Original | Odaily Planet Daily ( @OdailyChina )

Author | Wenser ( @wenser2010 )

Recently, the official custodian of the WBTC project, BitGo, announced that "it will establish an exclusive partnership and joint venture with Bit Global, and its WBTC business will be transformed into the world's first cross-jurisdictional and cross-institutional custody business," the latter being a global custodian platform supported by Sun Yuchen and the Tron ecosystem.

As WBTC plays an important "bridge" role in the DeFi field (according to WBTC's official website, the current amount of WBTC custody on the Ethereum chain exceeds 154,738, with a total value of over $9 billion), the news has attracted widespread attention in the industry.

In this article, Odaily Planet Daily will briefly introduce and comment on WBTC and recent changes, analyze its impact on Bitcoin and Ethereum prices, and discuss "centralization risks" and chain reactions.

The Birth of WBTC: A "Key Bridge" Connecting Bitcoin and Ethereum

For many crypto players who are only active on the Ethereum network, WBTC (Wrapped BTC) may be a relatively unfamiliar term compared to WETH (Wrapped Ether). However, for experienced DeFi players, WBTC is an important "tool" and "bridge" that has brought liquidity to many Dapps in the DeFi field.

A New Solution to Liquidity Issues: Introducing Bitcoin to Ethereum

As early as 2018, BitGo CTO Benedict Chen briefly explained WBTC, emphasizing at the beginning:

WBTC aims to introduce Bitcoin as an ERC20 token to the Ethereum network. This token will bring the stability and value of Bitcoin to Ethereum's extensive decentralized application ecosystem.

With this, WBTC users will be able to use Bitcoin in various new decentralized use cases (Dapps), including as stablecoins on decentralized exchanges (DEX) or as collateral for lending within the Ethereum ecosystem's payments and flexible smart contracts.

In 2019, with the advocacy of BitGo, Kyber Network, and Ren, many decentralized projects including Kyber Network, Republic Protocol, MakerDAO, Dharma, Airswap, IDEX, Compound, DDEX, Hydro Protocol, Set Protocol, Prycto, RadarRelay, and Gnosis began to support WBTC, achieving "the first tokenization of Bitcoin in a fully reserved manner" and "pegged to Bitcoin at a 1:1 ratio." Subsequently, star projects such as AAVE, Uniswap, 0x, and Coinlist also joined this "community."

WBTC official website supported project interface

It can be said that WBTC has greatly facilitated users and DEX, ERC20 wallets, or other DApps—bringing liquidity related to the Bitcoin market to the Ethereum chain without the need to run a separate Bitcoin node, significantly reducing transaction time and paths.

A Previous Attempt: Another Development After Tokenizing Gold

In 2017, BitGo collaborated with industry partners such as the Royal Mint and the Chicago Mercantile Exchange Group to create Royal Mint Gold (RMG), achieving "tokenization of gold." The landing of WBTC has tokenized "digital gold"—Bitcoin, which can be seen as a "new attempt" with a mature case.

At the same time, WBTC can also be seen as a strong response to the "tokenization of assets such as securities, commodities, and real estate" that many institutions are highly interested in, and to some extent, it provides practical examples for recent RWAs.

The Important Role of WBTC: Reducing Bitcoin Circulation and Boosting Price

It is worth mentioning that by connecting DeFi with the Bitcoin market, the emergence of WBTC also means that unless the holder redeems it, the Bitcoin held as WBTC collateral is basically in a custodial state (similar to long-term holding), which to some extent reduces the circulation of Bitcoin, thereby becoming a positive factor driving the rise in Bitcoin prices.

