Yesterday morning, shortly after the article was published, BTC experienced a rapid decline, breaking through the low point of 57128, and continued to break through the 57000 and 56000 support levels, hitting a low of 55606. The current price has rebounded to above 58000.

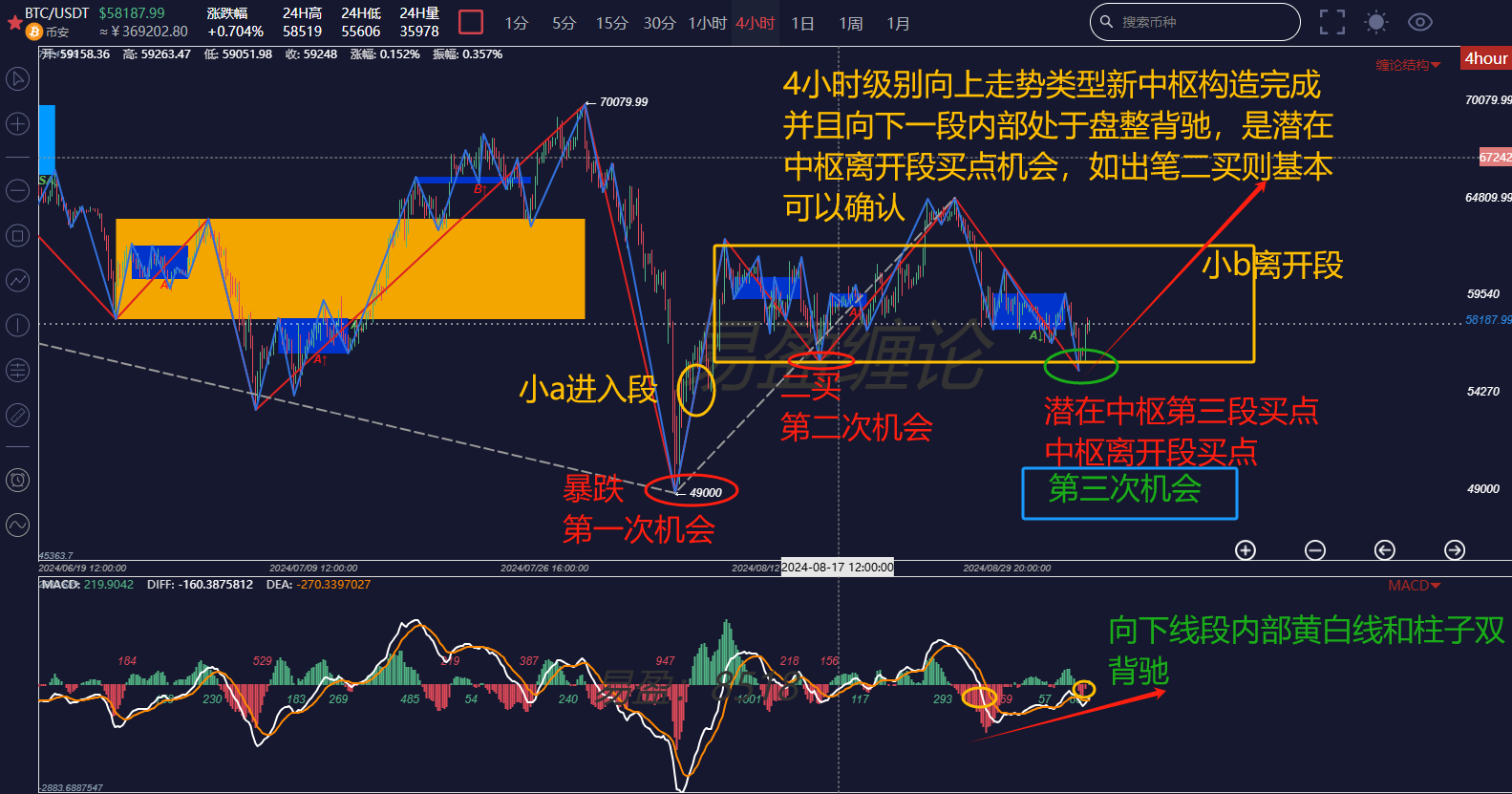

The rapid downward movement invalidated the expectation of a second buy in the 15-minute timeframe. However, it was this sharp decline yesterday that led to the completion of the larger 4-hour timeframe structure, making the opportunity for a third entry apparent.

This account clearly mentioned the deduction of the opportunity for a third entry at the 4-hour timeframe during a live broadcast on the evening of the 27th of last month, and once again emphasized the focus on the formation of a buying opportunity during the next pullback at the 4-hour timeframe in the article on the 28th.

Currently, the 4-hour pullback from the high point of 65000 on August 26th to yesterday has lasted for ten days, which is sufficient in terms of time cycle. This is consistent with the trend deduced in advance during the live broadcast and in the article.

Looking directly at the current 4-hour timeframe structure, it is clear from the chart that the central structure of the upward trend at the 4-hour timeframe has been basically completed. The sharp downward movement yesterday pierced through the previous second buy low point of 56079, forming a bear trap and quickly rebounding. From the internal structure, a consolidation divergence structure of a pen central structure has been formed, and the clear and relatively full structure has the probability of ending and forming the third entry point of the central structure. Of course, to confirm the end of this downward pullback, a second buy pen is needed. Currently, a consolidation divergence after the upward pen is running, and this pen has entered the internal of the pen central without a third sell pen. The absence of a secondary level third sell pen eliminates the risk of a substantial further decline. It remains to be seen whether the strength of the downward pullback after the end of this pen can withstand the attack of the bears and avoid breaking new lows.

Buying opportunities always appear during the panic decline, and predicting the bottom is very difficult. It always involves repeated washing and fighting. Similarly, the left-side bottoming during the end of the 4-hour downward movement cannot avoid the pain of downward extension, which is related to individual risk preferences and position management. The aggressive ones often like to build positions on the left side and add positions in batches on the right side, while the conservative ones can wait for opportunities on the right side, or at least wait for the appearance of a daily bottoming pattern.

The third opportunity is also the one with the greatest expected upward space, and the structure is gradually becoming clear and complete. Whether to seize it or not depends on whether the audience has the charm and determination!

The above analysis is for reference only and does not constitute any investment advice!

If you are interested in the Chan theory and want to obtain Chan theory learning materials for free, watch public live broadcasts, participate in offline Chan theory training camps, improve your trading skills with Chan theory, and build your own trading system to achieve stable profitability goals, and use Chan theory technology to timely escape peaks and bottom out, you can scan the code to follow the public account and add the WeChat of this account for more information!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。