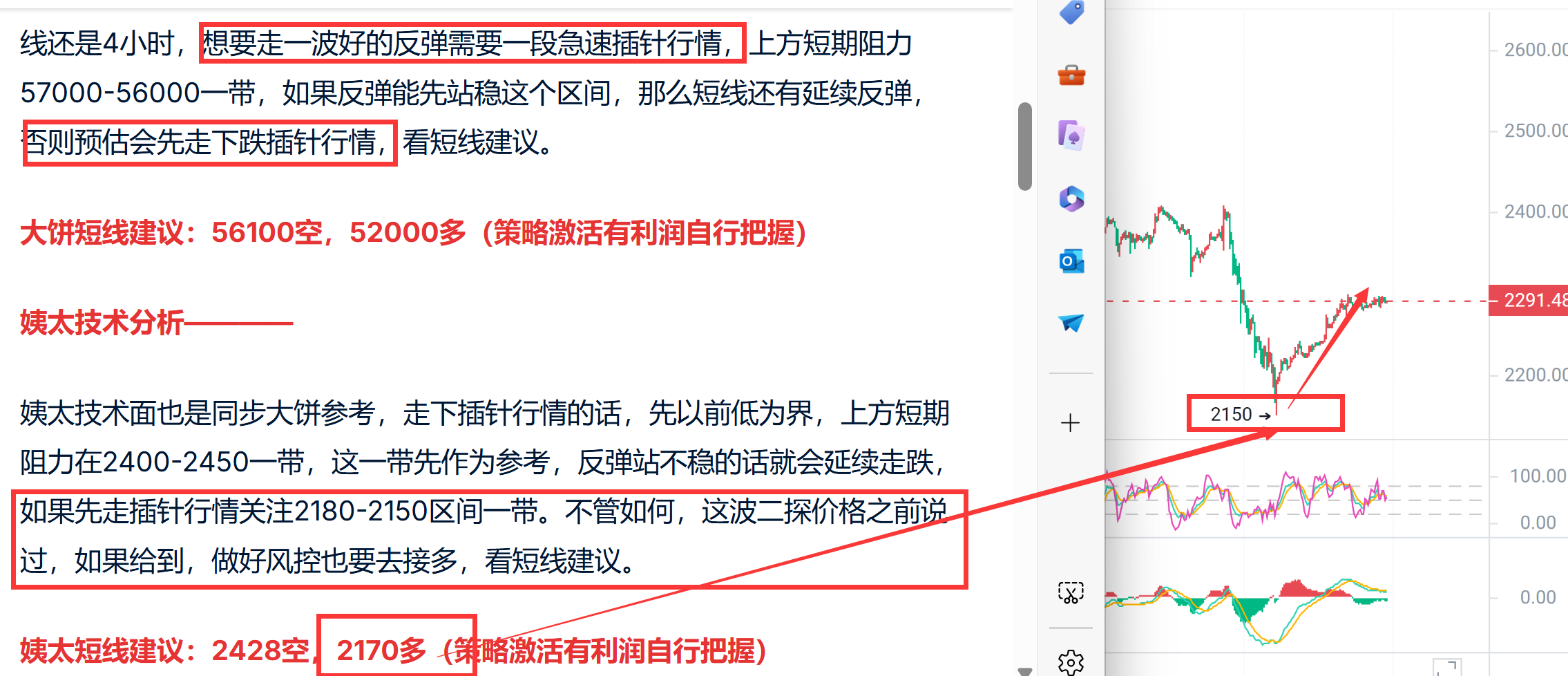

Good weekend, everyone. I am Yue Ying. The previous analysis and entry points basically match the market trend. The entry point for BTC was a bit lower, but the entry at 2170 by Auntie was executed, with a potential profit of over $100. Both BTC and Auntie's articles emphasized the need for a technical rebound at the time. Auntie specifically mentioned that if there is a downward trend, we should watch the range of 2180-2150, and also said that regardless of the situation, we should boldly participate when the given price is reached. Why so determined? It's because previous articles mentioned this important price range below, and suggested entering long positions when the market develops as expected. My articles have been bearish since the end of July, and I believe friends who have followed the analysis should have made some gains. Thank you for your likes and attention. It is estimated that the weekend will be mainly characterized by oscillating adjustments. I won't write an analysis today, but will briefly discuss what issues need to be paid attention to in trading, hoping to be helpful to friends.

Habits determine success or failure. Successful trading habits are correct, and through trading, one can constantly discover their own shortcomings and cultivate good habits beneficial to trading.

Firstly, never fantasize. Successful investors never blindly invest without full confidence. Because successful investors are trading experts who can understand the market trends, they always make profits. On the other hand, most failed investors are trading novices who are always eager to invest under partial understanding of the situation, and even eager to add positions to expand profits at the slightest hint, ultimately resulting in more losses than gains. What should you do if the price of a product you have invested in does not develop in the direction you originally anticipated?

Ordinary investors often come up with various reasons to "rationalize" this abnormal phenomenon. This kind of rationalization to avoid the pain of cutting losses is extremely fatal, and is also the main reason why many experienced investors eventually have to give up. Successful investors never let emotions influence them, or if they do, to a very small extent. No matter how painful it is to cut losses and admit mistakes, they never hesitate. They understand that allowing such a situation to continue will only bring greater pain and losses.

Secondly, never go all in. Successful investors rarely go all in, because they know that market trends often defy expectations, and long-term stable profits are the key to success. On the other hand, failed investors are always eager to get rich quick, and go all in or nearly all in. Although sometimes they may make more profits than successful investors, they may end up losing miserably.

Successful investors are not overly confident, not greedy, and pyramidally add positions in a disciplined manner, and are likely to make profits regardless of how the trend changes. On the other hand, failed investors are eager to add positions and expand their positions, and ultimately when the market reverses, their gains turn into losses.

Thirdly, almost all successful investors are lonely, because they often have to make decisions that are different from the majority. Successful investors never chase after the market in a big way, and often boldly buy when the market retraces to a suitable level, because they know that the trend is stable and reliable, and will continue in the original direction after the retracement.

On the other hand, failed investors often chase after the market in a big way, and often believe that the price has peaked when it retraces, resulting in "buying high and selling low," causing losses in a rising market. When the price is clearly in a downtrend, they always think about buying at the bottom, and end up getting trapped every time, either deeply in the red or constantly cutting losses, and when the bottom arrives, they have lost the courage or funds to buy at the bottom.

For intraday trading strategies, please contact me via private message on the public account below.

- I am Zhou Yue Ying, a teacher specializing in technical analysis. If you have any questions about operations or trends, you can discuss and learn with me! Let's exchange ideas and make profits together! Public account: I am Zhou Yue Ying

The market changes dramatically every day, and all I can do is to provide some weak assistance based on my many years of practical experience, so that everyone's investment decisions and management can be on the right track. Meeting is fate, and I am a person who believes in fate. If you have any doubts or questions in the cryptocurrency circle, you can pay more attention to Zhou Yue Ying, and I believe it will be helpful to you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。