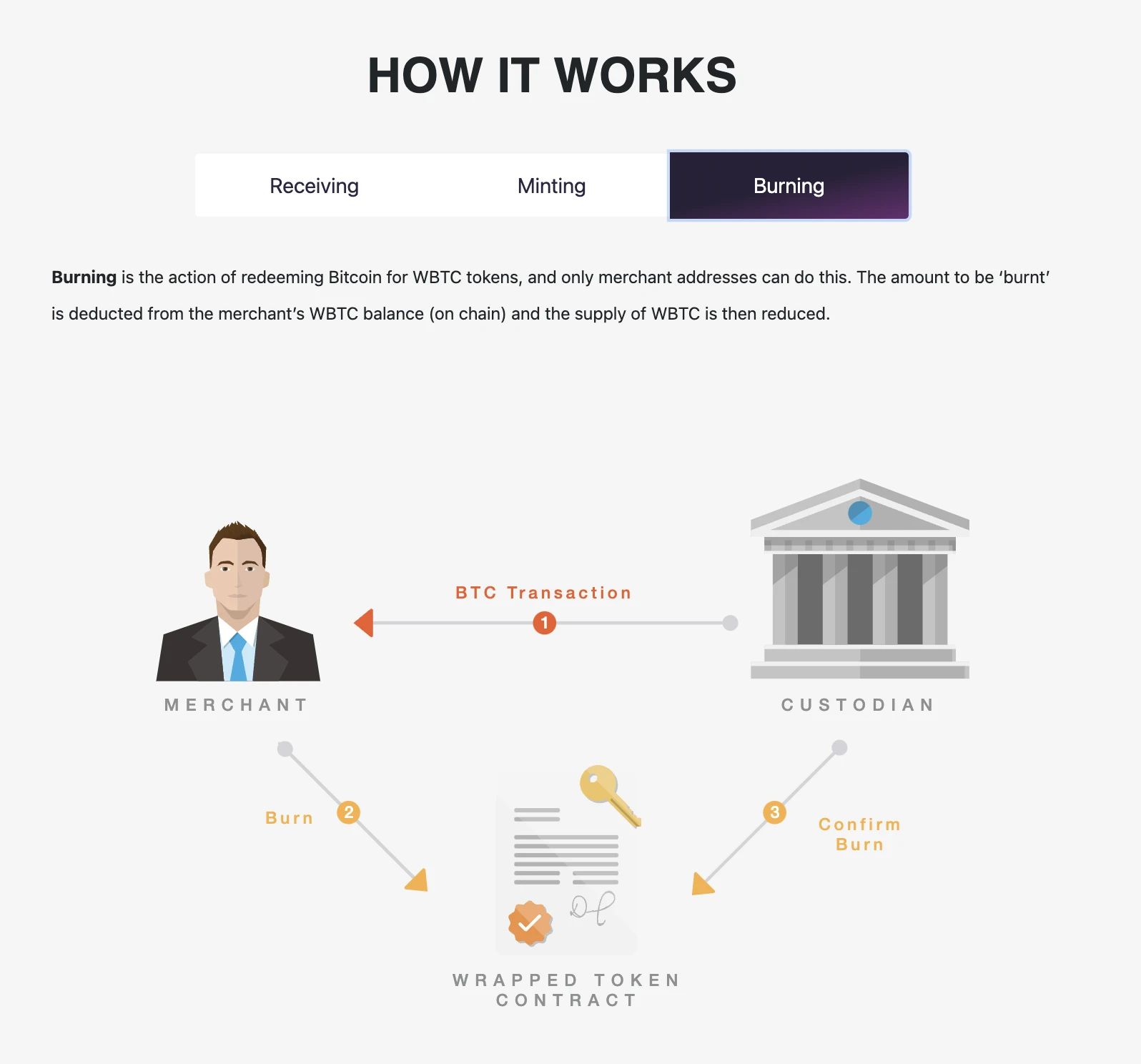

In addition, the Burning process mentioned on the WBTC project's official website also explains the possible reduction in WBTC supply, and "only Merchant addresses can execute the burning operation."

WBTC official website introduction interface

The Rise of WBTC: DeFi Summer and the Prosperity of the Ethereum Ecosystem

From the perspective of users, Dapps, and the overall Ethereum ecosystem, WBTC is a "win-win" situation, after all, increasing liquidity and flexible access are conducive to the efficient operation and stable growth of the market. However, the development of WBTC is not "an overnight success."

A Rapid Start: DeFi Summer

In January 2019, the first WBTC was successfully minted.

In July 2020, the daily trading volume of WBTC exceeded $1 million.

In October 2020, the daily trading volume of WBTC surpassed $50 million.

By the end of October 2020, benefiting from the increasing number of "liquidity mining projects" in the DeFi Summer boom, the market capitalization of WBTC exceeded $1.5 billion, making it the 6th largest cryptocurrency on the Ethereum network, second only to CRO, USDC, LINK, BNB, and USDT. At that time, its market capitalization ranked 18th in the cryptocurrency market.

In December 2020, the quantity of WBTC exceeded 115,000, with a market capitalization of $2.5 billion, ranking first among DeFi projects.

In June 2021, over $6 billion worth of Bitcoin was tokenized as WBTC on the Ethereum network, meaning that "1% of the total circulating supply of Bitcoin at that time had been tokenized as WBTC."

Of course, the growth of asset shares and the generation of WBTC based on the Ethereum ecosystem also laid the groundwork for hacking incidents.

WBTC Theft Cases: Proliferation of Hacker Attacks

In 2022, Inverse Finance suffered a flash loan attack, losing 53.2445 WBTC.

In 2023, Nirvana was hacked, and the attackers subsequently exchanged 3.3 WBTC for 48 ETH and 2.9 WBTC for 41 ETH.

In May 2024, a whale incurred malicious transactions due to a phishing attack, resulting in a loss of 1155 WBTC worth $68 million. Later that month, the attacker of Sonne Finance exchanged 59 WBTC for 1,185 ETH and 183,000 DAI.

Moreover, WBTC has been a favored token in hacking incidents involving platforms such as Balancer, Poly Network, Harmony Cross-Chain Bridge, HopeLend, Nomad Cross-Chain Bridge, EulerFinance, and Orbit Chain.

