Author: Glassnode

Translation: Plain Blockchain

We are pleased to release the third edition of our quarterly series "Crypto Market Guide," which was produced in collaboration with Coinbase Institutional. This report provides in-depth analysis of key developments in the cryptocurrency market for each quarter, including price performance, on-chain analysis, industry events, and derivative data.

Similar to previous editions, our goal is to provide institutional traders and investors with a better understanding of the digital asset market through actionable insights based on on-chain data. This edition focuses on three main insights: the rapid increase in on-chain activity, the transformative impact of ETFs, and an analysis of the current market cycle.

Key Highlights:

Assessment of market cycles: The cryptocurrency market is known for its unique cycles of ups and downs. The latest data indicates that despite a slight decline in the second quarter, we may be in the mid-term of the current bull market cycle that began at the end of 2022. Historical patterns suggest that this adjustment is typical and consistent with past market behavior.

ETFs changing the landscape: Spot Bitcoin ETFs have accumulated nearly $500 billion in assets under management (AUM) within six months, attracting new investors and deepening market liquidity. ETFs have introduced a regulated and familiar investment tool, complementing existing options and having a positive impact on the entire crypto ecosystem.

Rapid increase in on-chain activity: Over the past six months, various indicators such as total value locked (TVL), active addresses, and user base size have shown a significant increase in on-chain activity. This surge is being driven by various use cases, including decentralized finance, staking, and trading. With the maturation of existing use cases and the emergence of new innovations, on-chain adoption is expected to further increase.

1. Key Trends in the Third Quarter

Here are some trends worth paying attention to from an investor's perspective over the past quarter:

