Freeze and compensate the scattered U bank card freeze, list of involved accounts, and the full process of the two-card list solution

This is a piece of dry goods that the entire Internet will not teach you, from the principle of your U card being frozen, to the full process of lifting the mistaken injury, it is recommended to pay attention and bookmark.

What I am telling you here is that retail investors sell U on the exchange, rather than you actually engaging in illegal activities by renting out and selling bank accounts, gambling on the Internet, and other foreign exchange and investment activities can be used as a reference.

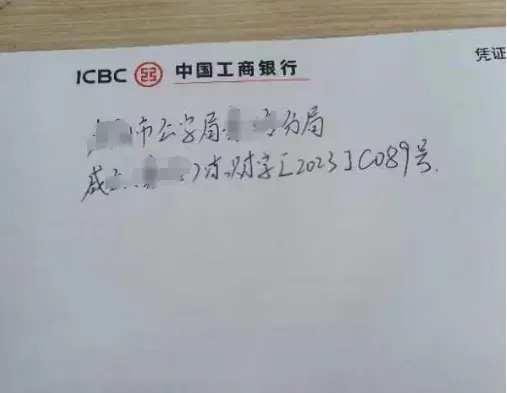

For bank card freezes, go to the bank as soon as possible to confirm whether it is a judicial freeze. The method is to go directly to the counter and ask which authorized agency has frozen my card, help me write it out or print it out, and I will appeal.

You will get a certificate like this, ask boldly, don't be afraid, this is something the bank must tell you, with this certificate, you can quickly obtain your freeze information.

After knowing the name or phone number of the freezing agency, do not contact the other party first, even if you contact them, it is useless, you must do the preparatory work first.

Then you need to self-check based on the freezing agency and your transaction records to determine which transaction caused the freeze. The purpose of doing this is to determine:

- Freezing unit

- Handler

- Handler's contact phone number (corporate mobile phone)

- Amount involved

- Involved transaction records

Only after confirming this information can you quickly resolve your problem.

After confirming this information, you can then appeal for unfreezing. Those who directly teach you to call the handling unit, who will you contact when you call? Uncle who freezes the card does this thousands of times, do they know who you are? Unless you are the head of a group.

If you insist on contacting them, you must state your identity, usually: I am XX's victim, XXX (your name).

You don't need to tell me the answer you get, I will tell you directly the result:

After spending time, effort, and cost, the answer you get is:

Go back and wait for the investigation results (wait for notification)

What have you gained? I told you to listen, don't listen to those half-baked bloggers who copy and paste everywhere.

Your goal is to quickly unfreeze your bank card, not to go through the process and wait for half a year or a year. Our professional legal team will give you advice and accompany you through the appeal process until the bank card is unfrozen, provided that you do not freeload.

After the preparatory work is completed, you need to determine whether your card is a first-level card involved. In fact, there is no need to panic. There are still many ways to distinguish first-level cards. The simplest way is to stay at home and wait.

For first-level card freezes, it is highly probable that Uncle will come to your door (or the issuing bank will call you).

If this is not the case, then you probably are not a first-level card, and you can also inquire at the local police station or anti-fraud center (in most cases, they will not pay attention to you).

You can also check it yourself, depending on what behavior caused your judicial freeze.

What you did and your receipt behavior will give you a rough idea of your situation:

If you engage in online gambling and directly withdraw funds from the platform, the probability of being a first-level case is 99%.

If you engage in online gambling and directly withdraw digital currency, and the payment requires time, the probability of being a first-level case is 90%.

If you sell USDT on an exchange OTC, and the merchant makes real-name payments, then there is basically no direct involvement in illegal activities, which means the probability of being a first-level case is low.

If you sell on a chat app overseas, then it is definitely a first-level case.

If you handle loans, and the agency asks you to create fake transaction records, the probability of being a first-level case is 100%.

If you sell or lend your card to others, the probability of being a first-level case is 100%.

If you sell U on the exchange, and the merchant says to use a family member's card to transfer funds to you, the probability of being a first-level case is 100%.

