On the afternoon of August 12th, AICoin researchers conducted a live graphic and text sharing session on "Major Single Advanced Tactics (with Membership)" in the AICoin PC-end - Group Chat - Live. The following is a summary of the live content.

I. Market Hotspots This Week

The market this week is filled with various major news, especially pay attention to Trump's movements.

With the fermentation of related news, dogecoin, meme coin, and Trump token may usher in a wave of market trends.

II. The Significance and Application of Major Single

Major players usually enter the market with the help of events. Currently, Trump's dialogue is a typical opportunity. In the next few days, large orders in the market will gradually emerge.

You can open the perpetual currency pair of Binance. Let's start with some simple examples.

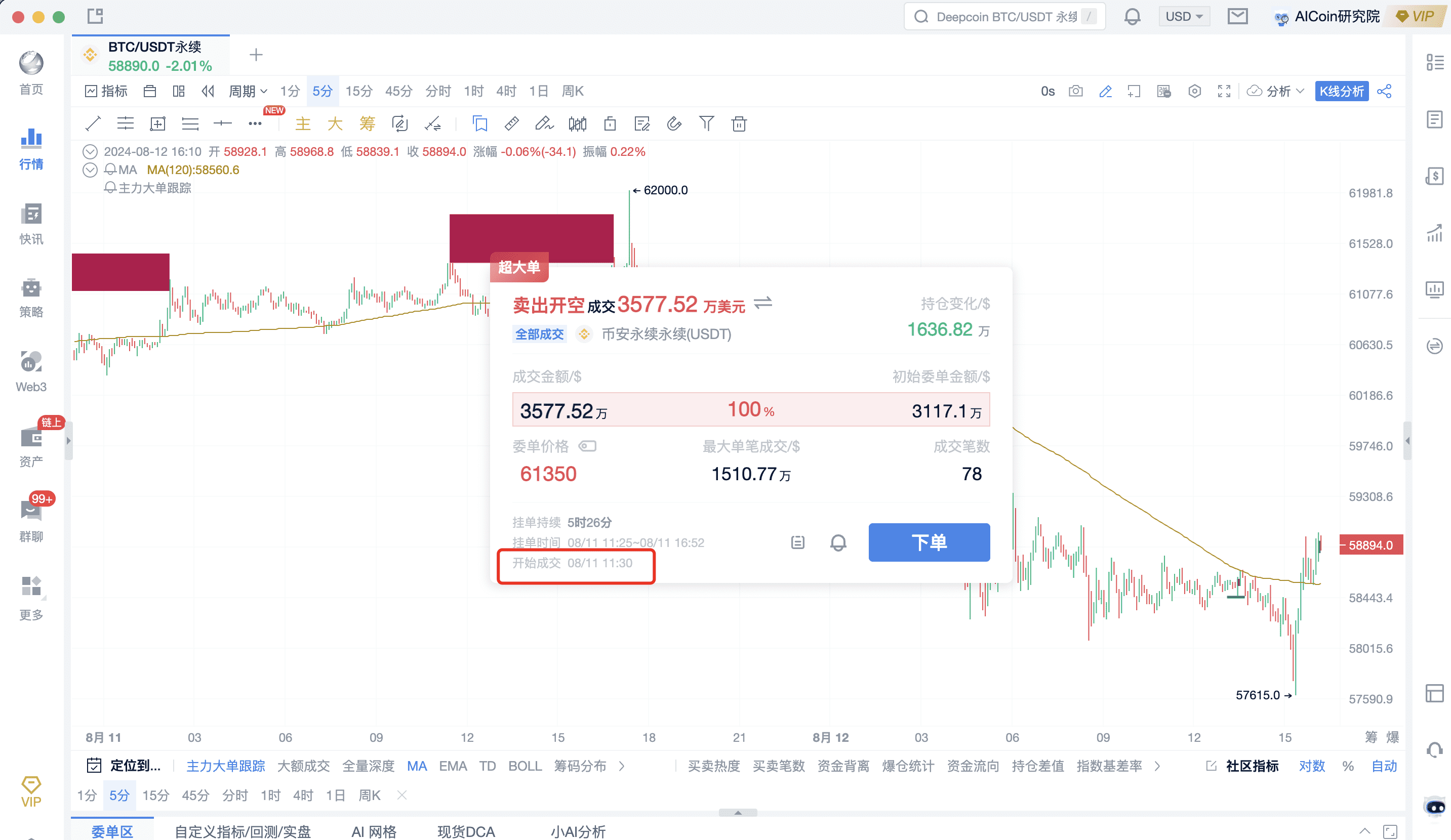

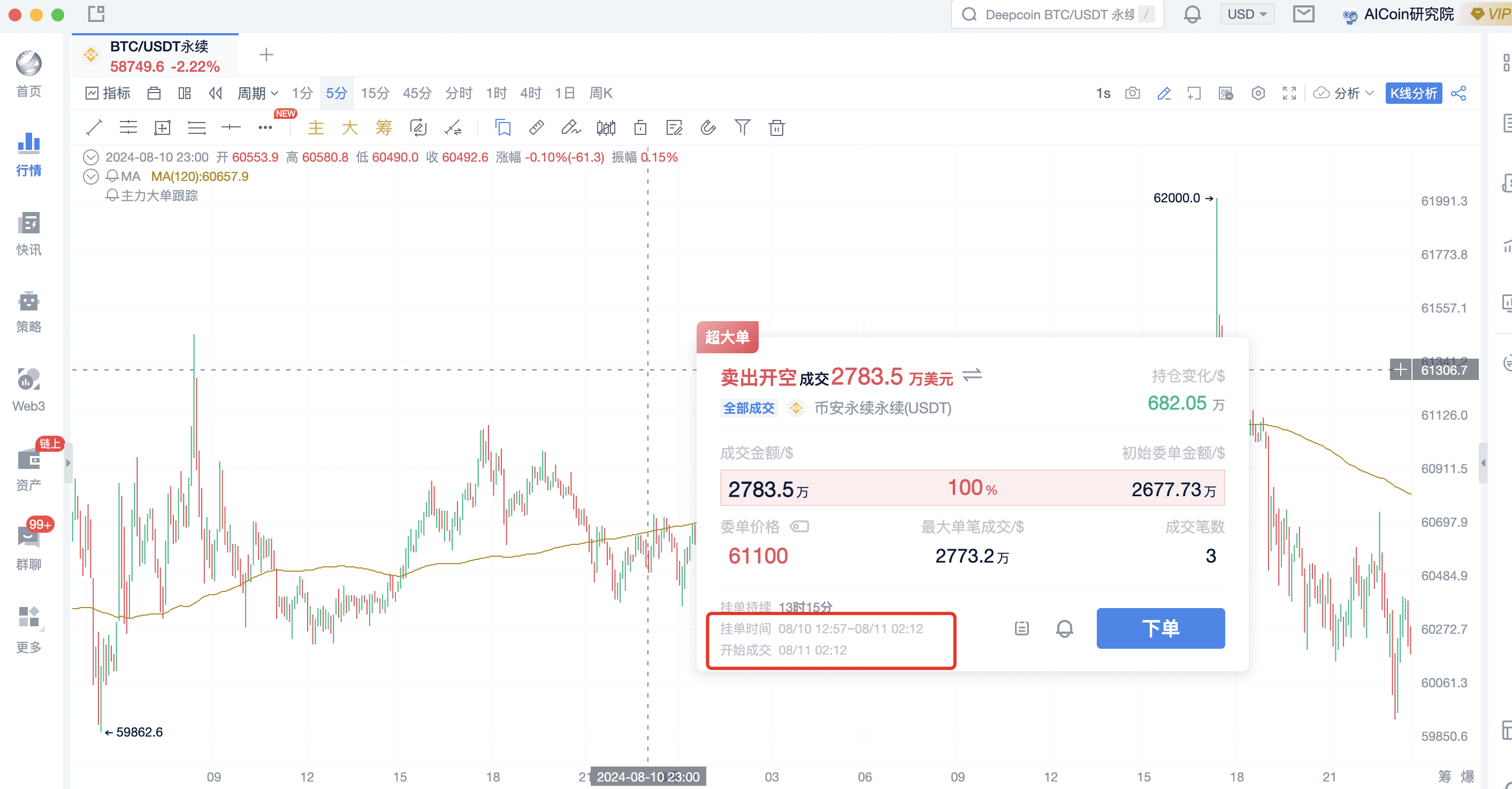

On August 11th, a super large sell order of $35 million appeared in the market, causing a significant price drop. This is the most basic and practical form of major single - a transaction of over tens of millions often means that the major player has locked in this price and started to lay out.

