The real warriors and tough guys dare to face the bleak market and confront the fierce competition, and self-improvement leads to great strength.

"Boring."

This is the recent evaluation of this cycle by many participants in the cryptocurrency market.

First-tier investors find the primary market boring, either thinking about how to explain to LPs, "the yield cannot outperform Bitcoin," or busy with safeguarding their rights in an attempt to recover some losses, after all, there's not much to invest in the primary market;

Second-tier investors also find it boring, apart from Bitcoin and Solana, there are some MEMEs, but they really can't find any good targets;

Project parties also find it boring, always feeling that their hard work in product development is like practicing the art of slaying dragons, having some skills, but can't find the dragons. MEMEs are prevalent, and retail investors are disenchanted with VC coins, not knowing what to do to attract the attention of retail investors;

…

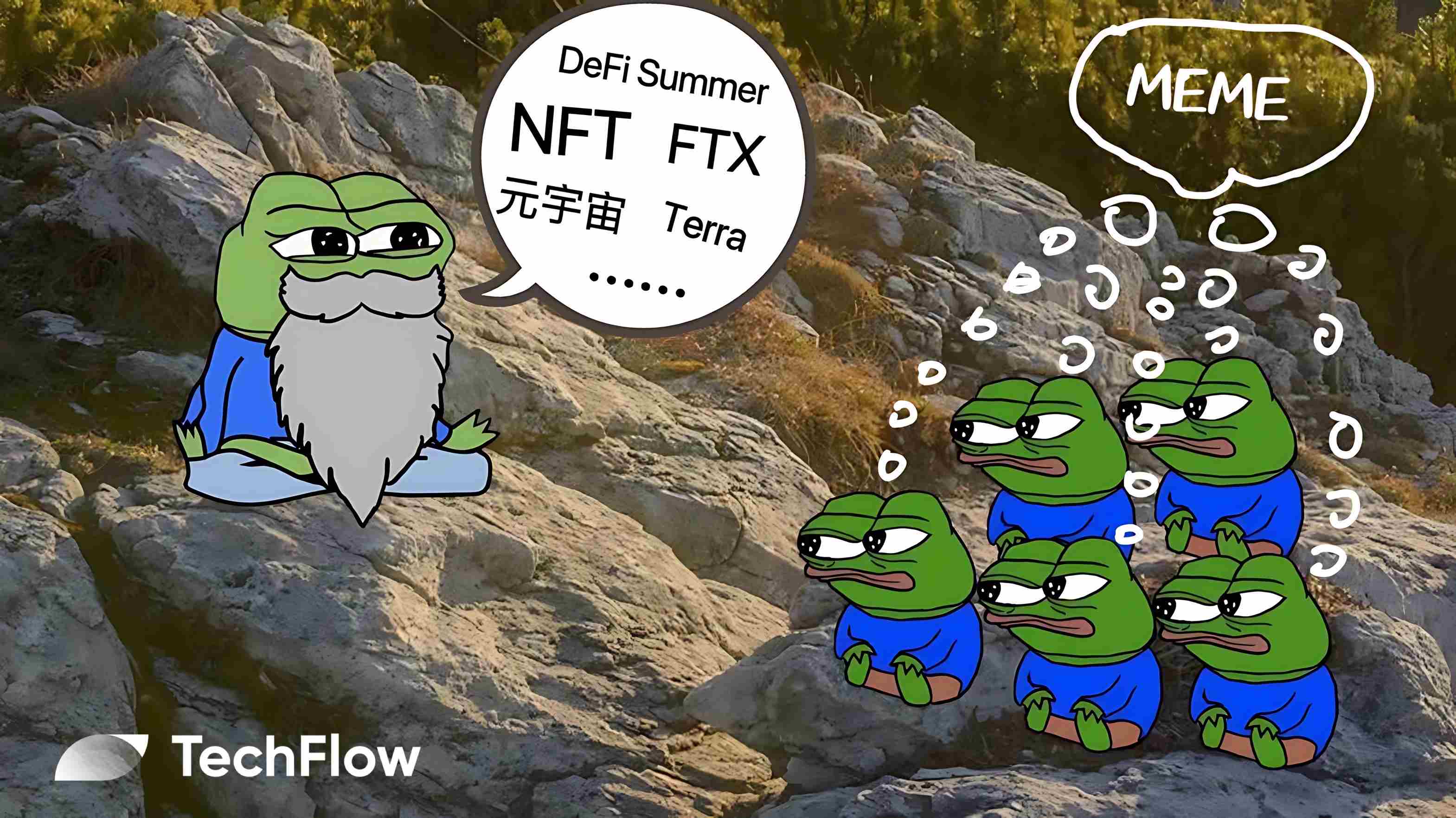

In summary, this is a pseudo-bull market lacking innovation, especially compared to 2020-2022, when various new concepts, products, and new tracks such as DeFi/NFT/Metaverse/algorithmic stablecoins/MEMEs… were blossoming, and each small innovation brought about a wide range of wealth effects, attracting a large number of newcomers (leeks) to enter the market. Even the major dollar-based fund grandpas who once looked down on Crypto have switched to NFT avatars of Punk/Bored Ape, shouting "ALL IN CRYPTO"…

The grandeur is no longer there. What has caused this cycle to lack innovation and only have MEMEs dancing?

