On the evening of August 8th, AICoin researchers conducted a live graphic and text sharing session on the topic of "24/7 Profit-Making Tools, Come and Join (Free Membership)" in the AICoin PC-end Group Chat Live. Below is a summary of the live content.

In today's live session, the AICoin Research Institute mainly introduced a 24/7 profit-making tool called Ai Grid to everyone.

As a grid trading robot, it automatically executes the buying and selling process of cryptocurrencies within a pre-set price range, aiming to profit from price fluctuations and achieve stable profits.

I. What is a grid trading strategy?

Grid trading is a strategy used in the spot market of cryptocurrency trading, where buy and sell orders are pre-set above and below the current market price. Its purpose is to profit from price fluctuations, regardless of whether the user holds positions for the long or short term.

1. What are the benefits of using a grid robot?

✅ Automated trading, saving time and effort

✅ Strategic profit-making, trading within the set price range

✅ Risk management, multiple termination options (such as stop loss and take profit)

✅ Intelligent parameters set through backtesting historical trading data, making it easy to start your grid trading

✅ Reduced time investment. You can choose to manually terminate the robot and select different methods, such as selling all cryptocurrencies at the market price. You can also manually set trigger prices for take profit or stop loss when creating the grid, to decide when to terminate.

By utilizing these different termination options, you can optimize your trading strategy, achieve the desired profit targets, and reduce risk at the same time.

2. Will the back and forth funding rate be very high?

The funding rate will not incur additional charges. The amount deducted in trading on the exchange is the same on the AiCoin platform.

Taking Binance as an example, the funding amount is calculated using the following formula:

Funding amount = Nominal value of position * Funding rate

Where,

Nominal value of position = Mark price * Contract size (for USDT-margined contracts)

Contract multiplier * Contract size / Mark price (for coin-margined contracts)

The mark price here is calculated in real-time and may differ from the mark price pushed every second. The specific mark price for each funding cost settlement can be found here.

On the Binance futures trading platform, the funding cost for all Binance perpetual contracts is generally calculated every 8 hours, at 08:00, 16:00, and 24:00 Hong Kong time. Only when a trader holds a position in any direction at the time of funding cost collection will the corresponding funding rate be charged or paid. If there are no positions held at that time, no funding costs will be charged or paid. In other words, no additional fees will be deducted.

