Core developers' dialogue, helping users better understand the world of each public chain - "Developer's Story"

Ethereum is one of the world's largest and developers' preferred public chain networks. In the future, with the advancement of Ethereum 2.0 and Layer2 solutions, it will continue to lead and shape the development trend of blockchain technology. Justin Drake is a key member of the Ethereum Foundation (referred to as "EF" below), and has played a crucial role in promoting the development and implementation of Ethereum 2.0, not only driving the advancement of Ethereum technology, but also bringing important innovations and insights to the entire blockchain field.

This issue is the 01st issue of the "Developer's Story" column, aiming to better understand the Ethereum world from the perspectives of Justin Drake and Owen, the OKX Web3 product manager. This issue covers various aspects such as technical improvements of Ethereum 2.0, consensus mechanisms, scalability, security, DeFi, user experience, ecosystem, environmental impact, and future development and strategies, aiming to gain in-depth insights into the views and plans of Ethereum core developers.

Changes in Ethereum and L2 after the Cancun upgrade

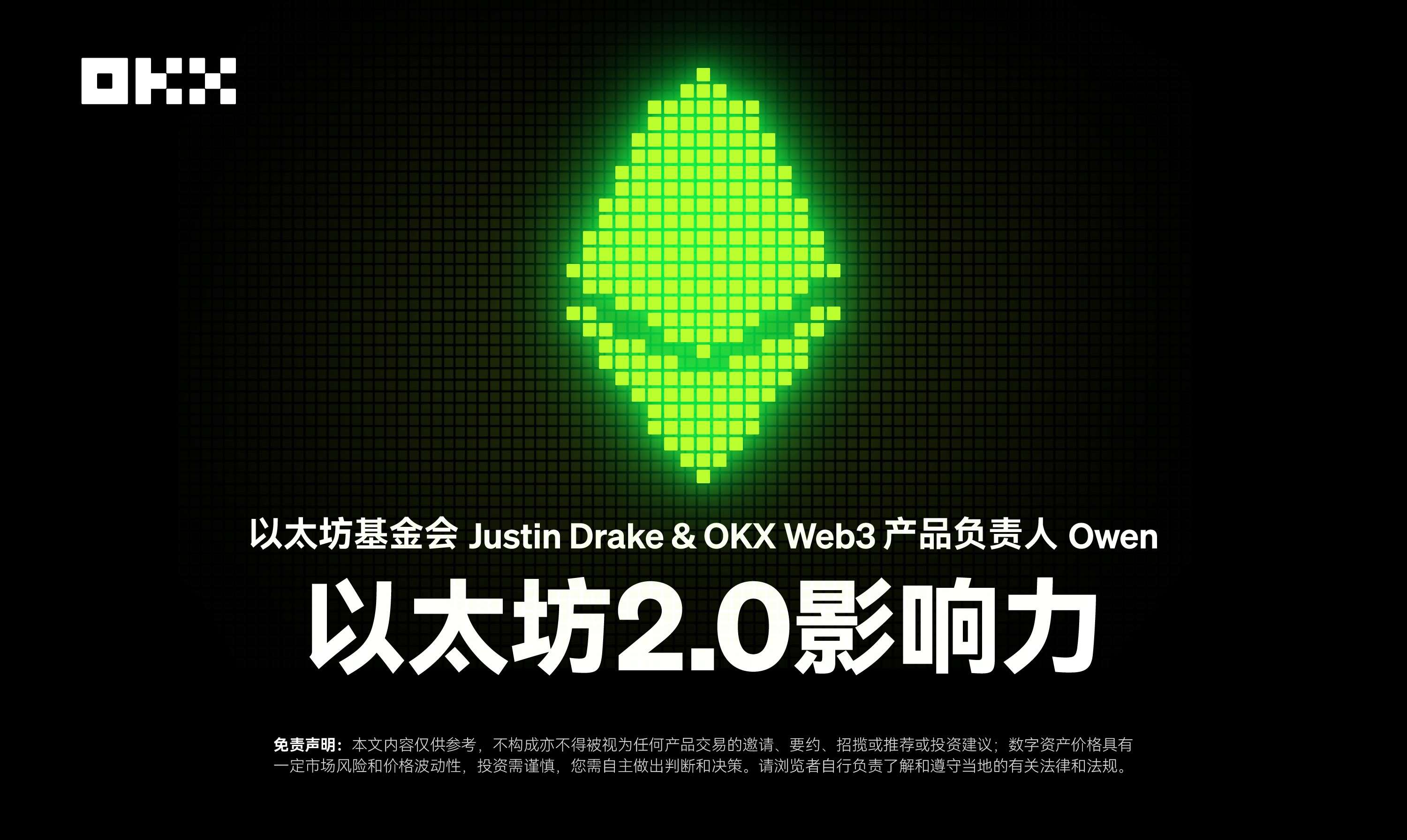

Justin Drake: After the Cancun upgrade, Ethereum's throughput has increased, and the GAS fees on the L2 network have significantly decreased. From the data, after the Cancun upgrade, Ethereum and L2 have indeed become more attractive to developers and projects, as shown by the continuous growth of transactions in the L2beat chart.

Image 1: Source L2beat

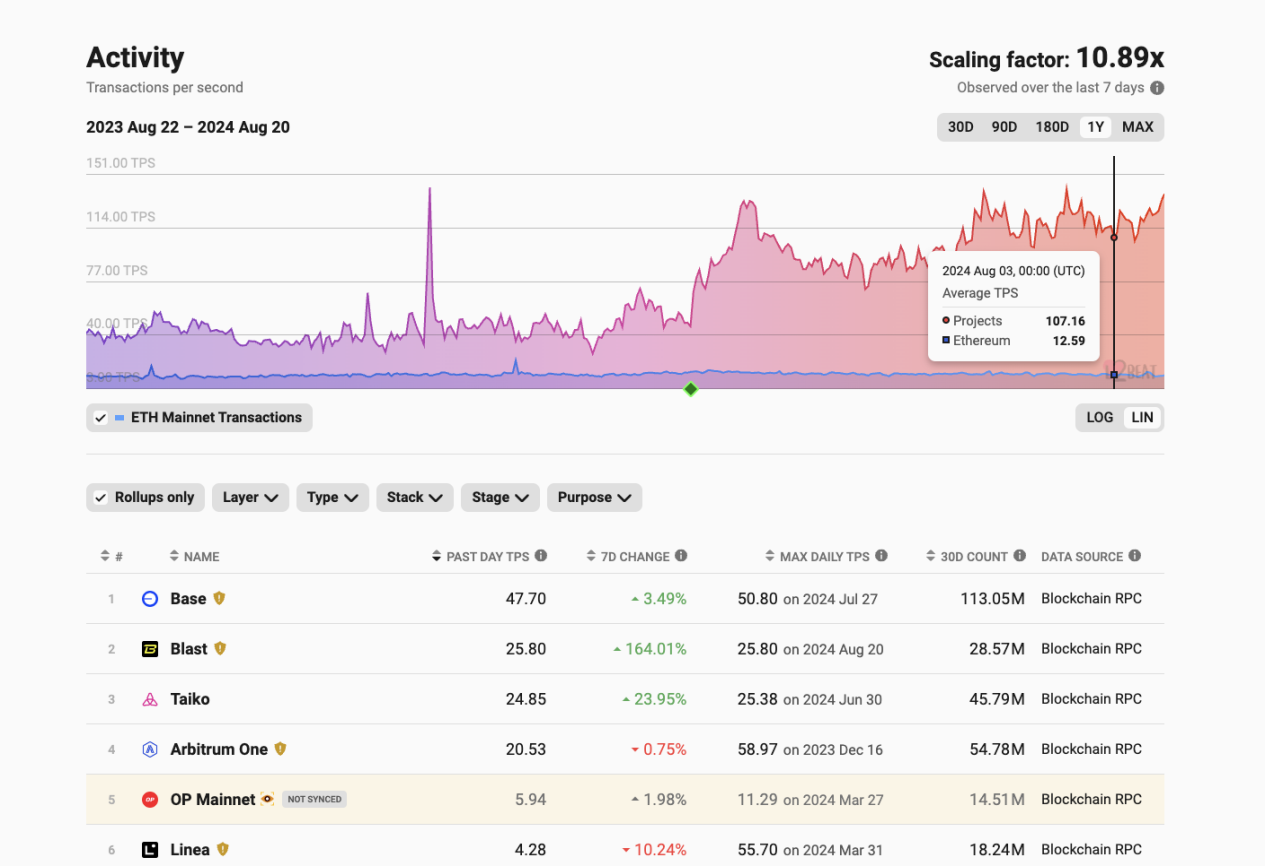

In addition, Dune's chart of "average Blob count per block" shows that the usage of Blob has increased from approximately 1 Blob/block in March to about 2.3 Blob/block today. This stable growth is largely due to Ethereum's guidance for various L2 solutions. In a few weeks, we should see the Blob demand reach the target of 3 Blobs/block, and the cost of Blob will reach a fair market level.

