Behind ETFs and stable coins, custodians such as OSL have become the "new infrastructure" to ensure the further prosperity of the virtual asset ecosystem in Hong Kong.

By OSL

On April 30, six virtual asset spot ETFs were officially listed and open for trading on the Hong Kong Stock Exchange. Now, after four months, the AUM (Asset Under Management) of Hong Kong's virtual asset ETFs has risen to over 300 million USD.

With the continuous growth in the volume of virtual asset spot ETFs, the previously hidden virtual asset custodian track has gradually emerged as a market necessity. It is well known that any ETF issuer needs to cooperate with compliant custodian institutions. Among the six virtual asset ETFs launched in Hong Kong, four ETFs issued by Huaxia Fund (Hong Kong) and CSOP have partnered with OSL Digital Securities Limited to provide virtual asset custodian services, custoding approximately 57% of the 300 million USD virtual asset spot ETF assets, placing them in a leading position.

For virtual asset ETFs, security is paramount. The tangible advantage that virtual asset spot ETFs provide to ordinary investors stems from their enhanced security. Therefore, reliable custodian services undoubtedly greatly enhance the confidence of ordinary investors, attracting more funds, which also ensures that custodian services will become a new business growth point in the virtual asset field.

The Custodian New Track Behind Virtual Asset ETFs

Looking at the opening data, the issuance scale of three Bitcoin spot ETFs reached 248 million USD on the first day of April 30 (Ethereum spot ETF was 45 million USD), far exceeding the initial issuance scale of the US Bitcoin spot ETF of approximately 125 million USD on January 10 (excluding Grayscale). This also indicates that the market's expectations for the subsequent performance of Hong Kong's virtual asset ETFs are quite high.

After four months, as of August 30, 2024, the total AUM of the six Hong Kong virtual asset spot ETFs has exceeded 300 million USD. The Bitcoin spot ETF holds a total of approximately 4,450 BTC, with a total net asset value of over 270 million USD; the Ethereum spot ETF holds a total of approximately 14,500 ETH, with a total net asset value of over 37 million USD, showing overall growth since the first day.

(Data source: SoSo Value Data)

Although the scale of 300 million USD is far less than the 71 billion USD of the US BTC and ETH spot ETFs in absolute terms, in terms of relative proportions, the 300 million USD Bitcoin spot ETF accounts for approximately 0.7% of the Hong Kong ETF market, while the 71 billion USD accounts for 0.87% of the US ETF market, indicating that the two are not orders of magnitude apart.

How to Ensure the Security of Spot Virtual Asset Custody?

As mentioned earlier, OSL currently custodies approximately 57% of the 300 million USD Hong Kong virtual asset spot ETF assets, placing them in a leading position. In addition to BTC and ETH, the custodian service capability also covers mainstream virtual assets such as BCH, LTC, COMP, AAVE, LINK, UNI, BAT, ENJ, GRT, USDT, USDC, and BCAP.

Let's take OSL's custodian service infrastructure as an example to understand how the current licensed and compliant virtual asset custodian in Hong Kong ensures the absolute security of spot virtual asset custody through its architectural design.

