were told not to engage in any financial activities because regulation is complex, which prevented them from sharing plans in advance. And this transaction does not mean selling. From now on, they will gradually plan to sell in a planned manner."

In addition, in such an unpredictable market environment, members of the Ethereum Foundation also find it difficult to conceal their frustration - Péter Szilágyi, the head of Geth development at the Ethereum Foundation, previously expressed doubts about whether he had chosen the right industry. He believes that compared to SpaceX, the crypto industry is simply a "casino for fools" with no contribution to humanity. Everyone wants to be the next Vitalik, but no one wants to build something useful, everyone just wants to extract value. Only Bitcoin tried (although it failed) to become a hedge asset, everything else is just selling shovels, and there is no sign of a gold rush.

To some extent, perhaps he also holds disappointment and anger towards the Ethereum ecosystem, which can be called "lamenting its lack of competition and resenting its misfortune."

Sin Five: Sloth - Ethereum Foundation unable to provide a coherent roadmap and leadership for the ecosystem

This, perhaps, is the criticism from Zhu Su, the founder of Three Arrows Capital, in August, when the Ethereum Foundation's related addresses frequently deposited large amounts of ETH into exchanges. He stated, "Although the Ethereum Foundation sold 30,000 bitcoins it raised when the price of Bitcoin dropped from $600 to $300 early on, Ethereum still became one of the most successful projects in the crypto field. The problem with the Ethereum Foundation is not the early 'selling,' but the current inability to provide a coherent roadmap and leadership for the ecosystem."

This is evident from Vitalik's previous promotion of SBT (Soul Bonding Token), and the once enthusiastic Ethereum ecosystem-related projects are now "overgrown with weeds."

In addition, the remarks of Ethereum Foundation personnel are quite puzzling: at the end of August, former Ethereum Foundation employee Hudson Jameson stated that the foundation's annual budget of $100 million is not unreasonable, and he mentioned, "Regarding salaries: I don't have the latest data on how many people 'work' at the EF (those who are paid regularly as contractors or employees). If I had to guess, I would say that so far, the number of people in various regions is at least 200, but this is just a guess."

After the Ethereum Foundation's spending was questioned, Ethereum Foundation member Josh Stark also stated that the Ethereum Foundation is about to release the latest report covering 2022 and 2023, expected to be released before Devcon SEA (scheduled for November 12-15 this year).

Regarding the "Ethereum Foundation's annual budget expenditure of $100 million," The Daily Gwei founder Anthony Sassano even believes that this matter is "insignificant" in terms of ETH's market value.

However, on the other hand, the Ethereum Foundation's attention to "legal issues" and "privacy issues" may not be as sufficient as we imagine: In April 2023, Ethereum Foundation researcher Justin Drake revealed that the IP addresses of ETH stakers were monitored as part of a metadata set, which the crypto community at the time viewed as a privacy issue for Ethereum.

In 2019, Ethereum Foundation researcher Vlad Zamfir issued a clear warning at Devcon 5: developers need to start considering the legal status of Ethereum, rather than just hoping for Ethereum's development to grow to a scale where the government has to accept it. He believed that the government would not allow such a disruptive revolution to happen, and Ethereum now needs to adapt.

Although former Ethereum Foundation employee Hudson Jameson also mentioned in a previous article that "key expenses that may be overlooked by the Ethereum Foundation include global trademark protection legal fees to prevent fraudsters from using the Ethereum name or logo."

In the recent 12th Ethereum Foundation AMA, in response to the question "Where is the value of ETH today? Has the rollup ecosystem overshadowed ETH, causing it to lose value?" Ethereum Foundation core researcher Dankrad Feist stated, "Ethereum is building a financial platform, which will be the most neutral platform to date. It allows the issuance of financial assets, allows the trading of these assets, and can create new financial products based on them without permission, which are very valuable activities. Capturing value from this is possible, but the mechanism for doing so is not yet clear… Personally, I believe that it would be best if we focus on building a value-generating ecosystem on Ethereum, and I think value capture will naturally occur in the end. This does not mean that I am not considering it, but focusing on it when the value generation part is still lacking is a big mistake… The highest value transactions will continue to occur on Ethereum L1, and rollups will expand the pie by providing enough space for users to transact on Ethereum."

