As the Ethereum roadmap continues to expand and the staking ecosystem matures, the role of ETH in the industry is becoming increasingly important. ETH not only provides a solid foundation for network security and decentralization but also demonstrates its unique role in the three major attributes of capital, consumable, and value storage assets by expanding economic security and enriching the ecosystem.

Author: IOSG Ventures

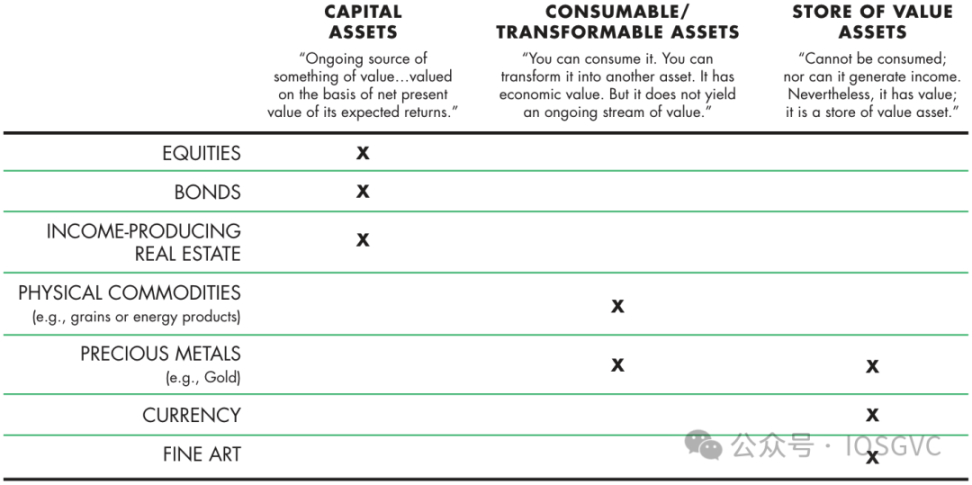

Source: ARK Invest

In 1997, Robert Greer proposed three asset categories in The Journal of Portfolio Management:

- Capital assets: assets that can generate value/cash flow, such as stocks, bonds, etc.;

- Consumable or convertible assets: assets that can be consumed, burned, or converted, such as oil, coffee;

- Value storage assets: assets with scarcity that sustain value over time/space, such as gold, bitcoin.

In 2019, David Hoffman pointed out that Ethereum can simultaneously function as the above three types of assets: staked ETH as a capital asset, Gas as a consumable asset, and ETH locked in DeFi as a value storage asset.

Over the past five years, with the vigorous development of the Ethereum ecosystem, the utility of ETH has continued to expand—manifested in ETH as the pricing unit for NFTs, Gas Token for Ethereum Layer2, the pricing unit for MEV activities, LST, and DeFi derivatives based on LST, and more.

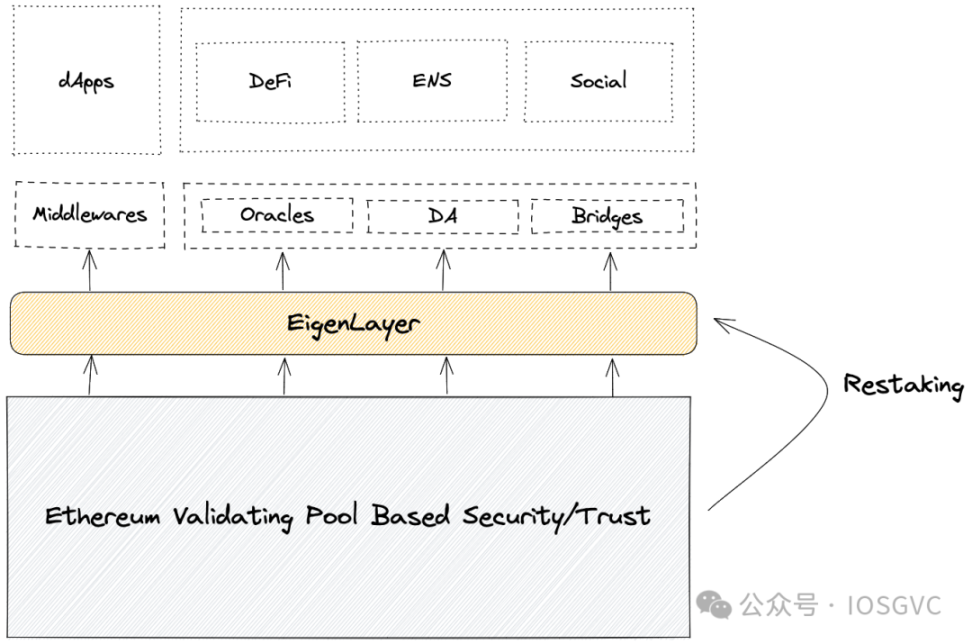

Recently, EigenLayer has extended the economic security of ETH to middleware and even other ecosystems such as Cosmos through re-staking, further strengthening the network effect of ETH.

