OKX collaborates with the high-quality data platform AICoin to launch a series of classic strategy research, aiming to help users better understand and learn different strategies through data testing and analysis of strategy characteristics, and to avoid blind usage as much as possible.

Time-weighted strategy and iceberg order strategy are two common trading strategies for large order splitting, especially suitable for bulk trading and quantitative trading.

The time-weighted strategy is a strategy that splits a large order and eats orders over time. Its purpose is to evenly spread a large order over a specified period of time to minimize the impact on market prices. The basic principle is to split the large order into multiple smaller orders and execute them in sequence within preset time intervals, so that the average price of the entire trading process is close to the market's average price. This strategy can effectively avoid market impact caused by placing a single large order, reduce the risk of slippage, and is usually suitable for traders or institutional traders who hope to avoid significant market fluctuations affecting trading prices.

The iceberg order strategy is a strategy that splits a large order and places orders in batches to hide the actual trading volume. By splitting a large order into multiple smaller visible orders, it prevents other market participants from detecting the intent of large trades, thereby avoiding drastic market price fluctuations. The basic principle is to decompose a large trading order into several smaller sub-orders, only displaying a portion to the market. When a sub-order is completely executed, the system will generate the next sub-order until the entire large order is traded. This allows the market to only see the "tip of the iceberg," hiding the true size of the order, and is usually suitable for institutional traders who wish to conceal their strength or traders with large fund sizes.

In summary, in actual trading, these two different strategies can be selected based on different usage scenarios to better manage the execution of large orders. By using the time-weighted strategy to spread the time impact and utilizing the iceberg strategy to hide the trading volume, traders can effectively control market impact and slippage risks while protecting their trading intentions. These strategies are widely used in high-frequency trading, institutional trading, and large order execution, especially suitable for use in markets with poor liquidity or high volatility.

Pros and Cons Comparison

Trading Strategies for Large Order Splitting

Category

Time-weighted strategy

Iceberg order strategy

Advantages

Minimal market impact

Hides true intent

Price smoothing

Gradual execution

Simple and understandable

Flexibility

High controllability

May prolong execution time

Disadvantages

Execution risk

Liquidity risk

Applicable Users

Institutional traders

Institutional traders

Large fund traders

Large fund traders

In general, the time-weighted strategy has multiple advantages in practical applications. Firstly, it has minimal market impact. By splitting large orders into multiple small orders for gradual execution based on time periods, it reduces the impact on market prices. Secondly, it achieves price smoothing. By dispersing trading time, it can avoid drastic price fluctuations caused by large trading orders, thereby obtaining a more average execution price. Thirdly, it is simple and understandable. The strategy logic is relatively simple, easy to understand, and easy to operate, and can be used with a single click on the OKX platform. Fourthly, it has high controllability. Prices, time intervals, quantities, etc., can be set according to individual needs, enhancing flexibility in execution.

However, its disadvantages are also relatively apparent. For example, there is execution risk. Due to the batch execution at timed intervals, it may not achieve the best price if the market experiences drastic fluctuations, and so on. AICoin's time-weighted strategy randomizes time intervals and trading quantities during operation to make the strategy more difficult to identify and target.

The iceberg order strategy also has multiple advantages in practical applications. Firstly, it hides the true intent. By splitting a large order into multiple small orders and gradually placing them in the market, it effectively hides the actual size of the large order, reducing the risk of being discovered and exploited by the market. Secondly, it involves gradual execution. Gradual execution of orders helps reduce the impact of large trading orders on market prices and obtain better execution prices. Thirdly, it is flexible. The displayed order quantity and frequency can be adjusted according to market conditions, showing strong adaptability.

Of course, the iceberg order strategy also has its drawbacks. For example, there is liquidity risk. Since only a portion of the order is exposed, if market liquidity suddenly decreases, there may be situations where orders cannot be executed in a timely manner, and so on. AICoin's iceberg order strategy randomizes order placement, order intervals, and trading quantities during operation to make the strategy more difficult to identify and target.

Theoretical Analysis - Performance of the Two Strategies in Bull and Bear Markets

Firstly, theoretical analysis of the performance of the time-weighted strategy in bull and bear markets.

1) Performance in Bull Markets

In bull markets, the time-weighted strategy avoids the impact of large buy orders on coin prices through batch orders, thereby reducing the cost of buying. This strategy can achieve relatively good excess returns in bull markets.

2) Performance in Bear Markets

In bear markets, the time-weighted strategy is defensively strong. By setting order limits, it can avoid buying at excessively high prices in bear markets, thereby reducing the risk of losses. Additionally, batch orders in bear markets can better capture low points and increase profit opportunities.

In general, the time-weighted strategy has significant advantages in dynamic environments. If the user's main goal is to disperse the market impact of large orders and gradually execute them over a longer period, the time-weighted strategy is a good choice, but attention should be paid to the risks brought about by market fluctuations.

Secondly, theoretical analysis of the performance of the iceberg strategy in bull and bear markets.

