Foresight News takes you to quickly review the hot topics and recommended content of this week:

01 Project Inventory "Intent-Centric"

"Project Inventory 'Intent-Centric': Emerging Trends in Web3"

02 September Running Guide

"September Web3 'Running' Guide"

03 Polygon Ecosystem

"MATIC Transforms into POL, What Impact Does It Have on Coin Price?"

04 Web3er

"Forbes Interview with Grayscale Research Director: This Rate Cut Is Different, Bitcoin's Prospects Are Promising"

05 Industry Insights

"Must-Read! Summary of Ethereum Foundation's AMA Yesterday"

"Data Research: Diminishing Effect of BTC Halving After 2016"

"1kx: Ethereum, a Hyper-Real Online World"

"Crypto Market Downturn Again: Can Non-Farm Payrolls, CPI, and Fed Rate Cuts Bring a Turning Point?"

06 Project Observation

"Gold Rush Manual | Story Protocol's Eco-Leading Interaction Guide"

"Reinterpreting EigenLayer and Potential Staking: Breaking the Trust Barrier"

"Review of EtherVista, How to Find the Next Hundredfold Coin?"

"Priced at 599u, Is SuiPlay Game Console Worth Buying?"

"Polymarket is Hot, But Is It a Good Prediction Tool?"

01 Project Inventory "Intent-Centric"

In July last year, Paradigm released an article on the top 10 most interesting areas, with "Intent-centric protocols and infra" ranking first. After a year, this article will summarize the current development of related projects centered around intent. Recommended article:

"Intent-Centric Project Inventory: Emerging Trends in Web3"

"Intent" simplifies the operation process by specifying the starting intent and the resulting endpoint, thereby improving the user experience.

Intent-based applications provide digital users with a method to execute applications, reducing costs and improving efficiency. Essentially, intent can be seen as a digital matching mechanism. Its principle is to connect the user's needs with feasible solutions, simplify the complex intermediate process, and provide a concise final result.

Based on this, Intent-centric, or "intent-centric" protocols and applications have been built to help users in the process of using DApps. Users only need to specify the goal or intent they want to achieve, and the system can automatically parse and execute the corresponding operation, obtaining the desired result. This design greatly simplifies the interaction process between users and DApps, reduces the usage threshold, and allows even non-Degen users to easily get started, experience the convenience and advantages of decentralized applications, thereby lowering the entry barrier for Web3 and attracting more users.

02 September Running Guide

Foresight News brings you the September "Running Guide," exploring the global Web3's autumn feast together! Recommended article:

"September Web3 'Running' Guide"

In September, several heavyweight events are about to take place. First, the Korean Blockchain Week is coming, followed by the global blockchain industry's focus on Singapore. The industry-wide event TOKEN 2049 and the annual summit of the Solana ecosystem will both be held in Singapore. On the other hand, Hawaii, USA will host its first large-scale tech week, including topics and peripheral activities related to Bitcoin and blockchain. Additionally, New York will host Mainnet 2024.

