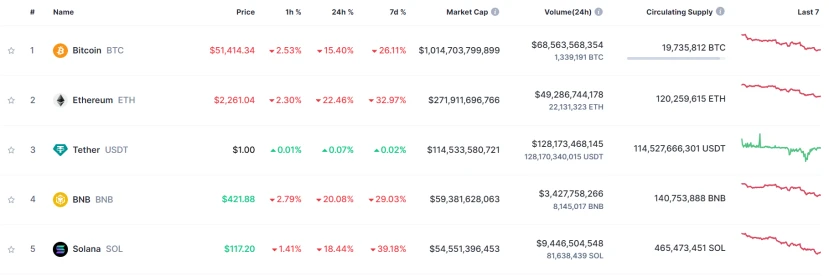

The cryptocurrency market has experienced a sharp decline, triggering a large-scale liquidation

Since August 2, the cryptocurrency market has been performing poorly, mainly due to geopolitical tensions, significant sell-offs in the Japanese stock market due to Japan's interest rate hike, weak US employment data and concerns about economic recession, as well as major technology and retail giants releasing weaker-than-expected earnings reports, triggering a large-scale sell-off of technology stocks, and more.

On August 5, as traditional financial markets such as Japan experienced a significant decline, the cryptocurrency market also saw a sharp downturn, with a total of $1 billion liquidated on exchanges within 24 hours, including $350 million for BTC and $342 million for ETH.

According to a report by on-chain analyst @EmberCN (余烬), the sharp drop in ETH prices triggered a wave of on-chain leverage liquidation by ETH whales, exacerbating the decline. Several whale addresses were forced to sell their ETH holdings to repay loans, including:

An address starting with "0x1111" liquidated 6,559 ETH to repay a 277.9 WBTC loan.

An address starting with "0x4196" liquidated 2,965 ETH to repay a $7.2 million USDT loan.

An address starting with "0x790c" liquidated 2,771 ETH to repay a $6.06 million USDC loan.

An address starting with "0x5de6" liquidated 2,358 ETH to repay a $5.17 million USDC loan.

CoinGecko data shows that in the past week, ETH plummeted from around $3,300 to below $2,200, a drop of over 30%. Other factors contributing to the sharp decline in ETH include increased pressure from leveraged liquidation in the market and news of Jump Trading selling a large amount of ETH.

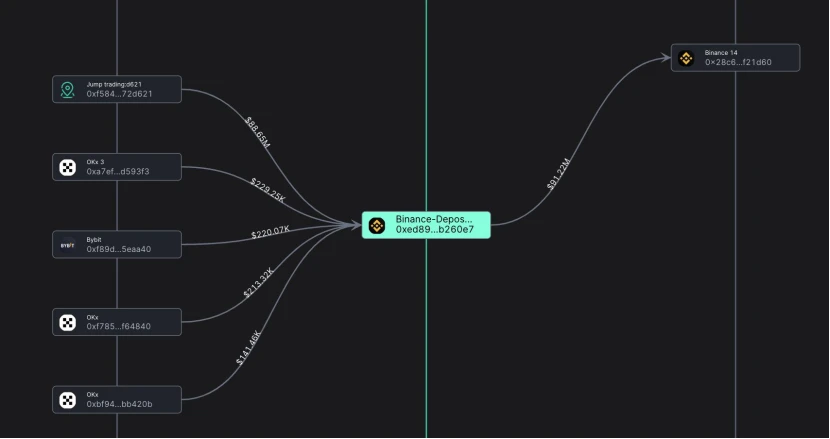

【Note: According to the on-chain analysis website Spot On Chain, on August 5, the Chicago trading company Jump Trading transferred more than 17,576 ETH worth over $46 million to a centralized exchange. Fortune magazine reported on June 20 that the U.S. Commodity Futures Trading Commission (CFTC) is investigating Jump Trading's cryptocurrency investment activities. Since July 25, the wallet has transferred nearly 90,000 ETH to exchanges, and after the market crash, the wallet still holds 37,600 wstETH from the Lido protocol and 11,500 stETH.】

Julian Hosp, CEO and co-founder of the decentralized platform Cake Group, believes that "ETH's plunge is related to Jump Trading, possibly because the company was required to provide additional margin in the traditional market and needed liquidity over the weekend, or possibly chose to exit the cryptocurrency business due to regulatory reasons."

Jump Trading transfers ETH to Binance trading platform

According to a research report by 0xScope, since August 3, five major market makers have collectively sold 130,000 ETH. Wintermute sold over 47,000 ETH, followed by Jump Trading, which sold over 36,000 ETH, and Flow Traders in third place, selling 3,620 ETH. GSR Markets also sold 292 ETH, while Amber Group sold 65 ETH. Although Wintermute sold the most ETH, Jump Trading began selling ETH over the weekend, leading the selling action among other mainstream market makers.

