If you do not actively manage the risk, the market will manage it for you.

Author: Edgy - The DeFi Edge

Translation: DeepTechFlow

In the field of cryptocurrency, risk management is the most important skill.

If you do not actively manage the risk, the market will manage it for you.

Here are 20 smart rules that can help you reduce risk and increase profits:

1. Quick Rotation

Market narratives and emotions change very quickly. New protocols may replace market leaders in a matter of weeks.

Stay tuned to market dynamics. Enter early and exit before most people.

Leave the last 20% to others

When you make a profit, it's easy to want to accurately capture the peak and squeeze out every percentage point of profit.

But this is impossible, and mistiming could make you a long-term holder.

Don't be greedy.

2. Stop Loss Early

We all make mistakes, but the difference is that some people sell at a loss of 15%, while others hold on until they lose 80%.

Establish exit plans and rules before trading. This way, funds can be reinvested in more potential investments.

For example: sell if the loss exceeds 15%.

3. Psychology of Profits

You may be afraid of missing out on a "100x" opportunity and hesitate to take profits.

But even if you sell early and it rises 100 times, you still profit. The key is that you protect yourself from potential losses.

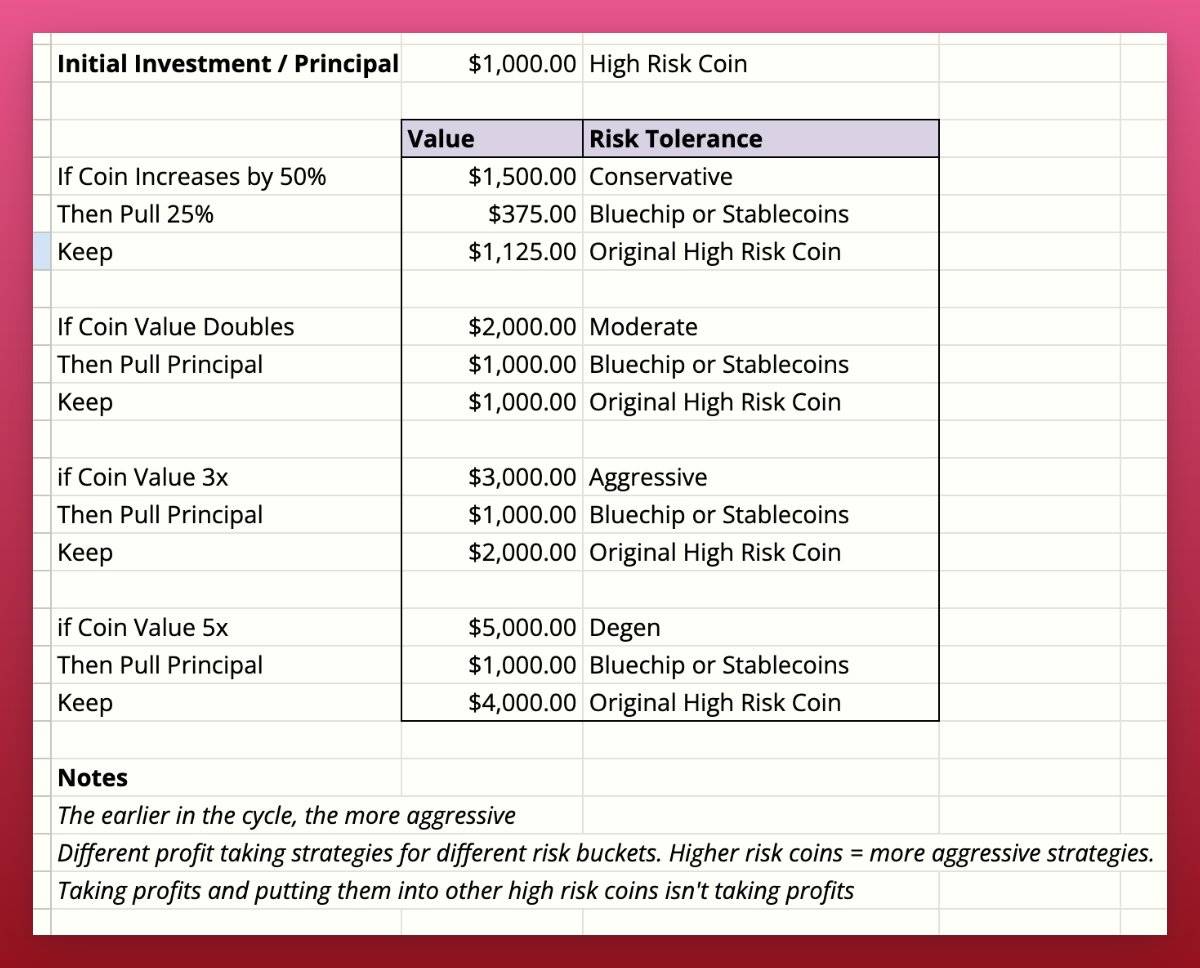

4. Take Profits

Until you lock in profits, it's all just numbers on the screen.