Some friends may ask: Why would the major player leave such an obvious trace?

The answer is, this is not left by the major player, but is accurately analyzed by us at AICoin after more than ten years of research based on market order book and transaction information. This tool is also one of the important tools for PRO members and is very worth using for PRO members.

Pulling back a bit, look at other data to see if the performance of major single has always been effective. Going back a bit further, there are also instances where the major player did not just open one position at a high level, but opened multiple short positions.

It's obvious, they want to control the market. Every time they encounter a high level, they make a big move.

This indicates two things:

- Either they are starting to look at the direction of the market after the layout.

- Or they currently have a short position, and they cannot let the price go up.

With a large number of chips in the hands of the major player, it is important to be very clear about what the major player is doing in the market.

III. Advanced Tactics: 5-Minute MA120 + Major Single Tactics

The "5-Minute MA120 + Major Single" tactic, through comprehensive analysis of time, price, market sentiment, and fund flow, can effectively improve the success rate of market operations. Its key points include:

5-minute cycle: Suitable for medium and short-term operations, with a moderate frequency of change.

MA120 indicator: As a traditional trend indicator, it can support market analysis well.

Major single data: Analyze the movement of major funds through large transactions and market sentiment.

So how do you operate? It's very simple, we just need to be able to look at basic transaction data, and break through the MA120 when it falls sharply.

Let's remember its buying and selling rules:

① When there is a continuous decline and a dense buy wall appears, and the price breaks through the 5-minute MA120, it is a strong buying signal.

② When there is a continuous rise and a dense sell wall appears, and the price falls below the 5-minute MA120, it is a strong selling signal.