II. How to set up a grid strategy on AiCoin?

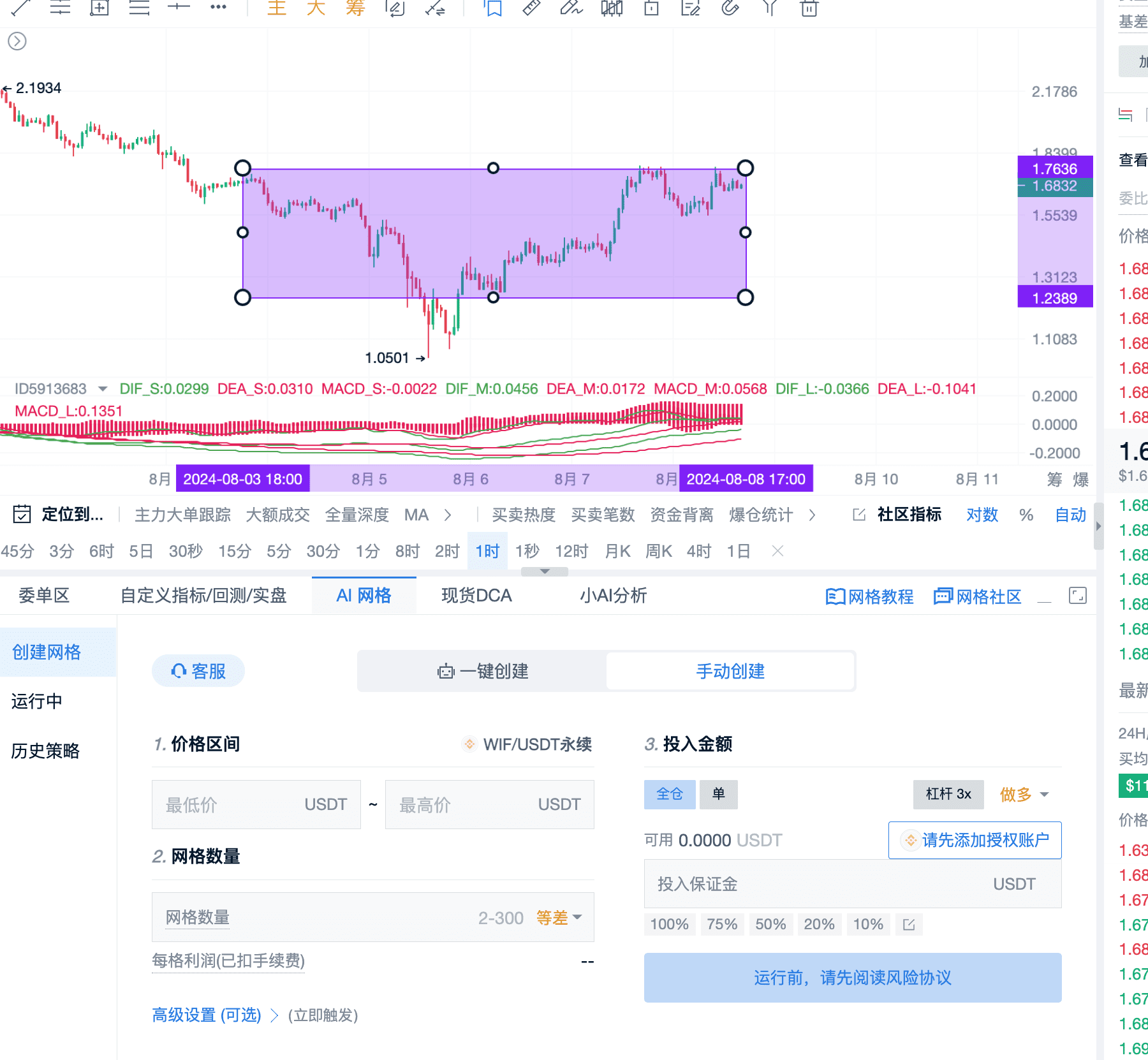

"Market Bottom" -> Ai Grid. Choose the grid strategy mode.

There are 2 grid strategy modes to choose from.

One-click creation: Use the system's recommended auto-generated parameters to set up the grid strategy

Manual creation: Customize grid strategy parameters to match your preferences

For beginners in grid strategy, it is recommended to start with the [One-click creation] mode.

Setting up grid strategy [One-click creation]

Click on one-click creation

Enter the initial investment amount for the grid strategy [ETH/USDT]. Enter the amount in USDT.

Click "Create Strategy" to complete the setup and start waiting for price fluctuations to generate profits.

To maximize the profit of the grid strategy, it is recommended to set the price range of the grid strategy above and below the current market price.

Setting up grid strategy [Manual]

Simple 3 steps, next, let's talk about the concepts and principles of these three steps:

First, you can customize grid strategy parameters according to your preferences, including price range, initial investment, number of grids, and quantity per grid.