When you recoup your initial investment, there is a psychological satisfaction, and the remaining profits can continue to grow.

Use a simple formula to guide your actions.

5. Wait for Market Stability Period

Market stability period refers to when liquidity enters the market and the entire industry shows a positive trend. This situation occurs several times a year. Don't participate in volatile markets out of boredom or seeking excitement. You don't need to trade every day. (As shown in the Solana figure)

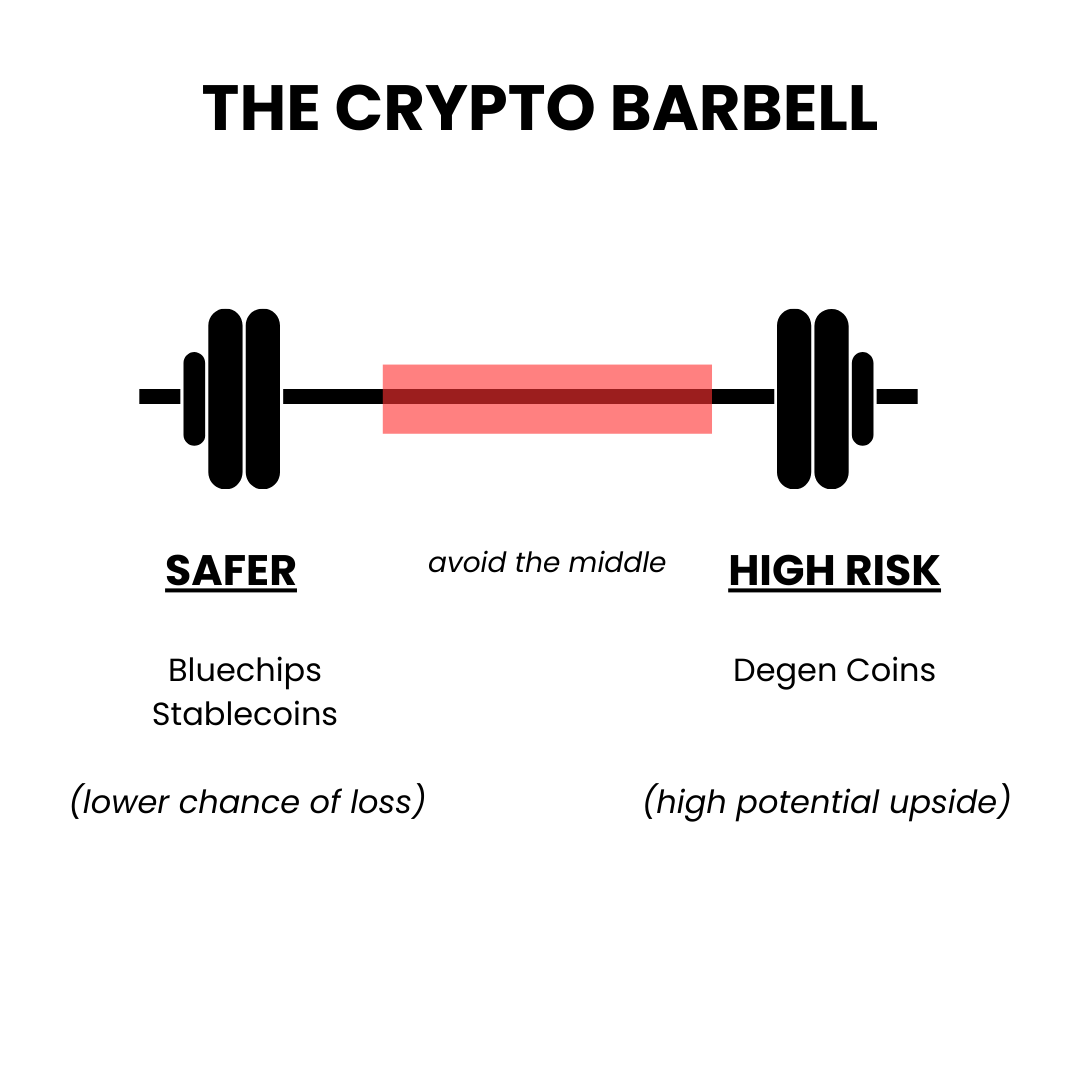

6. Create a Balanced Investment Portfolio

My long-term investment portfolio mainly includes ETH, and I hold some stablecoins. These safe assets allow me to take on greater risks more calmly. I like to use a barbell strategy to build my portfolio - one side is safe assets, and the other side is high-risk investments.

7. Pursue Alpha Investments

Many people lose money by constantly chasing high-risk beta investments. An alternative strategy is to choose market leaders:

Pendle for real-world assets (RWA)

Bananagun for Telegram bots (TG Bots)

Choose ETH instead of beta investments in ETH

Potential strong returns and lower risk.

8. Do Not Change Goals Arbitrarily

In 2021, my friend achieved his goal of turning $150,000 into $1 million. But then he set a new goal, "In a few months, I can retire for good." He misjudged the market peak and eventually saw his assets fall back to $150,000. Know when "enough" is enough.

9. Do Not Lock Assets

I have seen too many people lock tokens for additional income or points, only to be "harvested" by the protocol. Value selectivity - you don't want tokens to be locked and unusable when the market changes faster than expected.

10. Avoid Single Points of Failure

1) Diversify your stablecoins among USDC, USDT, and Dai

2) Use multiple centralized exchanges for deposits to prevent one from being locked

3) Diversify your cryptocurrencies among multiple wallets

11. Investing Profits in Degen Coins Is Not Real Profit

Profiting means withdrawing funds from the market, transferring profits to stablecoins, long-term holding, or cashing out. Investing profits in Degen coins is more like making compound bets.

12. Do Not Allocate More Than 15% of Funds to Non-Blue Chip or Non-Stablecoin Assets

In the cryptocurrency field, there are no guarantees, and nothing is too big to fail.

Terra and FTX have both failed.

Euler and Curve have also been hacked. Black swan events are more common than you think - protect your downside risk to avoid everything going to zero.