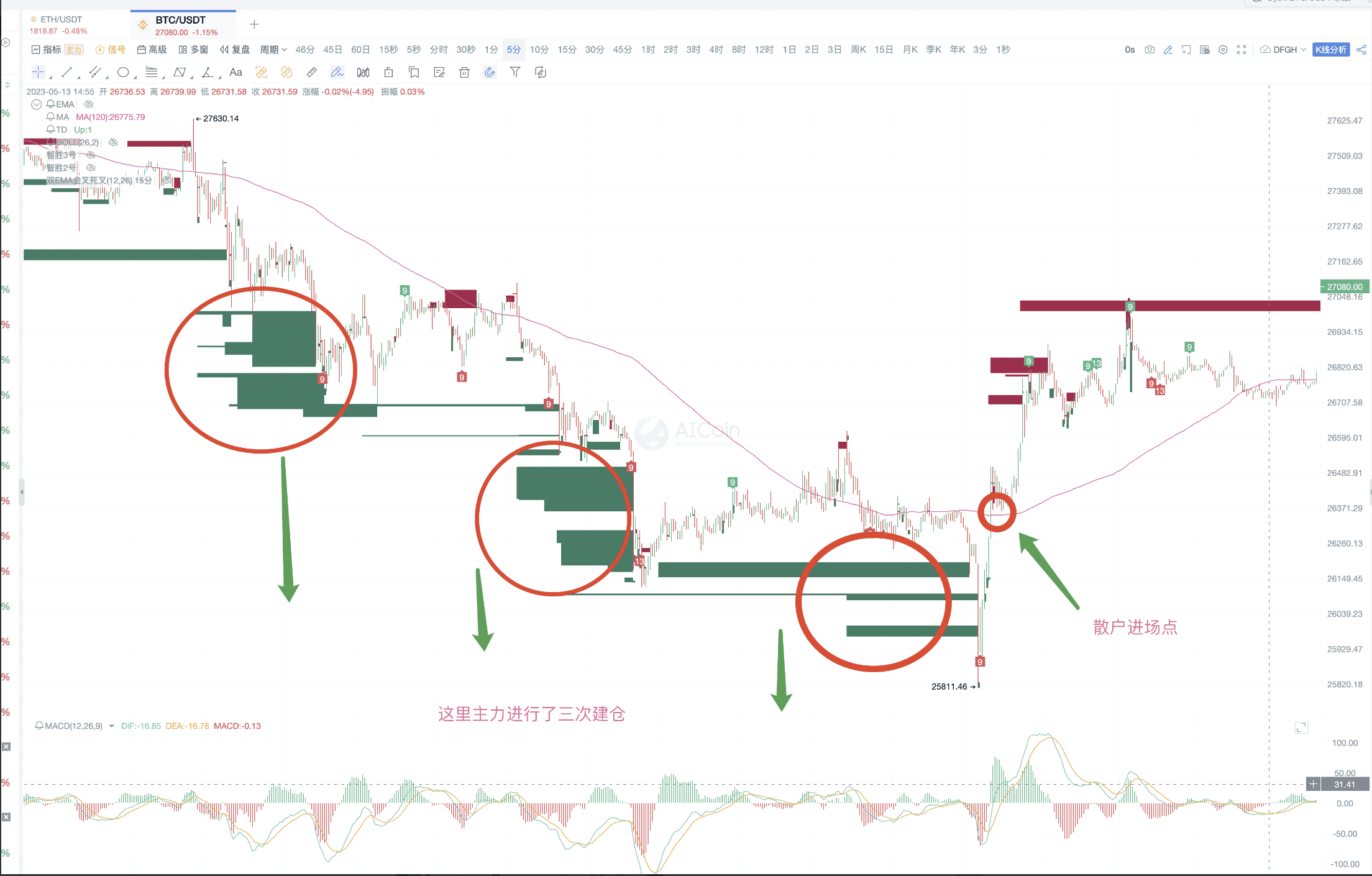

Let's look at the recent signal for ETH,

This is actually a relatively suitable buying point. Of course, its drawback is that when it continues to fall, there are no large buy orders. Everyone needs to have a very clear understanding that the major player has too many chips, and he will not place just one order, he will definitely place several.

In addition, the research institute found a very classic example from before,

As a retail investor, tracking the major player and combining it with MA120 can accurately find buying points.

For BTC here, it also counts

Summary and Key Points

The key to this tactic lies in two core points:

- The transaction volume of major single at the tens of millions level.

- The combination of the 5-minute cycle and the MA120 indicator.

By mastering these two points, investors can more accurately track the movements of major players and capture market opportunities. This strategy is simple and effective, and is a practical tool to improve trading success rate.

IV. Q&A

Q: Will the major player be eliminated by a larger major player?

A: Yes, this will happen, but generally this kind of market occurs more in a super bull market situation. Some major players control the market, but are supported by larger financial institutions.

For example, on July 29th, when it broke through 70,000, I was still live at that time, and I happened to see the major player laying out a large order of over 30 million at 70,000, and I specifically reminded everyone in the live broadcast room. Therefore, this tactic shows that identifying major single in the market is effective. For large orders at the tens of millions level, we need to pay attention, and for super large orders like over 30 million US dollars, if you don't follow up and understand, it's a pity.

Q: If the gap between the pending order and the market order is high, and there are many large market orders, which one should be used as the basis during the consolidation period?

A: If they are inconsistent, we recommend that the direction of the major player's pending order is better, because closing orders can better represent market sentiment. Of course, resonance would be even better.

Q: Will the orders opened by the major player be trapped?

A: Yes. But the major player has a lot of bullets. If he has his own position, he will continue to control the market, similar to what I showed at the beginning, opening short positions at high levels, and it is a very large amount of short positions, because the upward attack has mobilized the psychology of retail investors to chase the rise and kill the fall, making it very easy to achieve sales.

Q: How does AICoin obtain the data for pending orders? Is it seen through the exchange or obtained through other means?

A: How is the pending order of the major player obtained? It is a comprehensive monitoring algorithm obtained by the AICoin research institute through very in-depth analysis, screening, and integration of overall market data and the characteristics of digital currencies.

Q: If the price is at 70,000 and the major player's pending order is at 65,000, can the next action be understood as smashing back to 65,000 and attracting long orders?

A: This is also a usage of large orders, called large order attraction. The method you mentioned exists and needs to be combined with conditions. Similarly, if a major player appears in the opposite direction, and if a super large market sell order appears above, then there is a high probability that this position will be reached. The direction is correct, and it is recommended to continue using the major single tool, it will provide corresponding returns.

Recommended Reading

- “Profitable Signal Tactics”

- “Halving Effect? Middle East Situation? - Comprehensive Strategy for Turbulent Markets”

- “How Can Novices Trade Coins Correctly”

For more live content, please follow AICoin's "News/Information - Live Review" section, and feel free to download AICoin PC-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。