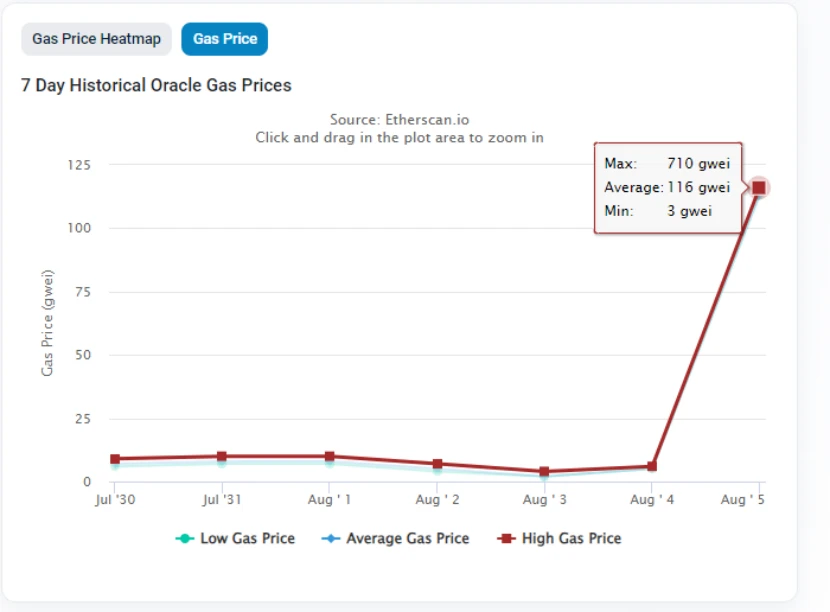

The chain reaction of the above events led to a liquidation amount of up to $1 billion for ETH within one hour, with a total liquidation amount of over $445 million within 24 hours. According to Parsec's data, on August 5, loan liquidations on DeFi platforms exceeded $320 million, reaching a new high for the year. Among them, the liquidation amount for ETH collateral was $216 million, $97 million for wstETH, and $35 million for wBTC.

As ETH dropped to nearly $2,100, the highest gas fee for Ethereum reached 710 gwei. It is worth noting that if ETH continues to drop to $1,950, encrypted assets worth $92.2 million in DeFi protocols will be liquidated; if ETH drops to $1,790, $271 million in DeFi assets will be liquidated.

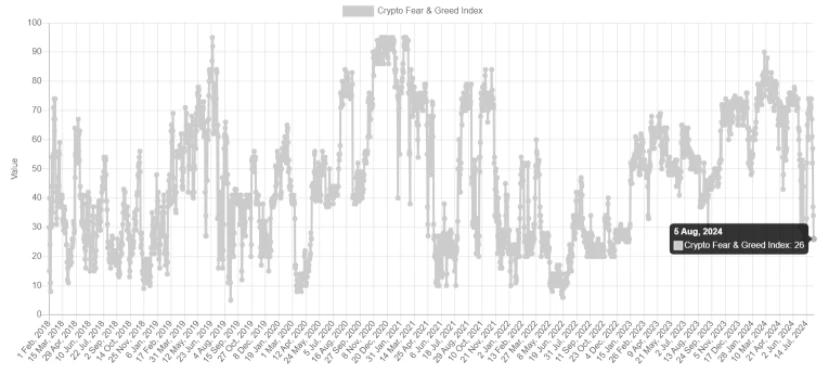

After this sharp decline, long leverages in the cryptocurrency market were massively cleared, and a large number of short-term spot holders exited the market, shaking the market fundamentals but not destroying them. The cryptocurrency market fear and greed index dropped to 26 (fear state), reaching its lowest level since 2023, with little room for further decline in the short term.

Where will the ETH spot ETF go from here?

Net inflow chart of BTC spot ETF

Looking at the data of the BTC spot ETF, despite a period of net outflows (mainly from the sale of Grayscale GBTC), the overall cumulative net inflow is still around $17.5 billion, which is also the reason for the relatively strong BTC price.

