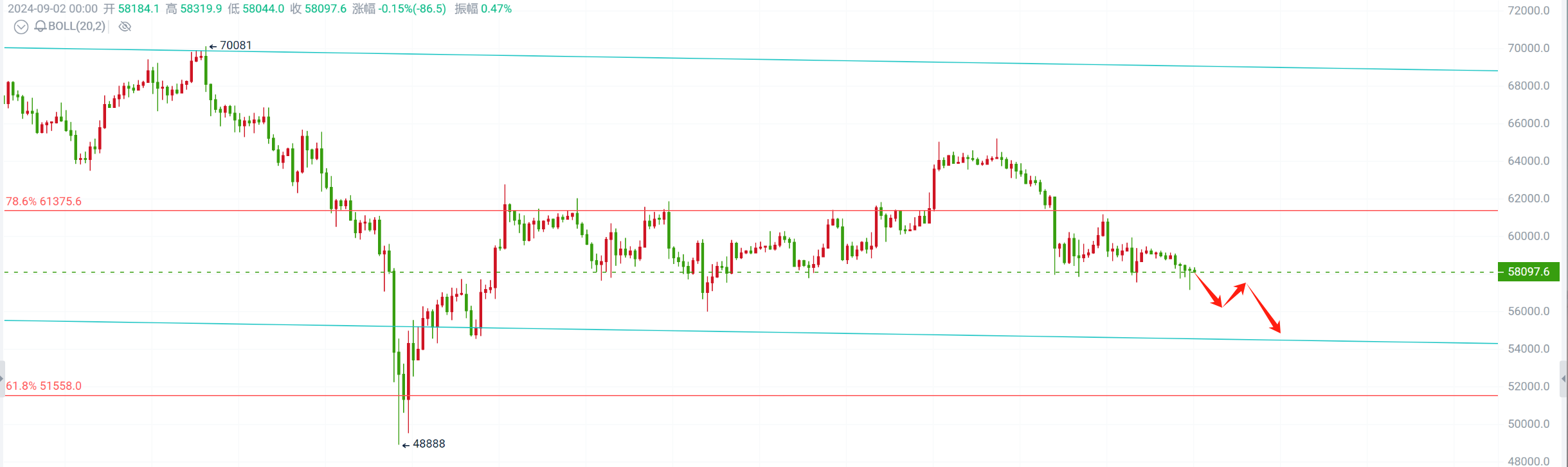

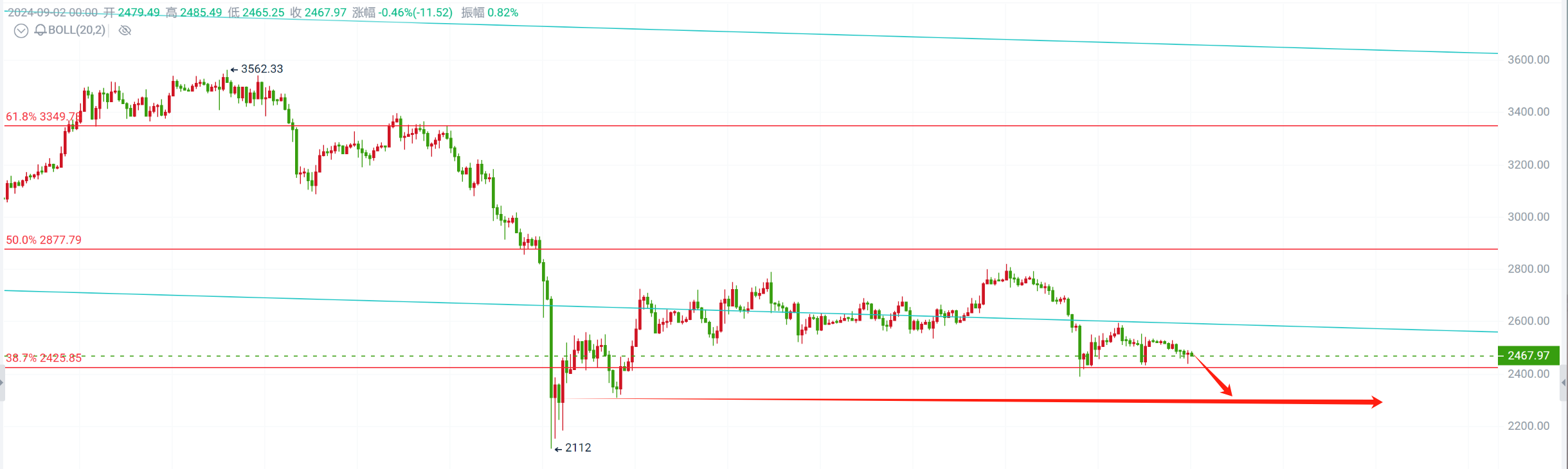

Currently, from the perspective of the monthly chart, both Bitcoin and Ethereum are showing a bearish trend. So, don't blindly say that Bitcoin will reach 70,000 and Ethereum 4,000. Even if there is a rate cut, it may not necessarily lead to an increase. Looking at the daily chart, Bitcoin is still under pressure at the 59,000-59,500 level, with support at the 58,000-57,500 level. After multiple attempts, the bearish trend has still broken through the 59,000 support level, forming short-term pressure. Similarly, Ethereum is under pressure at the 2550-2520 level, with support at 2430-2400. This support level is crucial. Whether the bearish trend can continue depends on the situation at this support level. If it is broken, it will approach the 2000 mark. Looking at the 4-hour chart, both Bitcoin and Ethereum are in a phase of downward probing. It is recommended to trade cautiously and suggest short-term operations of selling high and buying low. Wait for the trend to emerge before following the trend. Aggressively, you can short at the current price. It is expected that there will be further downward movements!

Operation strategy: Trade cautiously by selling high and buying low, or aggressively short at the current price!

Short Bitcoin at 58,000-58,500, with a target of 57,000-56,000 and a stop loss above 59,000.

Short Ethereum at 2470-2500, with a target of 2430-2380 and a stop loss above 2500.

The strategy is time-sensitive, and specific real-time guidance is the main focus!

Professional team's top analyst, Ruoyu, focuses on contract trading guidance. Follow the WeChat public account "币圈若渝" to understand real-time market analysis and operation strategies!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。