Last week, our article mainly discussed the short-term bearish outlook for Bitcoin. We suggested earning premiums by selling put options with a strike price of $51,000 expiring on September 27th, or buying Bitcoin at a discounted price.

As expected, Bitcoin dropped to around $52,000 shortly after our article was published. However, unexpectedly, it rebounded to around $57,000. Although it seems unlikely for Bitcoin to drop below $50,000 at the moment, the beauty of options trading strategy is that you can still profit through premiums in this unpredictable market environment.

This week, we will briefly review the macro data from last week to evaluate Bitcoin's next move. In short: we may be entering a consolidation period.

Let's delve deeper.

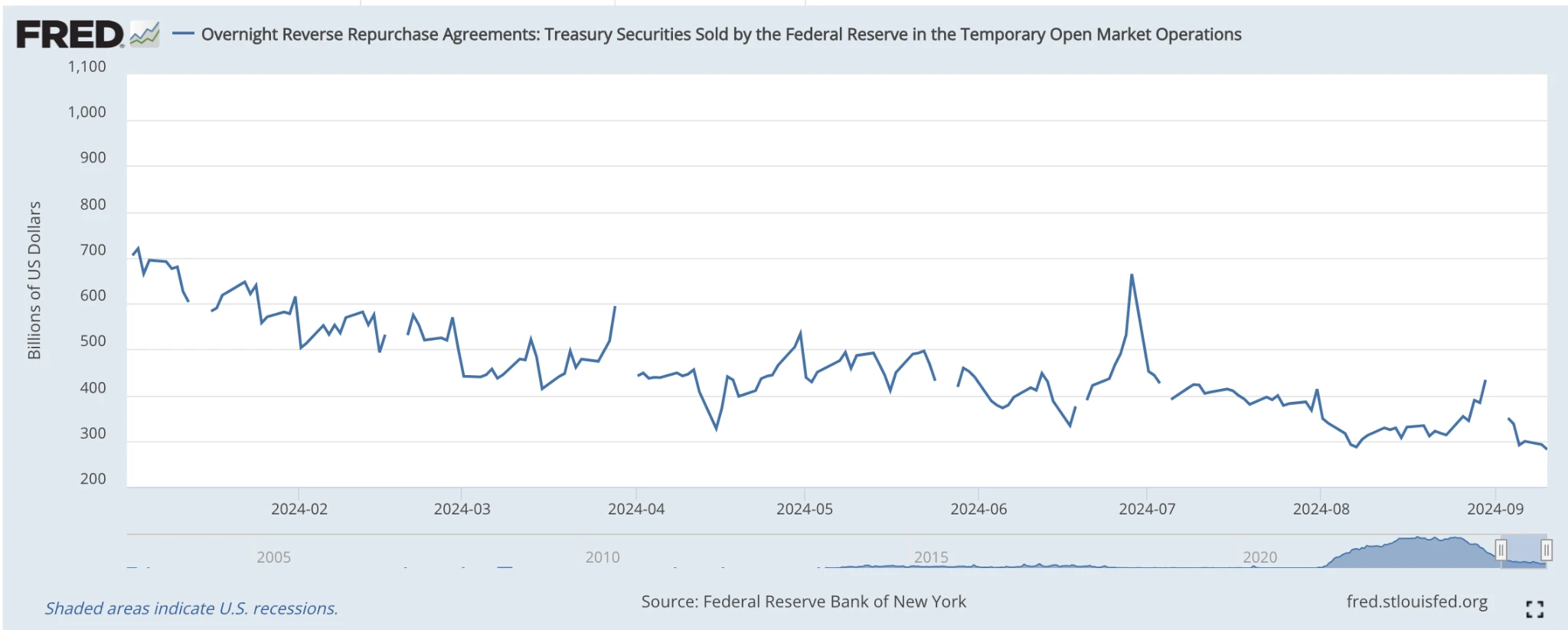

Reverse Repurchase Agreement (RRP) Balance Hits New Low

RRP is one of our favorite macro indicators by @cryptohayes. This is because it clearly reflects the liquidity conditions in the macro environment, which is a key factor in understanding the direction of cryptocurrencies.

Historically, high RRP has been unfavorable for Bitcoin, and vice versa.

Since last week, we have seen a significant decrease in RRP balances. In fact, they have dropped to the lowest level since 2024, reversing our previous concerns about the continuous increase. This sharp decline in RRP balances has a significant impact on the market. The reasons are as follows:

Increased liquidity: Lower RRP balances mean more funds flowing back into a wider financial system, potentially increasing liquidity in various markets.

Increased risk appetite: With increased liquidity, investors may be more willing to take on risks, which may be favorable for assets like Bitcoin and other cryptocurrencies.

Positive outlook for risk assets: The combination of increased liquidity and increased risk appetite usually creates a favorable environment for risk assets such as cryptocurrencies.

Not all is rosy

Don't forget— the small crash triggered by the infamous yen carry trade unwinding on August 5th is not far. As Arthur recently showed in his post, the yen has now rebounded to the level we experienced during the small crash. A stronger yen is unfavorable for Bitcoin, as traditional financial institutions typically borrow yen at low interest rates, exchange it for dollars, invest in assets, leverage, and then engage in interest rate arbitrage.