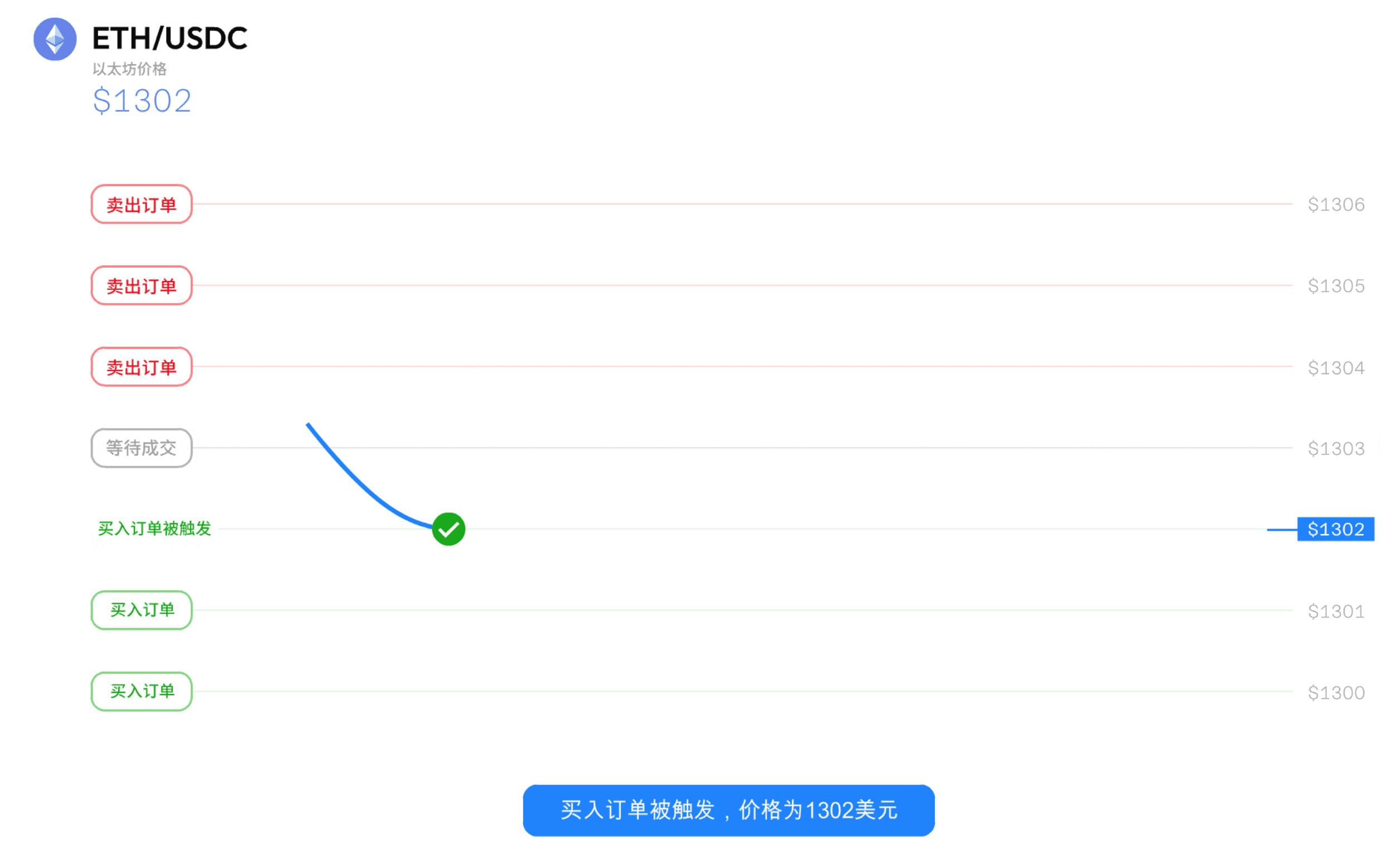

The number of grids is how you divide the money, there are a total of 7 in the figure below;