Image 2: Source Dune

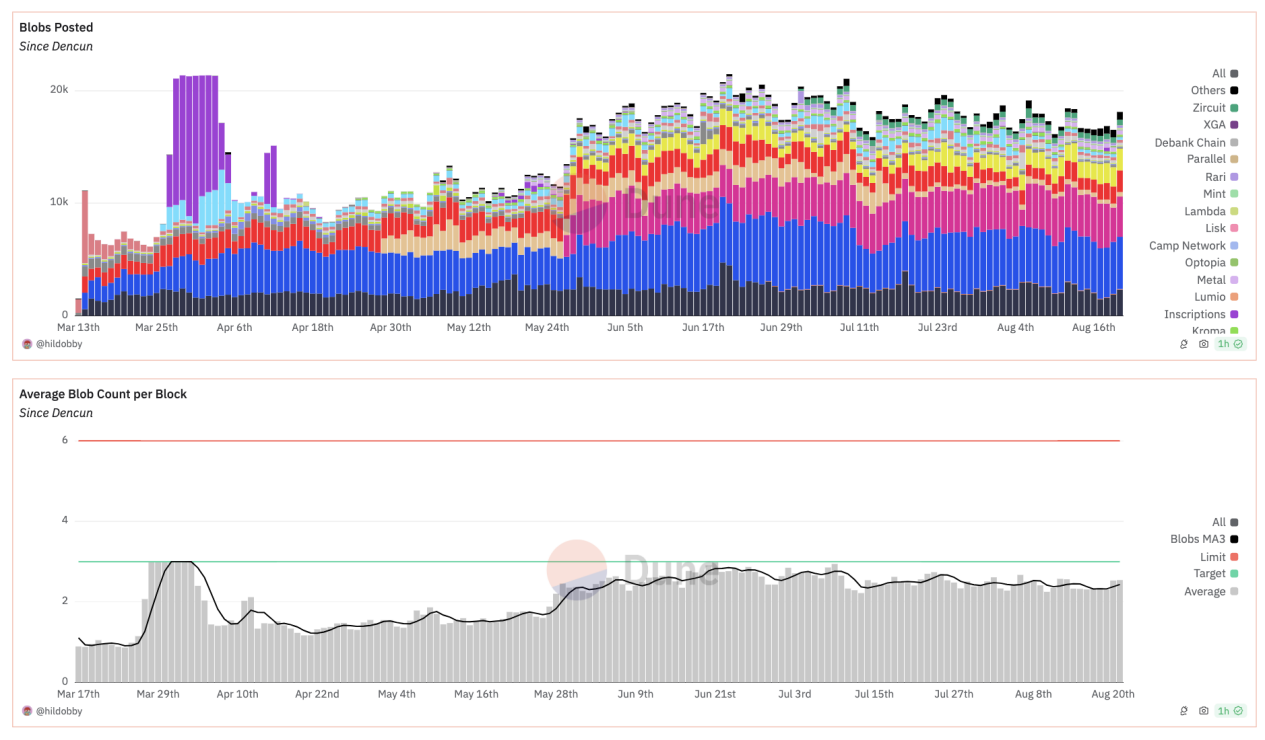

The reduction in Gas has stimulated user demand. From an economic perspective, when the supply curve shifts from S1 to S2, the price equilibrium shifts from P1 to P2, inducing demand to increase from Q1 to Q2.

Image 3: Source Network

OKX Web3 product manager Owen: So far, although there is no significant rapid growth trend in the overall transaction volume of Ethereum and L2, assets are transferring to L2, and the total locked value (TVL) of L2 continues to rise. The activity on L2 has surged, for example, after the upgrade, Base's daily average active users (DAUs) increased by 560% compared to before the upgrade, and the daily average transaction volume (DTXs) increased by 540%. Similarly, Optimism and Arbitrum saw a 70% and 200% increase in daily average transaction volume (DTXs) respectively. From the perspective of transaction volume and daily activity, the upgrade has indeed attracted some traders, especially small-scale traders.

