Author: OKX, AICoin Research Institute

OKX, in collaboration with the high-quality data platform AICoin, has initiated a series of classic strategy research, aiming to help users better understand and learn different strategies through core dimensional analysis such as data testing and strategy characteristics, and to avoid blind usage as much as possible.

Grid trading is a systematic trading strategy, with the core principle of dividing multiple grids within a preset price range and implementing contrarian operations—buying when the price falls and selling when it rises. This strategy reduces emotional interference by maintaining a balance of long and short positions and executing trades automatically, and accumulates profits through frequent small trades. It emphasizes flexible adjustment of parameters to adapt to market changes, focuses on risk control and fund management, and is particularly suitable for long-term operation in volatile markets. Although it performs well in sideways markets, it may miss out on major trends in trending markets. Successful implementation of grid trading requires flexible application of these principles based on specific assets and market conditions, while prudently controlling risks and avoiding excessive leverage.

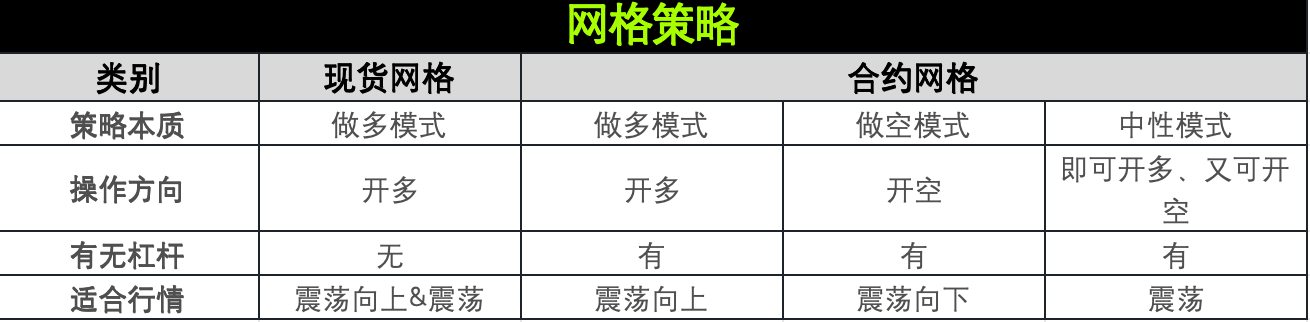

Generally, grid strategies are divided into two types: spot grid and contract grid. Among them, the contract grid is further divided into three types: long mode, short mode, and neutral mode, each of which is suitable for different market conditions. (Note: Neutral contract grid and below are collectively referred to as "neutral contract grid")

In the 2nd issue, grid strategy is introduced, using 3 major data models to conduct actual tests on [neutral contract grid & spot grid]:

Model 1: Neutral contract grid and spot grid under a 1-hour sideways oscillation running cycle

Model 2: Neutral contract grid and spot grid under a 4-hour downward oscillation running cycle

Model 3: Neutral contract grid and spot grid under a 1-day upward oscillation running cycle

In this issue's data test, the running standard for the neutral contract grid is: setting the market price of the trading pair as the center when the strategy is initiated, determining the lower and upper limits of the grid, and placing orders above and below the market price. When the price is above the market price, sell open positions are executed for each grid breakthrough, and buy-to-close positions are executed for each grid breakdown, in order to obtain profits from the price decline.

One-sentence summary of the neutral contract grid mode & spot grid strategy: Focusing on range trading, it provides a rational trading method under careful risk management and parameter optimization.

