In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities, including:

Sectors with strong wealth creation effects: DeFi blue chips (PENDLE, AAVE);

User hot search tokens & topics: Fractal Bitcoin, Polymarket, DOGS;

Potential airdrop opportunities: Polymarket, Solayer;

Data statistics time: September 12, 2024, 4:00 (UTC+0)

I. Market Environment

Yesterday's CPI data was announced to be lower than market expectations, and it can be basically confirmed that a 25 basis point rate cut has become a high probability event. Top cryptocurrencies have stopped falling and shown a slight rebound. Most market participants are waiting for the Federal Reserve interest rate decision meeting next week. The first rate cut by the Federal Reserve after maintaining high interest rates will have a significant impact on the market, and it is expected that the market volatility will greatly increase next week.

In terms of ETFs, Bitcoin ETF saw a net outflow of $43 million yesterday, and Ethereum ETF saw a net outflow of $5 million, reflecting the overall cautious attitude of market participants towards the market. The market cannot form continuous net inflows or outflows.

In the crypto ecosystem, the Bitcoin ecosystem has seen a surge in computing power after the launch of Bitcoin, which has attracted widespread discussion and attention within the industry. Investors are advised to closely monitor the future trends of this project.

II. Wealth Creation Sectors

1) Sector Dynamics: DeFi Blue Chip Sector (AAVE, PENDLE)

Main reasons:

The DeFi blue chip sector has shown strong resilience, largely due to the important ecological role played by DeFi blue chip projects in the volatile market, and through continuous development and operation, all aspects of their protocols have performed well. AAVE protocol has recently achieved new highs in user activity, and its revenue is steadily increasing. Pendle's current layout of major LSD yields is evident, and further layout of BTCFi will bring considerable growth to its future income.

Rising situation:

In the past 7 days, AAVE and PENDLE have risen by 13.5% and 28.1% respectively;

Factors affecting future market:

Total protocol asset size: The cash flow output of such protocols mainly depends on the protocol's asset size. As the protocol's accommodated asset size gradually increases, the protocol's ability to generate income will also gradually improve, corresponding to a strong performance in coin price.

Project product updates: AAVE previously updated its token economy, introducing a buyback mechanism. This behavior may lead to imitation by other DeFi projects. It is recommended to continue monitoring the product updates of DeFi sector projects, as the release of positive token news often creates trading opportunities.

2) Sectors that need to be closely monitored in the future: Solana Meme Assets (BEER, WIF, POPCAT)

Main reasons:

SOL price rebounded, ecological asset panic eased, and there are temporary signs of improved liquidity, driving an overall rise in ecological assets;

Specific coin list:

BEER: A Meme coin in the Solana ecosystem, with clear signs of capital inflow in contract data, and the entry of hot money has amplified volatility, and the upward trend may continue;

WIF: A Meme coin in the Solana ecosystem, previously listed on Robinhood. When SOL token rises, the rise of Meme coins in the top tier of Solana is even more rapid;

POPCAT: A core Meme coin on Solana, with sustained high trading volume, and a price increase of over 50 times this year, with a relatively stable token price;

III. User Hot Searches

1) Popular Dapps

Fractal Bitcoin

Fractal Bitcoin is a project focused on scaling the Bitcoin network, gradually expanding the scalability of the Bitcoin blockchain. The verification mechanism is POW, and the encryption method is sha256d, similar to the BTC blockchain network. The Unisat wallet can support mainnet switching, and ASIC machines are needed for network verification. Currently, the network has a computing power of 260 EH/s, with support from well-known mining pools such as Antpool, F2POOL, and Spiderpool. The ecosystem project CAT20 and others have received good exposure in the media. The community's attention is relatively high and worth continuous monitoring.