Foundation's reduction of ETH holdings is a good thing, promoting decentralization in the long term

Justin Drake: In terms of promoting ecosystem development, the EF is often seen as "governing by non-action," a style that has also faced some controversy. I believe that the reduced role of the EF in the entire ecosystem is a good thing.

Today, the responsibilities of the EF are mainly limited to:

1) Hosting a Devcon or Devconnect each year, which is now just one of many conferences, and there are many peripheral activities that are more important than the main event.

2) An execution client: Geth, one of the five execution clients, but the EF does not maintain any consensus clients.

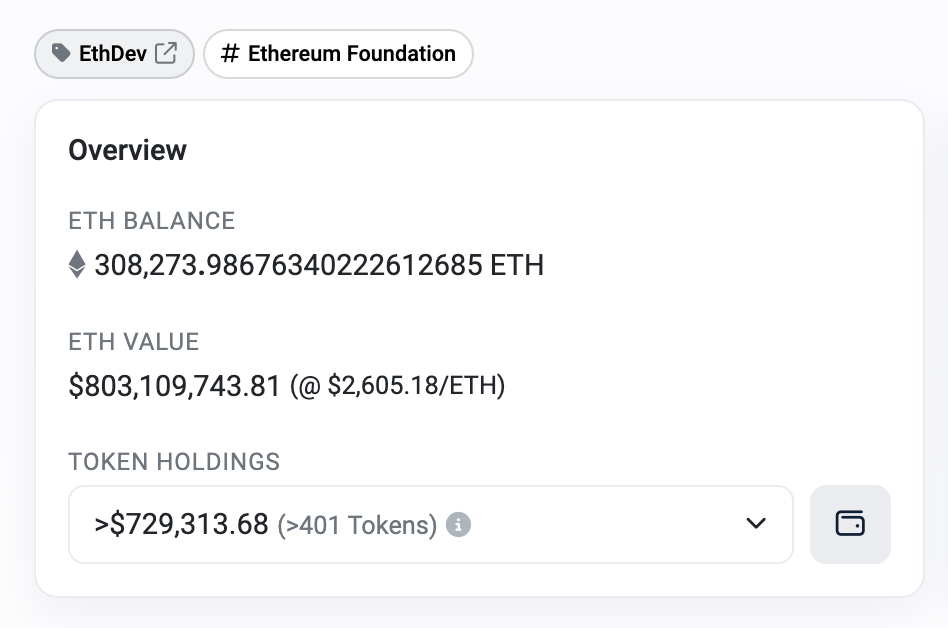

3) Providing grants: Providing tens of millions of dollars in unconditional grants to the broader community each year, leading to a reduction in the EF's ETH financial reserves. In the long run, it is healthy for the Ethereum Foundation to hold a reduced amount of ETH. Currently, the EF controls 0.23% of the ETH supply, and it is healthy for this number to approach 0% in the coming decades, as it promotes decentralization of the Ethereum ecosystem.

Image 4: Source Etherscan

4) Coordination calls: Many conference calls are hosted by EF members, such as All Core Devs (ACD) hosted by Tim Beiko, All Devs Consensus (ACDC) hosted by Alex Stokes, RollCall hosted by Ansgar Dietrichs and Carl Beekhuizen, Sequencing and pre-meeting hosted by me, and MEV-boost conference calls hosted by Alex Stokes.

More can be found at: https://www.youtube.com/@EthereumProtocol/videos

5) Research: This may still be a centralized area, but it is possible that some EF research teams will become independent.