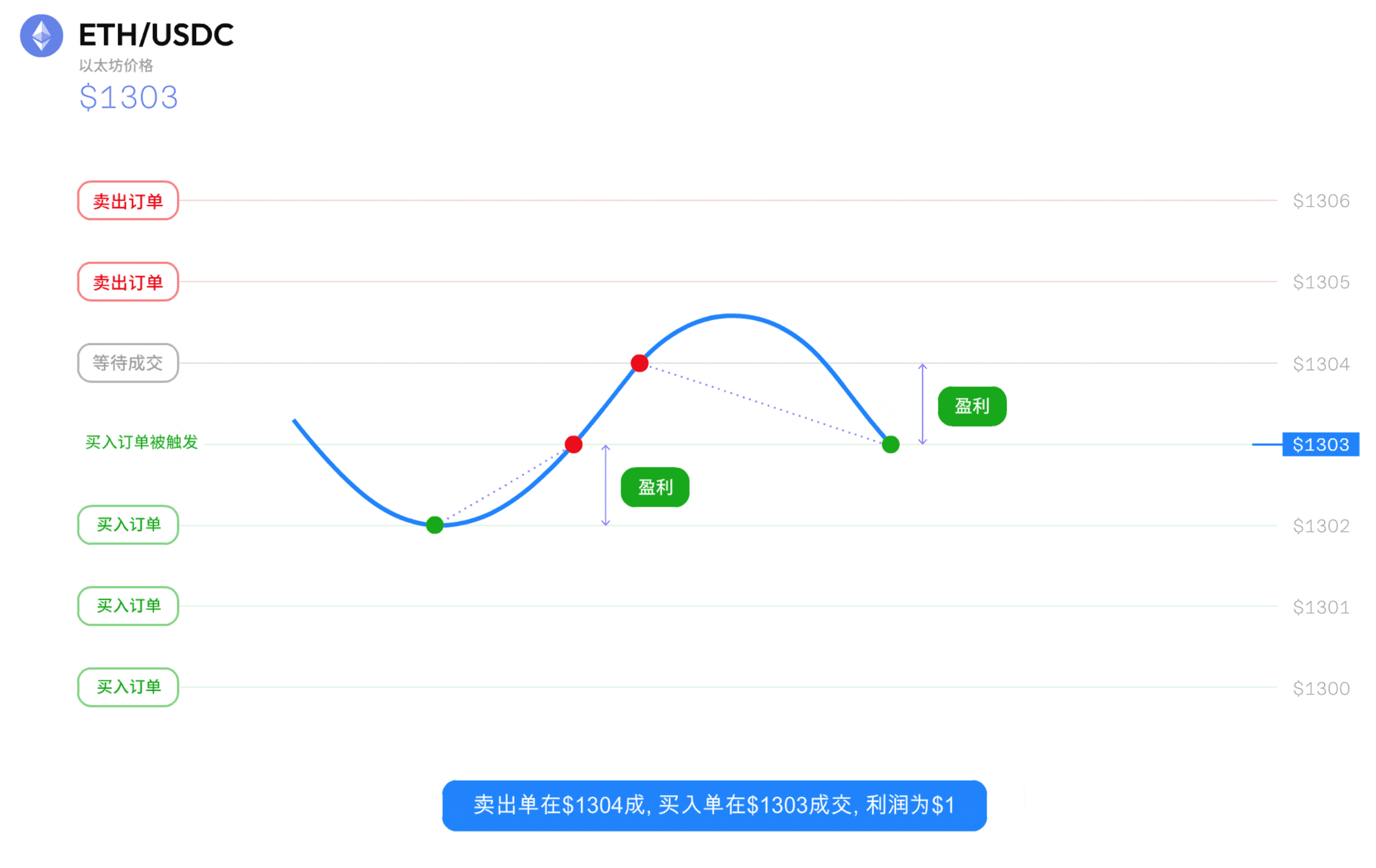

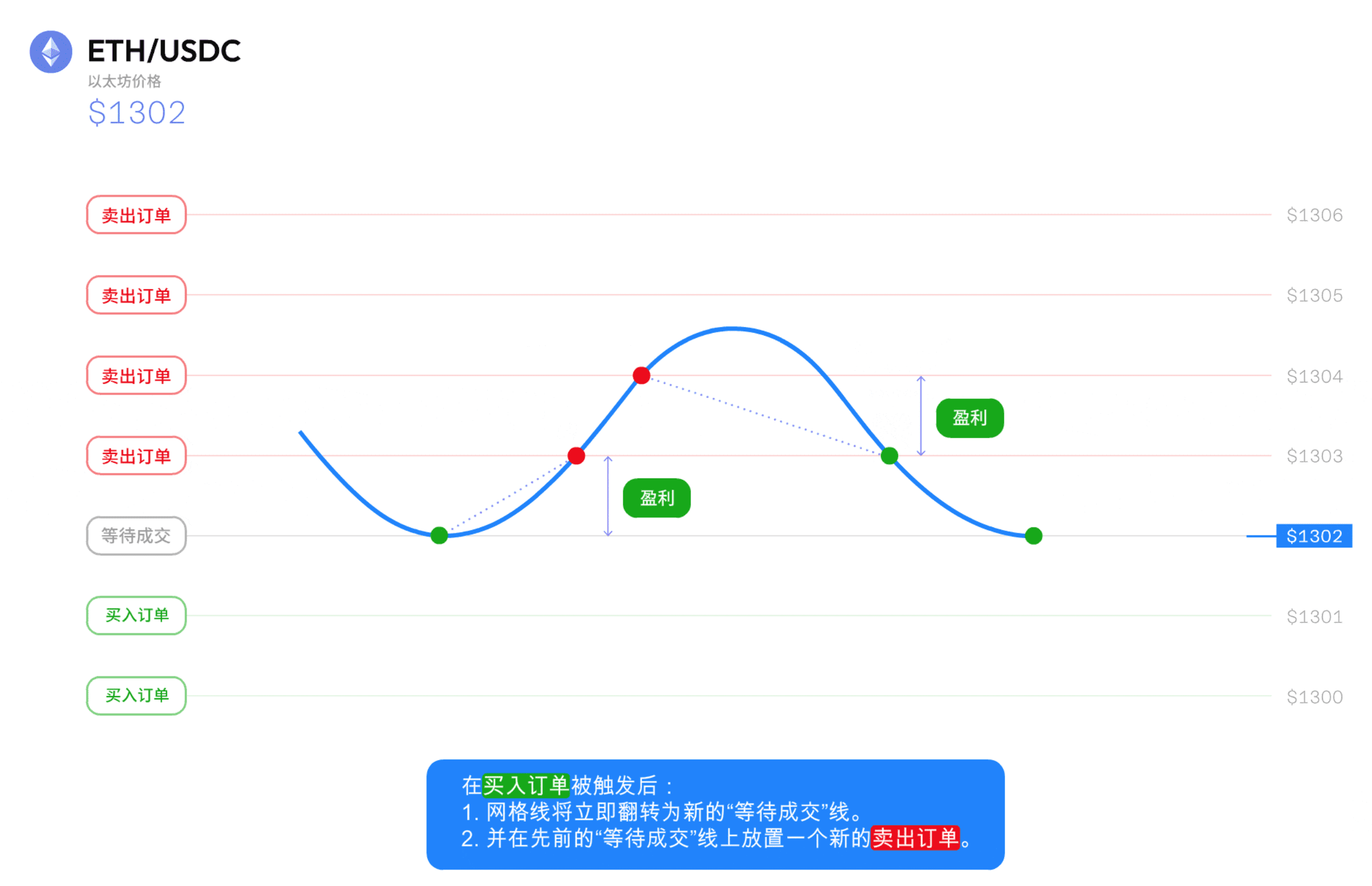

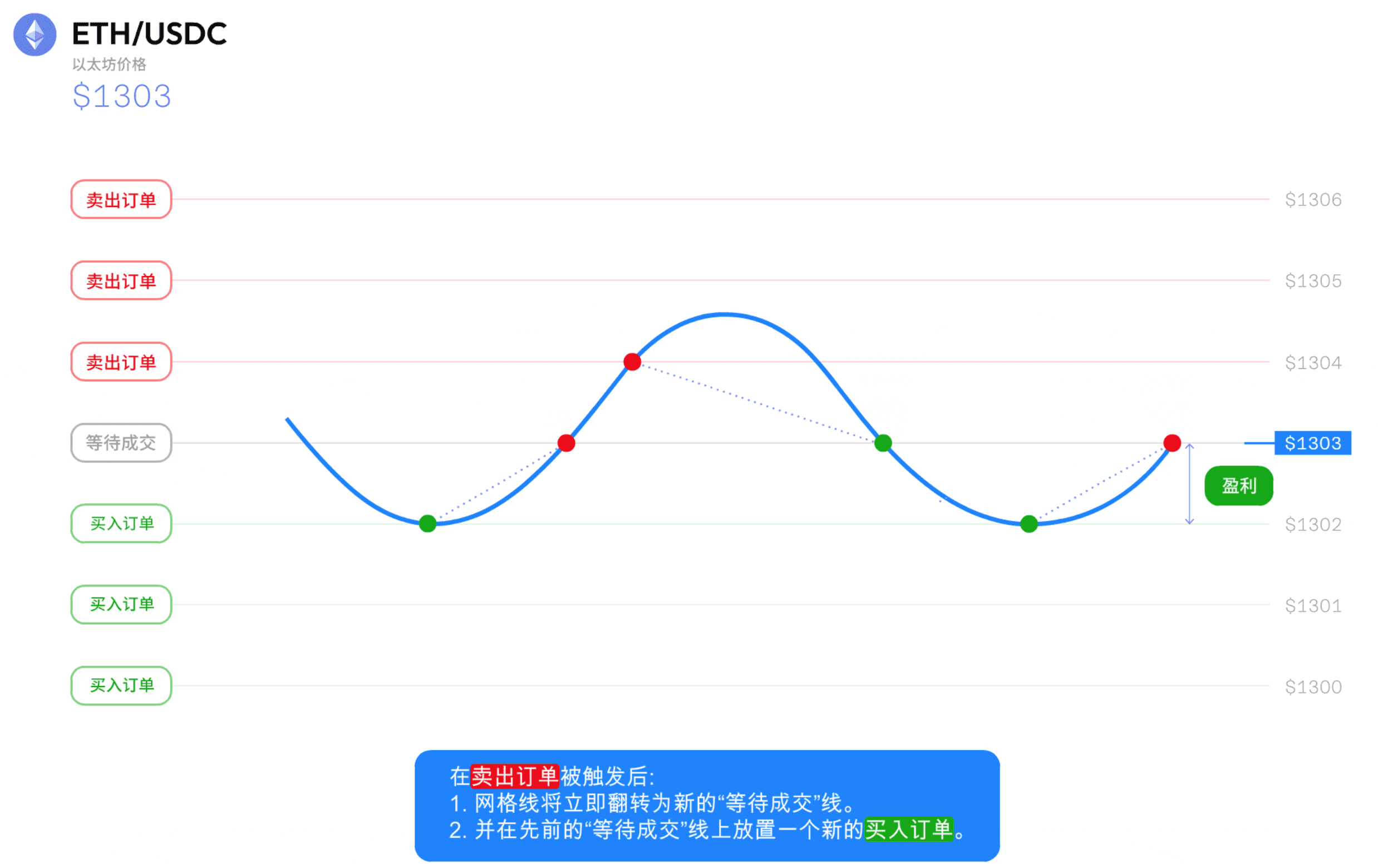

Then, if the price falls on the line, a trade is triggered, as shown in the figure below, where the small green dot triggers the first buy order;