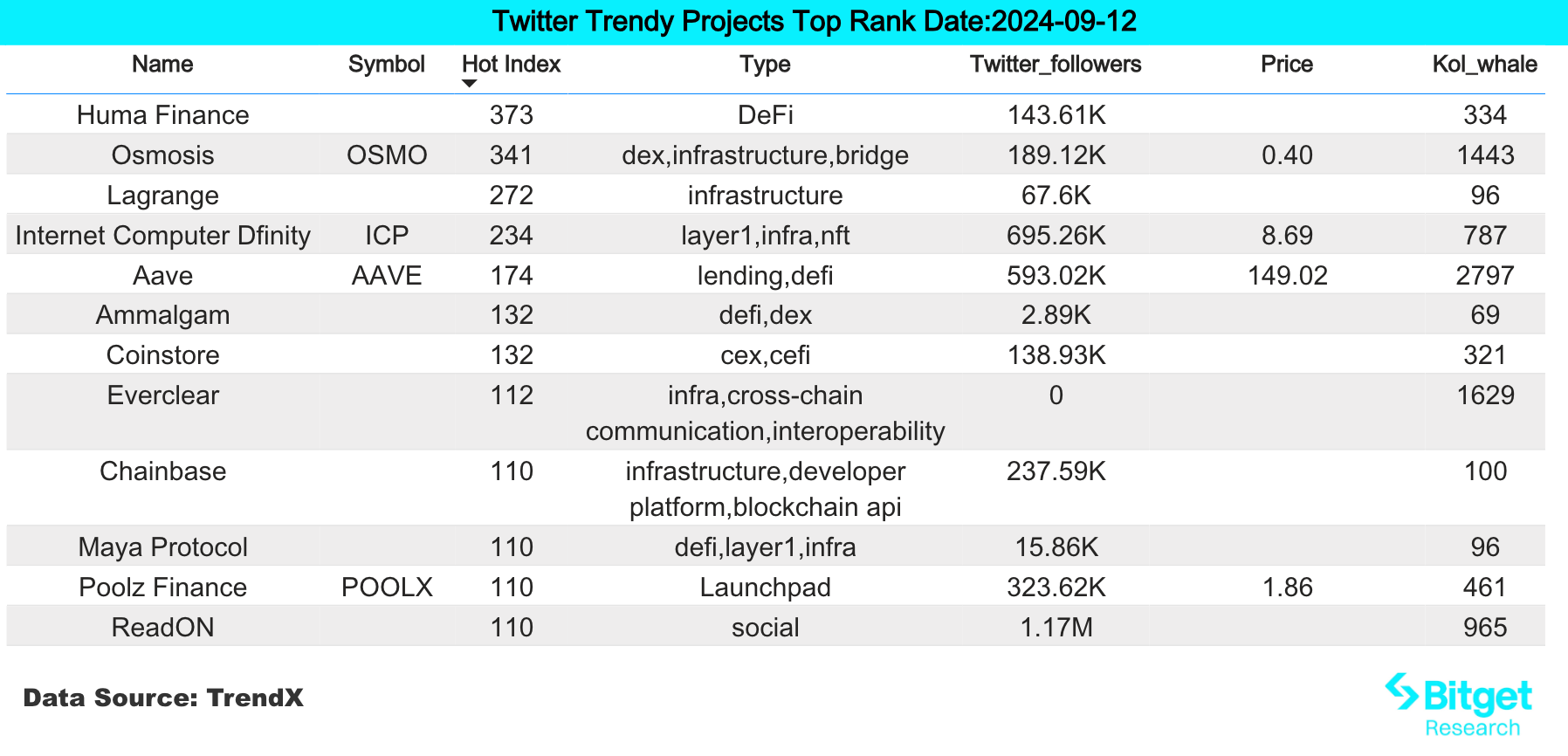

2) Twitter

AAVE (Token)

This week, Aave announced the deployment of the ether.fi weETH dedicated market on-chain, and users can now borrow stablecoins through weETH. DeFi projects AAVE and UNI on the secondary market have performed well this week. From on-chain data, AAVE and UNI have gradually attracted whale accumulation. In the past 24 hours, Vitalik's associated address has deposited 950 ETH and 2.28 million USDC into Aave, expressing support for the AAVE project. AAVE's performance in the secondary market has been relatively good, with a cumulative increase of over 50% in the past month, showing relatively stable trends, and worth continuous monitoring.