03 Polygon Ecosystem

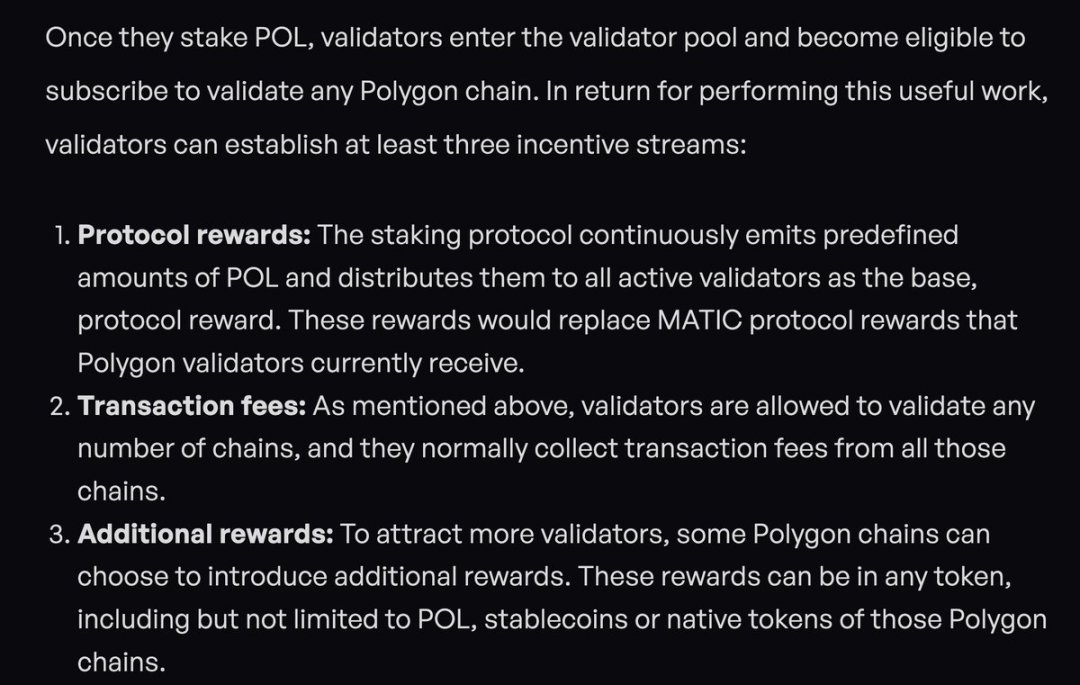

Polygon announced two major plans in its roadmap last year, one of which is to launch the POL token through a 1:1 upgrade between MATIC and POL tokens. What changes will occur in the token economics after MATIC is upgraded to POL? Are there potential airdrop opportunities? Recommended article:

"MATIC Transforms into POL, What Impact Does It Have on Coin Price?"

Currently, there are two additional rewards:

Providing token rewards for stakers on the CDK chain

Sharing fee income with stakers of AggLayer

More rewards are also in the works:

Sharing sequencing income

ZK proof income, and so on

It's like a network of fees where validators play multiple roles at different times.

04 Web3er

Zach Pandl is the research director of Grayscale Investments, the world's largest cryptocurrency asset management company. Forbes recently had a conversation with Pandl, in which he provided an important perspective on the annual expectations for the cryptocurrency market. Recommended article:

Zach Pandl: In my view, the recent underperformance of ETH is mainly a technical issue, not an issue with the Ethereum ecosystem. What I want to say is that Bitcoin and Ethereum are completely different assets and require different education for investors. Bitcoin and Ethereum ETFs provide a channel for a series of new investors and financial advisors to access crypto products. But they are completely different assets. They are both blockchains, but we categorize them differently within the Grayscale crypto industry framework. Bitcoin is primarily a currency, while Ethereum is primarily a smart contract platform. They are both blockchains, but their functions are different. I think the education process for Ethereum is longer than for Bitcoin. It is the foundation for smart contracts, decentralized applications, tokenization, stablecoins, and DeFi, which may be why the demand growth for Ethereum ETFs is slower than for Bitcoin.

Ryan Selkis wants to build a "parallel Washington" using modern technology. Recommended article:

"Ryan Selkis: Leaving Messari, I've Started a New Venture, Solomon"

I have left Messari and embarked on the most challenging project of my career: Solomon.

Below, I will outline:

- Why I left Messari and fully committed to two things: 1) Trump's re-election; 2) Building a "parallel Washington" using modern technology.

- What the next four years might look like and my 40-40-100-1000-400 strategy.

- When you can expect to see more information about the Solomon project and the initial timeline for the project.

- I can't believe how arrogant/crazy I am to want to do something so bold and against the trend.

- What help can you provide when I start the first two phases of Solomon?

05 Industry Insights

This week, the Ethereum Foundation research team held its 12th AMA on Reddit, with team members responding to community concerns about foundation spending transparency, budget allocation strategies, and delving into various subfields, including Rollup progress, ZK progress, Layer1 scaling, and Ethereum Foundation members' views on DeFi. Recommended article:

"Must-Read! Summary of Ethereum Foundation's AMA Yesterday"

Vitalik Buterin: There are two main Layer1 scaling strategies being actively considered:

Implement proposals that can reduce the load on full nodes (such as EIP-4444, Verkle trees, or hash-based binary trees, and ZK-SNARKing EVM), and after these improvements are in place (or about to be implemented), increase the Gas limit. The most realistic choice in the short term is EIP-4444, as it does not require a consensus change, just some work in the client code that is relatively orthogonal to all the other work being done on L1.