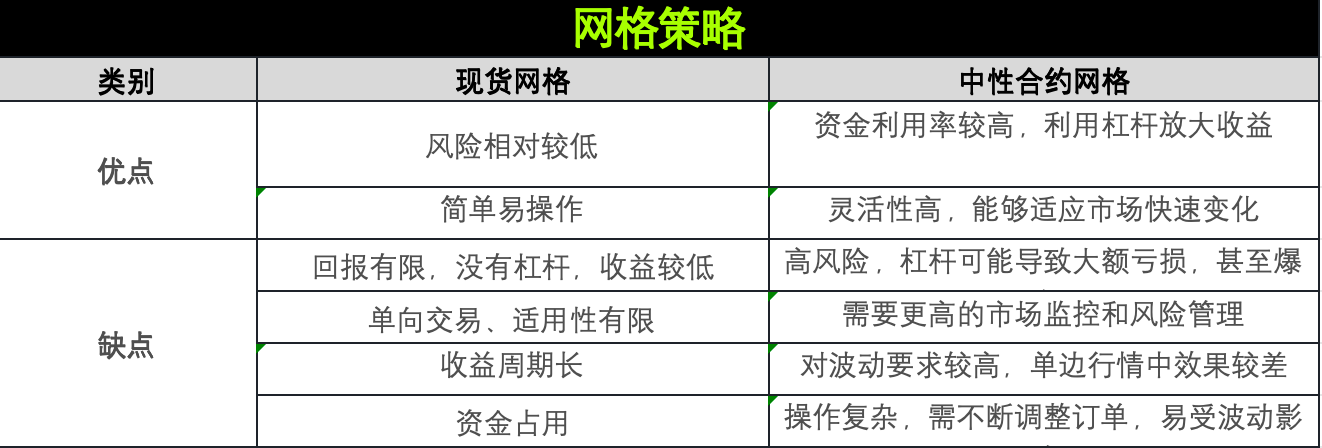

Advantages and Disadvantages Comparison

Overall, the sideways market reduces trend risk, and both strategies can focus more on range trading. However, it is necessary to be vigilant about the possibility of the market breaking through the current oscillation range, and it may be necessary to adjust the grid parameters. Users may consider optimizing the grid spacing based on the observed price fluctuation range. Try dynamically adjusting the grid to adapt to possible changes in the fluctuation range.

In addition, there are significant differences in operation and risk management between the two. The neutral contract grid is suitable for both long and short trades in the high-leverage contract market, emphasizing capturing opportunities in volatility and bearing higher risks; while the spot grid is suitable for single-direction trades in the relatively stable spot market, suitable for a more conservative trading strategy. The core concepts of the two are similar, but in practical application, the choice needs to be made based on the trader's risk tolerance and market conditions.

The neutral contract grid trading strategy combines the advantages of grid trading and market-neutral strategies, providing multiple advantages. It reduces systematic risk through long and short hedging, profits from high-frequency small trades and market fluctuations, and reduces directional risk. This strategy is characterized by strong flexibility and adaptability, can be automated, and is applicable to multiple assets, providing liquidity to the market, but is relatively complex to implement.