Conversely, a weaker yen is favorable for risk assets like stocks and Bitcoin. With the yen strengthening, we may see institutions starting to unwind, leading to forced asset sales, which could cause market weakness or even a crash.

The current strength of the yen may increase selling pressure, potentially hindering Bitcoin's continued rise.

Note: Bitcoin may enter consolidation in the coming week

Given the current market conditions, Bitcoin seems poised to enter a consolidation phase in the coming week.

On one hand, the significant decrease in RRP balances indicates increased liquidity, which may create a favorable environment for risk assets like Bitcoin, potentially supporting an uptrend. On the other hand, the strengthening yen poses a risk, as it may lead to unwinding of arbitrage trades, subsequently creating selling pressure on Bitcoin.

Other catalysts to watch?

In addition, upcoming events such as the debate between Trump and Harris, the release of the August Consumer Price Index (CPI), and the TOKEN2049 conference may introduce more volatility. These mixed signals indicate that while there are reasons for optimism and caution, Bitcoin may trade within a range as the market digests these conflicting factors.

Traders and investors should remain vigilant and prepare for potential volatility in any direction as these catalysts unfold.

Putting your market view into practice: Trading options

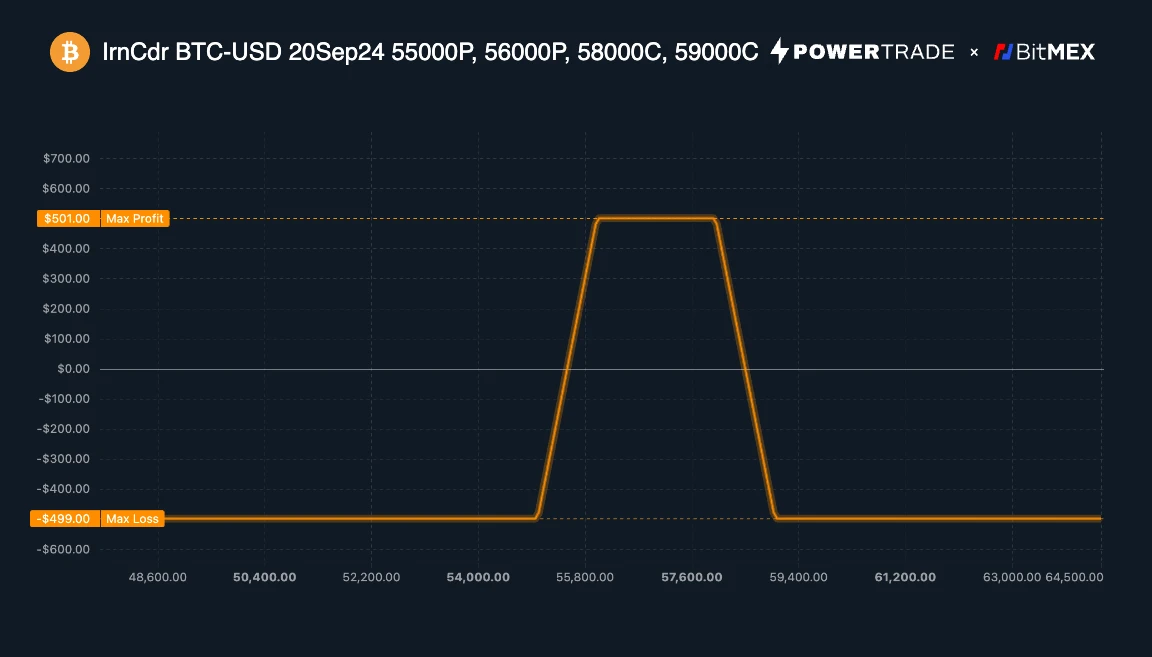

So, how can you profit from the prospect of short-term consolidation? The answer may lie in the Iron Condor strategy.

Iron Condor is a neutral options strategy involving simultaneously selling put spreads and call spreads with the same expiration date but different strike prices. This strategy is ideal for traders who believe the underlying asset (in this case, Bitcoin) will remain within a specific price range before expiration.

Trading strategy:

Buy 1 Bitcoin put option with a strike price of $55,000, expiring on September 20th

Sell 1 Bitcoin put option with a strike price of $56,000, expiring on September 20th

Sell 1 Bitcoin call option with a strike price of $58,000, expiring on September 20th

Buy 1 Bitcoin call option with a strike price of $59,000, expiring on September 20th

Potential returns:

Maximum profit: $501 (if Bitcoin remains between $56,000 and $58,000 at expiration, earning premiums)

Maximum loss: $499 (if Bitcoin moves beyond the range at expiration)

Breakeven points: $55,270 and $58,630

Advantages:

Limited risk: Maximum loss is capped, providing better risk management compared to selling naked options.

Profiting in a sideways market: This strategy may be profitable even if the Bitcoin price does not significantly change.

Flexibility: You can adjust the width between the strike prices to balance potential profit and risk.

Risks:

Limited profit potential: Maximum profit is limited to the net premium received.

Complex management: Managing four options positions may be more challenging than simple strategies.

Risk of early exercise: Especially nearing expiration, there is a risk of the options sold being exercised early.

This Iron Condor strategy allows you to take advantage of the short-term consolidation prospect for Bitcoin, with clear risks and the potential to profit from broader price movements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。