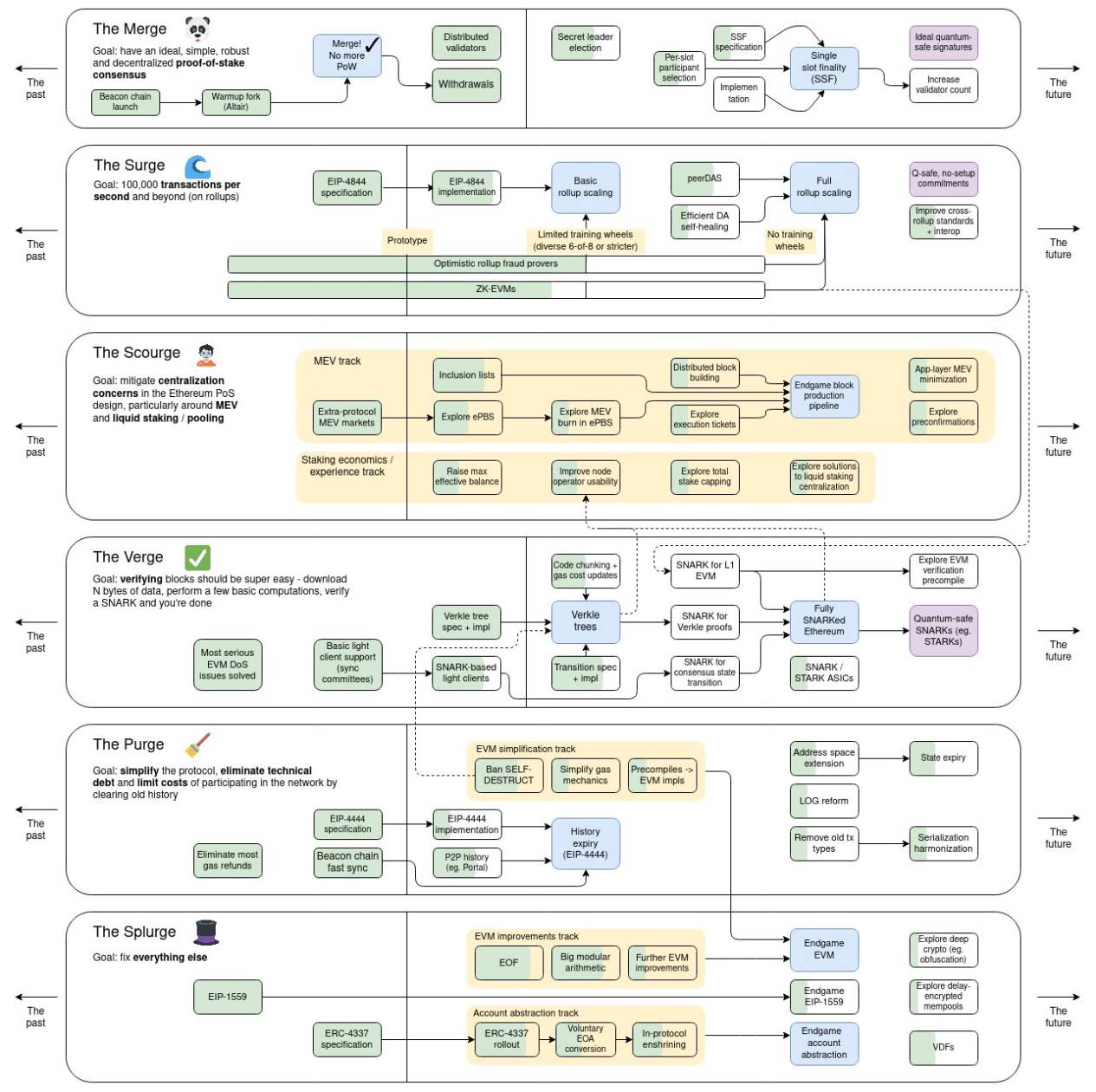

6) Roadmap development: Vitalik updated the roadmap diagram, and then there are dozens of tasks being developed in parallel by different teams.

Image 5: Source Vitalik's tweet

OKX Web3 product manager Owen: The EF should play more of an advisory role. The ecosystem has gained enough attention to continue developing without relying on key figures. This means that discussions can take place in an open and fair environment, making Ethereum a project recognized by everyone, rather than being influenced by a single party. This also aligns with the spirit of blockchain, which is community-driven governance and transparency.

Ethereum DeFi & Future Large-scale Application Scenarios

Justin Drake: Currently, the Ethereum community has a very pure technical atmosphere, always tackling various technical challenges, but ultimately, technology also needs to serve user needs and application scenarios.

First, I believe that existing DeFi will grow tenfold in the next five years:

1) Stablecoins: I hope to see $1 trillion in stablecoins, with a significant portion being decentralized stablecoins.

2) DEX: The trading volume of DEX compared to CEX is constantly increasing, and I expect this trend to continue.

3) Lending markets: Projects like AAVE and Compound should grow by about 10 times.

4) Prediction markets: Projects like Polymarket should grow by about 10 times.

5) Derivatives: Liquid perpetual contracts, options, futures, etc., all of which will be provided on Ethereum.

Second, in addition to DeFi, I hope to see decentralized front-ends using ENS and IPFS become more popular.