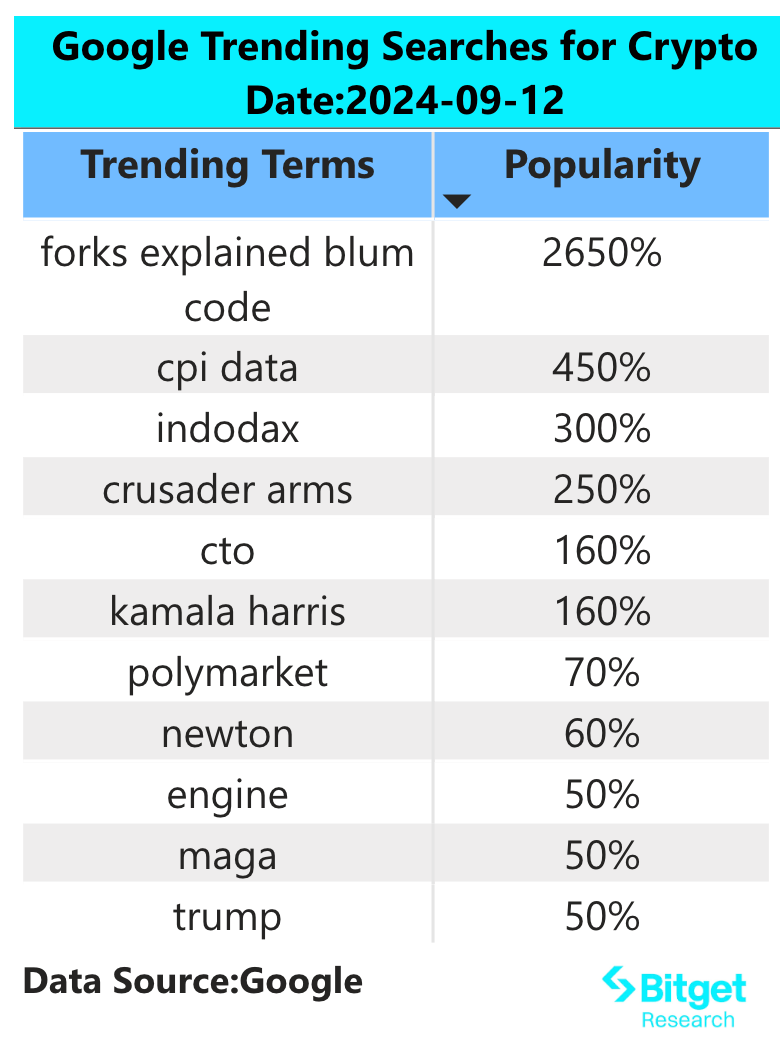

3) Google Search & Regions

- From a global perspective:

Polymarket:

Polymarket is a project focused on prediction markets, where all prediction events are initiated by the community, and users can participate in predictions. If the prediction is correct, they can receive corresponding rewards. Yesterday, Trump and Harris held a presidential debate on TV, and the market believed that Harris performed better than Trump. Polymarket shows that the probability of Harris being elected president has surpassed Trump. As the market believes Trump is a clearly crypto-friendly president, it is worth paying attention to Polymarket's data.

- From the perspective of various regional hot searches:

(1) Telegram Bot has become the main focus in regions such as Africa and CIS, with hot-searched projects including Dogs and Blum, and the countries where related hot searches have appeared are Russia, Vietnam, and Ukraine.

(2) Hot searches in Europe and the United States are scattered, but the main focus is on fundamental/old projects, including XRP, AKT, INJ, Glass, KAS, and others;

IV. Potential Airdrop Opportunities

Polymarket

Polymarket is a project focused on prediction markets, where all prediction events are initiated by the community, and users can participate in predictions. If the prediction is correct, they can receive corresponding rewards.

The centralized prediction market Polymarket completed a total of $70 million in two rounds of financing, with the latest round led by Founders Fund, completing a $40 million Series B financing in 2023 and a $25 million Series A financing in 222.

Specific participation method: There is currently no public airdrop participation method. According to community speculation, it is recommended for users to register an account, bind a wallet, deposit USDC through the Polygon network, and participate in predictions to be eligible for the project's airdrop opportunities.

Solayer

Solayer is building a re-staking network on Solana. Solayer uses its economic security and high-quality execution as decentralized cloud infrastructure to achieve a higher level of consensus and block space customization for application developers.

In July 2024, Solayer announced the completion of the Builder Round financing, with the specific investment amount undisclosed. Investors include Binance Labs, Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, and others.

Specific participation method: Users can stake SOL and some supported SOL LST (jitoSOL, mSOL, bSOL, INF) to earn points for each Epoch. The mainnet is currently open, and staking SOL can earn sSOL and platform points.

Original link: https://www.bitget.fit/zh-CN/research/articles/12560603815563

【Disclaimer】The market is risky, and investment should be cautious. This article does not constitute investment advice, and users should consider whether any opinions, views, or conclusions in this article are suitable for their specific situation. Investing based on this information is at your own risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。