After self-checking whether it is a first-level card, you now need to contact the handling person on the other side, not by directly calling, but by preparing the materials.

Whether you are knowingly involved or deceived, if there are unverified victim fraud funds in your bank card, even if you provide materials and explanations, the public security agency will not unfreeze your card.

At this time, all you can do is "wait." If you do not want to wait, you must quickly have the public security agency verify the funds in your bank card and the details of the defrauded funds, and then try to apply for unfreezing through actions such as returning or compensating.

This process is quick, and what needs to be done is to send the materials and explanations by registered mail to the handling person. This explanation must prove that you did not participate in illegal activities and that the funds were obtained in good faith. If it is online gambling, you cannot make a living from gambling, and you must have a legitimate job.

If you do not know how to write an explanation, you can consult our legal team. This explanation is very important, it is like a record, and every word you say must be true and supported by evidence.

Preparing the materials is crucial:

- Order details page

- Platform chat records

- Order records

- Other party account details

- Other party transaction screenshots

- Transfer records

- Appeal records

- Explanation

This explanation is very important. I have written a template for everyone, and you can fill in your own information accordingly (for those who spend money on lawyers to unfreeze, this can save you tens of thousands):

This simple version of the explanation is something 99.9% of people will not write.

Regarding the freezing of XX bank card, an explanation

XX Public Security Bureau Criminal Investigation Brigade, XX Police Station, Officer X:

I, XX (male, Han nationality, born on XX, XX, ID number: XXXX, working at: XXXX, living at XXXXX, phone XXXX).

Legal document mailing address: XXXXXXXX

On XX, XX, I discovered that my XX bank card XXXXXXXX (card number) was frozen by the XX Public Security Bureau Criminal Investigation Brigade. After calling the number XXX, I contacted Officer X (phone XXXX) and learned that on XX, XX, at X o'clock and X minutes, XX transferred XX RMB from XX's XX bank card XXXXXXXX to my XX bank.

Regarding this transfer, I hereby make the following statement:

I traded "coins" on XX website through a C2C model, similar to a stock exchange. These coins include "Bitcoin BTC" and "Tether USDT," and I made profits by buying low and selling high. There were gains and losses.

On XX, XX, at X o'clock and X minutes, XX purchased XXXX USDT (Tether) at a unit price of 6.5 RMB, with a total value of XXXXX RMB, through the XX platform, and I was matched with XXX, whom I do not know.

Afterward, I provided my card number to XXX in the chat box of the XX website, and the other party made the payment to me. I delivered the goods (USDT) to the other party, and the transaction was completed.

On XX, XX, I discovered that my bank card was frozen. After contacting Officer X, I was informed that this payment was suspected of fraudulent funds. I then filed a complaint through the XX website, but was unable to contact XXX.

Other laws and regulations:

In China, the legal status of Bitcoin and other encrypted assets is "virtual commodities," and the use, profit, and disposal of them are equally protected by the law. According to the "Notice on Preventing Bitcoin Risks" issued by the People's Bank of China and four other ministries, Bitcoin and other digital currencies are considered as a form of online commodity trading, and ordinary people have the freedom to participate at their own risk.

In summary, I am an innocent third party who unknowingly sold an order allocated by the system on the XX website, resulting in the freezing of my bank card, which has had a huge impact on my life and work.

I have not engaged in any suspected illegal activities and request the public security agency to issue a statement to exclude suspicion of illegal activities and unfreeze my bank card to restore normal life.

The explanation is very important and can be described according to your personal situation. There are also many techniques in telling the truth, and if you are unsure, you can entrust our legal team to help.

For a complex version that does not involve compensation, contact me separately.

Follow-up:

After you send the registered mail and confirm that the handling person has received the explanation, they generally will not contact you, and if the unfreezing is not processed, first review whether the materials or descriptions you provided are complete and appropriate;

Continuously follow up, periodically consult with the police handling the case about the progress of the case;

You can report the situation to higher-level legal departments or criminal investigation departments, communicate and coordinate, explain the reasons for lifting the freeze, and submit legal documents or evidence (if necessary, you can entrust a legal team specializing in unfreezing).