OKX Web3 product manager Owen:

From a data perspective, the total value locked (TVL) of decentralized exchanges (DEX) on Ethereum is still the largest, but this data has decreased significantly compared to two years ago. We believe that the biggest obstacle for Ethereum in DeFi is still the high transaction fees. The same transaction executed on Ethereum can be executed hundreds of times on L2, so market trading behavior will always move towards higher efficiency.

Currently, the technical development of the Ethereum community also considers practical needs. For example, the recently promoted EIP4337 Account Abstraction is aimed at reducing the entry barrier for Web2 users to enter Web3. This will be a cornerstone for all future applications.

In the foreseeable future, we believe that everyone will be able to easily self-custody their Web3 virtual assets with a user experience closer to Web2.

Global Adoption of Ethereum 2.0 & Attractiveness to Developers and Users

OKX Web3 Product Manager Owen:

Ethereum 2.0 is now widely adopted globally and has great appeal to both the blockchain world and current financial institutions.

In terms of network scale and staking, the total staked value of Ethereum 2.0 has reached a scale of hundreds of billions of dollars, and there are over 50,000 independent validator nodes participating in the consensus mechanism of Ethereum 2.0 globally. In terms of the development of the DeFi market, there has been a significant increase in TVL after Ethereum 2.0, as the PoS mechanism allows more DeFi projects to operate at lower transaction costs, attracting more users and funds. From a global perspective, several large enterprises and financial institutions (such as Microsoft, JPMorgan, IBM) are actively adopting Ethereum 2.0 technology. These enterprises use Ethereum 2.0 for supply chain management, financial transactions, and other applications.

For new users and developers, Ethereum 2.0 offers faster transaction speeds and lower fees, making the Ethereum network more attractive to ordinary users. For developers, the improvements in Ethereum 2.0 make it more efficient to build and deploy decentralized applications (dApps). The new consensus mechanism and sharding technology allow them to build more complex and innovative applications without worrying about high costs or performance bottlenecks.

All of these indicate a strong confidence in Ethereum 2.0.

However, Ethereum 2.0 still faces many obstacles in attracting larger-scale new users and developers.

First, for ordinary users, the entry cost is relatively high. It is important for the wallet, the "web3 gateway," to seamlessly integrate ordinary users.

Second, the overall learning cost is relatively high. Ethereum 2.0 includes many new concepts, such as Proof of Stake (PoS), sharding technology, Rollups, etc., which may have a steep learning curve for new users and developers. Developers need to spend time and effort to understand and adapt to these new technologies. Additionally, Ethereum's infrastructure and tools are still maturing, requiring continuous learning and keeping up with developments.

In terms of market and competition, the competition in the market is becoming increasingly fierce, with new platforms and technologies emerging constantly. Other blockchain platforms (such as Solana) are also actively developing and promoting their technologies, which may offer different technological advantages or lower entry barriers to attract a large number of users and developers.

Finally, in terms of regulation and compliance, the regulatory policies for blockchain and cryptocurrencies are constantly changing, and the policies of different countries and regions may affect the adoption of Ethereum 2.0.

Current Major Technological Advancements of Ethereum 2.0 & Focus on Technological Improvements

OKX Web3 Product Manager Owen:

Staking and Restaking.

On Ethereum 2.0, after adopting the PoS consensus, staking has saved a significant amount of energy for Ethereum and has also provided space for restaking. Providing security guarantees for other projects has become a major mission for Ethereum, and only Ethereum's scale can bear this responsibility.

In addition, Vitalik recently proposed EIP-7702 as a solution that allows user wallets to support smart contracts, making it more convenient for users to use wallets and providing support for more login methods. It can also provide more convenient features that ordinary EOA wallets cannot achieve, such as social recovery and paying gas fees for non-native tokens, making it possible for a large number of Web2 users to enter Web3 in the future.

Impact of PoS on Decentralization of Ethereum

OKX Web3 Product Manager Owen:

We will answer this question from multiple angles, including the impact of PoS consensus on decentralization, the effectiveness of incentives and penalties for validator participation in Ethereum 2.0, and how to ensure fairness for small validators under the PoS mechanism.

First, regarding the impact of PoS consensus on decentralization, this has been a long-standing topic of discussion. In the long run, the transition of Ethereum 2.0's consensus mechanism is beneficial for its development. Ethereum's goal is to become the "world computer," so all its improvements and upgrades must move towards this goal, making it a more suitable computing platform for running decentralized applications (dApps). After Ethereum 2.0 transitioned from PoW to PoS, it helps effectively balance the "impossible triangle" of decentralization, scalability, and security.