Further optimize client execution and increase the Gas limit after completion. Key areas for improvement here are: execution, including the virtual machine and precompiles; state reads and writes; data bandwidth. There are known inefficiencies in all three areas that can be further addressed.

Add functionality to the EVM to accelerate specific forms of computation. My favorite approach is to combine EVM-MAX and SIMD to provide the EVM with a numpy-like extension, allowing it to perform a large amount of cryptographic processing more quickly. This will lower the cost of applications that rely heavily on encryption, particularly benefiting privacy protocols, and make it cheaper for L2 layers to submit to the chain more frequently, thereby reducing deposit and withdrawal times.

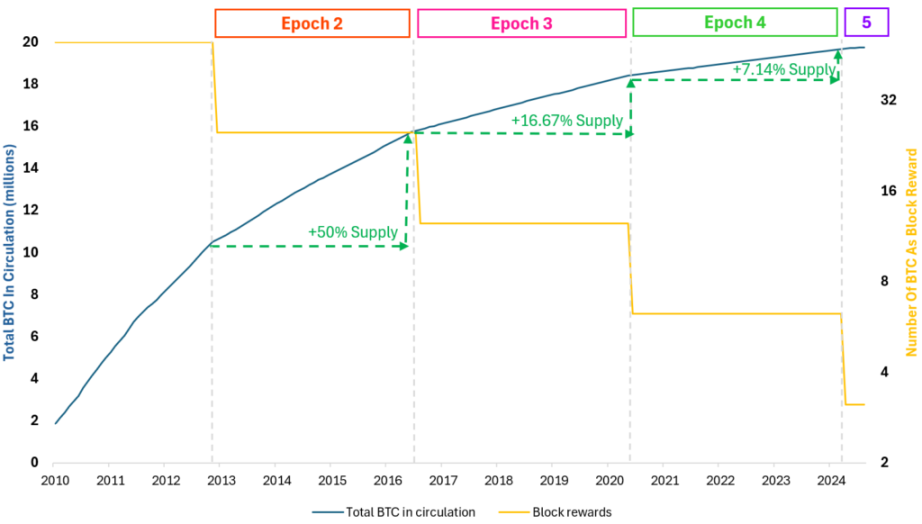

Bitcoin's halving is witnessing the worst price performance in history, 4 months after the halving. In this article, we explain why the halving no longer has a fundamental impact on the price of Bitcoin and other digital assets. Recommended article:

"Data Research: Diminishing Effect of BTC Halving After 2016"

Bitcoin halving occurs approximately every four years, reducing the block rewards for miners. This reduces the rate of new Bitcoin generation, thereby reducing the new supply in the market. The total supply limit of Bitcoin is 21 million, and each halving slows down the pace of reaching this limit. The period between each halving is called an Epoch, and historically, each halving has had an impact on the price of Bitcoin due to reduced supply and increased scarcity. All of this is shown in Figure 3.

Today's Ethereum is like a content-depleted game, and we are looking for the next great immersive world. Recommended article:

"1kx: Ethereum, a Hyper-Real Online World"

Ethereum provides people with an immersive, social, and meaningful game.

Although Ethereum has evolved into a universal infrastructure for cryptocurrency use cases (such as payments, transactions, and collectibles), its greatest success is not as the backend of applications, but as a complete world where people live, create, belong, and nurture.

The experience of Ethereum is difficult to define, it is both strange and novel. We have not given a serious name to the experience that belongs to it. To understand it, we may have over-rationalized it, thinking that it is a temporary state of cryptocurrency. This is a chaotic, strange, and exploratory period, an attempt to collectively understand blockchain as a new technology. However, with the momentum of most of the hype cycles in 2021 extinguished, the true nature of cryptocurrency may just be beginning to emerge: the experience of participating in blockchain itself is the product.