In a sense, the Ethereum Foundation is also feeling its way forward.

Sin Six: Gluttony - Ethereum ecosystem throughput limit has not been reached

In response to the same question, Ethereum Foundation core researcher Justin Drake's response was "more ambitious," and from his remarks, we can feel his confidence in the Ethereum ecosystem and his development ambitions.

He stated, "ETH is money. The accumulation of ETH value is crucial to the success of Ethereum. I believe that if ETH cannot become the programmable money of the internet, Ethereum cannot become the settlement layer of the value internet. The accumulation of ETH value boils down to traffic and monetary premium. The important metric is total fees, not fees per transaction. The ultimate goal of Ethereum's success is 10M tx/s, even if the cost per transaction is less than 1 cent, it can provide billions of dollars in daily revenue."

In terms of transaction throughput, Ethereum is also a "voracious beast."

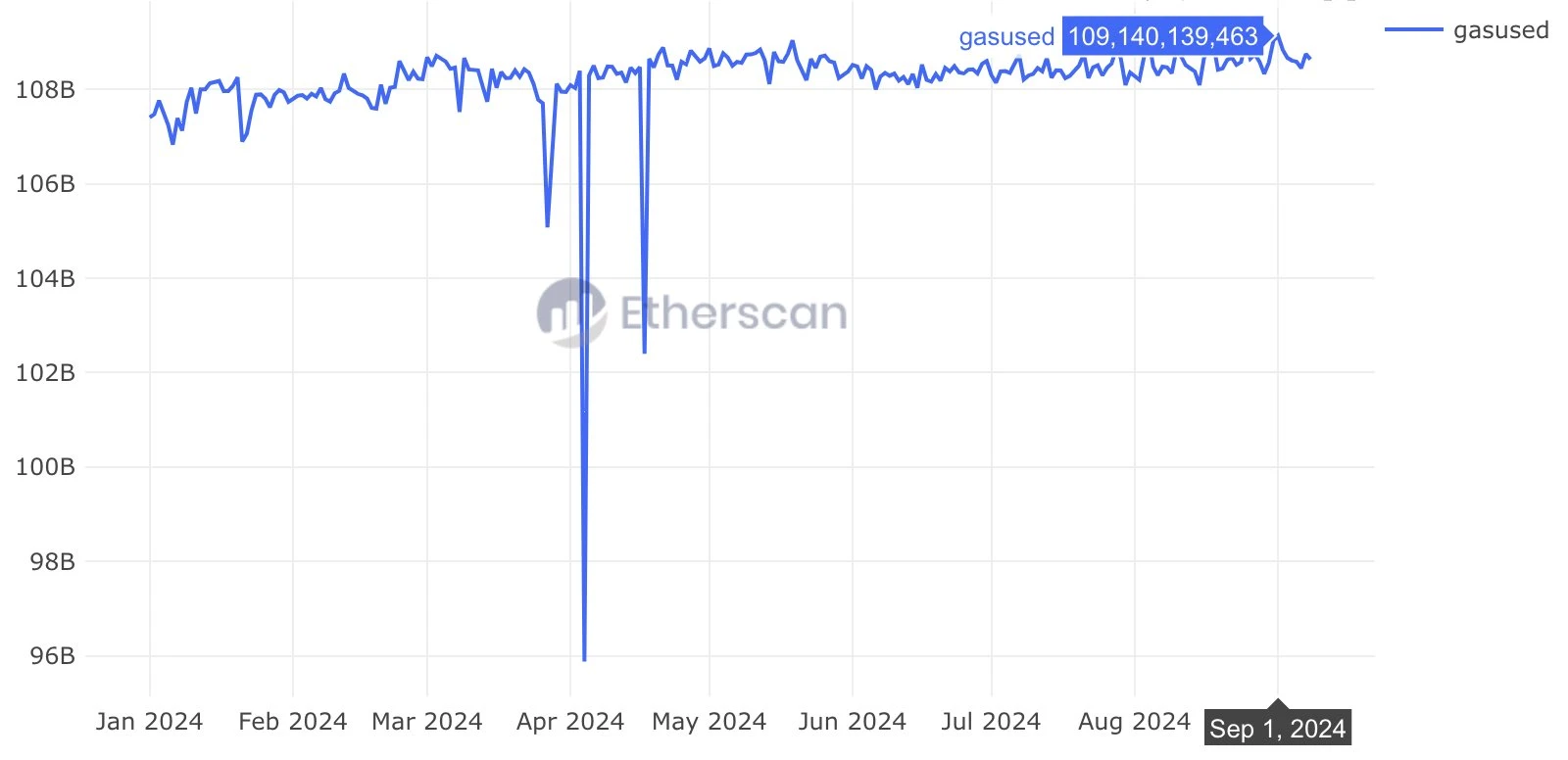

It is worth mentioning that earlier, the Ethereum block explorer Etherscan stated that on September 1st, despite the continuous decrease in gas prices in recent weeks, Ethereum's daily gas usage still reached a historical high of 109,140.14M. From this perspective, the Ethereum ecosystem is still the most active blockchain network in the cryptocurrency industry today. This, as SlowMist founder Yu Xian said, is also a side proof - after all, only ecosystems with high value and active transactions will attract a large number of phishing attacks.

It can be said that the "gluttony" symptoms of the Ethereum ecosystem are still continuing.

Ethereum throughput is still astonishing

Sin Seven: Lust - Founder Vitalik accused of being obsessed with romance and neglecting his career (satirical version)

First of all, it should be stated that this final sin is not a personal attack, but rather a form of satire.

As a co-founder of Ethereum and the "spiritual leader" of the Ethereum ecosystem, unlike the disappeared "father of Bitcoin - Satoshi Nakamoto," Vitalik's every move deeply affects the hearts of countless cryptocurrency industry professionals: his views are considered as a model, the technical standards he proposes are seen as the "designated route," and his on-chain operations are seen as endorsements. Even his personal life and emotional experiences are placed under the magnifying glass for careful observation and gossip.