1) Investor Profit Trends and MVRV

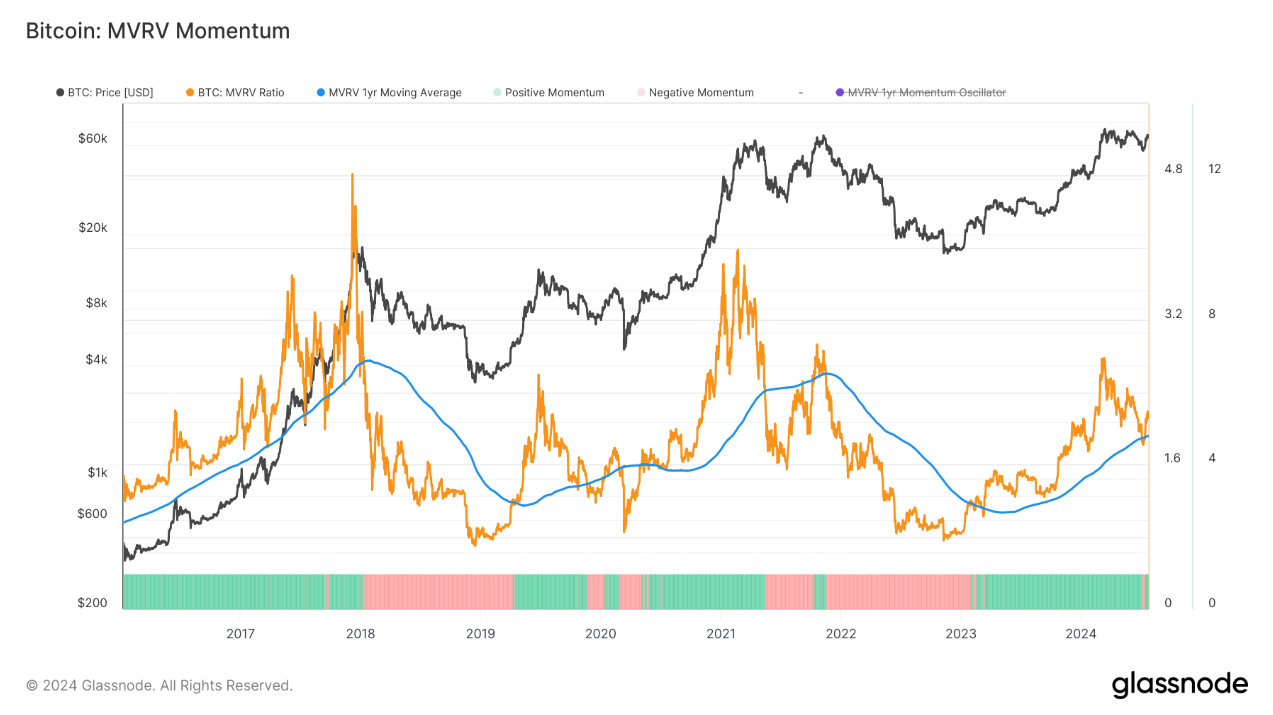

MVRV momentum is a tool that helps analysts monitor market trends. It analyzes the change in the ratio of investors' unrealized profit multiples (MVRV) to their 365-day moving average.

When the MVRV ratio trades above its 365-day average, it typically indicates a strong upward trend and improved investor profitability, often leading to increased positions during market adjustments. Conversely, when the MVRV falls below the 365-day average, it often signals significant unrealized losses, increasing uncertainty and hedging decisions.

In early July, the MVRV ratio found support near its 365-day moving average, indicating that the upward trend in 2024 remains intact and brings positive investor profitability.