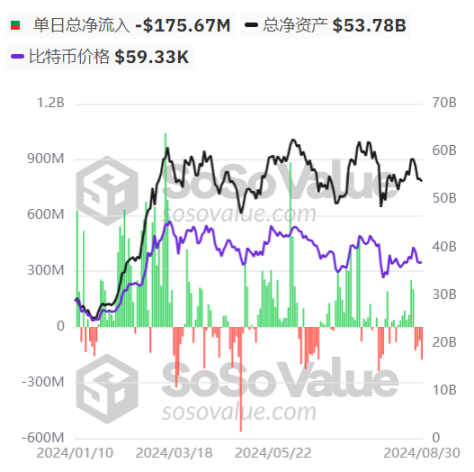

The crypto market has been quite dull this week, and the recovery of market liquidity will take time. Recommended article:

"Crypto Market Downturn Again: Can Non-Farm Payrolls, CPI, and Fed Rate Cuts Bring a Turning Point?"

The performance of BTC spot ETF is also not optimistic. Since the data changed to a net outflow of $127 million on August 27, it has been in a net outflow state.

If you bought altcoins from October last year and haven't sold, chances are you have no profit left. If you bought altcoins after March this year and still hold them, you may be deeply trapped. The crypto market continues to decline due to continuous profit-taking and the lack of a hot narrative. Ultimately, market liquidity is still very scarce.

Insufficient on-chain funds, external funds to make up for it. Although excessive attention to macro factors is picking sesame seeds and losing watermelon for cryptocurrency market investors, it must be acknowledged that macro factors still greatly influence the volatility of the cryptocurrency market. The main evidence is that before and after the release of non-farm employment data, CPI data, and Fed data, BTC and the entire market often experience significant fluctuations in the short term.

06 Project Observation

Which projects have gone live on the Story Protocol testnet? Stay ahead and interact first. Recommended article:

"Gold Rush Manual | Story Protocol's Eco-Leading Interaction Guide"

Recently, in an interview with Jason Zhao, co-founder of Story Protocol, by Foresight News ("Interview with Story Protocol Co-Founder: The Trillion-Dollar IP Market Urgently Needs Reshaping"), Jason Zhao outlined Story's vision: "We are not just a programmable intellectual property layer for blockchain, we are a programmable intellectual property layer for the internet. It's not just about putting media files on the chain, it's about having software-based rules for every piece of content on the internet, dictating how others can license, remix, and extend that intellectual property. It's also crucial for creators to monetize their IP as training data in AI."

With a whopping $140 million in funding, the ecosystem interaction of Story Protocol is also attracting attention. Today, Foresight News will take you behind the scenes of the projects and interaction strategies that have gone live on the Story testnet, witnessing the development of this new ecosystem for digitizing IP.

