On the afternoon of August 5th, AICoin researchers conducted a live graphic and text sharing session titled "312 Re-enactment! Giving You the Universal Bottom-Fishing Tool: DCA (with Membership Giveaway)" in the "AICoin PC End-Group Chat-Live" channel. The following is a summary of the live content.

I. Analysis of the Reasons for the Market Crash

Today's market crash was very intense. Our research institute's preliminary analysis indicates several main reasons:

- Interest Rate Hike in Japan: Multiple countries' stock indices triggered circuit breakers.

- Unexpected Non-Farm Payrolls: Causing concerns about a hard landing for the US economy.

- Market Makers' Large-scale Selling of ETH: This is the direct cause, indicating insider trading and large-scale selling.

- Significant Net Outflow of ETFs.

From a macro perspective, the probability of a circuit breaker in the US stock market tonight is very high due to the interest rate hike in Japan.

II. Super Universal Bottom-Fishing Tool: DCA

The audience tuning into the live broadcast today are all interested in opportunities amid this market downturn. The super strong, universal, and 360-degree protective bottom-fishing tool recommended by our research institute is DCA.

However, now is not the best time to use DCA. It should be used after this downturn stabilizes. Based on our institute's decades of experience, there will always be some digestion of the shock after each downturn, followed by a strong rebound. Therefore, our title today is "312 Re-enactment." We must recommend this powerful and universal tool to help everyone capture the profits in the latter half.

This tool is capable of both long and short positions. In this downturn, it has opened short positions.

Let's take a look at another set, based on 5-minute performance.

This 5-minute set has continuous profit-taking and will not open positions during a downturn. Currently, it has added to the position twice because it is a long DCA. In short, the DCA tool encompasses long, short, or both long and short positions.

III. Introduction to the DCA Tool

DCA, short for Dollar Cost Averaging, also known as the Martingale strategy. What is its function? It is an automated, phased, and low-point bottom-fishing strategy. In simple terms, it means buying more as the price falls, averaging the cost, and then selling for a one-time profit when the price rebounds and reaches the target. In short, it is the best companion for bottom-fishing, even better than a wife.

In the highly unstable and highly fluctuating cryptocurrency market, this tool can help investors avoid buying at a high point and better seize opportunities. The current market situation is highly unstable and characterized by large fluctuations. Using this tool can effectively utilize available funds and achieve a ripple effect.