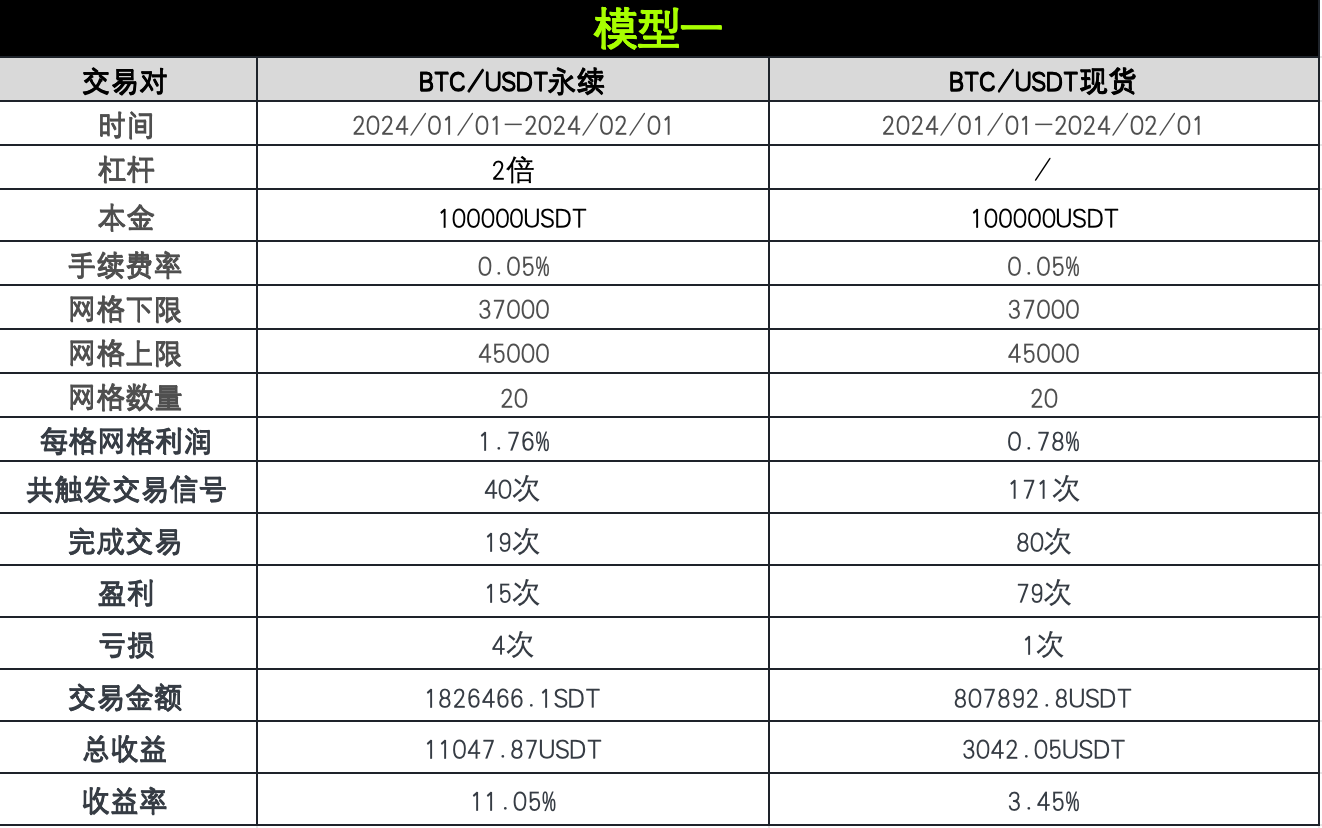

Model One

This model is: Neutral contract grid and spot grid under a 1-hour sideways oscillation running cycle

Figure 1: Neutral contract grid under a 1-hour sideways oscillation; Source: AICoin