We summarize it briefly:

- Staked or re-staked ETH, including liquidity staking tokens such as stETH and eETH, represents assets that can generate value/cash flow as capital assets;

- ETH spent as Gas on Layer1 and Layer2, including Rollup's data availability costs on Layer1, verification of zero-knowledge proofs, etc., corresponds to consumable assets that can be consumed, burned, and therefore considered consumable assets;

- ETH as reserve assets in various protocol DAO treasuries, collateral for CeFi and DeFi, as well as NFT transactions, MEV supply chain pricing, token trading pairs, etc., serve as units of account and exchange media, and the value persists over time/space, making it a value storage asset.

Among them, staking is the cornerstone of the Ethereum network. By allowing participants to lock ETH and participate in the validation process, staking provides strong economic incentives for the network, transforming Ethereum into a more secure, efficient, and sustainable blockchain platform, laying a solid foundation for its long-term development.

This article will provide a systematic report on the staking and re-staking field and its ecosystem, as well as the investment logic and viewpoints accumulated in our investment layout in this field.

1. Staking

1.1 Overview

The concept of "staking" was born before Ethereum. In 2012, to solve the high energy consumption of Bitcoin mining, Peercoin first proposed Proof-of-Stake (PoS), and staking is one of its key attributes.

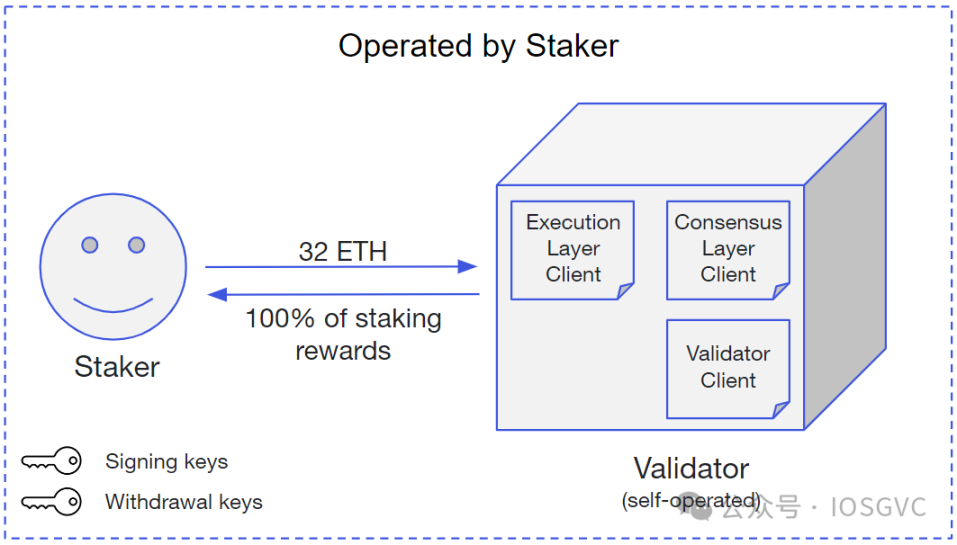

In the context of Ethereum, staking usually refers to running validator software on the Ethereum blockchain by locking 32 ETH to help validate transactions and maintain security on the Ethereum network, and receiving a certain amount of ETH rewards in the process.

Currently, the annualized return of Ethereum staking is about 3.24%, provided by the issuance of ETH, and other income may come from Tips and MEV income on the Ethereum network.

1.2 Four Forms of Staking

1.2.1 Solo Staking

Source: ConsenSys

Solo staking is the basic form of all staking methods. Stakers need to deposit 32 ETH and run and maintain a full Ethereum client to ensure the normal operation of the validator. Solo staking contributes to the decentralization of the network.

Ideally, since solo staking is self-managed and does not require payment of service fees to any third party, the resulting income is also the highest. However, compared to professional staking services, solo staking may result in missed rewards or penalties due to disconnection or malicious behavior, in addition to operational and maintenance costs, leading to fluctuating returns.

The proportion of solo staking is an important indicator of the decentralization level of Ethereum. According to a study conducted by rated, as of the end of 2022, solo stakers accounted for approximately 6.5% of all Ethereum validators.

Although solo staking is a key pillar for Ethereum to achieve decentralization, due to the capital requirement of 32 ETH and operational thresholds, solo staking is difficult to become mainstream. With the development of Ethereum staking, several staking methods have emerged in the market.

1.2.2 Staking Service Provider

To meet the scale development of the staking field, staking service providers typically offer scalable and professional staking services to institutional clients or high-net-worth individuals, and charge a certain percentage of fees based on the staking income (ranging from 5% to 10% depending on the staked funds). Companies such as Kiln and Figment are representatives of staking service providers, with Kiln's staked assets supported by technology exceeding $8.6 billion.

In addition to providing staking services for Ethereum, staking service providers also cover staking businesses on other PoS chains and are also involved in re-staking businesses.