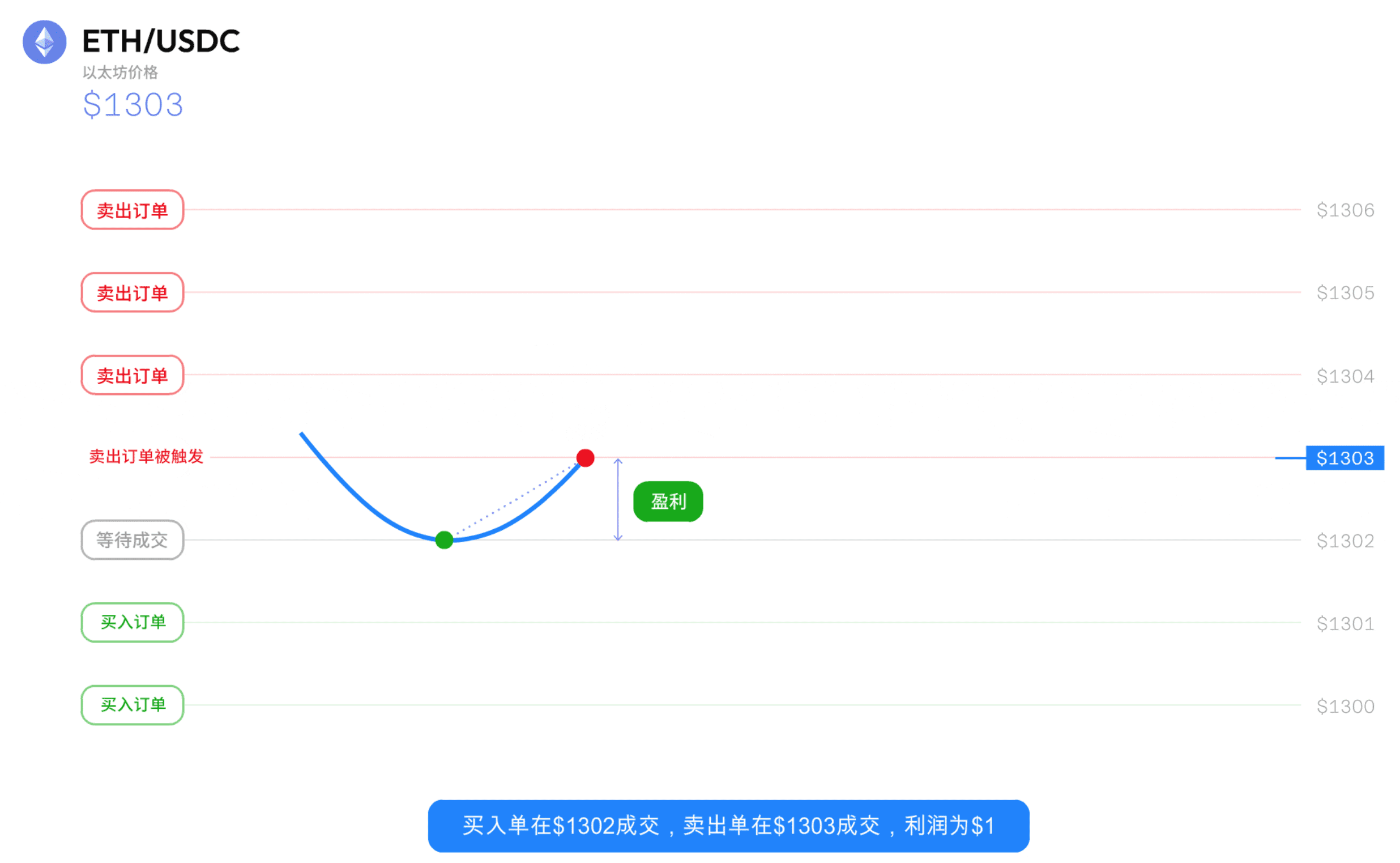

Finally, as the price rises, the red sell line is triggered, and the sell order is executed;

In this way, you have achieved profit, and this is completely automated robot operation!!! 24/7 to achieve passive income!!!