13. Act Within Your Circle of Competence

Choose 2-3 areas for in-depth research. Focusing on one area for 10 hours a week will put you in the top 1%. Many risks come from investing in areas you are not familiar with, just because you are afraid of missing out.

14. Regularly Adjust Your Investment Portfolio

You should set a target allocation for your portfolio, which will vary with different market cycle stages. In a hot market, high-risk tokens perform well, which can easily lead to an imbalanced portfolio, so get into the habit of regularly adjusting.

15. Diversify Investments Beyond Cryptocurrency

I often invest profits in areas outside of cryptocurrency, including maximizing retirement funds, building sufficient emergency funds, and reinvesting in businesses. This allows me to better cope with the volatility of cryptocurrency.

16. Try to Avoid Discussing Cryptocurrency in Real Life

When traveling in developing countries, people wearing jewelry are more likely to be targets of robbery than those who are low-key. Similarly, the more you talk about cryptocurrency in real life, the more likely you are to become a target.

If someone asks if I am involved in cryptocurrency, I would say that I lost everything in the FTX crash and now work in e-commerce supply chain. The wealthy are often high-profile, but true wealth is low-key. Don't attract unnecessary attention to yourself or your family. Avoid getting involved in status competition.

17. Use Appropriate Security Tools

You should use Rabby Wallet, Brave browser, DeFiLlama extension, Wallet Guard, etc. With the green Llama from the DeFiLlama extension, I can confirm that I am on the correct protocol website.

18. Use Temporary Wallets

I often try new protocols, so I have a temporary wallet. This way, even if the protocol is malicious, I will lose a maximum of $100. Treat the temporary wallet as a security measure used in Tinder dating.

19. Do Not Try to Achieve Success in One Cycle.

• Use a lot of leverage.

• Borrow money to invest in cryptocurrency.

• Over-invest in high-risk coins.

These behaviors are all due to taking on too much risk in order to achieve success in one cycle.

20. Ultimately, the entire industry is encouraging you to be more optimistic and take on more risk. Why?

Because if you manage the risk, they won't make money. They want you to buy the assets they hold.

You are responsible for your own wealth.

Learn to defend in order to win.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。