Alameda Research: Former Largest WBTC Minter

Another widely discussed event related to WBTC was the "unpegging crisis" in November 2022—WBTC/BTC briefly dropped to 0.9276 on November 23 and rebounded to above 0.99 on November 24. At the time, Alameda Research, which had applied for bankruptcy and was the largest minter of WBTC, had minted a total of 101,746.1 WBTC and burned 29,435.3 WBTC. Kyber Network CEO Victor Tran proposed to migrate the WBTC Big DAO to a new signature contract on November 25. The voting ratio changed from 11/18 to 8/13, and FTX-related Blockfolio (FTX) addresses would be removed. New members included B.Protocol, Badger, Balancer, BitGo, Chainlink, Compound, Gopax, Krystal, Kyber, Loopring, Multichain, Ren, and Tom Bean.

Subsequently, Alameda's inability to mint BTC but not custody BTC did not have a systemic impact on WBTC. On the eve of FTX's bankruptcy, an anonymous representative of Alameda applied to redeem 3,000 WBTC, but BitGo ultimately rejected the request due to non-compliance with the process.

New Changes in WBTC: Introduction of Tron Ecosystem and Sun Yuchen's Support

Based on past information, BitGo's recent announcement of introducing support from the Tron ecosystem and Sun Yuchen is not a hasty decision but rather a premeditated move.

Financial Games: Acquisitions and Counter-Acquisitions

In November 2022, sources claimed that BitGo was in preliminary discussions to raise new funds at a valuation of $12 billion, emphasizing that it had no risk exposure to companies such as FTX, Alameda, Three Arrows Capital, and Celsius. Previously, Galaxy Digital announced the termination of its acquisition of BitGo in April of that year due to the failure to provide required financial statements on time. In September, BitGo officially sued Galaxy Digital and sought $100 million in compensation.

In June 2023, a Delaware court ruled that Galaxy had "valid grounds" to terminate the acquisition of BitGo. That month, BitGo first announced plans to acquire the Nevada-regulated crypto custody company Prime Trust, and then decided to terminate the acquisition later that month.

It must be said that BitGo's financial games may have already been brewing changes at that time.

Turnaround: $100 Million Financing, $17.5 Billion Valuation

In August 2023, BitGo completed a $100 million financing at a valuation of $17.5 billion. However, BitGo only stated that the investors were from the United States and Asia. It wasn't until the recent announcement of BitGo's multi-jurisdictional custody of WBTC that people realized that the investors at that time might have included Sun Yuchen.

The joint venture company established with BitGo, Bit Global, founded on August 9, 2023, is a "strategic partner" with close ties to Sun Yuchen and the Tron ecosystem, with BitGo being only a minority shareholder in the new joint venture.

In view of this, despite Sun Yuchen's statement that his involvement in the WBTC project is only to provide strategic support and does not affect the project's security and decentralization, it is not surprising that industry insiders and organizations, including Jupiter co-founder Meow, BODL Fund founder Liu Feng, and Maker DAO risk management team Block Analitica Labs, have raised doubts and reacted to the "centralization crisis" of WBTC.

Centralization Concerns: Potential Chain Reaction from WBTC

According to Dune data, currently over 41% of WBTC is used in the lending ecosystem, with MakerDAO being the largest collateral provider (the largest on-chain collateralized lending protocol in the industry, managing assets of nearly $5 billion, and has initiated a proposal to "reduce the scale of WBTC collateral" to address potential custody change risks), and another nearly 32% is used for direct trading.

Due to the influence of WBTC inflows on many DeFi projects, if WBTC were to unpeg again, a large number of DeFi projects and L2 ecosystems would be at risk, potentially triggering a chain reaction. This is a key reason why BitGo's recent actions have sparked reactions from multiple parties.

No one wants to entrust their "fortune and life" to a "powder keg" that could cause a "chain explosion."

However, where there is fear, there is also "greed." Previously, the firm ETH/BTC bull James Fickel spent 12 million USDC to buy 211 WBTC at an average price of $56,824 from August 6th to 9th. It is unknown how he feels now, but WBTC still holds a dominant position in the market.

Conclusion: WBTC is inherently centralized, custody ownership is key

In summary, BitGo itself is a centralized custodian, and WBTC is a form of centralized synthetic asset. However, it is only due to its multi-signature and cold storage technology for securing assets and on-chain reserve proof since 2019 that the market and users believe that "WBTC is a trusted asset" and use it in multiple scenarios.

Therefore, despite BitGo CEO Mike Belshe's statement that Bit Global has a separate client fund custody team, cannot lend out funds, and cannot dispose of funds at will, and emphasizes that "in terms of certification, wbtc.network will continue to operate," it still cannot completely dispel the market's doubts about "custody ownership."

Whether WBTC can continue to be the "key bridge between Ethereum and Bitcoin" may depend on BitGo's next "self-justification action."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。