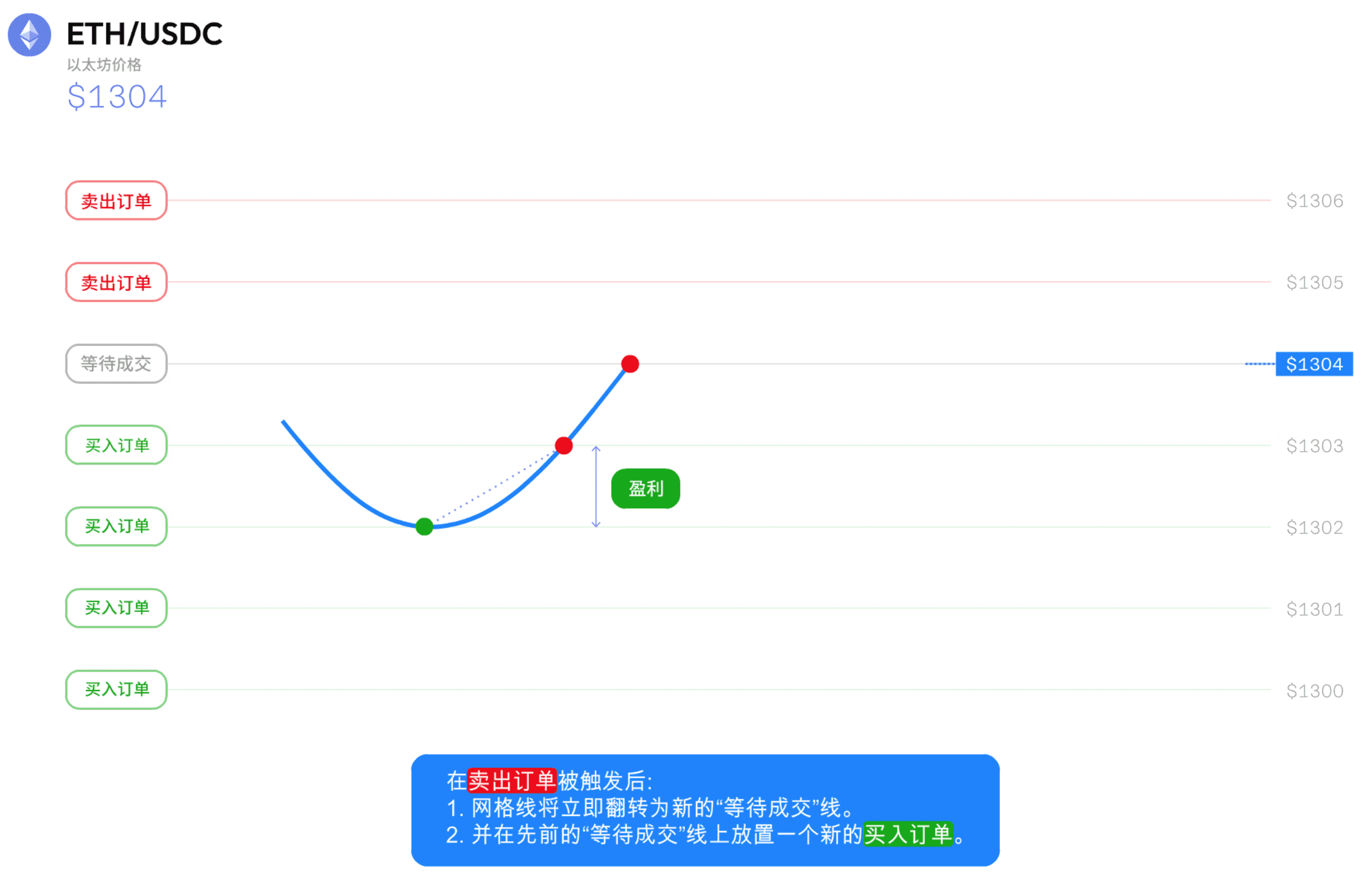

When the price continues to rise:

Rising and then falling within a range, achieving profit, with the same profit for each grid;

When the price triggers the buy line, rebounds again, you can profit!

After completing a low buy and high sell, you will profit from the profit of one grid; the money earned is far greater than the fees, and the fees can be ignored!

The only thing to note about the grid is to ensure that the current market price is within the price range you set, and there are many ways to deal with it if it breaks the price range:

Set stop loss

Manually stop loss when notified.

III. What kind of investment mentality is needed to use the grid robot?

When using the grid robot, it is essential to maintain a long-term investment mentality. The robot's operating strategy aims to obtain small and stable profits over a period of time, rather than making quick big money. It is important to carefully select investment projects and invest an amount that can bear the risk.

Note: If using futures contracts, the margin must be sufficient. The robot's operating strategy aims to obtain small and stable profits over a period of time, rather than making quick big money. We pursue a steady and consistent approach.

IV. How to set the price range

Assuming you run for three days, use hourly K-line, and check the trend of the previous week:

There are multiple retracement points above and below the rectangle, indicating that the price may continue to fluctuate within the range in the coming days:

When you input the number of grids, a profit of 0.2-0.5 for each is reasonable.

If the profit is too low, it means that there are too many grids, and your money may all be in pending orders. Maybe a dozen grids have been bought, but the price is falling. Then those dozen grids are trapped. But also pay attention not to have too few grids, if there are only two or three grids, the price cannot fall multiple times. Only when the price falls, can we make a profit!