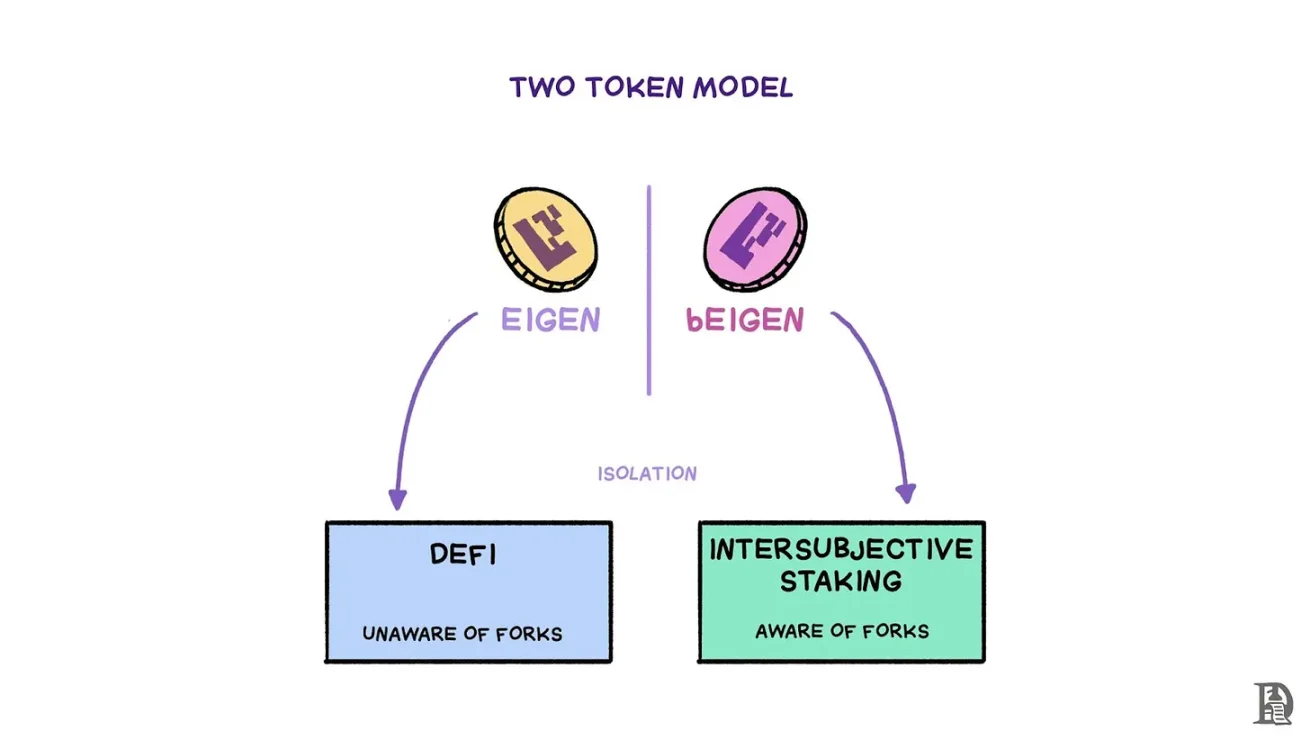

Re-staking and liquidity re-staking tokens (LRT) have taken an important position in the 2024 crypto market, mainly due to the introduction of new primitives by EigenLayer. Recommended article:

"Reinterpreting EigenLayer and Potential Staking: Breaking the Trust Barrier"

Typical staking mechanisms and governance models usually rely on a single native token to handle staking and other activities, such as trading or participating in DeFi. However, this one-size-fits-all approach may lead to complex situations, especially when dealing with complex disputes that cannot be easily resolved solely through on-chain data. This is an unexplored solution introduced by EigenLayer: using two interrelated tokens, EIGEN and bEIGEN, to separate these issues and enhance the flexibility and security of the system.

EIGEN: This token is mainly used for non-staking activities. It can be traded, held in DeFi protocols, or used for other applications without directly facing the risks associated with staking and governance disputes.

bEIGEN: This token is designed specifically for staking within the EigenLayer system. When users want to participate in staking, they wrap their EIGEN tokens into bEIGEN, and then bEIGEN is subject to the rules and risks of the staking process, including the possibility of being slashed or forked in case of disputes.

Since Vista went live, its market value has soared all the way, reaching 30M in just two days, topping the Ethereum Gas consumption rankings. EtherVista has been impressive, and this article will take you through the development of EtherVista, actively reviewing and seeking the next Alpha. Recommended article:

"Reviewing EtherVista: How to Find the Next Hundredfold Coin?"

As early as July, the project attracted some attention, but the hype was moderate. It wasn't until August 31 that EtherVista gradually gained popularity in the Degen community when it announced the Fair Launch of Vista on September 1.

What's different this time is that EtherVista was discovered and participated in by Chinese users early on, but the price increase was relatively small. After going live at 12:00 AM on September 1, it experienced a small initial increase, reaching a high of 2.8u, then quickly retracing to 0.5u.

On September 2, Jingtao revealed that the Dev's associated address was an early Ethereum whale and an assistant professor at ETH Zurich. Subsequently, foreign KOLs joined in, and well-known foreign KOLs such as Pow and Spider also joined in the promotion, causing the token price to soar rapidly, with a market value almost reaching 30M, but it has now fallen to 17M. The top 70 buyers of VISTA have reduced their holdings from 56% to 3.29%.

