Author: Xiyu, ChainCatcher

Editor: Marco, ChainCatcher

DeFi once attracted countless users with the ideal of inclusive finance, promising to eliminate unfairness and opacity in the traditional financial system through technological means. However, as the industry has developed, DeFi products have become increasingly specialized, with more complex strategy designs that seem more suitable for professional investors and institutions, leading to many potential users being blocked by high entry barriers.

This trend of increasing complexity not only discourages ordinary users, but also deviates from the original intention of inclusive finance. Simplifying the complex operations and strategy selection in DeFi applications to allow more ordinary users to participate and benefit has become a key issue in the industry's development.

The AI liquidity allocation strategy platform, Quantlytica, is committed to simplifying the process and experience of participating in DeFi, using AI technology to simplify the DeFi investment process, optimize investment experience, and meet the investment needs of ordinary users. The platform integrates multiple DeFi protocols and uses AI technology to horizontally compare data such as returns, liquidity risks, and security of all DeFi projects, and then provides a variety of automated liquidity investment strategies based on different user needs.

In an interview with ChainCatcher, Wesley, the Chief Product Officer (CPO) of Quantlytica, explained that Quantlytica is not a simple cryptocurrency asset management tool, but a liquidity gateway in the cryptocurrency field. It helps users allocate their asset liquidity to the cryptocurrency market and also attracts liquidity for projects. It is more like a systematic liquidity solution that meets the diverse investment needs of today's DeFi participants.

On August 8th, Quantlytica announced a €1 million financing, with investors including Polygon Labs Eco Fund, Web3Port Foundation, DWF Ventures, and other top crypto institutions.

On September 13th, Quantlytica's native token officially began its TGE and was listed on multiple exchanges such as Bitget, MEXC, and BingX.

Optimizing DeFi Investment Experience with AI

"The idea of creating Quantlytica originally came about in March last year, mainly to create a cryptocurrency banking-level product that can rival the traditional financial experience. After more than a year of development and refinement, the first test product, Quantlytica Tesnet, was released in May this year, attracting thousands of users to experience it," mentioned Wesley in the interview.

Quantlytica is an AI-driven multi-chain liquidity allocation protocol positioned as a "liquidity gateway" in the DeFi field. It integrates DeFi protocols or yield strategies from multiple chains into a unified platform, using AI technology to drive and coordinate liquidity allocation across multiple DeFi applications and chains to find and build the best investment strategy combination for users.

On the Quantlytica platform, users can automatically participate in investment opportunities across multiple chains with a simple one-click operation, greatly simplifying the complex process of DeFi investment and making the investment process more intelligent and convenient.

Today, as the market matures and competition intensifies, many DeFi projects are introducing complex mechanisms and designs to enhance product competitiveness and attractiveness. This trend of increasing complexity makes DeFi products increasingly difficult to understand and use.

For example, Uniswap V3 introduced concentrated liquidity and a multi-tier fee structure, which, while improving liquidity efficiency, also increased the learning and operational costs for liquidity providers. Aave V2 introduced advanced features such as credit delegation to increase capital utilization, but these are more suitable for professional investors and developers, making it difficult for ordinary users to understand and use.

Due to the complexity and high risk of DeFi products, more and more ordinary users are choosing to exit, leaving the dominant position to professional investors and institutions. Data shows that funds on top DeFi protocols such as Uniswap, Aave, and MakerDAO mostly come from large holders or institutional collaborations, making it difficult for ordinary users to participate and greatly reducing the inclusiveness of the DeFi market.

Quantlytica is committed to eliminating the industry barriers of DeFi by providing a series of features aimed at optimizing the DeFi experience, making it no longer an exclusive domain for high-end players. Users do not need any professional knowledge or background in cryptocurrency to easily participate in DeFi products, making DeFi truly inclusive for everyone.

All of this is thanks to the Quantlytica founding team's rich experience in traditional finance. Co-founders Wesley and Guy have decades of experience in the traditional finance field, both having held important positions at DBS Bank in Singapore. Guy also has a background in quantitative trading and has managed over $100 million in funds at the globally renowned venture capital firm, Acadian. Another co-founder, David, is an AI expert from Stanford University.

"It is precisely because of our deep financial experience and technical background that the Quantlytica team can clearly understand the products and processes that financial users want to participate in," summarized Wesley.