1) Performance in Bull Markets

In bull markets, where the market generally has a bullish outlook and strong buying power, trading is active, and liquidity is high. The iceberg strategy can effectively hide the actual size of large buy orders, avoiding market price hikes, and thus allowing for gradual buying at relatively low prices in rising markets. However, if market prices rise rapidly, the exposed small orders may not be fully executed, resulting in failure to buy at lower prices and missing the opportunity.

2) Performance in Bear Markets

In bear markets, where the market generally has a bearish outlook and strong selling power, trading is relatively quiet, and liquidity is low. The iceberg strategy can effectively hide the actual size of large sell orders, avoiding panic selling in the market, and thus allowing for gradual selling at relatively high prices in falling markets. However, due to low liquidity, the small portion of the iceberg orders may have difficulty in being executed quickly, increasing the risk of orders not being executed and the possibility of missing the opportunity to sell.

In general, if the goal is to hide the true size of large orders and avoid market reversals, the iceberg order strategy is very suitable and performs particularly well in high-frequency trading.

OKX Entry Points for the Two Strategies

Currently, OKX's strategy trading provides convenient and diverse strategy varieties.

The OKX iceberg order strategy adopts a more dynamic and flexible order placement method, not simply based on price distance or proportion for order placement. This order placement method can significantly reduce slippage and better achieve the goal of hiding trading intentions. In addition, the OKX iceberg order strategy provides multiple order placement modes, including faster execution, balanced execution speed, and better price three modes, allowing users to choose according to their preferences and needs. Overall, the OKX iceberg order strategy has many core advantages, such as large order splitting, hidden trading, reduced slippage, and customizable order placement preferences.

The characteristics of the OKX time-weighted strategy are: large order splitting, timed order placement, and reduced slippage. The benefit of this strategy is that it splits large trades into many smaller trades, enters the market to eat orders gradually, and avoids stimulating the market with single orders. When the price meets the set conditions, it can quickly execute through eating orders. Furthermore, these orders enter the market in an Immediate Or Cancel (IOC) mode, which means that any portion of the order not immediately executed will be canceled, minimizing slippage. The time-weighted order can be used not only in spot trading but also in perpetual contracts, delivery contracts, and leveraged trading, making it widely applicable.

For example, how does the OKX time-weighted order work?

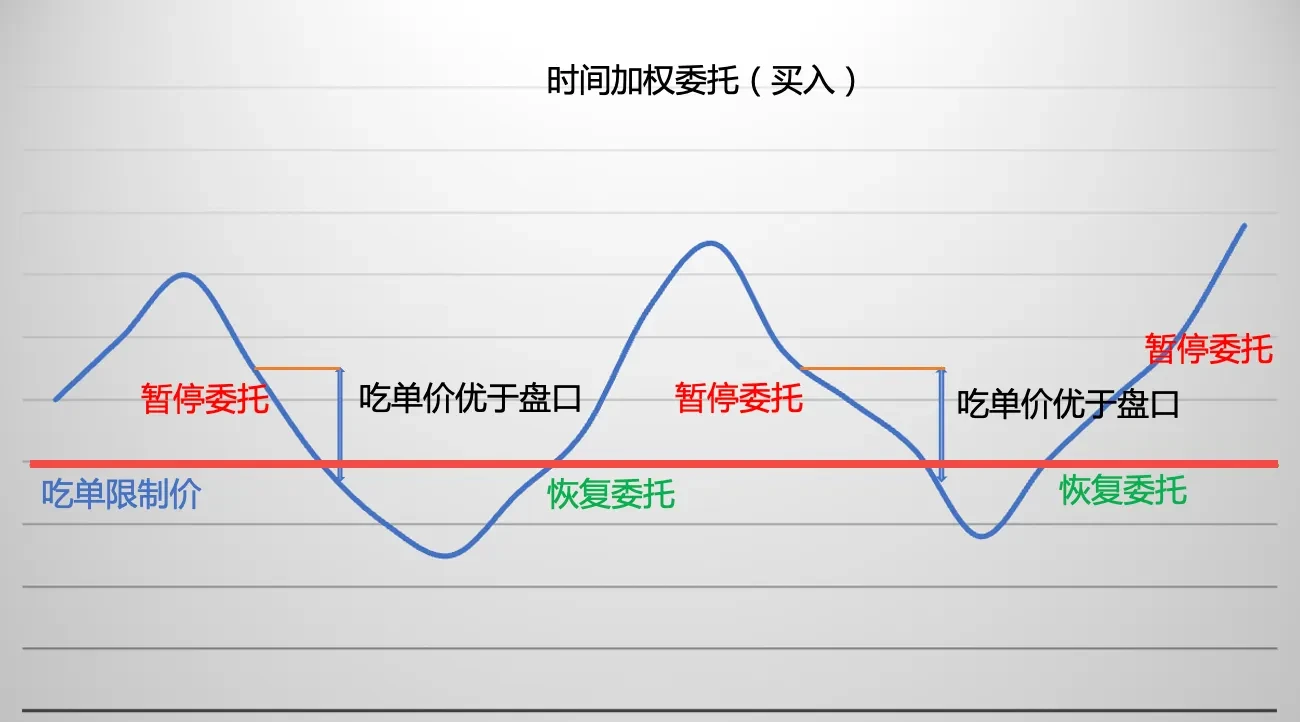

Taking buying as an example, when the market price is above the order limit, the strategy pauses the order placement. When the market price is below the order limit, the strategy resumes order placement, calculates the order price based on the current latest bid price and the set price distance, and then places small orders to eat trades. If the price continues to be below the order limit, it will place timed orders until the total order quantity is executed.