2. BTC Cycle Performance and Drawdown

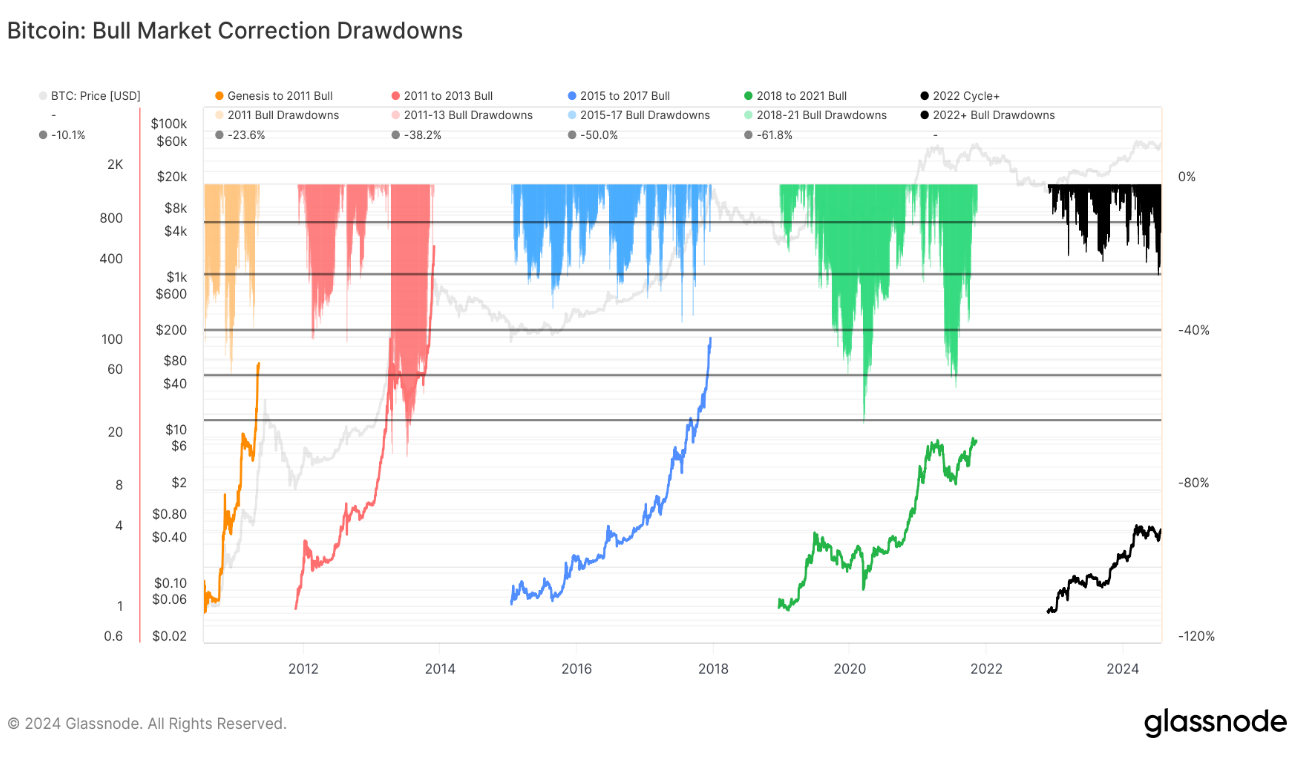

Since the beginning of the current bull market in late 2022, the price of Bitcoin has risen by 400%. Following the FTX collapse, Bitcoin experienced a continuous 18-month period of stable price increases, reaching a historical high of $73,000. Subsequently, the market entered a three-month period of range-bound volatility, followed by a 26% drawdown.

Compared to previous cycles, this downturn trend is more gradual, indicating a strong market structure and reduced volatility. The 2023-24 cycle is similar to the 2018-21 and 2015-17 cycles, providing valuable insights into cycle structure and duration.

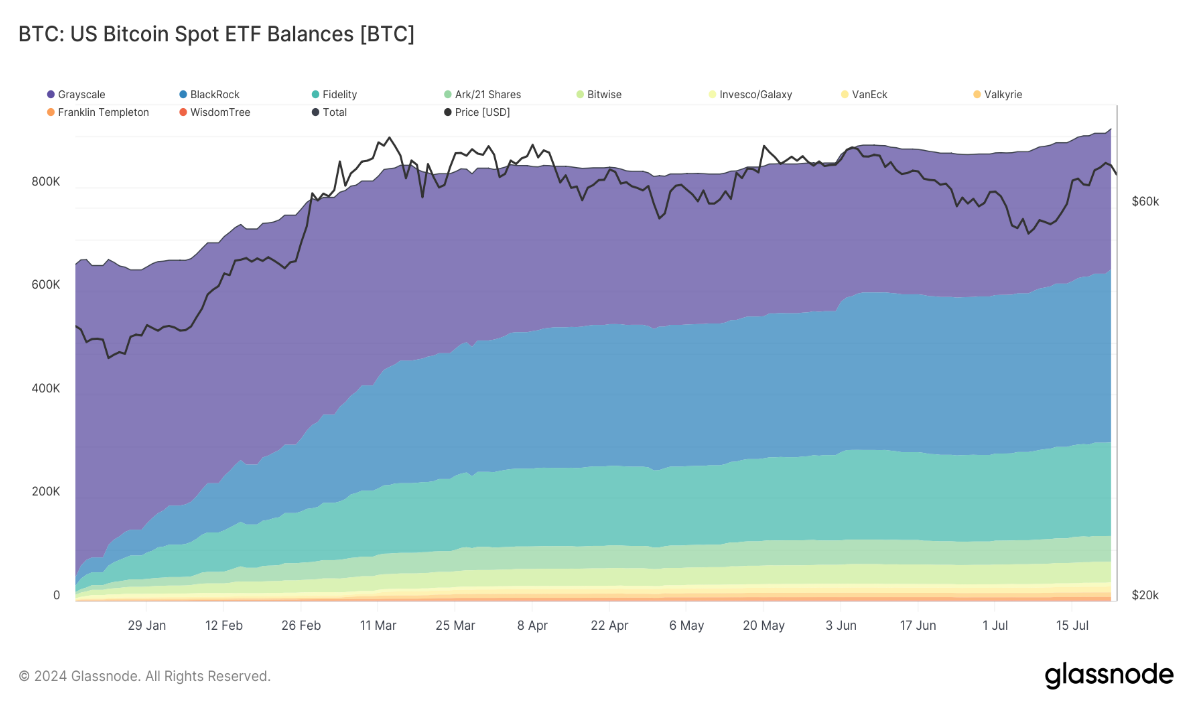

1) Balance of Bitcoin Spot ETFs

Tracking the balances of the top ten US-traded Bitcoin ETFs provides insight into the inflow of funds into these products. Spot Bitcoin ETFs have achieved unprecedented success, with assets under management exceeding $500 billion, making it the most successful ETF launch in history.

