The cryptocurrency trading is a long-term plan, not a matter of overnight success, so there is no need to be too hasty. Even if there is a short-term loss, there is nothing to fear as long as the subsequent direction is chosen correctly. The lost will eventually return. However, it is important to grasp the timing of trading and the current market trends in order to increase the winning rate. At the same time, investment is a process of growth. Mr. Coin suggests that everyone should learn while operating, summarize the gains and losses in a timely manner, deepen their understanding of risks, and plan with the correct mindset in order to reasonably avoid risks and become a qualified investor.

Mr. Coin's BTC (Bitcoin) Market Analysis Reference on September 9th:

The overall trend of Bitcoin over the weekend maintained a wide-ranging oscillation. The bulls and bears pulled up and down by more than a thousand points in the early morning. A rebound was made near the 53600 support line after a pullback. The bulls made a slight effort in the early morning, breaking through the 55500 resistance, but the subsequent supply was insufficient, and the market did not stabilize for further upward movement. Compared to the previous trend, the oscillation range has slightly compressed. If the price cannot make a strong rebound and break through the previous resistance near 56200, it is expected that the oscillating market will continue for some time.

In the short-term hourly chart, the MACD fast and slow lines are running above the zero axis, and the DIF and DEA lines are gradually approaching to form a golden cross sign. The EMA7 and EMA30 are close to the current price, which can provide short-term support. EMA30 and EMA120 are both higher than the current price, forming upper pressure.

Looking at the daily chart, the MACD is still in the low position, the daily RSI is hovering around 40, temporarily not entering the extreme area, and the daily EMA still maintains a bearish arrangement. There is resistance between EMA7 and EMA30. The current price is near 55600, and the recent price fluctuates in the range of 54000-56000, showing a significant oscillation and consolidation. The current trend is about to approach the middle band resistance maintenance. If the price is obstructed in the upward movement, there is a risk of further testing the 54000 support line. The overall trend of Bitcoin still maintains a wide-ranging oscillation, so it is recommended to maintain high short and low long positions in operations.

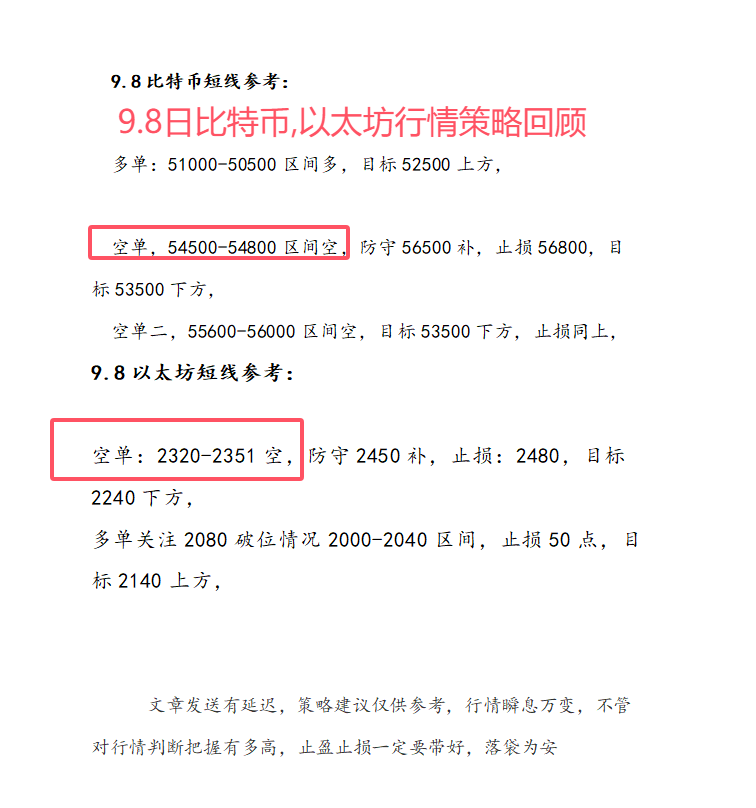

Short-term Reference for Bitcoin on September 9th: For more real-time single strategies, online technical learning, and getting out of the market, you can follow the mentor's official account (Mr. Coin) to obtain the method of adding: the first ten people every day can get free access to the strategy for getting out of the market.

Long position 1: Long in the range of 51000-50500, target above 53000.

Long position 2: Long in the range of 52500-53000, defend at 51500, stop loss at 51000, target above 53500.

Short position 2: Short in the range of 55600-56000, target below 53500, stop loss at 400 points.

Short-term Reference for Ethereum on September 9th:

Short position: Short in the range of 2320-2351, defend at 2450, stop loss at 2480, target below 2240.

Long position: Pay attention to the breakthrough of 2080, in the range of 2000-2040, stop loss at 50 points, target above 2140.

There is a delay in the article delivery, and the strategy suggestions are for reference only. The market changes in an instant. No matter how high the judgment of the market is, it is essential to set stop-loss and take-profit levels. More real-time singles can be obtained by following the official account of the author. You can also learn about technical analysis of the market and getting out of the market online. The author has studied the market for many years, analyzed the major trends in the cryptocurrency market, and has provided guidance on BTC, ETH, DOT, LTC, FIL, EOS, BCH, ETC, and other cryptocurrencies. For those who are not familiar with trading, you are welcome to study and learn together.

This article is exclusively written and shared by Mr. Coin. It represents Mr. Coin's exclusive viewpoint. There is a delay in the article delivery, and the risk is at your own. It is important to control the position reasonably when trading, and avoid over-positioning or full-positioning. Mr. Coin hopes that all fans and friends can achieve financial freedom and move forward together. In the depths of time, hold a sense of understanding. In investment, one must learn to be optimistic. Do not let the future you dislike the present self. We live in reality, but not every piece of data needs to be taken seriously. Let the past go, and let the future come faster! Rest well, prepare yourself, and get ready at any time. Let's go!

- This article is written by Mr. Coin. Refusing to plagiarize, respecting originality!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。