Illustration of the time-weighted order placement for buying on OKX

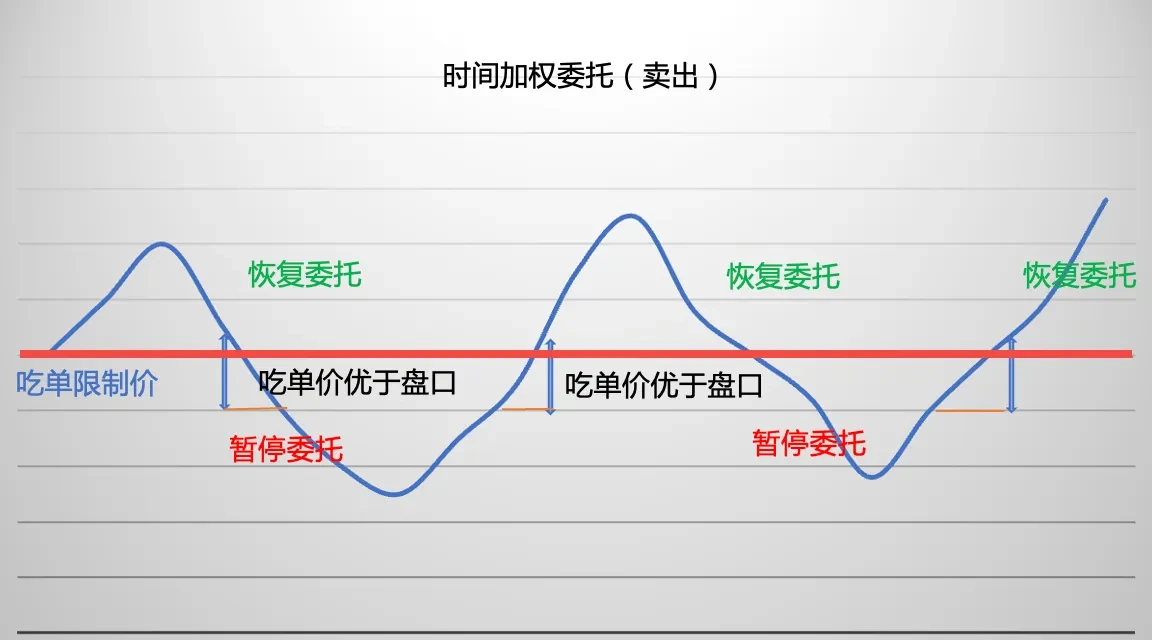

As an example of selling, when the market price is below the order limit, the order placement is paused. When the market price is above the order limit, the strategy resumes order placement, calculates the order price based on the current latest ask price and the set price distance, and then places small orders for trading. If the price continues to be above the order limit, timed orders will be placed until the total order quantity is executed.

Illustration of time-weighted order placement for selling

How to access OKX strategy trading? Users can access the "Strategy Trading" mode in the "Trading" section of the OKX APP or official website, and then click on "Strategy Plaza" or "Create Strategy" to start the experience. In addition to creating strategies on their own, the strategy plaza currently provides "High-quality Strategies" and "Strategies with Followers", allowing users to copy strategies or follow strategies.

OKX strategy trading has multiple core advantages such as easy operation, low fees, and security. In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically, and provides text and video tutorials for users to quickly get started and master the platform. In terms of fees, OKX has comprehensively upgraded its fee rate system, significantly reducing user trading fees. In terms of security, OKX has a security team composed of top global experts, providing bank-level security protection.

How to access AICoin's strategy?

How to access AICoin's strategy trading? Users can access the "Trading" mode on the right side of the "Market" section on the AICoin homepage, and then click on "Smart Order Splitting" to start the experience. In addition to smart order splitting strategies, the "Community Indicators" also provides many "High-quality Indicators" that users can search for and add to "My Indicators".

AICoin provides intelligent parameters to help users set trading parameters more scientifically and provides text and video tutorials for quick start. Smart order splitting has the advantages of flexible order placement, order intervals as small as 0.3 seconds, and highly hidden order splitting to prevent monitoring by counterparts.

Disclaimer

This article is for reference only, represents the author's views, and does not represent the position of OKX. This article does not intend to provide (i) trading advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may experience significant fluctuations. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For your specific situation, please consult your legal/tax/trading professionals. Please be responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。