Wesley gave an example, saying that when it comes to banks, people often think they are very complex and profound, but in reality, people use banks through various apps such as Alipay, WeChat Pay, and UnionPay, which is very simple. Users do not need any financial knowledge or background to participate.

"Simplifying complex financial products" is the advantage of the Quantlytica team.

Firstly, in product design, Quantlytica will provide some small tools or page entrances to help users better participate in the DeFi market, such as integrating various DeFi protocols on the market into a unified page, allowing users to participate in multiple investment opportunities with one click.

In addition, the Quantlytica team will integrate traditional financial experience and knowledge with Web3, and use AI technology to help users better enter the market and use products, such as using AI technology to analyze data such as returns of DeFi protocols, supporting users to customize the best investment portfolio and strategy according to their needs to maximize returns.

Liquidity Strategy Aggregation Platform: Supporting Customized DeFi Investment Strategies

Currently, Quantlytica's product consists of four main components: Liquidity Automation, AI Asset Management Assistant QuantGPT, Modular Fund SDK, and Risk Management Engine.

Firstly, Liquidity Automation is Quantlytica's flagship feature, which uses AI technology to automatically optimize liquidity allocation across multiple networks and DeFi applications, ensuring more efficient capital deployment strategies for users to maximize returns. Quantlytica provides users with a complete set of liquidity management tools and automated investment strategies, allowing users to easily manage cross-chain liquidity and automatically nest investment portfolios to maximize returns.

Specifically, Quantlytica will use AI technology to collect and horizontally compare data such as returns, liquidity risks, and security of all DeFi projects, such as by collecting operational data and update status from project social media platforms like Twitter and GitHub to select projects with relatively high security. Then, it provides customized automated investment strategies to adapt to different user risk preferences.

For example, the upcoming intelligent dollar-cost averaging (DCA) and AI grid trading strategies in October can analyze market data in real-time through AI technology to optimize regular and automatic execution of grid trading strategies, helping investors capture excess returns in volatile markets.

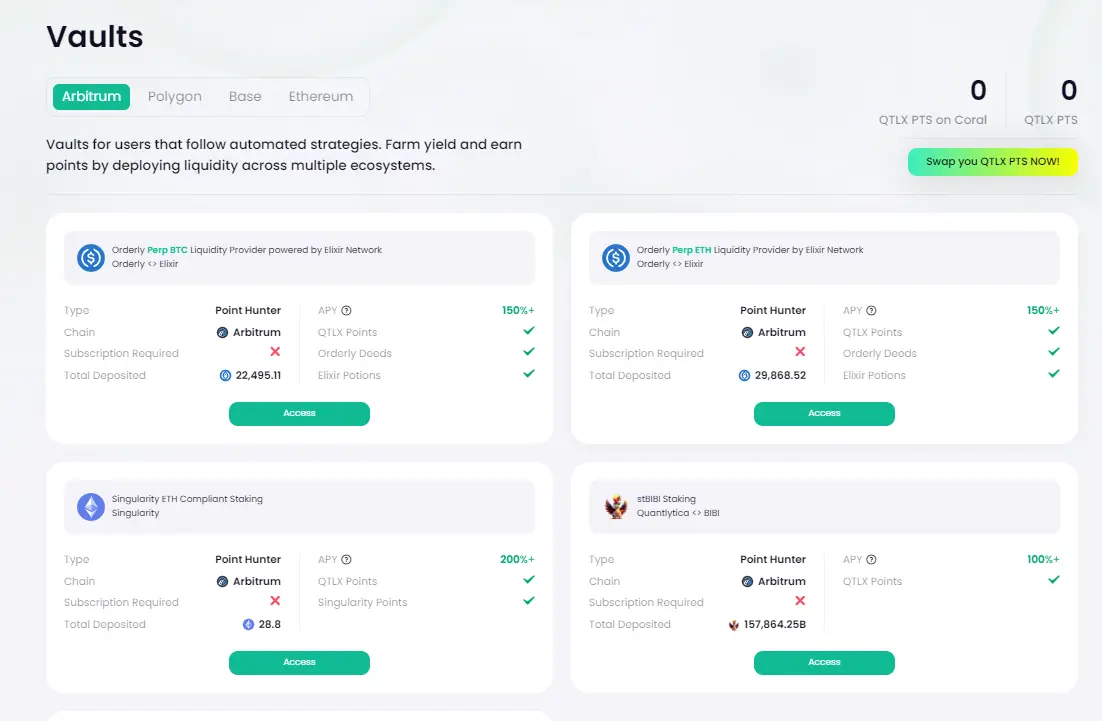

The Vault investment product launched by Quantlytica in August is one of the passive strategy investment products selected using AI. Users can deposit corresponding assets in various vaults to participate in multiple DeFi yields with just one click.