Figure 2: Spot grid under a 1-hour sideways oscillation; Source: AICoin

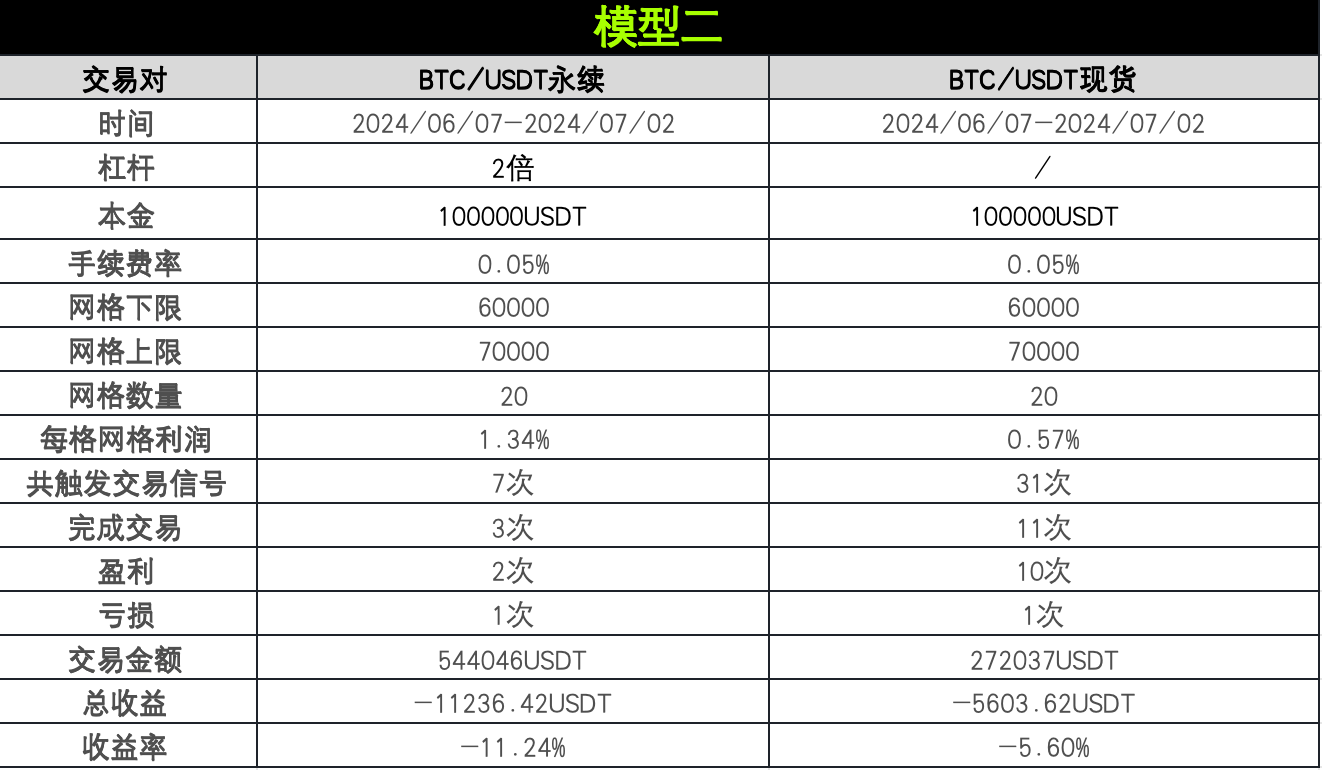

Model Two

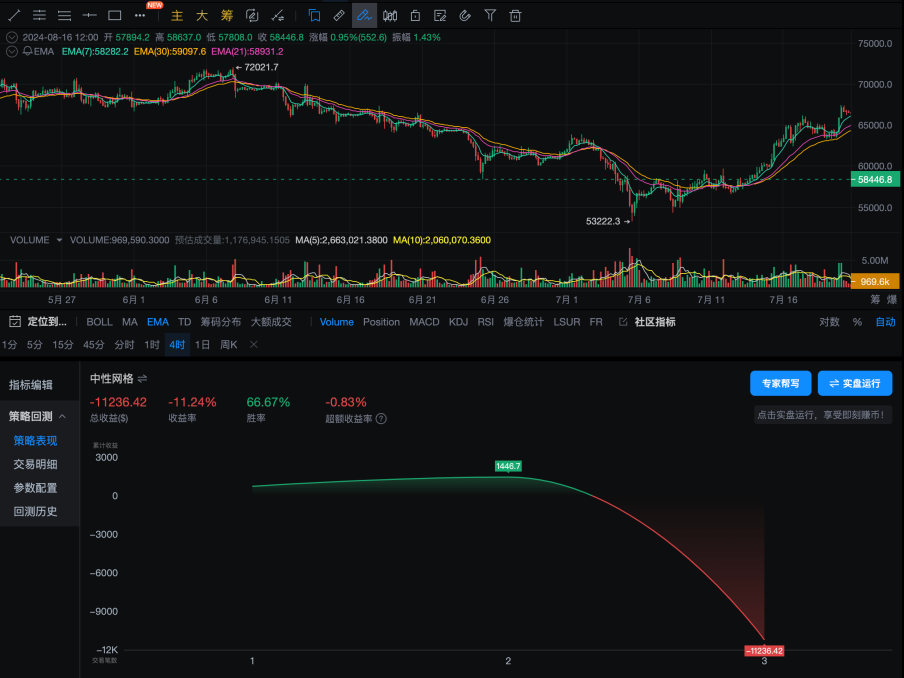

This model is: Neutral contract grid and spot grid under a 4-hour downward oscillation running cycle

Figure 3: Neutral contract grid under a 4-hour downward oscillation; Source: AICoin