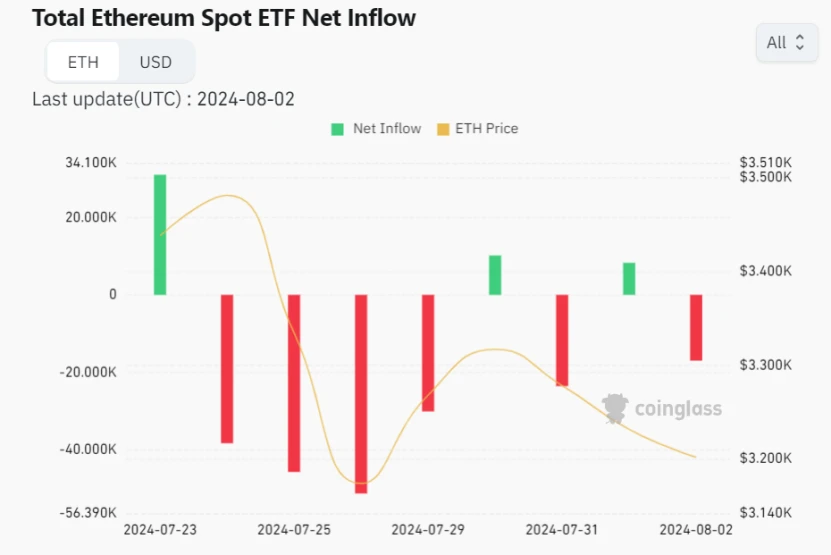

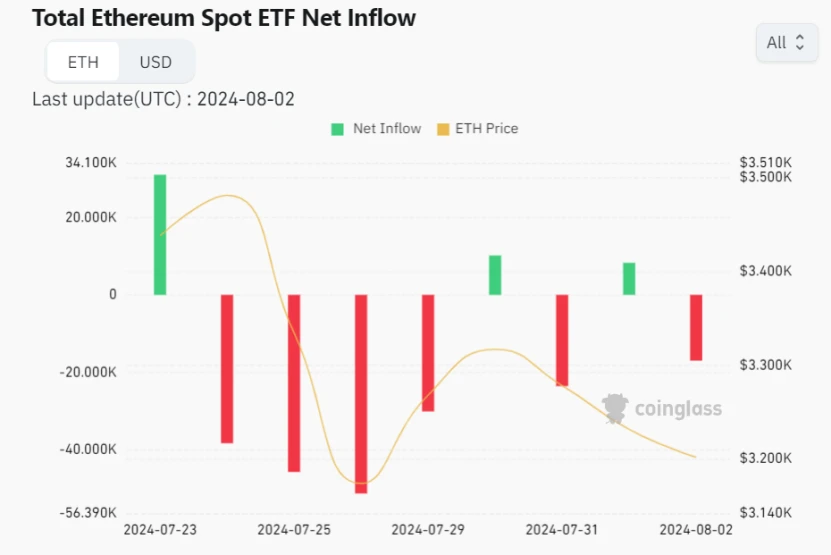

Net inflow chart of ETH spot ETF

In contrast, the net inflow data of the ETH spot ETF, due to its launch coinciding with a turbulent macroeconomic environment and a significant decline in risk markets such as the US stock market, currently stands at a cumulative net outflow of $511 million, with a relatively smaller total asset market value compared to BTC. Grayscale's ETHE accounts for the majority of the outflow, worth over $2.1 billion, while other ETF issuers are in a net inflow state. As Grayscale's ETHE still holds over $5.97 billion worth of ETH, further outflows are possible in the coming weeks.

Currently, in terms of recognition and acceptance from the traditional market, there is still a significant gap between ETH and BTC. Although ETH is still just a "supporting role" in the BTC spot ETF, it signifies a significant regulatory advancement for the cryptocurrency industry, which is of great long-term significance. As traditional institutions further understand the fundamentals of ETH, there will be more potential funds flowing into ETH in the future.

After the market crash, the CEO of Circle stated, "When facing global macro fluctuations, attention should be focused on technology, industry, and adoption rather than price, and I still believe in the cryptocurrency industry." Historical data shows that the cryptocurrency industry often performs poorly in August and September, but the trend is more optimistic after October.

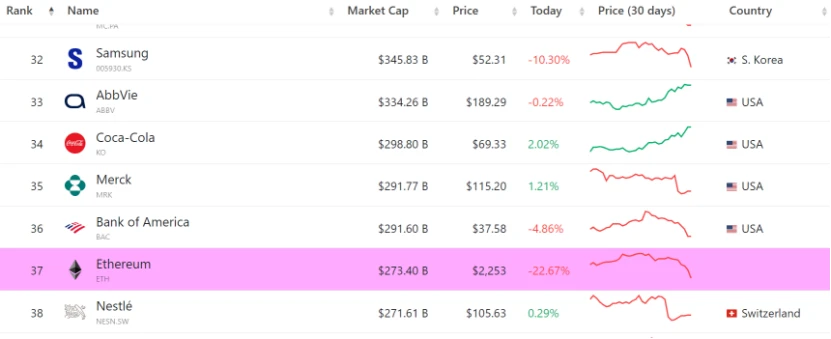

Based on the data from August 5th, the market value of ETH is $273.4 billion, ranking 37th in the global market value list, lower than the market value of companies like Coca-Cola and Bank of America, and even lower than the cash reserves of Berkshire Hathaway after Buffett reduced his holdings in Apple ($276.9 billion).

As a leading application-oriented public chain in the cryptocurrency industry, ETH has enormous potential in terms of technological adoption and innovation. The decline in ETH market value has also created better opportunities for institutional positioning. In addition, the market believes that the Federal Reserve is likely to initiate a rate cut in September. A rate cut by the Federal Reserve is sufficient to offset the short-term impact of the yen, and the release of market liquidity at that time may bring more funds into the ETH spot ETF.

Ebunker official website: https://www.ebunker.io

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。