Since their launch, the inflow of funds into ETFs has significantly exceeded the new issuance of Bitcoin, creating substantial demand. This increased demand has driven up trading volumes in both spot and derivative markets.

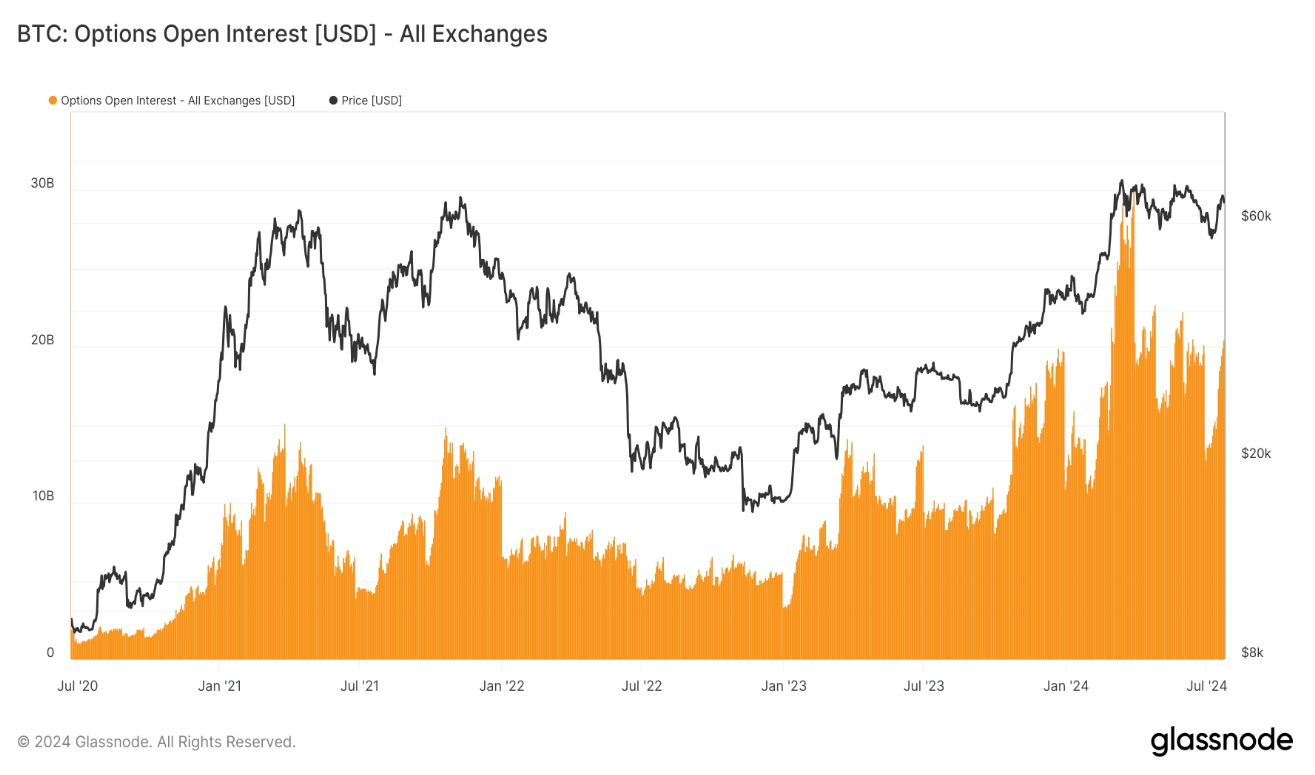

2) Bitcoin Futures Trading Volume and Open Interest

The trading volume and open interest of Bitcoin futures have significantly increased. Both traditional futures and perpetual futures show increased participation and liquidity, reflecting the growing interest in Bitcoin derivatives.

To delve deeper into these and other topics to enhance your digital asset investment strategy, please refer to the complete version of the Q3 2024 "Crypto Market Guide."

Download the full report here: https://get.glassnode.com/guide-to-crypto-markets-q3-2024/?utmsource=Insights&utmmedium=content&utmcampaign=Q3Guide

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。