Original Author: Biteye, Core Contributor: Viee

Original Translation: Biteye, Core Contributor: Crush

Recently, the Hong Kong Monetary Authority announced that JD Coinlink Technology (Hong Kong), a subsidiary of JD Technology Group under JD.com, is one of the first institutions to enter the "sandbox" program for stablecoin issuers. This is undoubtedly a major news!

It is worth noting that behind the issuance of stablecoins by JD, there are the shadows of two internet tycoons, Liu Qiangdong and Lei Jun. Tianxia Bank, a licensed virtual bank under Xiaomi Group in Hong Kong, will assist JD Coinlink Technology in developing a cross-border payment solution based on stablecoins. This means that JD and Xiaomi may cooperate in the stablecoin field.

The deep layout of the two industry giants in the digital currency field is not only a catch-up on past payment market opportunities, but also a forward-looking investment in future financial technology! This article will delve into this event and analyze the reasons for JD's entry into the stablecoin market.

01 The Rise of Stablecoins

1. What are Stablecoins

Stablecoins are a type of cryptocurrency pegged to fiat currency or other assets, designed to reduce price volatility. Compared to highly volatile cryptocurrencies like Bitcoin, they provide a relatively stable form of cryptocurrency. They are usually pegged 1:1 to fiat currency to ensure their stability.

