In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

In the past 24 hours, the net inflow of BTC ETF exceeded 200 million US dollars, and BTC's oscillation and decline stabilized around 63,000 US dollars, indicating that the market is in a phase of overheated rebound repair. Specifically:

Strong wealth creation sectors: AI & DePin sectors, Solana ecosystem;

User hot search tokens & topics: Orderly Network, Bitget, DOGS, NULS;

Potential airdrop opportunities: Soneium, Orderly token claim and staking;

Data statistics time: August 27, 2024, 4:00 (UTC+0)

I. Market Environment

In the past 24 hours, the price of BTC has oscillated downward and is currently stabilizing around 63,000 US dollars. According to Alternative.me's data, the fear index has recovered to 48, indicating a neutral phase. The total open interest of the entire market's futures contracts has decreased by 2%, and the funding rates for BTC and ETH futures contracts are less than 10% annualized. Major market traders are in a wait-and-see state.

From a macro perspective, BTC ETF has seen a net inflow for 8 consecutive trading days, with a total net inflow of over 700 million US dollars. According to Defillama's data, the total market value of stablecoins in the crypto market is close to 170 billion US dollars, with an increase of nearly 5 billion US dollars in the past month. The influx of traditional funds into the crypto market is very evident, and it is expected that the liquidity in the crypto market will improve in the future, possibly triggering a wave of altcoin trends. It is recommended to pay attention to the recent trends of altcoins.

II. Wealth Creation Sectors

1) Sector Movement: AI & DePin Sector (HNT, AKT)

Main reasons:

NVIDIA released its financial report this week, and the market is actively positioning itself in the AI & DePin field;

Recently, AI-related terms such as AI and FET have appeared on the Google hot search list. AI-related projects are the core sectors of attention for users in Europe and English-speaking regions, attracting high market attention;

Price increases: HNT and AKT have increased by 12% and 10% respectively in the past 24 hours;

Factors affecting future trends:

NVIDIA's future trends: NVIDIA will release its financial report this week. It is recommended to closely monitor NVIDIA's financial data. If the profit situation is better than expected, there is a high probability that the AI sector will continue to rise;

Changes in open interest: The open interest of AKT futures contracts has increased by 22% in the past 24 hours. The price of AKT has risen due to the influx of hot money. It is recommended to continue to pay attention to the changes in the open interest of related assets in the secondary market. If the open interest increases, it indicates that hot money continues to flow in, and it is advisable to continue holding.

2) Sectors to Focus on in the Future: Solana Ecosystem (JUP, WIF, POPCAT)

Main reasons:

- SOL's price is relatively stable, stabilizing at the $150 mark. In the past 24 hours, the exchange rates of SOL relative to BTC and ETH have both risen, and the TON ecosystem has encountered setbacks, which is relatively favorable for the SOL ecosystem;

Specific coin list:

JUP: A leading aggregated DEX platform in the Solana ecosystem, with a high user base and a good position in the ecosystem;

WIF: A meme coin in the Solana ecosystem, previously listed on Robinhood. When the SOL token rises, meme coins at the top of the Solana ecosystem tend to rise more rapidly;

POPCAT: A core meme coin on Solana, with recent significant increases in trading volume and high trading demand, providing room for layout of the token;

