Zhou Yanling: Unexpected Non-Farm Payrolls Expectations. Next Week's Latest Trends Forecast and Long Strategy for Bitcoin and Ethereum

Last night, the non-farm payroll data was expected to slow down, especially when there was a large expectation of interest rate cuts, but a bucket of cold water was poured on everyone's head, making everyone wake up. 55500 has become an unavoidable point, a strategic stronghold. Before the non-farm payroll, it fell first, and the data helped to push up the good news, and finally the Americans suppressed it below 55500, forming a process of unexpected expectations, which is in line with the Americans' trading methods.

Looking back at the overall operation of this week, in the past few days, we have been maintaining a high short-term mindset towards Bitcoin at the end of the week, insisting that the price will not break 57500 and will be under pressure to fall back. Yesterday, with the help of the non-farm payroll data, Yanling also maintained the previous high short-term mindset and pressure to kill the fall, so yesterday's wave of high shorts can be said to be a big win. So, what about next week? Has the price bottomed out at this time?

Without further ado, let me give you the conclusion directly. Yanling is going to turn bullish next, so everyone pay attention and keep up with the pace. Below, I will explain in detail why I will do this:

First of all, in terms of news, after the non-farm payroll cooled down expectations, it entered a retracement phase, which is the process of digging a pit; it takes some time to cool down market expectations. Only after the interest rate expectations have cooled down will there be a new reversal. In addition, the trend in the currency circle is inversely related to the expectation of interest rate hikes; once it is implemented, it is not certain, but instead it will cause the currency price to fall, which has always been Yanling's reverse thinking and prediction point. Although it is difficult, reality proves that it is still effective.

Secondly, in terms of form, the area above 55000 is a high area. For several days, it has not broken through the 57500 resistance. The bulls also need to retreat and gather strength. This process is consistent with Yanling's expectations. Without breaking the resistance, it will definitely fall back below 55500 and gather strength. It indicates that the upward trend is still there, but the dullness is quite serious. Going up in this way will be weak and powerless. Not only will it not complete the breakthrough, but the bears will counterattack after the rise. So, this is the model on Friday night. It must fall first in order to gather strength for the later upward trend next week.

Lastly, in terms of position, it is very easy to reach below 55500, and the expected rebound space is 3000 points in amplitude; if the upward trend is to continue, it must break through the stronghold of 55500. This position is not difficult to break through. By combining market expectations and counter-expectations, and using the digging pit form to gather strength, it will quickly be achieved. It is common in the currency circle for the price to fall and then rebound to where it was.

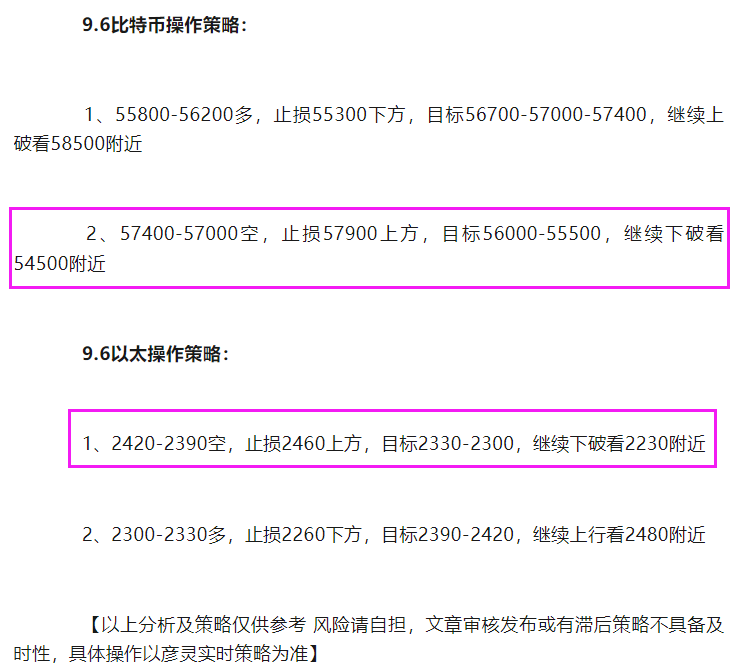

Bitcoin Operation Strategy on September 7th:

- Long at 53400-53800, stop loss below 52900, target 55000-55500, continue to break through and look at around 56700

- Short at 55400-54900, stop loss above 55900, target 54000-53500

Ethereum Operation Strategy on September 7th:

- Long at 2200-2230, stop loss below 2160, target 2320-2360, continue to rise and look at around 2420

- Short at 2350-2320, stop loss above 2380, target 2250-2220

What to do if you are trapped: In recent times, the market has fluctuated greatly, and many friends have been trapped in long positions. If you are currently in this situation while reading my article, don't worry. Since everyone's situation is different, and the position points are different, I cannot provide detailed solutions and position operations here. If any friends are still trapped in the predicament, you can follow my public account: Zhou Yanling, to get more specific strategies to help you get out of the predicament as soon as possible.

【The above analysis and strategies are for reference only. Please bear the risk on your own. The article review and release may have lagging strategies and lack timeliness. Please refer to Yanling's real-time strategy for specific operations】

This article is exclusively created and shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for more than ten years, mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV and other currency circle contract/spot operations. If you need to know more about real-time community guidance, trapped consultation, and chart reading skills, you can follow the public account of the teacher: Zhou Yanling to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。