2. Stablecoin Market Landscape

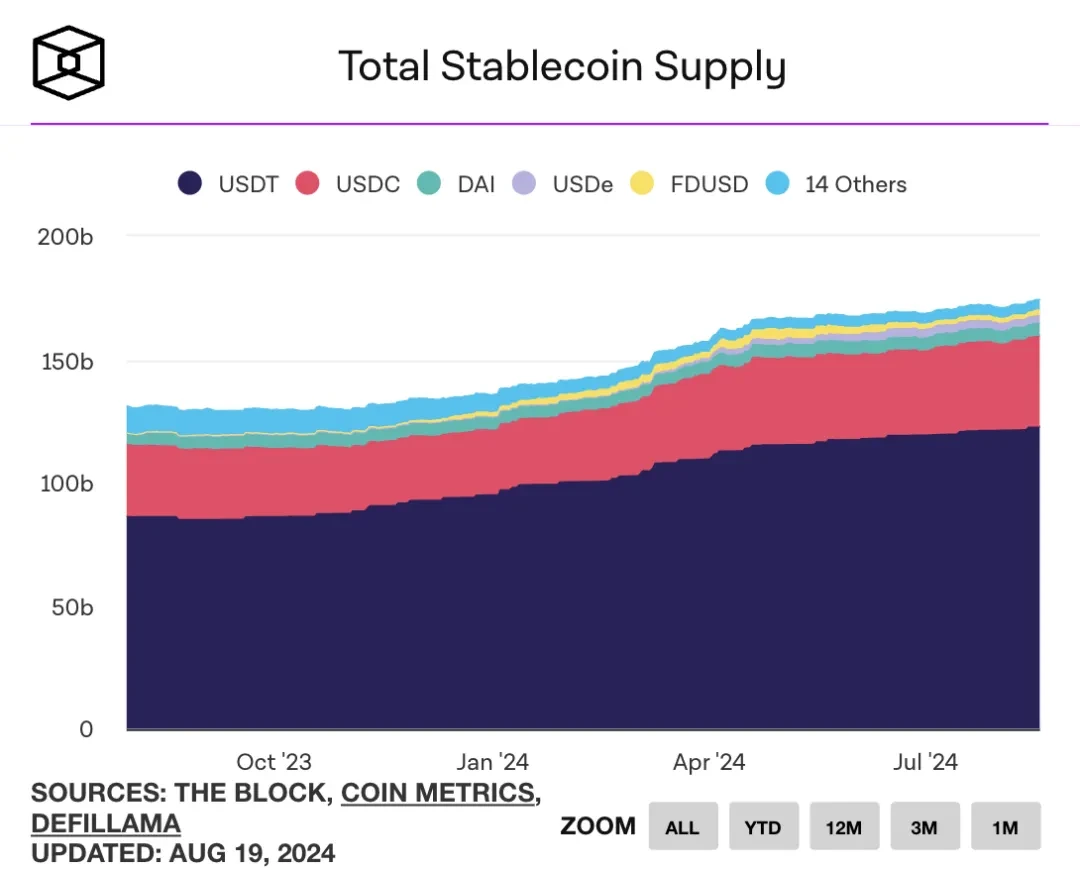

According to the latest market research by The Block, the total market value of stablecoins has exceeded one trillion US dollars, becoming an important and indispensable part of the cryptocurrency market.

Source: https://www.theblock.co/data/stablecoins/usd-pegged/total-stablecoin-supply

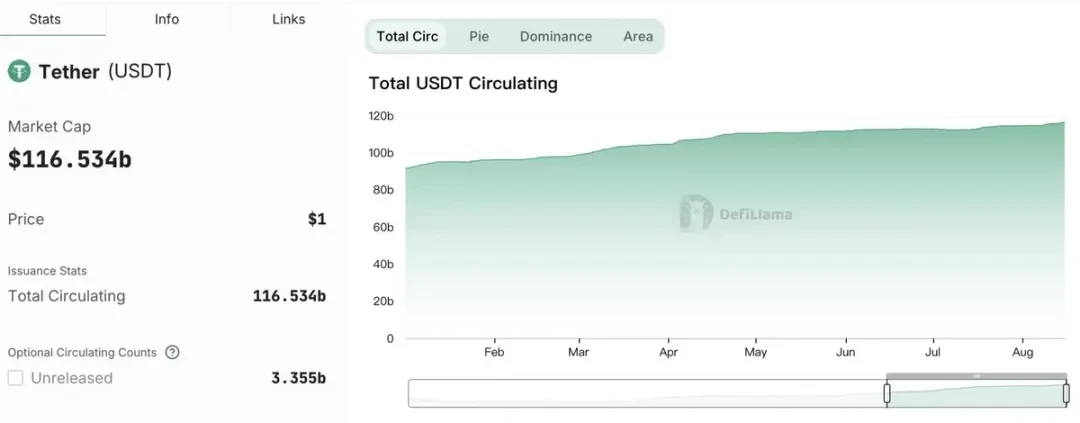

Currently, USDT (Tether) occupies 70% of the stablecoin market share, making it the market leader. However, if non-USD pegged stablecoins, such as JD stablecoin (JD-HKD), are introduced, can they make a breakthrough in market share? In addition to the need for a suitable regulatory environment, it is even more crucial to find use cases for HKD-pegged stablecoins and expand market share through scenario-based applications.

02 Coinlink Technology: The Driving Force behind JD's Stablecoin Issuance

JD Coinlink Technology (Hong Kong) (JINGDONG Coinlink) is a wholly-owned subsidiary of JD Technology Group, focusing on the application and development of blockchain technology. It is the only stablecoin issuer under JD. The company was officially registered in March of this year and was selected as one of the first participants in the "sandbox" program for stablecoin issuers by the Hong Kong Monetary Authority just 5 months later. Its rapid development demonstrates JD's ambitious plans!

JD stablecoin, also known as JD-HKD, is a stablecoin based on a public chain, with its reserves composed of highly liquid and trustworthy assets, as detailed below:

Anchored 1:1 to the Hong Kong dollar, for every unit of stablecoin issued, JD Coinlink Technology will hold an equivalent amount of Hong Kong dollars in its reserves.

Each JD-HKD can be redeemed at a 1:1 ratio, with its reserves composed of highly liquid and trustworthy assets, securely held in an independent account of a licensed financial institution, with regular disclosure and auditing to ensure the integrity of the reserves.

This means that users can use JD stablecoin with greater confidence, enjoying a secure and stable digital asset experience.