In addition to the B2B business model, the B2B2C business model is also an important part of the revenue for these companies. For example, Kiln cooperates with mainstream wallets such as Ledger, Coinbase Wallet, and Metamask to provide a one-stop staking solution for users of these wallets. Wallets provide distribution channels for staking service providers, and the latter provides infrastructure and services to the former, with revenue sharing between the two.

1.2.3 Centralized Exchange Staking

Centralized exchange staking is a staking service provided by various centralized exchanges for their users. This type of staking is custodial and requires almost no capital threshold, but the disadvantage is that the fees are usually high and opaque, and there are risks of fund misappropriation. Companies such as Coinbase and Binance are representatives of centralized exchange staking.

The proportion of centralized exchange staking has decreased from around 40% from 2021 to 2022 to the current 24.4%. The reasons may be: first, after the collapse of FTX, users' trust in centralized custodial solutions has decreased; second, in February 2023, under pressure from the US SEC, Kraken announced the termination of staking services to US customers, causing concerns among users about staking service providers in specific jurisdictions. Nevertheless, centralized exchange staking remains the second largest staking option after liquidity staking.

1.2.4 Liquid Staking (LST)

LST is an application at the protocol and smart contract level for staking. Protocols such as Lido collect ETH from the user side and outsource the operation of validators to third-party staking service providers, while charging fees.

LST's main feature is that these protocols usually return an equivalent tokenized debt certificate to the user (such as Lido's stETH), thereby freeing up the liquidity of the funds. These certificates can be considered equivalent to ETH and can be used in multiple DeFi protocols to earn additional income. The tokenized debt certificates of LST are subject to the risk of becoming unanchored, but this risk has been reduced after the "Shanghai Upgrade" Ethereum activation withdrawal.

Lido currently holds the highest market share in LST, with a TVL 12.9 times that of the second-ranked Rocket Pool. In addition to Lido, there are also some differentiated products that have emerged.

- For example, compared to the professional staking service providers operated by Lido, Rocket Pool allows anyone to run validators for Rocket Pool's stakers, with a total of 3,716 node operators, providing better decentralization and capital efficiency.

- Institutions mainly consider three factors when participating in staking: security, liquidity, and compliance. Traditional institutions need to conduct due diligence on counterparty risk and complete a series of compliance processes such as KYC/AML. At present, unlicensed LST like Lido cannot meet these requirements. Alluvial, in collaboration with leading staking service providers such as Coinbase, has launched the industry standard for LST: Liquid Collective, which mainly provides fully compliant "dedicated pools" that meet KYC/AML requirements, better assisting traditional funds to enter the Ethereum staking market.

The table above summarizes the above content.

1.3 Summary

a. Looking back at the development of the staking field, the emergence of LST has not only solved the two major pain points of funds and operations but also further released liquidity. These three points are the primary reasons for Lido's success. The quality of liquidity directly affects users' psychological expectations and their trust in the protocol. Before the "Shanghai Upgrade" activation withdrawal, Lido already had the best exit liquidity in the market, which is also the main reason why Lido has been able to attract new funds to participate in staking. As the competitive landscape of LST has been established and competition between LRTs has intensified, Ether.fi has established a leading position in the market with good liquidity pools, validating this point.

b. Looking at the staking market, Lido has long held a leading position with a market share of around 30%, showing a significant network effect. Nevertheless, there are still opportunities for differentiated products in the market. For example, Liquid Collective has introduced a compliant staking solution targeting more traditional institutional users, and the market opened up by the narrative of re-staking—indeed, Ether.fi has rapidly attracted funds in the short term, with ETH deposits reaching 1.21 million in the past 6 months, a growth rate of 288.1%, making it the third largest staker in Ethereum, second only to Lido and Coinbase.

c. In addition to LST, we believe that staking service providers are also a good investment category. LSTs like Lido essentially act as intermediaries connecting node operators to end users, playing a distribution role and relying on node operators for actual operations and management. Compared to running nodes themselves, these node operators have the advantages of scale cost and high-level service guarantees. Whether it is running nodes in cooperation with LST, re-staking protocols, etc., or helping wallet users participate in staking, node operators have a good ecological position and a solid business model. In addition, as validators, these node operators are critical gatekeepers in the transaction lifecycle on the chain. The recent emergence of Pre-confirmation in the market is one of the services that validators can provide.

2. Restaking

2.1 Overview

Building on Ethereum staking, projects represented by EigenLayer have proposed restaking—where stakers re-stake based on their existing Ethereum staking exposure to provide economic security for middleware and earn corresponding returns; at the same time, restakers need to bear the risk of slashing due to improper operation and other factors affecting the staking exposure, after the "Shanghai Upgrade" Ethereum activation withdrawal, this risk has been reduced.