In addition, when discussing decentralization, we need to consider real-world situations. PoW is a permissionless participation method that theoretically achieves maximum decentralization. However, in reality, mining is a highly specialized work, leading to professional services such as mining pools, mining machine manufacturers, and mining farms. Before Ethereum transitioned to PoS, the top five mining pools controlled over 75% of the total network hashrate, and the largest single mining pool accounted for over 33% of the total network hashrate. The electricity consumed by Ethereum mining is equivalent to that of a small country, and for professional mining farms, electricity cost is one of the most sensitive cost factors, so mining farms are usually concentrated in regions with low energy prices. This geographical concentration makes the supply of hashrate susceptible to regional government intervention, threatening the security and stability of the crypto network. We saw a similar situation during China's "environmental" mining ban in 2021, when Bitcoin's total network hashrate plummeted by over 50% in two months. Additionally, professional mining relies on specialized hardware. Before Ethereum transitioned to PoS, mining required the use of graphics cards, and there are very few global chip companies that can produce graphics cards. If hardware suppliers intervene in mining activities, network security will also be threatened. For example, Nvidia once reduced the mining efficiency of RTX 3060 graphics cards for Ethereum mining by half to force miners to find alternative solutions. Therefore, I believe that it is not realistic to discuss "decentralization" in isolation from the real world, and Ethereum's transition to PoS is a move towards a better direction.

Second, we want to discuss whether the incentives and penalties mechanism for validator participation in Ethereum 2.0 is effective. The upgrade of Ethereum 2.0 has been in operation for over two years, and from the current operational results, the incentives and penalties mechanism is effective. The attack patterns that were heavily discussed before the upgrade, such as short-range reorganization, bounce attacks, balance attacks, avalanche attacks, and denial of service attacks, have all been effectively defended against.

The last point is how to ensure fairness for small validators under the PoS mechanism. These issues have been incorporated into Ethereum's mid-term roadmap. For example, by reducing hardware requirements: using Verkle trees combined with EIP-4444, staking nodes can run with extremely low disk requirements. This allows staking nodes to synchronize almost immediately, greatly simplifying the setup process and switching from one implementation to another. These proposals also make Ethereum light clients more feasible by reducing the proof data bandwidth required for each state access. Or through economic means, such as allowing a larger validator set (lowering the minimum staking requirement) while reducing the expenses of consensus nodes. Through these measures, validation becomes fairer, and light clients become more secure.

Current Development Status of Ethereum L2s & Potential of Rollups Technology

OKX Web3 Product Manager Owen:

I have completed the translation of the provided markdown text. Here is the translated text:

Regarding the Current Development Status of Ethereum L2s and the Potential of Rollups Technology

In terms of the current development status of Ethereum L2s, the Layer2 track on Ethereum is currently overcrowded, which goes against the original intention of establishing Layer2 for Ethereum's scalability. The competition has led to increasing fragmentation of Layer2 liquidity and UI fragmentation. It is difficult for users to access the Layer2 ecosystem through a single entry point. OKX Web3 Wallet is researching corresponding solutions. From a product development perspective, the network effect itself will concentrate liquidity and interaction towards the top few Layer2s, leading to a long tail situation, and even Layer2s with low user volume may be gradually phased out. From a technical solution perspective, we see the rise of chain abstraction technology, allowing users to enter through a single entry point and achieve seamless use of Layer2 through cross-chain atomic swap service providers.

Regarding the potential of Rollups technology in the Ethereum ecosystem, it can be viewed from two aspects, as Rollup has dual characteristics.

Advantages of Rollup:

1) Scalability: significantly increases transaction throughput and reduces gas fees. 2) Security: uses ETH as the data availability layer, retaining the security and decentralization features of the Ethereum main chain. 3) Ecosystem support and compatibility: Rollups receive extensive support from the Ethereum community and developer ecosystem. 4) Flexibility and innovation potential: Rollups support complex smart contracts and decentralized applications. 5) Future scalability development direction: with the gradual implementation of Ethereum 2.0 and the introduction of sharding technology, Rollups are seen as a complementary scaling solution to the Ethereum main chain. 6) After the Cancun upgrade, it is cheaper to put main chain data on-chain.