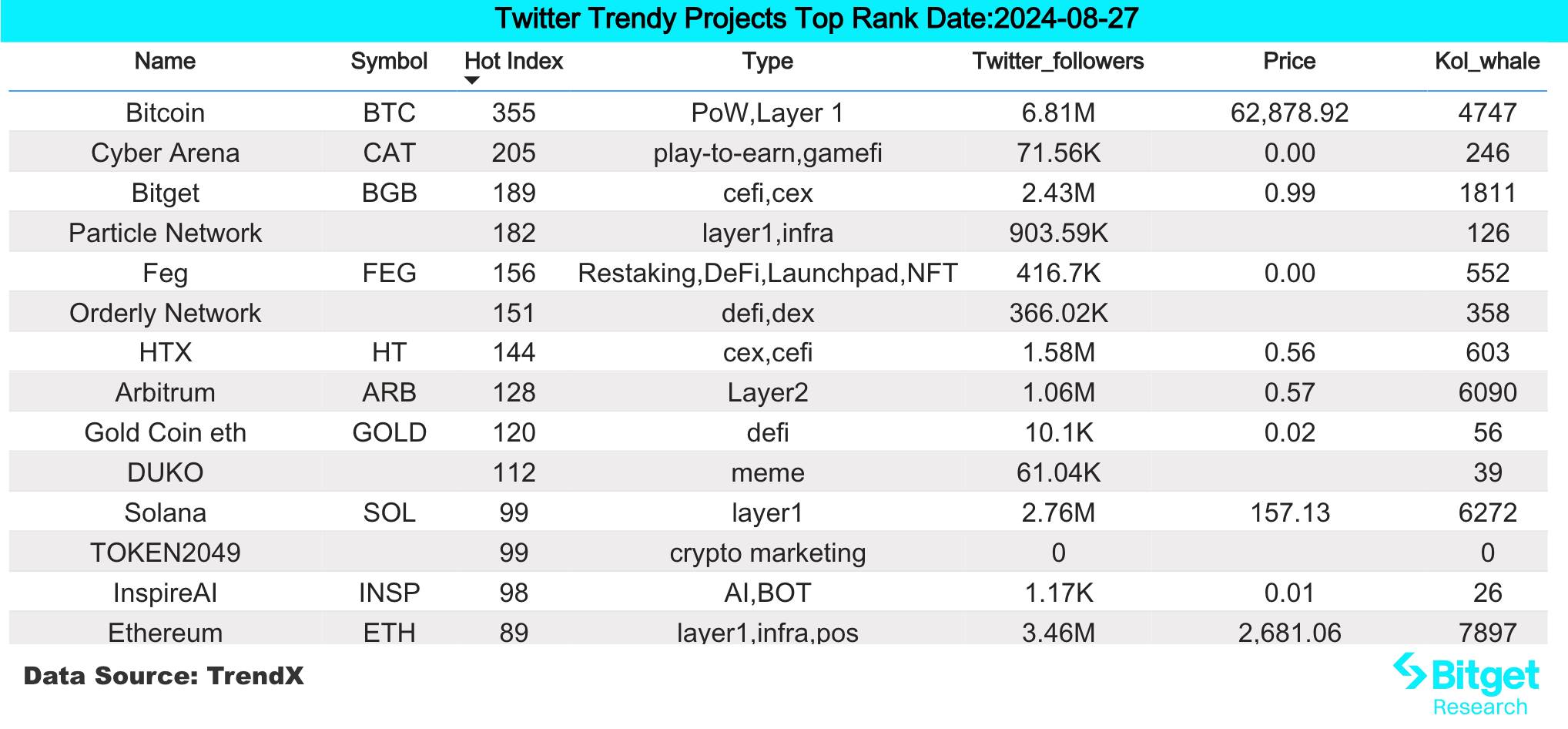

III. User Hot Searches

1) Popular Dapps

Orderly Network:

Orderly Network, a Web3 liquidity provider invested by Pantera Capital, Dragonfly, and others, has completed the TGE of its token ORDER. The token claim and staking of airdropped tokens are now available. Two related contracts of Orderly Network have transaction counts of 35,043 and 27,931, ranking third and fifth in terms of active interactions on the ETH chain.

2) Twitter

Bitget (BGB):

Orderly Network (ORDER) has been launched on Bitget Launchpool. Bitget has also opened a new user pool for DOGS on PoolX, where new users staking USDT in DOGS PoolX can receive over 350% APY. BGB broke through $1 again yesterday and has risen over +130% in the past year.