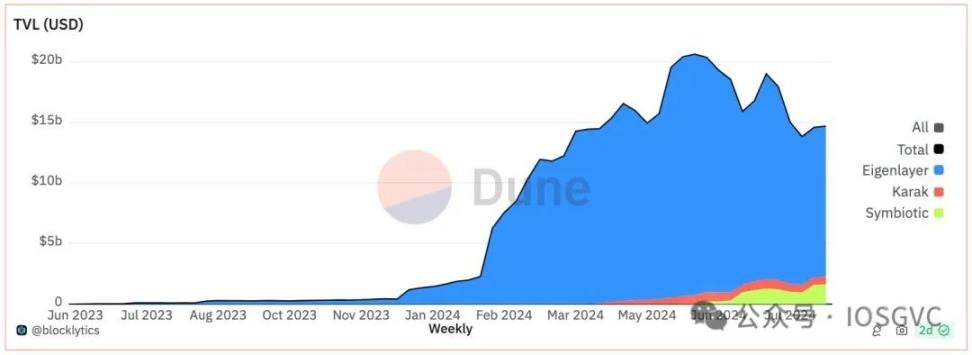

In terms of market size, shortly after the mainnet launch, EigenLayer quickly surpassed Uniswap and AAVE, becoming the second largest DeFi protocol after Lido. As of now, EigenLayer's TVL has reached $15.5 billion, three times that of Uniswap, with 19 AVS and 339 node operators running on the mainnet.

In addition to EigenLayer, the restaking protocol Symbiotic, supported by Lido and Paradigm, has also been launched. Symbiotic is a restaking solution supported by Lido and Paradigm. On the asset side, Symbiotic accepts any ERC-20 tokens or LP positions as restaking assets. As of now, Symbiotic's TVL has reached $1.2 billion, mainly composed of ETH-based LST and stablecoins.

This chapter will mainly discuss EigenLayer.

2.2 EigenLayer

Before EigenLayer, there were significant pain points in the middleware of the Ethereum ecosystem:

- To become a validator (node operator) for middleware, one needs to invest funds. For the sake of capturing token value, validators are often required to stake the native tokens of the middleware, which incurs a certain marginal cost, and due to the fluctuation of token prices, there is uncertainty in their risk exposure, and the losses caused by a token price drop may be much greater than the gains.

- Project teams also need to maintain a certain token value, otherwise rational funds will move to other platforms or protocols with higher returns. Furthermore, the security of the middleware depends on the overall value of the staked tokens; if the token price plummets, the cost of attacking the network also decreases. This problem is particularly prominent in the early stages of the project and when the token value is low.

- For some dApps that rely on middleware (such as derivatives that require oracle price feeds), their security actually depends on the trust assumptions of both Ethereum and the middleware. This creates a "weakest link" effect—system security depends on its weakest point.

These are the basic problems that EigenLayer aims to solve.

EigenLayer addresses the above issues by introducing restaking: existing Ethereum stakers can restake without the need for additional funds, extending their existing ETH staking exposure to a new protocol (of course, this introduces new risk exposure and assumptions), and with the relatively stable price of ETH, the economic security based on ETH becomes more reliable.

Project teams can adopt a dual staking model, where validators stake both native tokens and ETH, ensuring that the utility of the tokens is not sacrificed, while also avoiding the death spiral caused by a single token price drop. At the same time, Ethereum validators become more decentralized.

Source: IOSG

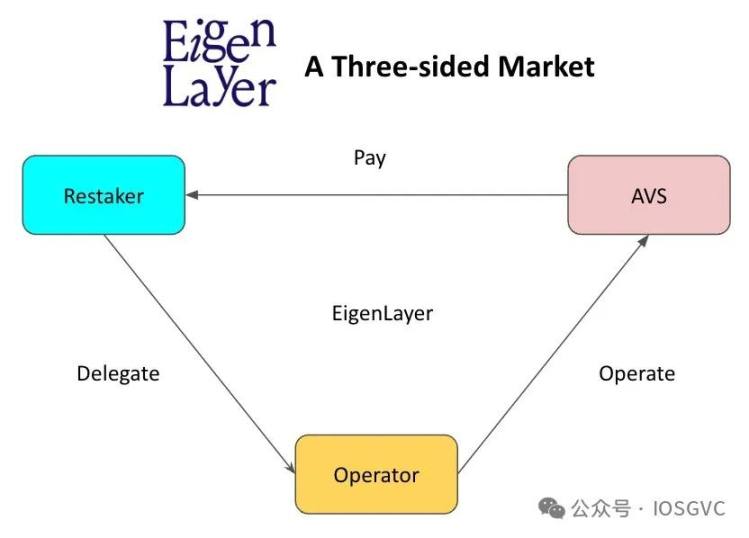

Structurally, EigenLayer is a three-party market:

- AVS (Actively Validated Service). This includes cross-chain bridges, oracles, and other infrastructure. AVS, as consumers of economic security, are guaranteed economic security and pay restakers.