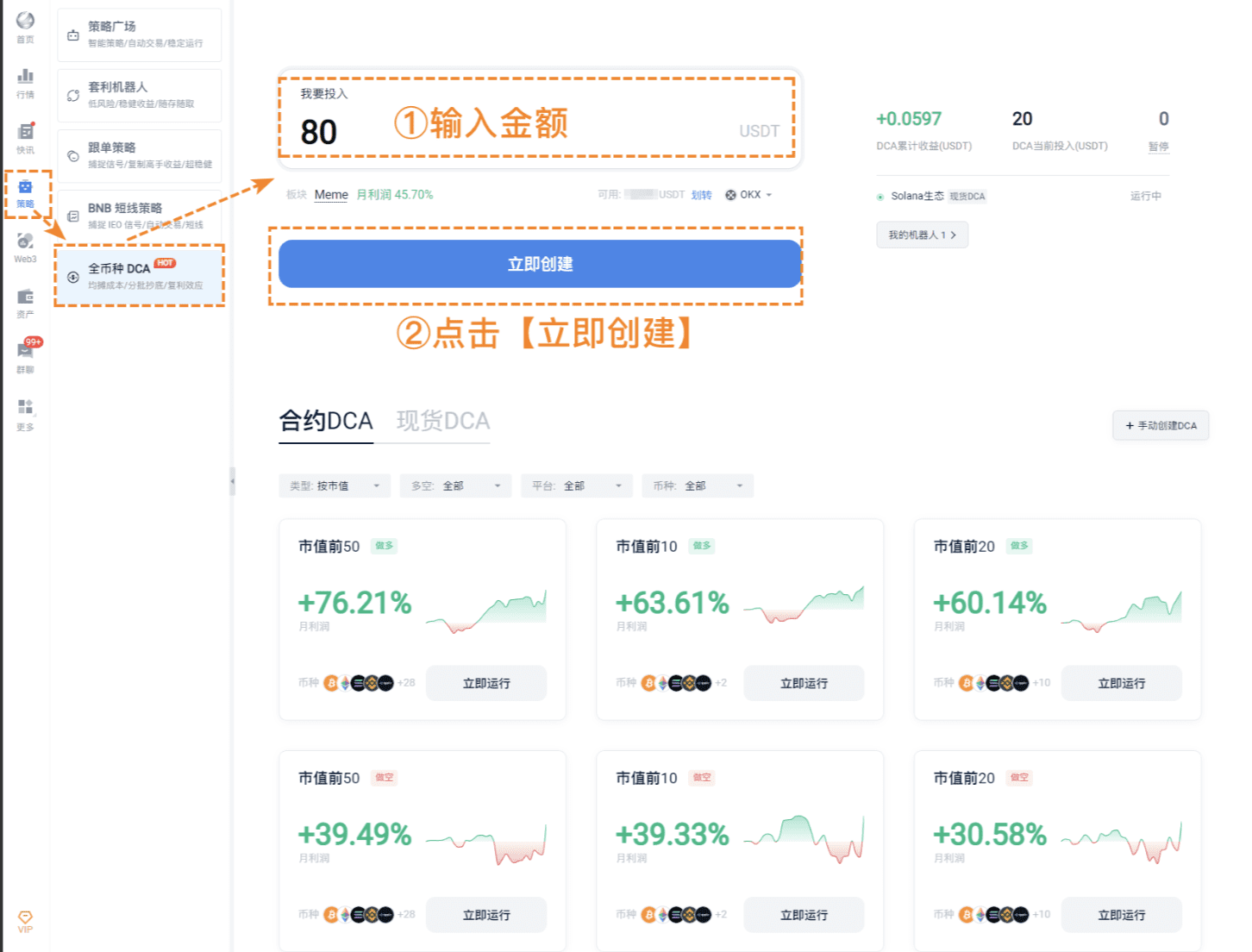

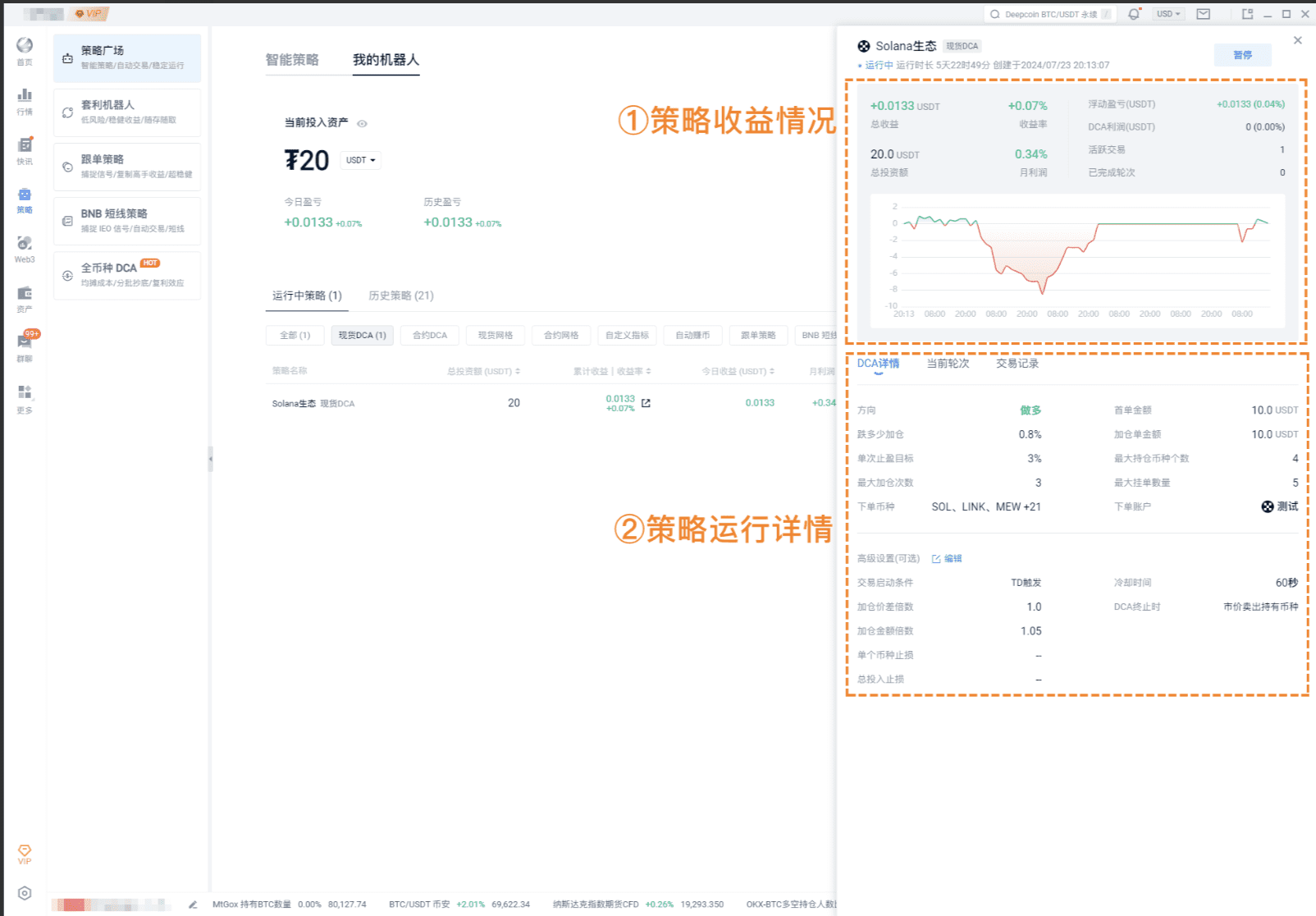

1. Operation of the DCA Tool

You only need to set a fixed investment amount, and regardless of market fluctuations, the same amount of cryptocurrency will be purchased according to the set parameters. This strategy tool can help reduce the interference of market emotions and, in the long run, effectively "average out" your investment costs. AICoin's DCA robot for all cryptocurrencies will automatically execute this process, saving time and effort!

Next, let's show everyone! AICoin's amazing operation has created this tool, making the bold even bolder and helping those who want to make money earn even more!

The AICoin DCA tool supports OEX, OKX, Binance, Bitget, Gate, HTX, and Pionex platforms. After authorization, you can create strategy robots to run. Currently, the DCA tool is only available on the PC end. PC users can follow our steps to find the strategy module.

It's important to note that the strength of this tool lies not in its ability to run a single cryptocurrency, but in its ability to handle all cryptocurrencies. As long as there is an opportunity for a particular cryptocurrency, this tool will seize it, giving you the opportunity to naturally earn money, fatten your wallet, boost your confidence, and walk with the wind.

2. How to Choose the Right DCA Tool

After opening this, we find a bunch of options. How do we choose?

The DCA tool is divided into spot and contract modes. Generally, you can start with a small amount of capital to test the waters, understand its operation rules, and then increase your investment.

- Spot DCA: Suitable for conservative bottom-fishers, you can choose large-cap and mainstream coins based on market value, which is relatively safe.

- Contract DCA: Suitable for aggressive bottom-fishers, you can choose mainstream coins based on market value, and it includes long, short, and both long and short contracts.

(1) For Relatively Conservative Bottom-fishers

If you are testing the waters, you can start with a few hundred US dollars to understand its operation rules before committing more funds. If you are relatively conservative, then use spot DCA. It's important to note the strength of this tool—it is a DCA for all cryptocurrencies, making the entire cryptocurrency market your playground!

How do you choose a conservative spot DCA?

You can choose based on market value. When testing initially, you can choose from the top 50, 20, or 10 by market value for bottom-fishing.

