The "L2 vs Ethereum" debate is a mistaken dichotomy. This is not a zero-sum game. Ultimately, Ethereum and L2 are interdependent.

Author: Jun, Bankless

Translator: Deng Tong, Golden Finance

Ethereum has recently been in a predicament.

Emotions are low, and critics quickly point out that ETH's performance is not as good as SOL, mainly attributing this to the market share and user loss of L2.

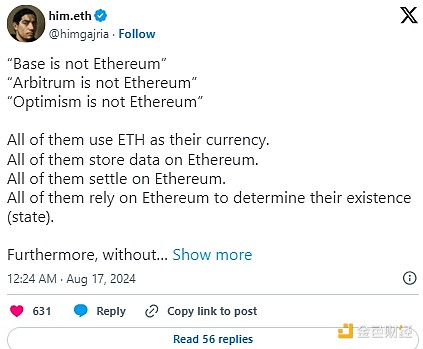

This argument has sparked a crucial debate: Is L2 Ethereum? The answer, like most things in cryptocurrency, is a perfect combination of chaos and simplicity. So, let's carefully examine both sides of this argument and explore the relationship between Ethereum and L2.

Symbiosis or Division?

From the beginning, L2 has been a core part of Ethereum's rollup-centric roadmap. They are envisioned as an extension of Ethereum (both technically and culturally), aimed at expanding its capabilities and attracting a broader user base.

Fundamentally, L2 has deep connections with Ethereum. They share Ethereum's DNA—relying on ETH as currency, benefiting from Ethereum's security, and using it for data storage and settlement. It's like a startup using its parent company's infrastructure and brand recognition, a win-win for both parties.

The symbiotic relationship between L2s and Ethereum is undeniable. L2s thrive on Ethereum's infrastructure and security, while Ethereum benefits from increased activity and demand for ETH, making it a better store of value.

By providing lower fees and faster transaction times, L2s make it easier for developers to build different types of applications. Look at the explosive growth of memecoins on Base, or the rise of SocialFi platforms like Farcaster, creating new markets for users.

In addition, L2s are becoming the main hub for DeFi activities, and assets in ETH are at the core of this ecosystem. Look at these numbers: Arbitrum, Optimism, Base—these chains are dominated by assets related to ETH.

Vampire Attack?

However, one of the main arguments against Ethereum's rollup-centric scaling approach is the concern that L2 may no longer depend on Ethereum. Of course, L2 and Ethereum currently seem like a happy family. But what if L2 builds its own empire and completely abandons Ethereum? No longer relying on Ethereum for security, no longer needing ETH as gas, and not even needing Ethereum's block space.

The concern of "L2 going out of control" is valid. Technically, they can build their own validators to create an independent ecosystem, allowing them to have an entire modular blockchain stack. So, is this the future—a messy breakup between L2 and Ethereum? Not necessarily.

Creating a new ecosystem or launching another L1 blockchain is a complex and resource-intensive task. Bootstrapping a validator set is a significant undertaking, and building a new L1 could lead to the same scalability challenges that Ethereum currently faces. If L2 intends to go down these paths, they likely would have done so from the beginning.

The Secret of Division?

Instead, L2 builders are playing a different game. Their main focus is on expanding transactions, attracting developers, incentivizing them to build applications for different use cases, and bringing new users into cryptocurrency, while Ethereum deals with security and decentralization issues.

But this doesn't mean that the development of the L2 landscape is without foreseeable issues. It's a strange paradox. On one hand, the surge of L2s proves the success of the rollup-centric roadmap. But on the other hand, this is the root of division.

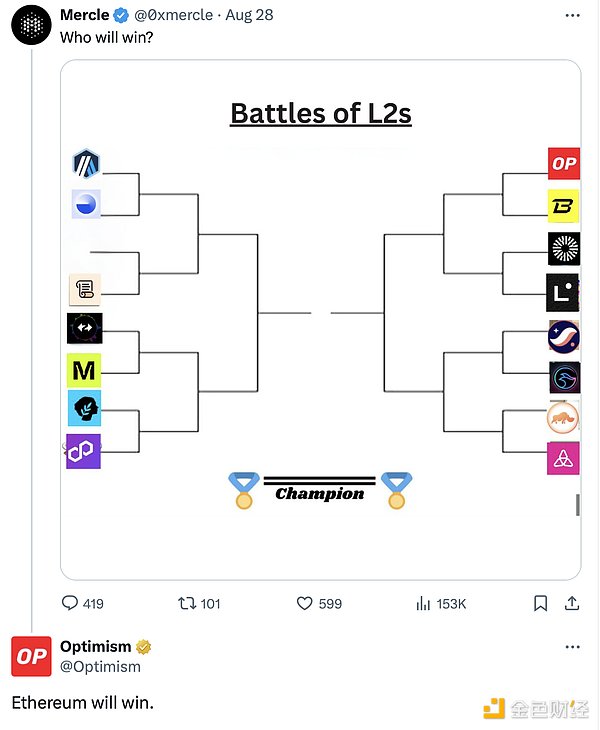

We all agree that there may be too many L2s. Too many imitators. Too little differentiation. It's like a thousand startups chasing the same market, all promising the same things. This is not healthy.

What we need are significant L2s. L2s that offer uniqueness, something different. Security, application diversity, GTM strategy—these are the areas where we need to see real innovation.

Let's not forget the bigger picture. As Ethereum uses these L2s to scale, we need to ensure that it still feels like Ethereum. We need to avoid falling into the trap of division, where everyone is striving in their own direction.

L2s need seamless connections. Teams are rolling out technical stacks to develop a unified chain network, sharing resources and providing users with a more seamless and expedited experience—initiatives like Superchain, AggLayer, Elastic Chain, and Orbit Chains are promising steps in this direction.

But we must beware of the "echo chamber." These chain networks should not become isolated universes. A healthy L2 ecosystem is one where chains work together, not in isolation. We need bridges, not moats.

We need collaboration. We need communication. We need education. We need incentives. We need to establish shared infrastructure and standards to facilitate seamless connections between L2s. Only then can we truly win together.

Conclusion

You can say that L2 is not Ethereum. You can argue that L2 is not even an extension of Ethereum. But you cannot deny that L2 enhances the utility of Ethereum and ETH.

The "L2 vs Ethereum" debate is a mistaken dichotomy. This is not a zero-sum game. Ultimately, Ethereum and L2 are interdependent. Let's build a future where Ethereum and L2 thrive as a symbiotic whole and drive the advancement of the crypto ecosystem forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。