Figure 4: Spot grid under a 4-hour downward oscillation; Source: AICoin

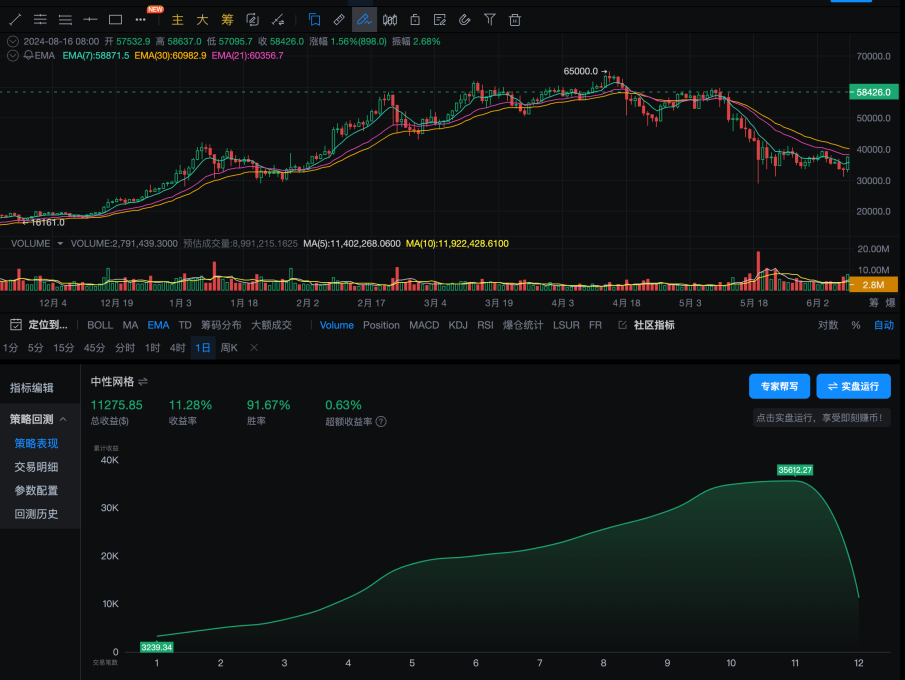

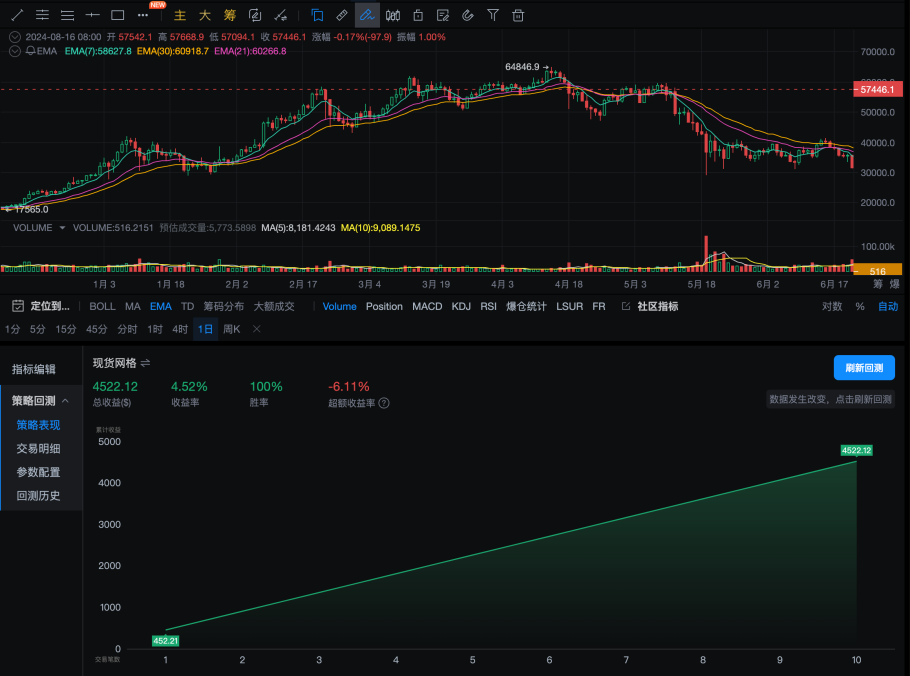

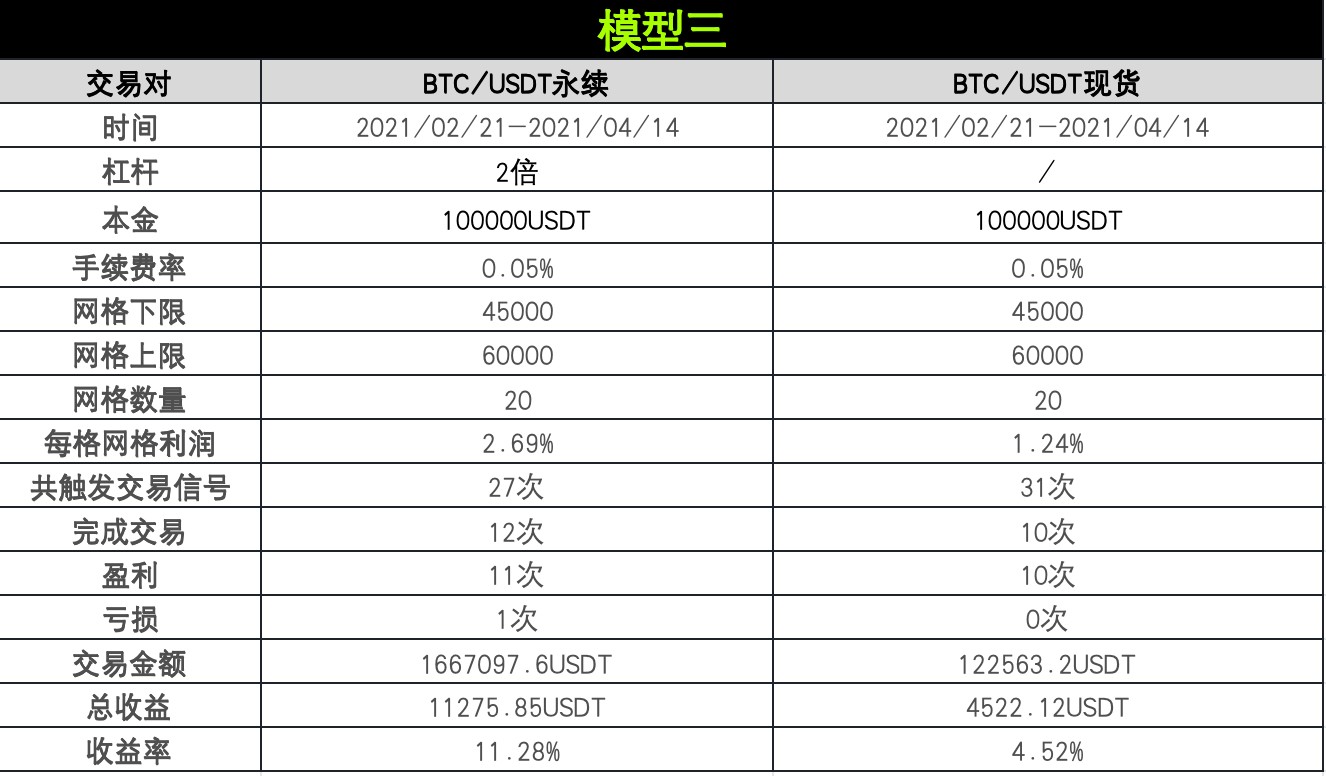

Model Three

This model is: Neutral contract grid and spot grid under a 1-day upward oscillation running cycle

Figure 5: Neutral contract grid under a 1-day upward oscillation; Source: AICoin

Figure 6: Spot grid under a 1-day upward oscillation; Source: AICoin

Analysis and Summary

The grid strategy performs differently under different market conditions, and traders need to choose the appropriate strategy based on market trends while balancing risks and returns. In models one and three, the neutral contract grid's return rate is significantly higher than the spot grid, especially in model three's upward oscillation environment, where the neutral contract grid's return rate reaches as high as 11.28%. In model two, which represents a downward oscillation environment, both the neutral contract grid and the spot grid incurred losses, indicating that both strategies performed poorly in a declining market.

By observing the performance of the spot grid in models one, two, and three, it can be seen that the win rate of the spot grid fluctuates significantly in different market environments, making its performance relatively unstable. While the neutral contract grid has higher returns, it also comes with higher risks due to the use of leverage. For example, in model two's downward oscillation market, leverage amplified the losses, while spot trading is relatively stable but may incur losses in unfavorable market conditions.

Specifically:

1. Performance of the Strategies

The contract grid strategy generally demonstrates higher potential returns in different market environments but may also face greater risks. The spot grid strategy performs well in sideways oscillation and upward oscillation markets but incurs losses in a downward oscillation market.