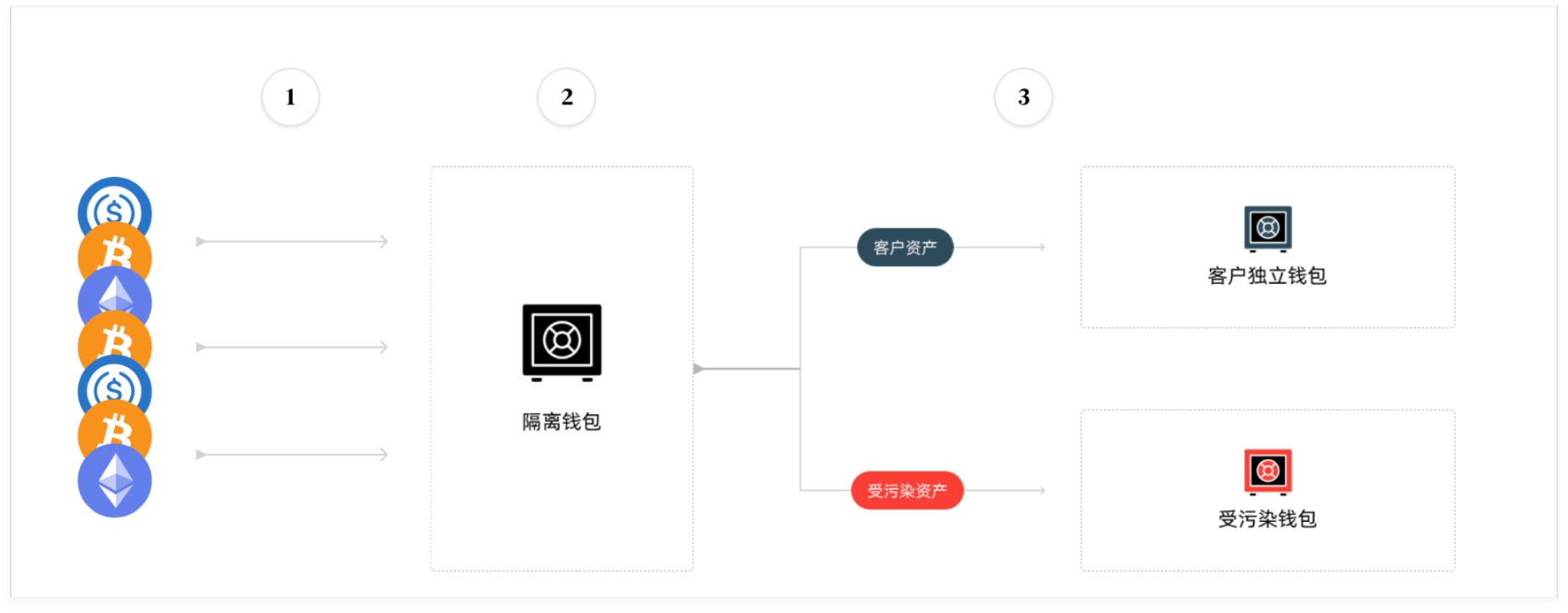

Client Independent Wallets

Naturally, the first step is to design independent wallets for each client. OSL stores clients' virtual assets in separate client wallets, which are protected by a bankruptcy-isolated trust structure. Additionally, clients' fiat currency deposits are also held in separate accounts.

This means that each client is assigned a dedicated, isolated wallet address, ensuring that their virtual assets are completely separated from the assets of other clients, greatly reducing the potential impact of risks associated with other client accounts.

For example, when one client's account faces security threats or attacks, the assets of other clients in their separate isolated wallets remain unaffected and secure. In essence, this setup of independent wallets is like building individual "safes" for each client's virtual assets, which can only be accessed with the corresponding authorization and verification.

Furthermore, all virtual assets transferred to isolated addresses undergo comprehensive compliance and security reviews, effectively reducing risks through virtual asset traceability analysis.

In addition, independent wallets facilitate clear asset accounting and management for clients. Clients can accurately track and monitor the inflow and outflow of their assets, with each transaction associated with a specific independent wallet, ensuring the transparency and traceability of asset movement.

Customized Insurance

Customized insurance is another important means by which OSL ensures the security of the spot virtual asset custody. OSL collaborates with professional insurance institutions such as the London insurance underwriting team to tailor insurance plans based on the client's asset scale, risk situation, and specific needs. These insurances cover various risk scenarios, including network attacks, internal fraud, and technical failures, providing timely economic compensation to clients in the event of unforeseen security incidents, such as large-scale hacker attacks leading to asset losses.