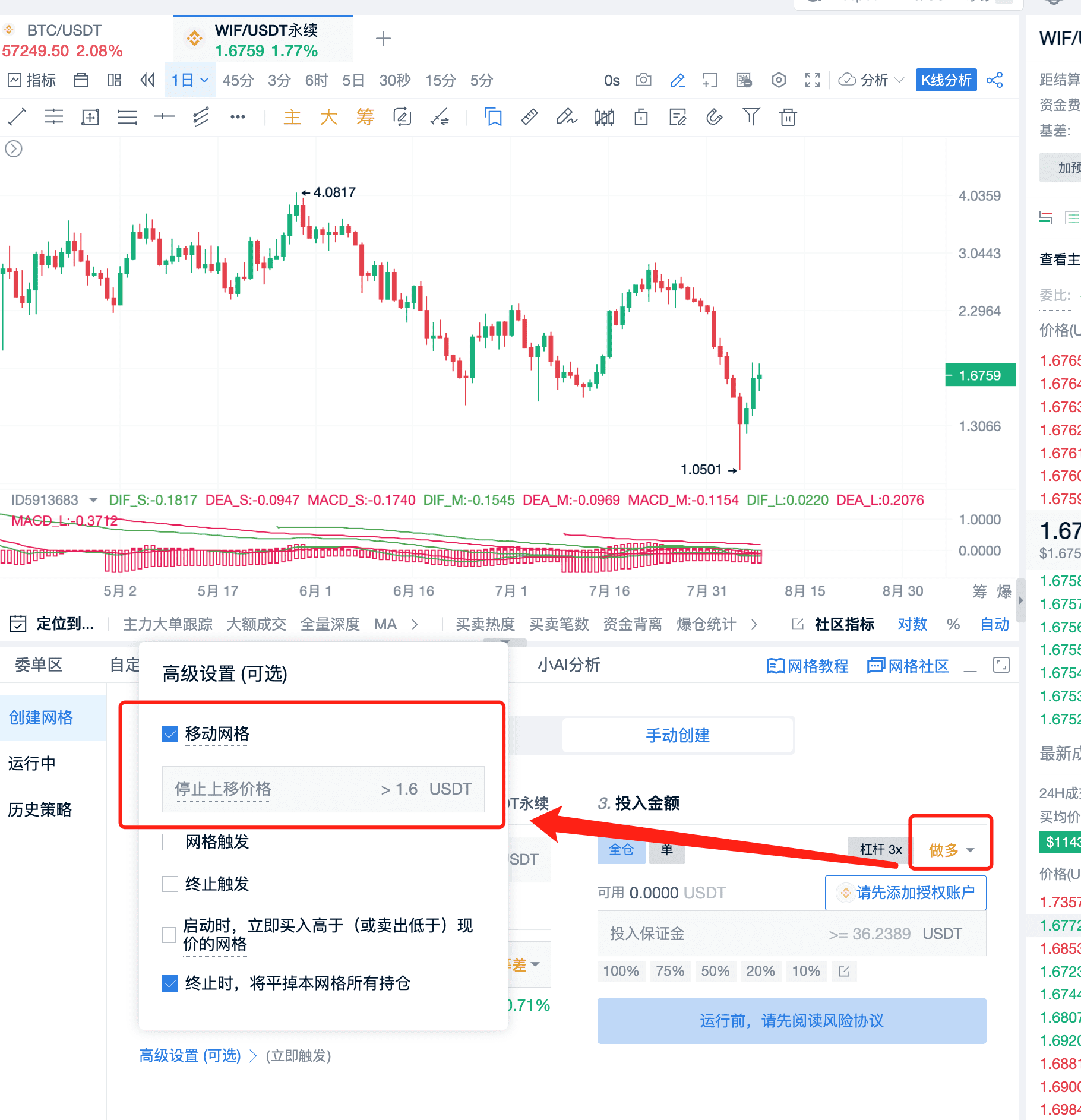

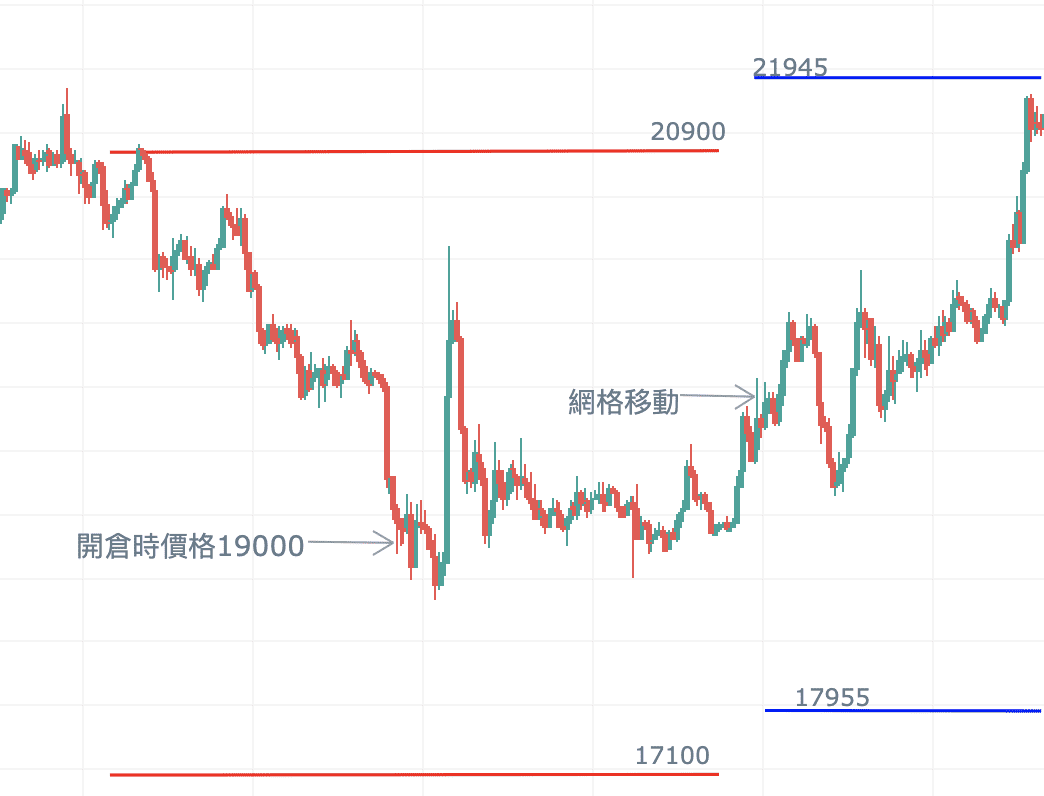

V. What is a moving grid?

Have you noticed that some exchanges actually do not support moving contracts? But on AICoin, long contract grids support upward movement, and short contract grids support downward movement.

The moving grid is the latest advanced feature developed. After enabling the moving grid, as the average price rises, the upper and lower limits of the grid range will automatically move upward.

Recommended Reading

For more live content, please follow AICoin's "News/Information - Live Review" section, and feel free to download AICoin PC-end platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。