Previously, Vitalik's photos with different women have been subject to "excessive concern" by many people. In a sense, for many people, Vitalik has become a symbol, and many people have developed unrealistic "alternative demands" for him - such as "Vitalik should not date, he should focus on his career," "Vitalik should tweet more to pump Ethereum," and so on.

Vitalik forced to "pump" Ethereum in the image

Vitalik should be quite helpless about this. He previously tweeted, "Someone told me that I need to do less philosophical thinking and post more content to pump Ethereum, so I'm going to post an Ethereum bullpost."

In this regard, I can only say that even as the helmsman of an entity worth billions of dollars, Vitalik is still just a person, not a "god," so, let's have fewer expectations and give him more freedom. After all, no one wants their every move to be excessively interpreted by the onlookers under the "magnifying glass."

As for dating, it is his personal freedom, and even lust, what's wrong with that?

Alleged image of Vitalik on a date (from the internet)

In conclusion: Named "Seven Sins," it is actually "Seven Dragon Balls"

In the end, as mentioned earlier, "when the price performance is weak, everything said is wrong." The "seven sins" of Ethereum seem like accusations and criticisms, but in reality, the author wants to emphasize that these issues are more like "seven dragon balls" - when collected, they can summon "Shenlong" and fulfill a wish.

When the Ethereum Foundation and the Ethereum ecosystem can face the existing problems, perhaps we will see a more prosperous and thriving blockchain network ecosystem.

In the next article, we will delve into the more fundamental issues of the current Ethereum ecosystem based on the specific details mentioned today.

After the prelude, the main content of this series of articles will be presented, so stay tuned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。