2. Risk and Return

The neutral contract grid strategy achieves higher absolute returns through the use of leverage but also carries higher risks. While the spot grid strategy has relatively lower absolute returns, considering the absence of leverage, its risk-adjusted returns may be more attractive in certain situations.

3. Market Adaptability

The neutral contract grid strategy demonstrates relatively stable performance in different market environments. The spot grid strategy performs well in an upward or sideways market but is susceptible to losses in a downward market.

4. Trading Activity

The neutral contract grid strategy typically has higher trading frequency and volume, which may help capture more market opportunities but could also result in higher trading costs.

5. Suitable Investors

The neutral contract grid strategy may be more suitable for investors with higher risk tolerance and a deep understanding of the market. The spot grid strategy may be more suitable for investors with lower risk tolerance seeking stable returns.

6. Risk Management

When using the neutral contract grid strategy, more cautious risk management is necessary, including setting stop-loss orders and monitoring leverage levels.

In conclusion, both strategies have their advantages. The neutral contract grid strategy offers higher potential returns and better market adaptability but also comes with higher risks. While the spot grid strategy may have relatively lower returns, it also has lower risks and can still provide stable returns in certain market environments. Investors should choose the strategy that best suits their risk tolerance, investment goals, and market judgment.

OKX & AICoin Grid Strategy

Currently, OKX's strategy trading offers convenient and diverse strategy varieties, including spot grid, contract grid, and infinite grid strategies. Whether it's OKX's spot grid strategy or contract grid strategy, they essentially involve an automated strategy of buying low and selling high within a specific price range. Users only need to set the highest and lowest price range and determine the number of grids to start running the strategy. If necessary, trigger conditions can also be set in advance, and the strategy will automatically start running when the market conditions are met. The strategy calculates the buy-low and sell-high prices for each small grid, places orders, and continuously earns profits from market fluctuations.

However, there are three key differences between OKX's contract grid strategy trading and spot grid strategy trading:

1) The contract grid strategy trades in the contract market, while the spot grid strategy trades in the spot market.

2) The contract grid strategy can use leverage, while the spot grid strategy cannot.

3) The contract grid strategy supports three trading strategies: long, short, and neutral, while the spot grid strategy only supports one-way trading.

Currently, OKX's grid strategy supports two creation modes:

1) Manual creation: Setting parameters and trigger conditions based on one's judgment of the oscillating market range. Currently, OKX's spot grid strategy and contract grid strategy can set price triggers and RSI technical indicator triggers.

2) Smart creation: Directly using the system's smart recommended grid strategy parameters.

How to access more strategy trading on OKX? Users can access the "Strategy Trading" mode in the "Trading" section of the OKX app or official website, and then click on "Strategy Square" or "Create Strategy" to start the experience. In addition to creating strategies, the strategy square currently also provides "Premium Strategies" and "Strategies with Copy Traders," allowing users to copy strategies or engage in strategy following.

OKX's strategy trading has multiple core advantages, including ease of operation, low fees, and security. In terms of operation, OKX provides intelligent parameter assistance to help users set trading parameters more scientifically and offers text and video tutorials for quick and thorough understanding. In terms of fees, OKX has comprehensively upgraded its fee rate system, significantly reducing user trading fees. In terms of security, OKX has a security team composed of top global experts, providing bank-level security protection.

Additionally, AICoin also provides users with various strategy trading options, allowing users to understand the current market more quickly and intuitively. Users can find the "Strategy Square" option in the "Strategy" section of the left sidebar of the AICoin product. Clicking here, users can find grid trading strategies in the "Featured Strategies" section.

At the same time, AICoin's grid strategy supports manual creation and AI grid creation, which can be found in the "AI Grid" section at the bottom of the "Market" option in the left sidebar. In this interface, users can see AI-recommended grid strategies for the trading pair and the option to manually create a grid strategy. In addition to grid trading strategies, this series will also introduce several other trading strategies, including the DCA strategy for all currencies. These trading strategies can all be found in the "Strategy Square" section of the left sidebar.

Disclaimer

This article is for reference only and represents the author's views, not the position of OKX. This article does not intend to provide (i) trading advice or recommendations; (ii) solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may experience significant fluctuations. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For your specific situation, please consult your legal/tax/trading professionals. Please be responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。