Disadvantages of Rollup:

1) Data availability issue: compressed data and state roots need to be published on the Ethereum main chain to ensure data availability, requiring all data to be accessible and verifiable. 2) Delay and exit time: exiting a Rollup chain usually requires waiting for a challenge period. 3) Compatibility issues: partial incompatibility exists between different Rollups networks, such as EVM OP_CODE. 4) Centralization risk: fewer nodes, more centralization.

Overall, Rollups primarily drive the development of Ethereum by improving scalability, reducing transaction costs, enhancing security, and supporting complex applications. Despite some disadvantages, it remains an important force for Ethereum's development.

From the Perspective of OKX Web3 Wallet, How to View the Security, Community Governance, Energy Efficiency, and Privacy Technology of Ethereum 2.0

OKX Web3 Product Manager Owen:

First, the main challenges for the security of Ethereum 2.0 should not be underestimated. The main challenges include:

1) Security of the Proof of Stake (PoS) mechanism: Although PoS is more energy-efficient than PoW, there is a risk of malicious behavior by large ETH holders. 2) Decentralization of validators: Projects like Lido occupy a high proportion of the staking network, significantly reducing decentralization. 3) New attack risks brought by sharding: The introduction of sharding in Ethereum 2.0 aims to increase network throughput but also introduces new risks due to the complexity of sharding.

Second, the future of community governance in Ethereum 2.0 is full of potential. As the network moves towards greater decentralization and scalability, governance will become more decentralized. The transition from Proof of Work (PoW) to Proof of Stake (PoS) increases the influence of stakers. For example, in the first upgrade after Ethereum transitioned to PoS, the priority of withdrawing staked ETH was mainly influenced by the interests of Ethereum stakers.

As the Ethereum ecosystem matures, the governance process will become more structured and formalized, and social governance will continue to play an important role in the network's development. Additionally, with the widespread adoption of Layer 2 solutions, governance will also need to address the interaction between Ethereum 2.0 and these scaling solutions.

The future of Ethereum 2.0's community governance will be more decentralized but will require careful design and continuous innovation to maintain the decentralization of the network and the community's voice in governance decisions.

Next, is there still room for improvement in the energy efficiency of Ethereum 2.0? We have observed that after transitioning to PoS, Ethereum has reduced its electricity consumption by over 99%, but storage costs can still be optimized, such as transitioning Ethereum's state management from Merkle Patricia Tree (MPT) to Verkle Tree (VKT).

Finally, the development of privacy technology in Ethereum. We believe that future Ethereum privacy technology will focus on enhancing transaction privacy, protecting user data, and finding a balance between decentralization and regulatory compliance. The main development direction includes more widespread adoption of zero-knowledge proof technology. Most importantly, as quantum computing technology advances, research on defenses against quantum computing attacks will drive the development of quantum-resistant encryption technology to ensure the long-term privacy and security of Ethereum. The Ethereum community has already begun researching and discussing how to prevent quantum computing attacks.

Challenges Ethereum Will Face in the Next 10 Years and Whether Ethereum Will Exist in the Next 30 Years

OKX Web3 Product Manager Owen:

If we classify Ethereum and its corresponding EVM L2 (Ethereum Layer 2) as Ethereum, the main challenge in the next 10 years will be to reduce friction between L1 and L2, improving the user experience of cross-chain interactions, and reducing liquidity fragmentation. The ecosystems of L1 and L2 should seamlessly integrate like a single chain, which is a challenge that teams like Polygon's AggLayer are working hard to solve.

In the next 30 years, Ethereum should still be significant, as it has established itself as one of the most decentralized and long-lasting networks.

About the "Developer Stories" Section

Web3 developers have made significant contributions to the development of the crypto industry. Their innovative spirit and technical capabilities have injected enduring vitality and momentum into the entire industry, improving not only the technology itself but also providing support for future application scenarios and business models. However, they are active but often overlooked. The "Developer Stories" section launched by OKX Web3 and ChainCatcher aims to understand the development context, technical insights, latest developments, market changes, and hot comments of different public chain core developers and the OKX Web3 technical team through conversations, enhancing the voice of Web3 developers, getting closer to these most active and interesting individuals, and providing them with the greatest support.

Disclaimer

This article is for reference only. The views expressed in this article are those of the author and do not represent the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may experience significant volatility. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For your specific situation, please consult your legal/tax/investment professionals. You are responsible for understanding and complying with applicable local laws and regulations.

If you have any further questions or need additional assistance, feel free to ask!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。