As a writer, the editor has been worrying about the topic selection all the time. Compared to the previous cycle, there is a lack of exciting topics, especially a lack of new personal stories.

Biographies of individuals have always been the key to traffic. Looking back, the rise of this industry is the success stories of various legendary figures, such as KaoC, Wu Jihan, Godfish, CZ, He Yi, Xu Mingxing, Li Lin, Justin Sun, Da Hongfei, Vitalik, BM, Li Xiaolai, and Bao Er Ye… Each of them is a tough guy, some of them rose from grassroots, but they have left their mark and popular stories in the history of encryption, becoming the material for us editors to attract traffic.

In 2018, a media-produced cryptocurrency tycoon poker deck

In the previous cycle, during the DeFi Summer, many "new crypto heroes" emerged: Musk, SBF, SuZhu, Andre Cronje, Stani Kulechov, Do Kwon, Anatoly Yakovenko, Barry Silbert, Kyle Samani… Each has a legend, and behind each person represents a force, like local warlords, competing with each other, forming factions, and behind each faction are a large number of project assets, representing potential wealth opportunities.

What about this bull market?

Sry, indeed, I haven't seen many new forces and new heroes. After FTX fell, the "old people in the industry" are still active in the center of the stage.

Is it because the lack of innovation is not attracting new people, or is it because there are no strong new people that there is no innovation? This problem seems to be like the chicken and egg question. I am more inclined to agree with the latter. Compared to before, the industry's attraction to elites is weakening.

There can be many reasons:

The collapse of FTX/3AC/DCG has brought the industry into a moment of disillusionment, and some elites and capital in traditional industries have lost trust in the cryptocurrency industry;

With the approval of Bitcoin ETFs, traditional financial giants such as BlackRock and Fidelity have begun to enter the cryptocurrency market, and Bitcoin and Ethereum have external liquidity, but grassroots opportunities are becoming increasingly scarce;

ChatGPT is on fire, and OpenAI founder Sam Altman and NVIDIA's Huang Renxun have become globally renowned AI heroes, and AI has surpassed WEB3 to become the darling of capital, and elites from all walks of life are competing to enter the field;

…

In short, the current situation is that "the old people are in charge": old project founders are continuously launching new projects; old VC people are personally entering the market, creating (speculative) high valuations for new projects; old people in the industry are launching new projects based on new concepts… It's indeed a bit boring.

According to first principles, the future of this industry or investment opportunities ultimately still depends on people. Whether it's the primary or secondary market, investing in a coin means investing in the people and teams behind it. Without innovation, outdated narratives, and no copycat market trends… In the end, it is still the lack of new talents in the industry, lacking new talents that can bring innovation, or new talents are still dormant and under construction, needing time to usher in a qualitative change.

At the time of writing this article, I happened to receive a news push, Binance Labs announced an investment in Particle Network.

A VC practitioner has continuously invested in Particle Network, and the reason given is very simple, "The founder is strong, resilient, has ideas, knows how to deal with people, and has strong execution… Regardless of the direction Particle Network takes in the future, it will be successful."

At the beginning of its birth, the Particle Network team's background was not particularly dazzling, and even a bit "obscure," but a few years later, some projects of the same period either stagnated and closed down, or went silent… Particle continued to iterate, from an MPC application to a modular L1 chain abstraction network, and now it has become a representative project in the field of chain abstraction.

Recalling several projects from the same period, it is lamentable. When a project encounters difficulties, some blame the market, "the market is not good, I can't do anything"; some blame the track, "this track has cooled down, I can't do anything"; some blame their own background, "we are a Chinese project, discriminated against, and did not receive enough support"…

The real warriors and tough guys dare to face the bleak market and confront the fierce competition, and self-improvement leads to great strength.

Looking forward to the cryptocurrency industry once again ushering in an era of fierce competition and innovation, at that time, do not hesitate to invest in the new heroes and tough guys of this era. Talent is the root of all problems and problem-solving.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。