The idea of unstoppable liquidity is still being implemented in the BTC ecosystem.

Author: Deep Tide TechFlow

The Bitcoin ecosystem is still one of the few hotspots in the current market.

With the launch of the Babylon mainnet, the gas within Bitcoin surged yesterday, reaching over 800 satoshis/byte at one point. There are three reasons for the surge in gas fees:

Staking, staking, and more staking.

As a major BTC staking protocol, Babylon's mainnet launch has sparked a staking arms race, with various LSD protocols within the Bitcoin ecosystem such as Solv, Lorenzo, Bedrock, and Pump BTC competing to attract idle BTC to their protocols in search of returns.

Beyond the returns, the significance of staking lies in using the security of BTC to enhance the security of PoS chains; this approach is similar to what ETH does for the Ethereum network.

Clearly, where there is staking, there will be restaking, i.e., taking LST out and turning it into LRT to enhance the security of more applications; this is also the approach of Eigenlayer.

And this kind of gameplay is gradually becoming a trend in the Bitcoin ecosystem.

Yesterday, the BTC restaking project Satlayer, based on the Babylon protocol, announced the completion of an $8 million pre-seed round of financing. Hack VC and Castle Island Ventures jointly led the investment, with participation from companies such as Franklin Templeton, OKX Ventures, Mirana Ventures, Amber Group, Big Brain Holdings, and CMS Holdings. Unnamed angel investors from companies such as aPriori, Custodia Bank, LayerZero, Manta Network, Magic Eden, Sui, and Pendle also participated in this round of financing.

From the name, it's not difficult to understand the general idea. "Sat" bears the imprint of "satoshis" in the Bitcoin system, and the full name of Satlayer also easily brings to mind Eigenlayer.

In the Bitcoin ecosystem, restaking is used to enhance the security of more applications using BTC's LRT, and a nesting war for BTC assets is imminent.

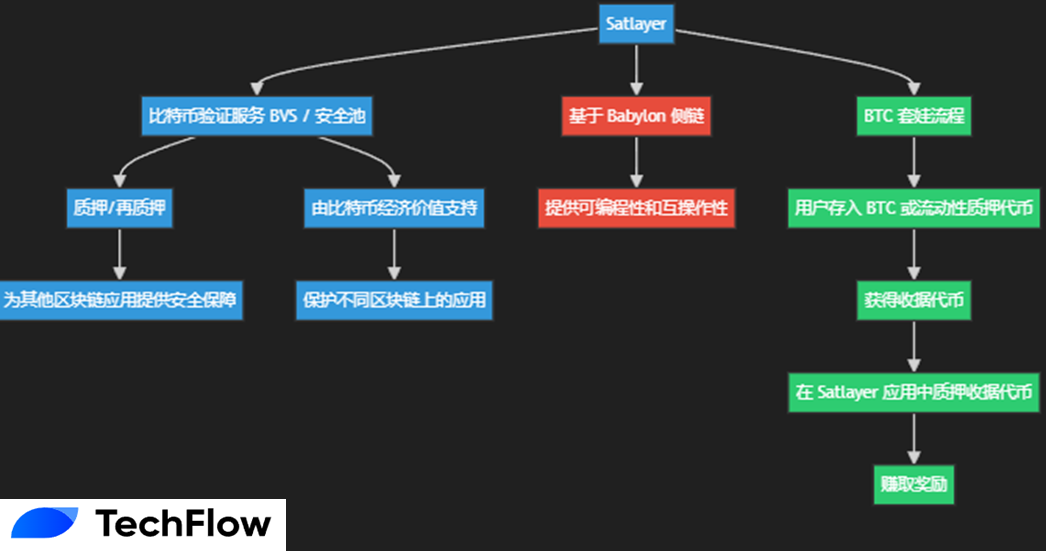

You have AVS, I have BVS

The approach of Satlayer does indeed have certain similarities with Eigenlayer.

The concept of restaking introduced by Eigenlayer provides new asset uses for ETH holders, but its core is actually the introduction of Active Validation Services (AVS): allowing developers to create custom validation services, using the extensive security of ETH and restaking to protect their project operations.

Satlayer has brought this concept to Bitcoin, introducing the concept of a Bitcoin Validation Service (BVS) - allowing Bitcoin holders to provide security guarantees for other blockchain applications through staking/restaking.

It is important to note that these protected applications may run on different blockchains and can use the economic value of Bitcoin to enhance their own security.

Setting aside this technical narrative, fundamentally, it is still about finding a reason for nesting BTC at different levels to seek more returns.

Therefore, it can be seen that Babylon, a sidechain solution designed for Bitcoin, provides necessary programmability and interoperability for platforms like Satlayer. Clearly, there are still more gameplay and possibilities around nested assets related to BTC.