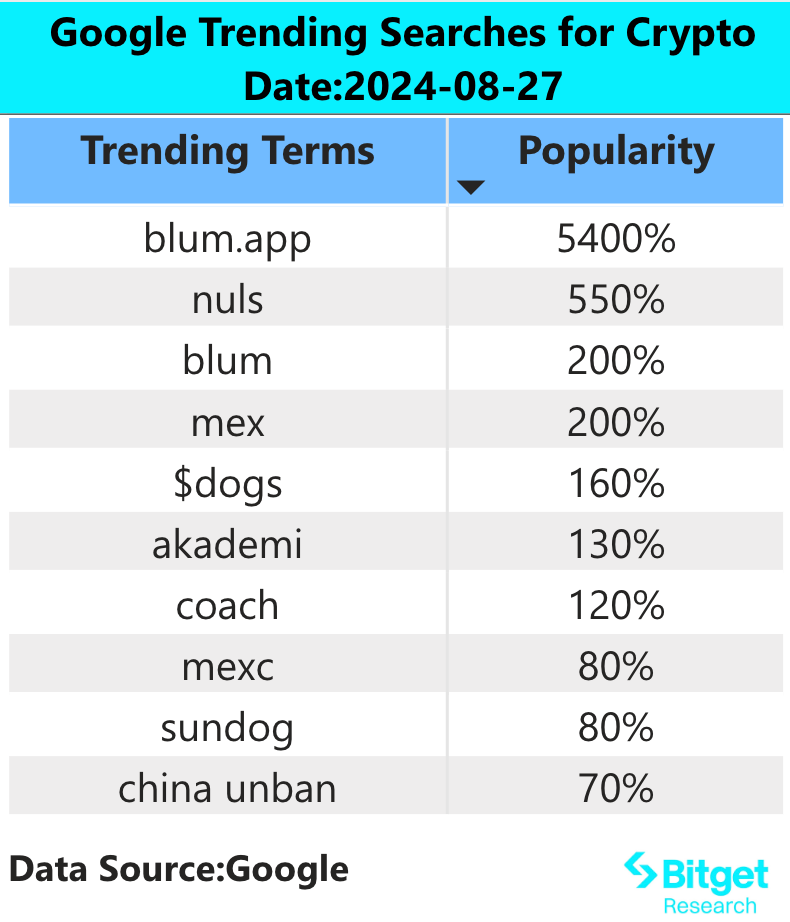

3) Google Search & Regions

Global Perspective:

DOGS:

The high-traffic project DOGS on Telegram completed its TGE, and the total trading volume exceeded 2 billion US dollars within 20 hours. Currently, DOGS' FDV is approximately $700 million, which is 78% of Notcoin's (NOT) FDV.

NULS:

Binance announced the launch of NULS 1-75x USDT perpetual contracts. NULS rose by over 30% within the day. Recently, after Binance launched perpetual contracts for old coins such as ALPACA, SYS, and RARE, the tokens all experienced price increases.

IV. Potential Airdrop Opportunities

Soneium

Soneium is an Ethereum Layer2 launched by Sony, which will connect blockchain technology (Web3) with everyday internet services (Web2). It will use Optimism Rollup technology and build on the OP Stack of the Optimism blockchain ecosystem.

Specific participation method: Soneium will launch its testnet on August 28, 2024, and testing interactions will be available at that time. Currently, the only thing that can be done is to understand the project information and obtain a Discord role; https://discord.com/invite/soneium.

Orderly Network

Orderly Network is a Web3 liquidity provider invested by Pantera Capital, Dragonfly, OKX Ventures, Foresight Ventures, and others. The ORDER token was TGE'd yesterday, and the token claim and staking are now available. Bitget has launched the ORDER Launchpool.

After claiming the tokens, staking ORDER/esORDER can earn Valor and obtain a portion of Orderly's treasury. Valor can be exchanged for USDC. Previously, Orderly announced that "60% of net fees will be distributed to token stakers." Even after the token TGE, tokens can still be obtained as rewards on Orderly through trading, providing MM, and other methods.

Orderly token claim and staking links:

Airdrop Claim: https://airdrop.orderly.network

Staking: https://app.orderly.network/staking

Trading Rewards: https://app.orderly.network/tradingRewards

MM Rewards: https://app.orderly.network/MMRewards

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。