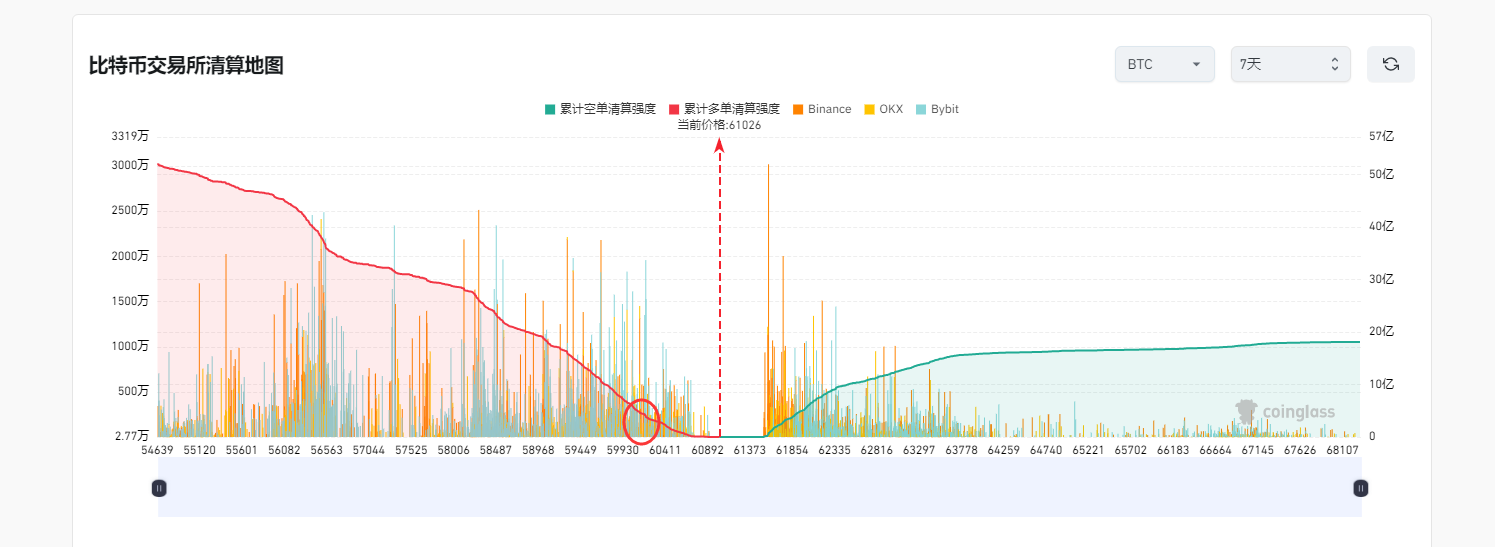

This week can be said to have experienced ups and downs, but the overall trend is still within our expectations. Last week, we worked around 60,000 and promptly turned south. Although we didn't catch the top, we also successfully took profit near the support of over 54,000, but the downturn far exceeded expectations. After the oversold condition, the subsequent trend basically revolved around the rebound. Observant friends may also notice that after the breakthrough this week, it has been calling for buying at the bottom. Currently, the price has returned to above 60,000. I wonder if you seized the opportunity.

From a technical analysis perspective, the market has entered a narrow range oscillation over the weekend. A sudden small spike occurred at noon. Looking at it from the Fibonacci perspective, the current support is near 60,000, and the pressure is near 62,000. However, the overall trend is definitely still biased to the north. At the 4-hour level, the upward trend is gradually decreasing in volume, showing a potential death cross trend. However, it hasn't gone down much. As the saying goes, when the death cross doesn't go down, it's the bottom. You should understand what I mean! This week, the upward trend is still the main focus, and the general direction has always been unchanged! Plus, with the expectation of interest rate cuts in September, the overall situation can be expanded a bit, and it's advisable to hold for the long term until it reaches one hundred thousand!

BTC operation suggestion: Go long near 60,000

Target: 65,500

Specific operations should be based on real-time market data. For more information, you can consult the author. The article is subject to delays in publication, and it is recommended for reference only. Trade at your own risk.

In the market, there are many imitators but few successful ones. The easy path often leads downhill, and seemingly favorable market conditions are often in decline. Those without an umbrella walk alongside those with one, but no matter how close they are, they cannot escape the rain and end up getting even wetter. It's better to be carefree. Excessive worries will only make the original trading situation worse. Don't let yourself become confused with worries and uncertainties. What needs to be done is to unconditionally believe and strictly execute decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。