The processing time for my legal team is usually within a week for appeals and unfreezing.

As long as you are not actively lending or renting out bank cards and are not involved in first-level cases, you generally will not be included in the card suspension punishment (two-card list), but the handling person will report to the national anti-fraud data platform, and the national anti-fraud centers will receive clues and case numbers, also known as the list of involved accounts. Major commercial banks will receive notifications and then list you as a high-risk individual, which is what people call the "bank blacklist." The manifestation is that when you swipe your ID at the bank, it will prompt: the reason for being on the fraud blacklist, and serious bank tellers will even pick up the phone to report to the police.

Bank-involved blacklist:

This is related to the card freeze. Many people think that if their bank card is frozen, they can just leave it for half a year and it will automatically be resolved, but this is definitely not the case.

Because as long as you have one card involved, the handling person can upload you to the anti-fraud big data system, and then distribute it to major banks, causing your other uninvolved bank cards to be controlled by the bank. This is also called associated accounts under the involved account name. So you must continue to follow up, actively resolve, avoid being included in the list of involved persons, and then have your other unrelated bank cards controlled by the bank.

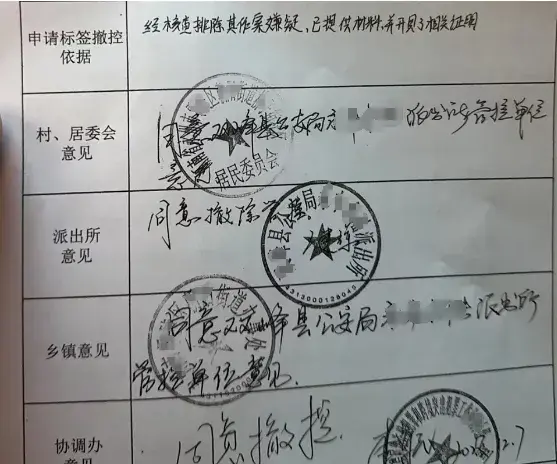

So how can you appeal this blacklist? The premise is that you must first lift the freeze status of all your bank cards, obtain a "non-involved certificate" or other explanation issued by the authorized agency, and then you can go to major banks to appeal. The simplest way is for the handling person to directly send your release information to the bank in their work group.

If your bank card has been frozen and you did not handle it, but the freeze has been automatically lifted, according to policy requirements, you also need the original freezing agency to issue a release document or explanation in order to report the removal of the restriction on the "involved account name list." So when faced with a freeze, you must handle it, rather than waiting for it to automatically expire.

Non-counter after freeze:

The last situation is when the freeze has been lifted, but the bank has restricted your card, not allowing you to use it. You should go to the bank and handle the release procedures. During the process, the bank needs to stamp and issue a "Fraud Risk Account Review Form," and transfer it to the local anti-fraud center for review. The "Fraud Risk Account Review Form" is issued by the bank and stamped for submission to the public security, and you should not be asked to stamp it.

Do you understand? Many people find out that their cards have been restricted after three days of being frozen, and the bank asks them to go to the anti-fraud center to stamp, but this is a deceptive process.

Just tell them that your bank should issue the "Fraud Risk Account Review Form," and then accompany me to stamp it. This is their necessary workflow.