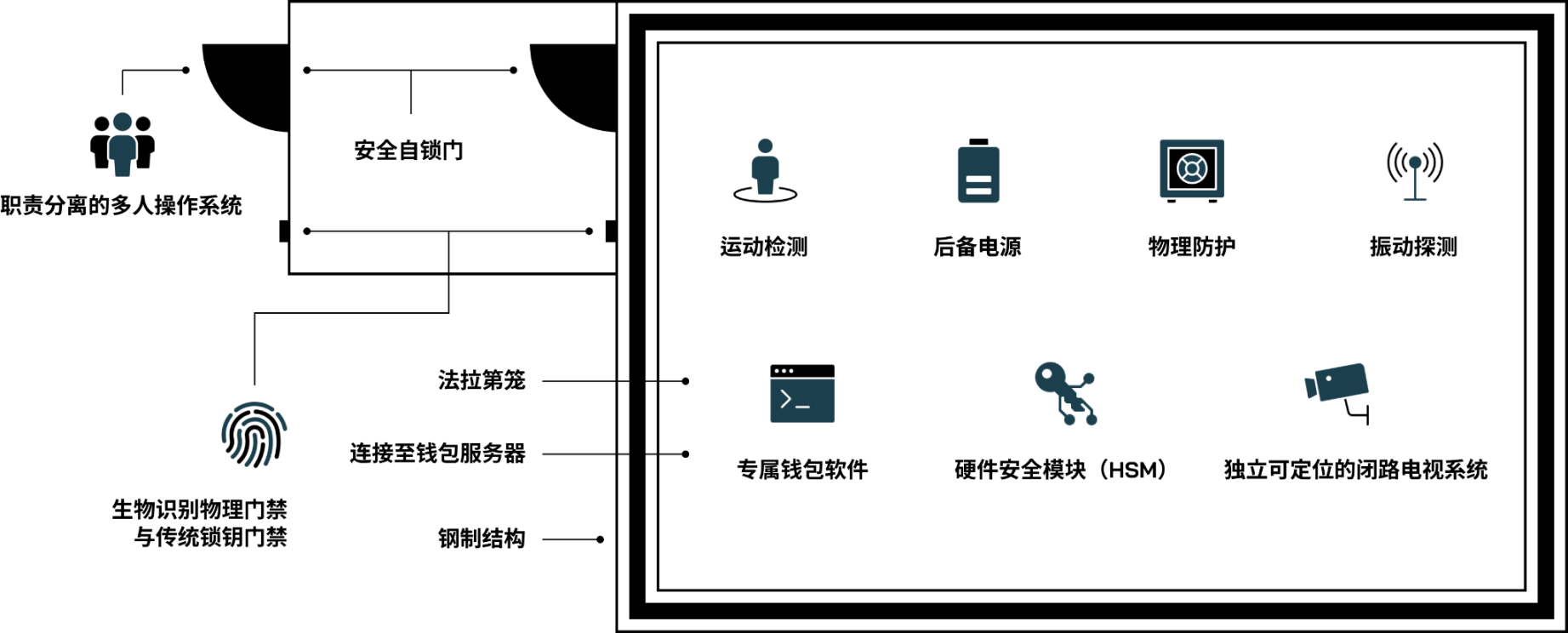

Comprehensive Defense Architecture

In addition, OSL's comprehensive defense architecture ensures the absolute security of the entire process and chain of virtual asset custody:

- Digital defense. It adopts a multi-layered security protection system, including a double cold wallet system and a military-grade Faraday cage vault, to completely isolate virtual assets during the storage process, ensuring the absolute security of virtual assets in storage.

- Physical defense. The entire vault is monitored 24/7 and equipped with motion and vibration sensors to detect and respond to potential intrusion in real time. Any abnormal activity or potential security threats triggers immediate alerts, effectively isolating potential attacks and threats at the physical level.

- Process defense. It implements strict duty separation and multi-person operation systems, ensuring double control. Only rigorously screened and trained employees can access the key custodian systems, and their operational permissions are strictly limited and monitored to prevent improper or malicious actions by internal personnel.

- Slippage prevention. OSL conducts real-time monitoring of blockchain nodes 24/7 to intervene immediately in the event of abnormal fluctuations or potential risks, as well as effectively identify and screen trading counterparties through blacklists and whitelists to reduce trading risks.

Overall, OSL's custodian architecture not only rivals bank-level security but also, being at the forefront of Hong Kong's virtual asset custodian business, continuously learns and improves through rich practical experience, maintaining its comprehensive defense architecture at the industry-leading level to effectively address evolving security challenges.

Conclusion

Security is not only an eternal topic in the virtual asset world but also the lifeline for the vigorous development of new businesses such as virtual asset ETFs and upcoming compliant stable coin businesses.

Especially for the increasingly robust virtual asset ETFs and the nascent compliant stable coin businesses, reshaping a new security paradigm centered around virtual asset custodianship is the only way to lead the virtual asset field into the next era of growth. Before incremental funds flow in, investors need to understand whether the issuers of ETFs/stable coins can ensure the sufficient security of their underlying assets.

Therefore, custodian service providers represented by OSL are actually ensuring the "new infrastructure" for the further prosperity of Hong Kong's virtual assets and the Web3 ecosystem. The market's demand for security is rigid, and only in this way can investor trust be effectively enhanced, providing confidence to investors and attracting more funds into new markets such as virtual asset ETFs and stable coins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。