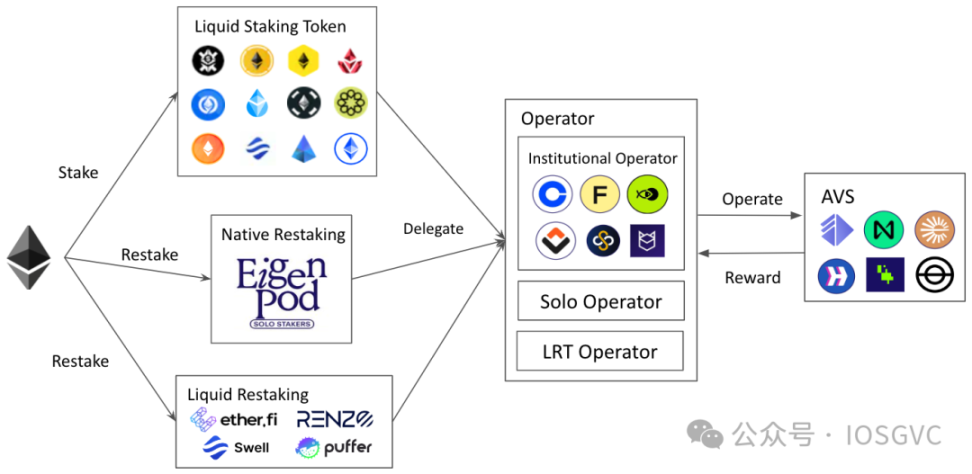

- Restakers. Restakers with ETH exposure can participate by transferring their staking withdrawal certificates to EigenLayer smart contracts or simply depositing LST (such as stETH). If restakers are unable to run AVS nodes, they can delegate this task to operators.

- Operators. AVS nodes are operated by operators delegated by restakers or provide validation services. Operators can choose which AVS to serve. Once they provide services to AVS, they must comply with the penalty rules set by AVS.

The following diagram summarizes the ways and workflow for participating in restaking on EigenLayer.

Source: IOSG

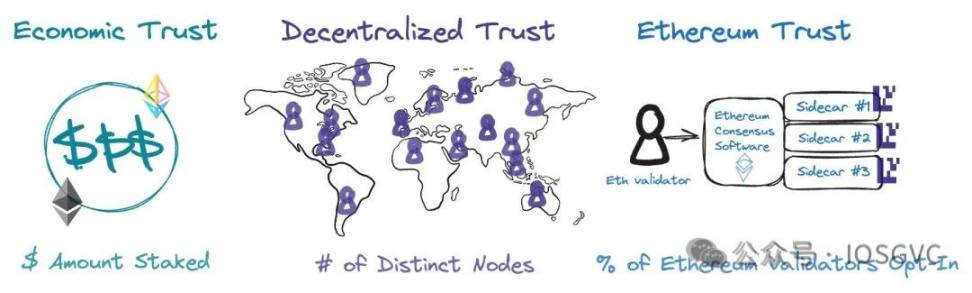

EigenLayer provides the following three programmable trusts:

Source: EigenLayer

- Economic Trust: Economic trust depends on people's confidence in staked assets. If the profit from corruption is lower than the cost of corruption, economically rational actors will not launch an attack. For example, if the cost of attacking a cross-chain bridge is $1 billion, but the profit is only $500 million, then economically speaking, the attack is obviously irrational. As a widely adopted cryptographic economic primitive, penalties can greatly increase the cost of corruption, thereby strengthening economic security.

- Decentralized Trust: The essence of decentralized trust is to have a large and widely distributed set of validators, both virtually and geographically. To prevent collusion and Liveness Attacks between nodes in AVS, it is best not to let a single service provider run all nodes. On EigenLayer, different AVS can customize their level of decentralization. For example, they can set geographical location requirements for node operators or only allow individual operators to provide node services, and provide more incentives to attract such operators accordingly.

- Ethereum Inclusion Trust: In addition to making a commitment to Ethereum through staking, validators who further restake on EigenLayer can also make trusted commitments to AVS. This allows proposers to provide some services on Ethereum (such as partial block auctions through MEV-Boost++), without the need to make changes at the protocol level of Ethereum. For example, forward block space auctions allow buyers to ensure future block space in advance. Validators participating in restaking can make trusted commitments to block space, and if they do not include the buyer's transaction later, they will be penalized.

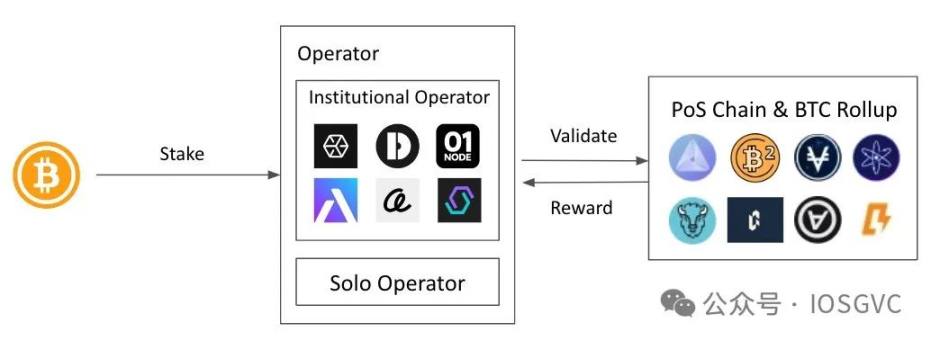

2.3 Babylon

(In concept, Babylon does not belong to "restaking," but rather to "staking" for Bitcoin. However, because its use case is similar to EigenLayer in providing economic security for blockchains, middleware, etc., it is discussed together in this chapter)

