On July 23, 2024, Lightning Labs released the first mainnet version of the multi-asset Lightning Network, officially introducing Taproot Assets to the Lightning Network. This milestone event marks the official support of stablecoins on the Lightning Network!

So, what sets stablecoins on the Lightning Network apart from stablecoins on other blockchains? For stablecoins running on blockchains such as Ethereum and Solana (e.g., USDT and USDC), they are primarily used as a medium of exchange and a unit of account for evaluating other digital assets, but their real-world use cases are limited. The Lightning Network fills this gap. With its settlement speed of up to 1 million transactions per second (1M TPS), ultra-low fees, and high security, stablecoins on the Lightning Network will stand out.

Here are three use cases showcasing the unique advantages of stablecoins on the Lightning Network:

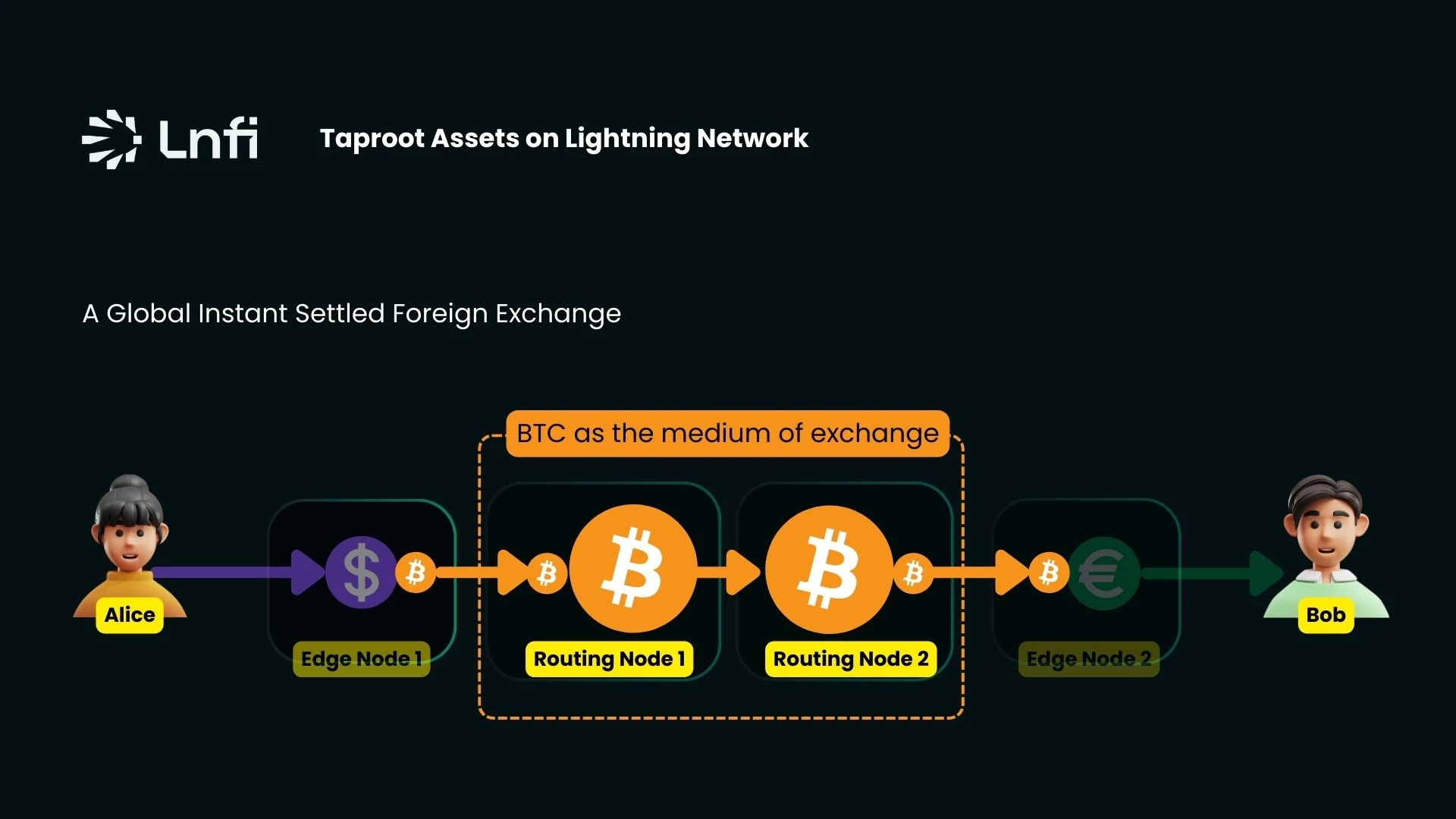

1. Global Instant Settlement Forex Trading: Alice Sends USD Stablecoin, Bob Receives EUR Stablecoin

Through the Lightning Network, Alice and Bob can exchange USD and EUR locally in an atomic, decentralized, secure, and instant manner. In contrast, traditional financial systems charge high fees of 2-5% and take several days to settle similar transactions. The openness of the Lightning Network allows anyone to become an edge node or routing node, thereby reducing spreads and fees, providing users with the most competitive exchange rates.

2. Direct Payment of Stablecoins for Goods Using Lightning Invoices

Let's look at another scenario that combines stablecoins with real-world payments.

Currently, merchants and platforms like Nubank, Shopify, PickNPay, NCR, Blackhawk, Clove, and Bitrefill already support Lightning Network payments. Even interesting small businesses like Pubkey@NYC and JooBar@SG have joined the ranks of Lightning payments. With the existing Lightning Network, stablecoins can be easily used in these payment scenarios without any upgrades to existing infrastructure. For example, in the scenario where Alice buys coffee, the café accepts Bitcoin.

We can see that using stablecoins like USDT and USDC for real-world payments on other blockchains still poses challenges, but this is where stablecoins on the Lightning Network naturally have an advantage.

3. Stablecoins Will Benefit Bitcoin

Stablecoins in Taproot Assets will align the interests of Bitcoin miners and Lightning Network users in several key ways:

Bitcoin as an Exchange Medium for Routing Nodes: Stablecoins in Taproot Assets allow Bitcoin to be used as an exchange medium in the Lightning Network, as shown in the diagram above. This creates practical value for Bitcoin.

Liquidity Provision: Users can safely earn income by participating in liquidity provision on the Lightning Network. This income is generated through RFQ spreads and routing fees, increasing Bitcoin's financial value through cash flow multiples.