For example, the Ordely PreBTC vault provides liquidity for the Elixir liquidity platform. Users only need to deposit USDC to receive Quantlytica points, as well as Elixir points, Ordely rewards, and tokens from the Coral Finance platform, equivalent to a four-in-one benefit.

Next, Quantlytica's product will integrate the AI-powered investment assistant, QuantGPT, which is an AI chatbot that provides users with personalized investment advice, assists in project selection, market analysis, strategy selection, and dynamic liquidity adjustments, thereby simplifying the DeFi experience.

Wesley revealed to ChainCatcher that QuantGPT is expected to go live around October or November and is also collaborating with decentralized computing network io.net to launch its own computing model platform in Q1 next year.

Furthermore, Quantlytica will also launch the Fund SDK for strategy creation, providing developers, fund managers, and other market participants with the opportunity to build and expand customized investment strategies. This modular, no-code toolbox allows users to assemble or build their own set of DeFi investment strategies like LEGO blocks without any coding skills, enabling them to create, test, and deploy their own customized DeFi investment strategies, ranging from quantitative trading, index investments, TVL incentives, to customized DeFi investment portfolios. This allows users to transition from participants and strategy users to true strategy creators or developers.

Lastly, there is AI-driven risk management. Quantlytica will use AI technology to provide real-time monitoring, analysis, and on-chain data for risk management. It can identify smart contract vulnerabilities, fraud, and systemic market risks in a timely manner to ensure the security of users' assets. Additionally, users can integrate their own data sources and train customized models to develop strategies based on specific market conditions and their risk preferences.

Through a series of innovative features and products, Quantlytica simplifies the complex process of participating in DeFi products or integrates them into specific intelligent investment strategies. This greatly reduces the research time for users, allowing even those without any DeFi experience or knowledge to easily capture on-chain returns.

Wesley emphasized that Quantlytica is not just a simple asset management tool, but a liquidity strategy aggregation platform that provides users with tailored liquidity investment solutions to meet the diverse needs of today's DeFi participants.

Unlike common asset management tools such as InstaDapp and DeBank, Quantlytica focuses more on addressing the high barriers to entry, complex processes, and product selection for users to participate in DeFi. It is more like a library of DeFi investment strategies, where the platform gathers multiple investment strategies for users to choose from based on their risk preferences or profit goals. In contrast, InstaDapp, DeBank, and similar asset management tools are more like asset trackers and do not provide investment strategies.

As an example, Wesley explained that for cross-chain transactions, some users may prioritize low fees, while others may prioritize fast transaction times. Quantlytica will recommend different cross-chain bridge products based on users' personalized needs.

50% of Revenue to be Distributed to veQTLX Token Holders, QTLX Staking Plan to Launch at TGE

On September 13th, Quantlytica's native token QTLX officially began its TGE and was listed on multiple exchanges such as Bitget, MEXC, and BingX, attracting widespread attention and investment from the crypto community.

According to official data, the total supply of QTLX tokens is 100 million, with an initial circulation of 78.5 million tokens. Approximately 50% of the total supply, or 50 million tokens, will be used for community incentives (including a 5% airdrop), 20% will be allocated to the team and advisors, 13% will go to the ecosystem fund, 5% will support QTLX token liquidity, and market-making, 9.5% will go to strategic investors and early supporters, and the remaining 2.5% will be used for the IDO round.

On September 9th, the QTLX token raised $300,000 USDT at a price of 0.2 USDT per token on the IDO platform Enjinstarter.

It is important to note that the 5% community airdrop will not be unlocked at the TGE.

QTLX is the core driving force to ensure the normal operation of the Quantlytica ecosystem, with use cases covering revenue sharing, community governance, and more. Its token economic model aims to incentivize users to participate in the construction and development of the ecosystem by coordinating the interests of all stakeholders. By providing various practical functions, it aims to attract users to participate in the governance and development of Quantlytica in the long term.