Babylon was launched against the background that due to the limitations of Bitcoin's blockchain programmability, Bitcoin cannot generate "native" returns. Generally, there are two main ways for Bitcoin to generate returns:

- Wrapped Bitcoin. Solutions like WBTC issue WBTC on Ethereum in a 1:1 pegged manner, allowing Bitcoin to participate in various DeFi activities on Ethereum in a mapped manner. Currently, the volume of WBTC is around $10 billion. However, these solutions are usually based on multi-signature and custodian mechanisms, with a high degree of centralization.

- Depositing on centralized exchanges. Financial products on centralized exchanges provide returns for Bitcoin. However, the returns are often opaque, and there is a significant risk of funds.

Babylon introduces native Bitcoin staking on the Bitcoin blockchain using the Bitcoin time-locked opcode and the Extratable One-time Signature (EOTS) signature algorithm, without relying on any third-party custody, wrapping, or cross-chain bridges. This technological mechanism is the technical innovation of Babylon, unlocking the value of idle Bitcoin and providing extremely important infrastructure for the Bitcoin ecosystem.

The following diagram summarizes the ways and workflow for participating in Bitcoin staking on Babylon.

Source: IOSG

- Liquid Restaking (LRT)

3.1 Liquid Restaking (LRT)

LRT is a new asset category derived from EigenLayer's three-party market. Currently, the total TVL of the LRT protocol is approximately $6.4 billion, accounting for about 41.29% of EigenLayer's TVL. The starting point of LRT is similar to LST, mainly to unlock the liquidity (locked in restaked ETH). Due to the different underlying asset composition of LRT, it is more complex than LST and has a dynamic nature.

Source: IOSG

The following compares the two:

1. Portfolio

LST's portfolio only includes Ethereum staking, but LRT's portfolio is diverse, allowing funds to be invested in different AVS to provide economic security, naturally with different risk levels. The fund management methods and risk preferences of different LRT protocols also vary. In terms of fund management, LST is passively managed, while LRT is actively managed. LRT may provide different management strategies corresponding to different levels of AVS (such as mature AVS compared to newly launched AVS) to adapt to users' income/risk preferences.

2. Yield, Source, and Composition of Yield

- LST's yield is currently around 2.6% to 3%, derived from the combined yield of the Ethereum consensus layer and execution layer, composed of ETH.

- The yield of LRT is currently uncertain, but it mainly comes from the fees paid by various AVS and may be composed of AVS tokens, ETH, USDC, or a combination of the three. According to information obtained from discussions with some AVS, most AVS will reserve several percentage points of the total token supply as incentives and security budgets. If an AVS is already online before issuing tokens, it may also pay in ETH or USDC, depending on the specific situation.

- Since it is token-based on AVS, the risk of token price fluctuations will be greater than ETH, and the APR will fluctuate accordingly. AVS may also have rotation in entering and exiting. These factors will bring uncertainty to the yield of LRT.

3. Penalty Risk

Ethereum staking has two types of penalties: Inactivity Leaking and Slashing, such as missing block proposals and double voting, with high rule certainty. If operated by professional node service providers, correctness can reach around 98.5%.

And the LRT protocol needs to trust that the AVS software code is error-free, has no objections to the penalty rules, to avoid triggering unexpected penalties. Due to the variety of AVS and the fact that most of them are early-stage projects, there is inherent uncertainty. Additionally, AVS may have rule changes as their business develops, such as iterating more features, and so on. Furthermore, in terms of risk management, considerations need to be made regarding the upgradability of the AVS Slasher contract, whether the penalty conditions are objective and verifiable, and so on. As LRT acts as an agent managing user assets, it needs to consider these aspects comprehensively and carefully select partners.

Of course, EigenLayer encourages AVS to undergo complete audits, including the code, penalty conditions, and logic interacting with EigenLayer. EigenLayer also has a multisig-based veto committee to provide final review and oversight of penalty events.

In summary, LRT is a protocol for asset management. Based on this market positioning, LRT can further explore related businesses, such as expanding to protocols like Symbiotic and Babylon, or similar to Yearn's DeFi strategy vaults, to meet the needs of different ecosystems and users with different risk preferences.