After Vista's surge, a series of Vista animal tokens quickly emerged, including VistaDOG, VistaCAT, and VistaPEPE. Among them, VistaDOG became the leader, with a market value reaching as high as 4M, but has since fallen along with Vista. In addition, the claw machine robot also quickly went live during this hype, with some scientists earning 22 ETH per day, but with the entry of top Bot ae13, many claw machine robots have been eliminated.

Mysten Labs (a Sui blockchain development company) and the game startup company Playtron have collaborated to launch the SuiPlay0x1 handheld game console, which is now available for pre-order. The first 1000 pre-order customers will receive special soul-bound NFTs, entitling them to special access, rewards, and benefits. Is it worth buying? Recommended article:

"Is the SuiPlay Game Console Worth Buying at $599?"

The first 1000 pre-order customers of SuiPlay will receive special soul-bound NFTs, entitling them to special access, rewards, and benefits, according to the official announcement. This strategy is clearly aimed at competing with the Solana Saga phone. However, whether there will be a related airdrop frenzy remains to be seen, depending on whether the ecosystem projects cooperate with the official announcement.

However, compared to the pre-discount price of 1000u and a total supply of over ten thousand for Solana Saga 1st generation, the $599 price of SuiPlay and a limited NFT supply of 1000 doesn't seem like bad odds. On average, holders of Solana 1st generation phones received over a thousand dollars in tokens. For SuiPlay NFT holders, to "just" break even, they would need a total airdrop value of $600,000.

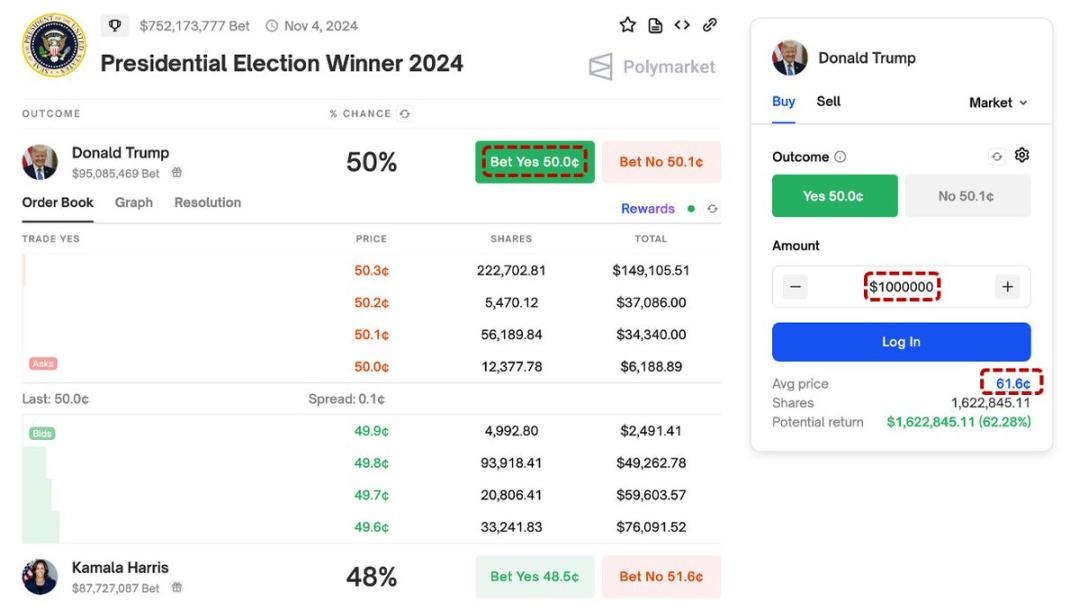

The author believes that Polymarket is still an inefficient emerging market and cannot predict small changes in event probabilities (5%). Recommended article:

"Polymarket is Popular, but Is It a Good Prediction Tool?"

The problem with Polymarket is that the price impact is too large relative to the small deviation from consensus. In the following market, I believe the probability of Trump winning is 50%, and Robert Kennedy's support would increase his chances of winning to 55%. The issue is that I cannot actually make a $1 million trade to earn $10,000 (assuming my prediction of 50% to 55% is correct), because buying a $1 million bet would cause the average price to skyrocket by 62%. If the market's probability is readjusted to 55%, I would actually incur a loss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。