Because they are large-cap or mainstream coins, they are stable and reliable. There are other selection methods, such as by sector or custom selection. However, during a market crash, it is not recommended to bottom-fish by sector, as it is not stable enough.

When is it suitable to bottom-fish by sector? In a volatile uptrend market, such as the AI sector and the Hong Kong sector.

The above are the strategies for relatively conservative spot DCA.

(2) For Relatively Aggressive Bottom-fishers

If you are aggressive, you can start with contracts. As for the leverage, that's another story. Choose based on the size of your heart and the frequency of your heartbeat.

Contract DCA also has three modes, and you can choose mainstream coins based on market value. This is suitable for friends with a smaller heart and a slower heartbeat, less thrilling but still profitable.

It's important to note that contracts are divided into long, short, and both long and short contracts. In other words, you can play in multiple directions. For example, if you want to escape the peak, you can use this DCA tool. It will help you open short positions at the peak, smoothing out the cost of your short position. So, by using it, you will arm yourself, as if you have nuclear weapons.

Its stronger point is that you can trade the coins you want through your own custom combination.

In other words, if AICoin selects coins you don't like, you can choose the positions you like.

You can run with just 20 US dollars.

Finally, it is important to remind everyone:

Using AICoin's DCA for all cryptocurrencies can make your investment simpler and more effective. However, it is important to note that although historical backtesting shows that the DCA strategy can bring stable returns, there is still uncertainty in future market performance. Investors should make rational judgments based on their own circumstances.

Contract DCA also has parameter settings. During your testing process, you can gradually understand it. If there are any areas you don't understand, you can directly ask our customer service team or have in-depth discussions with our VIP managers and editors in our PRO CLUB exclusive group.

Recommended Reading

- "Profitable Signal Strategy"

- "Halving Effect? Middle East Situation?—Comprehensive Strategy for Turbulent Markets"

- "How Newbies Can Trade Coins Correctly"

For more live content, please follow AICoin's "News/Information-Live Review" section and feel free to download AICoin PC End.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。