03 The Unbreakable Bond between JD and Blockchain

JD's history with blockchain can be traced back to 2017, when it actively began exploring this emerging field with the rise of blockchain technology.

In 2017, JD Finance collaborated with China UnionPay to successfully build the first inter-regional and inter-operator alliance chain "Zhi Zhen Chain" based on the public network in China. The establishment of this alliance chain not only enhanced JD's capabilities in blockchain technology, but also laid the foundation for subsequent multi-party cooperation. Subsequently, Wanda Group and China Merchants Bank also joined the alliance chain, forming a cooperation network covering multiple industries.

In 2018, JD Finance launched "JD Digital Assets" based on blockchain technology, and also released a blockchain anti-counterfeiting traceability platform, using blockchain technology to achieve full traceability of goods, enhancing consumer trust in product quality.

In 2021, JD launched its own NFT platform "Lingxi", another important attempt by JD in the field of blockchain. The platform aims to provide users with trading and collection services for digital artworks, further expanding JD's boundaries in the application of blockchain technology.

It was not until July 2024 that JD Coinlink Technology (Hong Kong) announced the issuance of stablecoins anchored 1:1 to the Hong Kong dollar.

So why did JD choose to enter the stablecoin market?

04 Reasons for JD's Entry into the Stablecoin Market

Liu Qiangdong has stated on multiple occasions that there are many regrets in JD's layout in the payment field, especially the failure to keep up during the rapid development of mobile payments in the golden period. JD's vigorous development of stablecoins seems to reflect its determination to catch up after missing out on the development opportunities in the payment market.

Therefore, the reasons can be analyzed from multiple perspectives:

Enriching the financial product line: JD's layout in the field of financial technology has already taken shape, and the introduction of stablecoins will further enrich JD's financial product line. By entering the cryptocurrency industry, it can attract more users to participate in its financial ecosystem, providing a more diverse range of financial services such as lending and investment.

Improving cross-border payment efficiency: On one hand, with the approval of Bitcoin ETFs and Ethereum ETFs, cryptocurrencies have entered the public eye more quickly, attracting the attention of the global financial market. The introduction of stablecoins will improve JD's efficiency in the field of cross-border payments, supporting its internationalization strategy and making it more competitive in the global market.

Most importantly, the issuance of stablecoins is quite profitable: According to DeFiLlama data, the market value of stablecoins has increased by nearly 28.4% from the beginning of this year to August 15, reaching 166.96 billion US dollars. The issuer of the leading stablecoin USDT, Tether, has profits that rival those of Wall Street giants! In the first half of 2024, its net profit reached a historical high of 5.2 billion US dollars, and what is even more shocking is that the entire team has only about 100 employees.

However, further consideration of this matter reveals that the entry into the stablecoin market also reflects the anxiety of Chinese e-commerce giants collectively going global.

As two of the giants in the Chinese internet industry, JD and Xiaomi have achieved great success in e-commerce and smart hardware respectively. After the pandemic, the competition in going global has become more intense, with cross-border payments becoming a top priority. However, challenges such as the efficiency of cross-border payments and geopolitical risks have been plaguing these companies going global. Perhaps in search of new growth points, both companies have begun to focus on financial technology and the cryptocurrency field.

In this context, JD's issuance of stablecoins becomes particularly important. It is not only a strategic move for JD to respond to market changes, but also an attempt to improve the efficiency of cross-border payments. Through stablecoins, JD hopes to provide users with more convenient payment solutions, overcoming existing payment barriers. At the same time, this also enhances the competitiveness of JD, and even other Chinese e-commerce giants, in the global market.

05 Conclusion

The joint entry of JD and Xiaomi into the stablecoin market signifies a new round of layout by the two industry giants in the field of financial technology. This move is not only a catch-up on past payment market opportunities, but also a deep investment in the future digital economy.

As the stablecoin market continues to develop, whether JD and Xiaomi can achieve a comeback in this wave of change is worth our continued attention!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。