It was revealed that on the day of the TGE launch, Quantlytica will introduce the QTLX staking feature, allowing users to stake QTLX to obtain veQTLX and initiate lock-up incentive activities. The staking yield can be as high as 40-80%, and users can choose to settle the staking yield in USDT.

The relationship between veQTLX and QTLX is similar to "veCRV and CRV". Users can stake QTLX at a 1:1 ratio to obtain veQTLX, and holding veQTLX can unlock multiple benefits.

Firstly, veQTLX holders will receive a share of up to 50% of the platform's revenue.

Secondly, veQTLX holders can participate in protocol governance, such as voting on important decisions regarding the platform's development and future direction. This includes proposals related to new features, protocol changes, and the development of the ecosystem.

Additionally, veQTLX token holders will have priority access to Quantlytica's VIP features, such as the right to access exclusive high-yield reward pools, early access to advanced platform features, tools, and analytics such as SDK integration, advanced quantitative strategies, data analysis services, and yield enhancement services.

Finally, veQTLX holders can participate in Quantlytica's unique insurance pool plan, allowing users to purchase insurance to guarantee a certain pool's yield, avoiding income losses due to market fluctuations. For example, if a DeFi fund pool has a yield of 20%, but certain factors may cause the final yield to be lower than 20%, veQTLX holders can purchase insurance to maintain the yield at 20%.

More importantly, unlike the unlimited inflation of common DeFi protocol tokens, QTLX also introduces a buyback and burn mechanism. Quantlytica promises to use 20% of monthly revenue for buyback and burn strategies, systematically reducing the supply of QTLX tokens, potentially increasing their scarcity and token value.

Bridging the Gap Between Web2 and Web3, Enabling Direct Fiat Participation in DeFi Investments

After the token TGE, Quantlytica will not only launch the QTLX token lock-up feature and activities but will also deploy and expand on multiple chains such as Base, Polygon, EVM chains, and non-EVM chains like Solana and Ton.

Quantlytica optimizes liquidity allocation across multiple blockchain networks through AI technology and a series of innovative tools and products, providing a comprehensive liquidity management solution for users. It successfully simplifies the process of participating in DeFi investments and reduces barriers to entry, making it an innovator in the field of DeFi investments. Its diverse product features can accommodate users with different levels of experience and risk preferences.

For new players without on-chain trading experience or professional knowledge, Quantlytica will provide various passive participation strategy modes, such as high-frequency trading strategies, mining strategies, dollar-cost averaging strategies, index investments, fixed income strategies, and more. It will also collaborate with quantitative fund strategy companies to develop more products for users to choose from. For advanced professional players with ideas and experience, they can use the Fund SDK toolkit provided by the platform to build their own exclusive investment strategies. Additionally, the platform provides a backtesting framework, allowing users to visualize the historical performance of their strategies through AI databases, simulate future performance, and optimize strategies.

According to official sources, within just three months of its launch, Quantlytica has surpassed 250,000 community members and achieved significant milestones of over 1,000 daily active users and $10 million in assets under management. The Valut treasury investment product was launched less than a week ago and has already surpassed $1 million in TVL, now standing at $2.2 million.

At the same time, Quantlytica has secured partnerships and investments from several leading companies in the industry. On August 8th, it announced the completion of a €1 million (US$1.1 million) financing round, with investors including Polygon Labs Ecosystem Fund, Web3Port Foundation, Eureka Partners, DWF Ventures, Connectico Capital, ZBS Capital, and other well-known crypto capitals from home and abroad.

Regarding the support provided by investment institutions, Wesley stated in an interview that they not only provide capital but also offer product feedback and strategic introductions. For example, Web3Port has assisted a well-known institution in entering the DeFi market through Quantlytica's liquidity automation strategy. Additionally, they also require their traders to test the Fund SDK and provide feedback.

Wesley revealed to ChainCatcher that Quantlytica also had support from individual investors in the early stages, with the total amount of funding received exceeding $1.5 million.

Quantlytica is not just a Web3 project, but aims to bridge the gap between Web2 and Web3, allowing both traditional financial institutions and individuals to participate in Web3. The ultimate vision is to enable users to directly invest in DeFi protocols on the Quantlytica platform using fiat currency, truly eliminating barriers for users to enter the crypto world. While providing new ways for ordinary users to participate in the DeFi market, it is expected to bring more vitality and vigor to the DeFi market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。