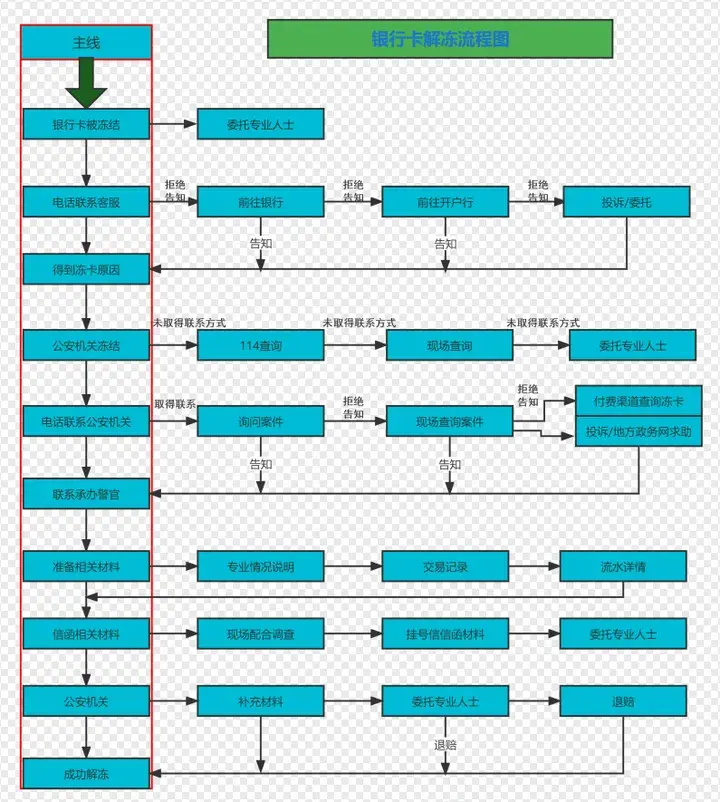

(Bank card unfreezing process)

The most serious situation is when a first-level card is involved, and you are put on the punishment list or the two-card list.

The most common cases my team encounters are due to receiving first-hand black funds as a result of selling U (such as when a merchant sells U and the buyer directly participates in pyramid schemes, online gambling, fund pools, or Ponzi schemes and then reports a loss or fraud to the police, and the money is directly transferred to the merchant). The second most common situation is when retail investors sell U and receive non-self-named payments, resulting in first-hand black involvement.

These can be appealed, but most people back down as soon as Uncle from the freezing location comes to press charges, and then they apply for bail.

However, the premise of applying for bail is to admit guilt. If you admit that you have committed a crime, then there is no solution.

Those who understand some legal knowledge and criminal litigation procedures will not consider themselves to have committed a crime at this point. No matter how scared they are, they will insist that it was their own actions and that they did not participate in illegal activities.

Therefore, these people can ultimately appeal to lift the punishment.

How to appeal to lift the punishment for mistakenly restricted cards (two-card list)?

- First, you need to determine which authorized agency reported you. Many people have different locations for the freezing, card issuance, and household registration. The location of the incident (freezing location) will not report you, and the card issuance location also has authority.

I encountered a case where the household registration location reported the individual, and many people cannot find this information. Even if you know who reported you, the other party will not admit it, so it's difficult. At this point, you need to present evidence that the other party cannot deny. You need to entrust professional legal services to confirm this evidence for you.

Confirm the name and contact number of the person responsible for the punishment. With this information, you can find the relevant responsible person and ask them to help you go through the process of appealing to lift the punishment.

Once you have found the responsible person, you need to provide materials, such as the "non-involved explanation" issued by the freezing location. Because you can only appeal if you are not involved, but do you think they will easily issue this explanation to you? Wouldn't that be admitting to a mistake in their previous work? The non-involved explanation is not a legal document, and the freezing location may not issue it. Many people call and are told that Uncle will not issue it, so there is nothing they can do.

Other supporting materials: stamped documents from the community, neighborhood committee, showing that you have not engaged in other illegal activities, have a good community record, have not defaulted on property fees, and have no criminal records, etc.

Finally, it needs to be reported step by step to the public security department, which will then be sent to the People's Bank, in order to lift your punishment or remove you from the two-card list.

Then, with the release certificate, you can go to major banks or other institutions to appeal to lift the control, such as not being able to apply for a card, leave the country, or apply for a passport, etc.

But the consequence is that you will be instantly rejected for loans, and you will not be able to get a loan to buy a car or a house.

This is called credit punishment, and it is temporarily unsolvable because the relevant responsible department cannot be found. My legal team has been working on this process for three years and has not made progress. Please be patient.

This is the most detailed unfreezing process on the entire internet.

Contact me for selling U, guaranteed approval.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。