Specifically for Satlayer, the nesting process for BTC is roughly as follows:

By deploying a series of smart contracts on Babylon, Satlayer achieves its core functionality. Users can deposit their BTC or liquid staking tokens (such as Wrapped BTC, Liquid Staked BTC) into Satlayer to receive tokens representing their deposits. These receipt tokens can then be staked within the Satlayer application to start earning rewards.

Correspondingly, this mechanism creates a security pool supported by the economic value of Bitcoin, which can be used to protect various applications running on different blockchains.

Nesting for Returns

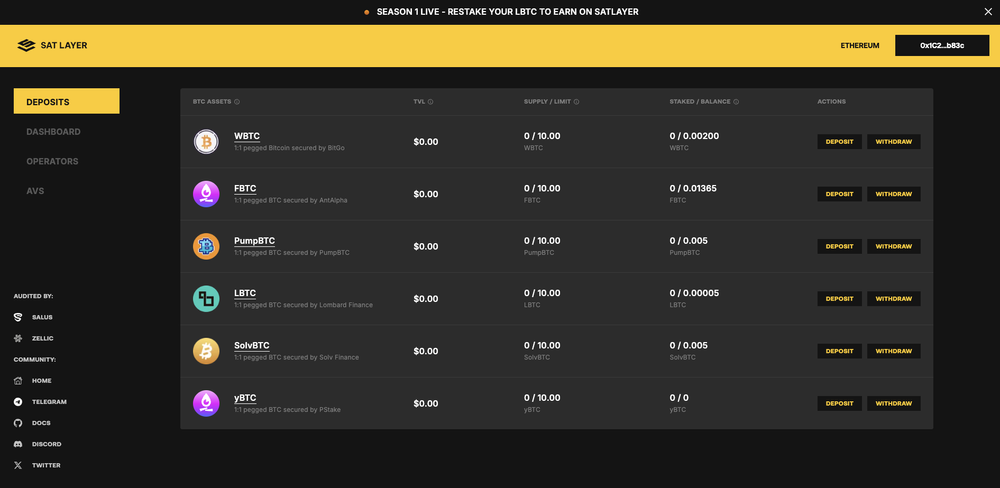

Through SatLayer, users can now restake Bitcoin and Bitcoin liquid staking tokens on platforms such as Solv Protocol, Lombard, Bedrock, pStake, and PumpBTC, which are used to protect BVS.

Clearly, from the current perspective, different participants in the entire chain can benefit:

Liquid Staking Token (LST) platforms: BTC deposits on LST platforms have additional earning opportunities. Users can earn more returns by participating in this innovative staking method.

BVS platforms: By re-depositing BTC into Satlayer, BVS platforms gain enhanced security and access to new features that were previously unavailable.

Babylon ecosystem: Satlayer supports AVS at the level of Eigenlayer, further expanding the functionality of Babylon.

BTC Stakers: For those holding Bitcoin, Satlayer provides an opportunity to earn additional rewards by locking BTC in the system.

After all, no one would object to earning returns.

From the current pages displayed on the project's official website, at this stage, Saylayer supports the deposit of BTC in various LST forms such as wBTC, FBTC, PumpBTC, LBTC, SolvBTC, and yBTC, with varying returns.

At the same time, the project is also conducting a deposit activity for Season 1 Epoch 1, starting at 00:00 UTC on August 23, 2024, and lasting for 2 weeks, with a maximum deposit limit of 100 BTC for the first season.

Users will need to bind their wallets, DC, and follow the project's X account in order to deposit assets into the protocol, indicating a clear intention to promote the project.

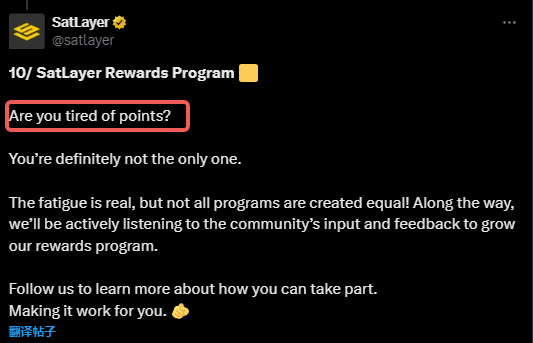

It is worth mentioning that the project may not completely follow the old routine of "deposit money to earn points, and then distribute airdrops" during the activity; its official announcement has clearly stated that they are aware that players are tired of points, and they hope to actively listen to the community's opinions and feedback to develop a reward plan.

However, more information is needed to understand the specifics of this plan from the official announcement.

Overall, the idea of unstoppable liquidity is still being implemented in the BTC ecosystem. Where there is staking, there will be restaking, and nesting for more returns, but clearly, smart contract risks and other issues are always present.

In this limited hotspot, active participation and cautious operation are the correct ways to participate in this uncertain bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。