3.2 AVS (Actively Validated Service)

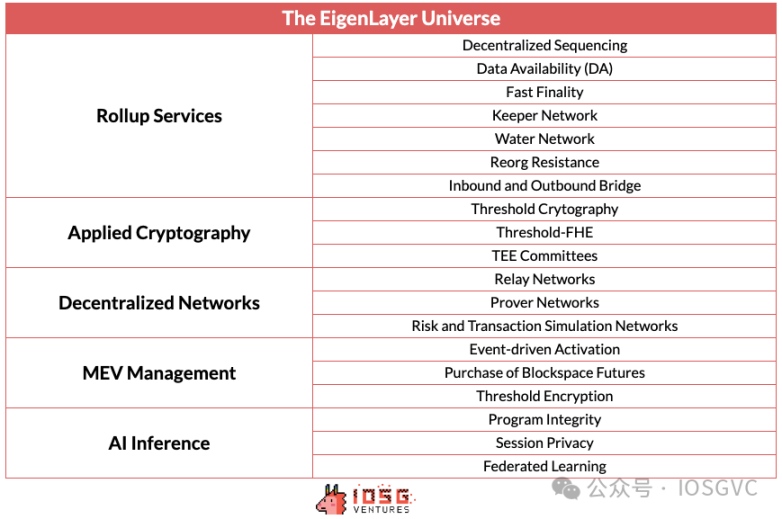

AVS is the object of economic security provided by EigenLayer. According to EigenLayer's official documentation, AVS covers the following infrastructure: sidechains, data availability layers, new virtual machines, guardian networks, oracle networks, cross-chain bridges, threshold encryption schemes, trusted execution environments, and so on. The table below lists more types that can be built based on AVS.

Source: EigenLayer, IOSG

Around the core primitives of restaking, EigenLayer has established a good pipeline for AVS. Currently, 19 AVS have been launched on the mainnet.

For example, EigenDA, developed by EigenLabs, is a data availability solution and is also the flagship AVS entering the market. EigenDA's solution is derived from the Ethereum scaling solution Danksharding. The concept of data availability sampling (DAS) is also widely used in DA projects such as Celestia, Avail, and others.

For AVS, EigenLayer provides the following benefits:

- Economic security and node operation services in the project's startup phase. In the mature stage of the project, if there is a sharp increase in economic security demand in the short term, EigenLayer can also provide flexible security for rent;

- AVS node validation services are run by Ethereum validators, which can achieve better decentralization compared to independent operation by project parties or centralized node service providers;

- It may reduce the cost of validation and operation (depending on the specific situation), reducing marginal costs;

- The Dual Staking model proposed by EigenLayer can provide certain token utility for AVS;

- Building certain services and products based on the trusted commitments of Ethereum validators, such as pre-confirmation;

- As an EigenLayer ecosystem project, it receives a certain endorsement, marketing support, and market exposure.

As a technical solution, AVS often appears more natural and concise compared to launching its own node network on L1 or middleware. In addition, it should be recognized that AVS is essentially a middleware and infrastructure project, and the logic of investing in AVS should be based on evaluating such projects (product, technology, competitive landscape, etc.), as AVS itself does not provide particularly differentiated features.

As mentioned above, AVS is the consumer and lessee of restaking and is the core of the three-party market. The market relies on AVS for payment, which is generally made in the native tokens of AVS (if the tokens are not yet listed, they may be in the form of points), usually around 3%-5% of the total token supply of AVS. Recently, EigenDA will start paying restakers and node operators at a price of 10 ETH per month. EigenLayer itself will also allocate 4% of its total token supply to support all early-stage AVS, helping them through the cold start period.

From a medium to long-term perspective, the sustainable development of the EigenLayer ecosystem depends on the demand side, the need for sufficient AVS to foot the bill for economic security, and the need for sustainability. This is related to the business situation and operational capabilities of AVS and will ultimately be reflected in the token price.

The returns from Ethereum staking will exist in the long term and remain in a stable range, while the returns from AVS may not. The returns, persistence, and volatility provided by the tokens of each AVS are different, and the risk preferences and pursuit of returns of each restaker are also different. In this process, there will be dynamic self-regulation in the market (more ETH staked to a certain AVS will reduce the yield, prompting restakers to switch to other AVS or other protocols).

3.3 Summary

- After the hype of airdrops has subsided and the market has cooled down, EigenLayer's TVL has decreased by about 20%, entering the period of mean reversion that we previously predicted. In the long run, we believe that restaking on EigenLayer will not be a short-term narrative based on sentiment, but will become a permanent attribute of the Ethereum ecosystem, used to externalize Ethereum's economic security and help projects launch.

- As mentioned above, TVL is not the most core indicator for evaluating EigenLayer; the quality of AVS is. If more high-quality AVS are built on EigenLayer, they will definitely bring high returns, and TVL will follow. Therefore, the competition between restaking protocols is actually a competition in early identification and "investment" in AVS. Restaking protocols will obviously be a winner-takes-all market.