Increased Network Activity: Stablecoins in Taproot Assets will encourage more channel openings and closures, as well as loop-in and loop-out operations on the Lightning Network. The network effects on the Lightning Network are expected to drive more Bitcoin transactions on the mainnet, not just pure Lightning Network transactions.

These, in turn, may increase the demand for Bitcoin for trading on the Lightning Network.

However, to widely adopt stablecoins on the Lightning Network, both internal and external challenges need to be addressed.

External Challenges: Connecting the Lightning Network with traditional finance.

To connect with traditional finance, addressing concerns related to regulation and compliance is crucial. LightSpark has developed UMA, supporting comprehensive compliance messaging, including anti-money laundering, sanctions screening, and travel rule requirements. LightSpark has successfully integrated the Lightning Network with multiple centralized institutions, including Bitso, Bitnob, Coins.ph, Foxbit, Ripio, Xapo Bank, and others.

On the other hand, the Amboss team has developed Reflex, a payment operations platform that provides proactive risk management for Lightning Network compliance policies. This platform enables entities to effectively implement their compliance policies, ensuring their compliance with regulatory requirements.

In the near future, hundreds of millions of users will be able to quickly access the Lightning Network.

Internal Challenges: Deep liquidity of stablecoins on the Lightning Network.

To trigger a positive flywheel effect, deep liquidity of stablecoins on the Lightning Network is crucial in three areas:

Demand Liquidity: From a critical mass of end users.

Supply Liquidity: From RFQ provided by edge node operators and various scale transactions facilitated by routing node operators. As the network evolves from microtransactions to larger-scale transactions, ample channel liquidity is crucial.

Hedging and Rebalancing Liquidity: Access to deep liquidity sources for hedging positions and rebalancing inventory on the Lightning Network is crucial for edge node operators.

Stablecoins on the Lightning Network are expected to be the last mile solution for global adoption. With unparalleled transaction speed, low fees, and high security, they provide unique solutions that traditional blockchains struggle to achieve. By bridging the gap between digital assets and real-world use cases, stablecoins on the Lightning Network will empower global users, merchants, and financial institutions, driving a new era of financial inclusion and making global payments faster, cheaper, and more secure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。