- For the LRT protocol, TVL is certainly one of the explicit indicators for measuring protocol performance, but the TVL number alone cannot summarize the entire protocol. For "savings" type protocols, user support, especially from large holders, is a key factor. Compared to retail investors, large holders are relatively "lazy" with their funds, have a lower willingness to seek short-term and quick returns, and have a more stable risk appetite, so they are more likely to stay on the platform for the long term. Liquidity is crucial for large holders and is related to their confidence in the project. Therefore, establishing and maintaining liquidity should be one of the primary goals of the LRT protocol.

- Investment Logic and Layout

We have actively positioned ourselves in the Staking & Restaking track around the two key time points of "The Merge" and "Shanghai Upgrade" for Ethereum. In summary, our positioning is mainly based on the following judgments:

"The Merge" for Ethereum means that PoS becomes a permanent attribute of Ethereum, and staking is an indispensable part; after the "Shanghai Upgrade," Ethereum staking, as a means of asset management, changes from "in-only" to "in and out," achieving a closed loop of fund flow. These two landmark events are the foundation of our focus on this track.

We believe that the staking track will inevitably evolve towards product diversification. The market favors diversified solutions. As a pioneer and absolute leader in the staking track, Lido, due to its sensitive position (the community has expressed concerns multiple times about Lido's market share exceeding 33%), will be more cautious in launching new products. Therefore, we believe that as other competitors launch differentiated strategies, Lido's market share will show a long-term downward trend.

Over the past year, the market's performance has also validated our judgments:

```

```

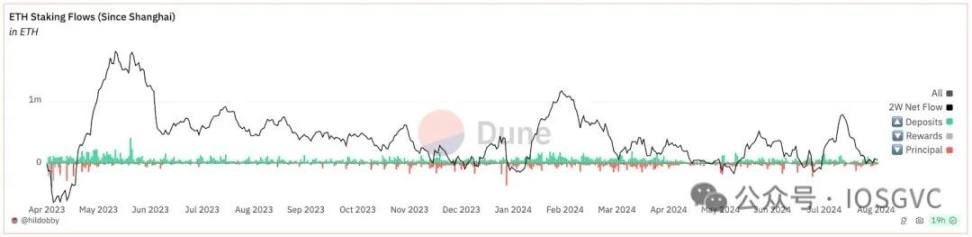

Source: ETH Staking Dashboard by @hildobby

- Ethereum's staking rate has increased from about 12% a year ago to 27.28%, a growth rate of 227.3%. In the current Ethereum staking queue, there are 6,425 stakers waiting for 3 days and 14 hours to enter the queue, while there is only 1 staker waiting to exit the queue, almost no waiting required (data as of May 31). It has been in a long-term state of supply exceeding demand.

- Driven by the Restaking narrative, many LRT protocols (such as Ether.fi, Renzo) have effectively become some of the largest stakers on Ethereum. In addition, institutional-level staking schemes and independent staking schemes are also flourishing. Lido's market share has also decreased from a peak of 32.6% to 28.65%.

- Conclusion

Source: Justin Drake

Looking back at the development of the Ethereum staking and restaking ecosystem, we can clearly see that the value of ETH as a multi-functional asset continues to be strengthened and expanded. From its initial single valuation and gas functionality to now playing multiple roles, ETH has become an indispensable cornerstone of the crypto economy.

As the Ethereum roadmap continues to expand and the staking ecosystem matures, the role of ETH in the entire blockchain industry is becoming increasingly important. Through staking and restaking, ETH not only provides a solid foundation for network security and decentralization but also demonstrates its unique role in the three major attributes of capital, consumption, and value storage assets by expanding economic security and enriching the ecosystem.

In the future, ETH may play a more important role in the following aspects:

- As an anchor for cross-chain ecosystems: Through restaking protocols like EigenLayer, ETH has the potential to become the economic security foundation of a multi-chain world.

- Driving composability in financial innovation: DeFi products based on LST and LRT will become more diverse, providing users with more income and risk management choices.

- Deepening integration with traditional finance: The entry channels provided by ETH ETFs and the stability of ETH staking returns may attract more institutional investors, promoting the integration of crypto assets with traditional financial markets.

A few predictions:

- As the ETH staking rate increases, staking returns will gradually decrease, and funds will seek more diversified income sources. As restaking solutions mature, restaking will capture the flow of these funds and provide additional returns. (Similar to how MEV-Boost has become the default block construction method for almost all validators to increase returns) The proportion of ETH participating in restaking relative to ETH participating in staking will gradually increase.

- In the field of restaking, due to the flexibility of asset management by LRT, its positioning will gradually expand from a liquidity restaking platform to a "center for asset management" and a DeFi Hub across protocols and ecosystems, even connecting to the real world. For example, Ether.fi has launched its native crypto credit card, linked to its LRT and Liquid products. In this process, market leaders have a higher bargaining power when negotiating with upstream and downstream partners.

We firmly believe that Ethereum will continue to serve as the cornerstone of decentralized finance, supporting and driving the widespread adoption of decentralized applications globally. We will continue to closely monitor this rapidly developing field and align our investment layout with the future development trends of Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。