From the initial cautious exploration to the later mindless purchase of new coins, it all relies on information asymmetry.

Having been in the cryptocurrency circle for many years, I have witnessed numerous people achieve financial freedom by taking big risks with small investments. Without exception, it's either due to platform bonuses, sheer luck, or blatant information asymmetry. This time, I made my first million by leveraging information asymmetry and quick reflexes, which took about 20 days. The process wasn't particularly thrilling or high-risk; it mainly involved discerning information and blindly trusting LBank's "global debut." With the MEME coin market being so hot this year, and seeing many group members making good money from it, I decided to allocate some funds and try my luck in the MEME coin market.

Subsequently, I researched several exchanges that continuously list new MEME coins, including Poloniex, BitMart, CoinEx, XT, and LBank. I allocated some funds to these exchanges and followed the market sentiment and exchange announcements to occasionally invest in a few MEME coins. After comparing and using these exchanges several times, I chose to focus on LBank and started recording data. I will organize this process into a "coin trading diary" for everyone. As for why I chose LBank, I will explain the reasons after everyone has read the coin trading diary.

Below is my coin trading diary, with screenshots as evidence.

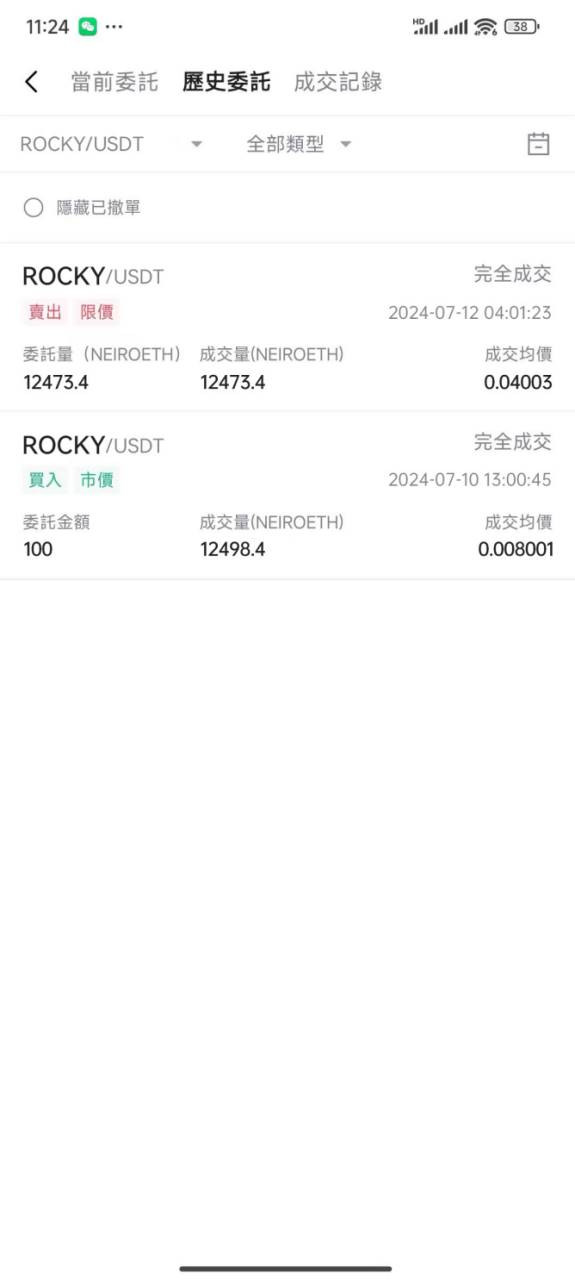

July 10th, BTC: Overcast

Today, I initiated my first trade on LBank, opening at 13:00. I immediately bought $ROCKY at a price of 0.008001, worth 100U. I then waited, and it peaked at 0.04003. I didn't expect this sector to be so bullish; my first trade yielded a fivefold return. I immediately stopped and waited for the next opportunity.

July 11th, BTC: Clear to Overcast

LBank has no global debut projects, so I'll wait…

July 12th, BTC: Partly Cloudy to Clear

LBank still has no global debut projects, I'll wait a little longer…

July 13th, BTC: Clear

LBank still has no global debut projects. I can't wait any longer; I'm going to report this to the "Coin Circle Committee."

July 14th, BTC: Clear

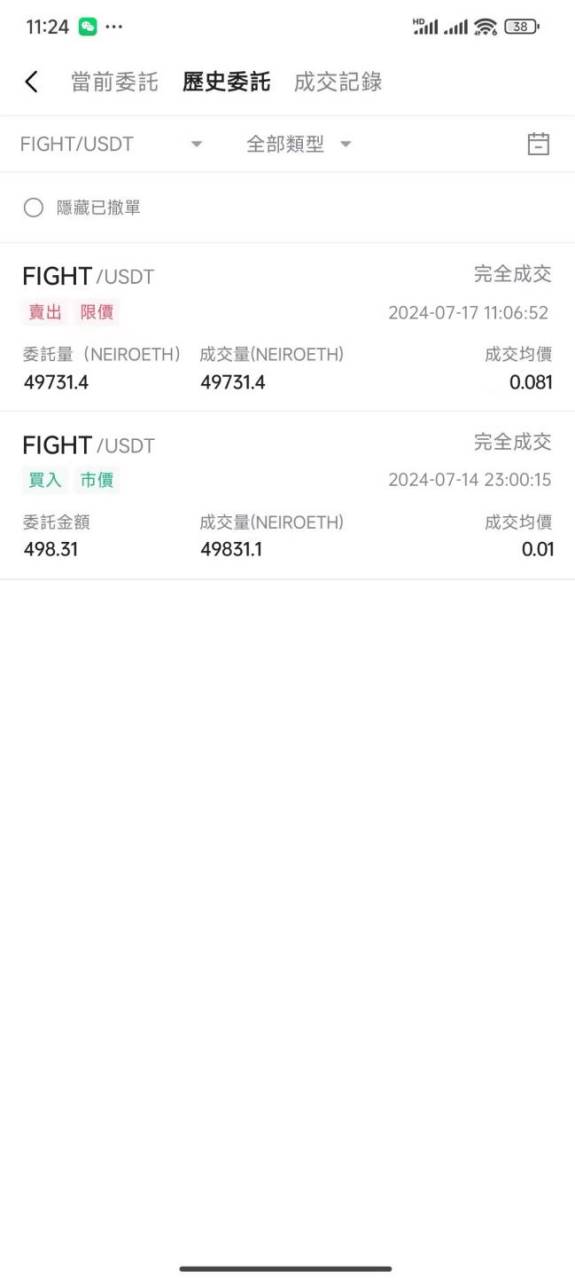

Finally, today LBank had a global debut with the launch of $FIGHT at 23:00. I immediately bought at a price of 0.01. The market heat was very high this time, so I held on. During this time, $FIGHTSOL was also launched, but I have always been uninterested in imitating portfolios, so I continued to hold.

July 15th, BTC: Sunny, Clear Skies

Continuing to hold $FIGHT, today's increase was 69.68%. This data looks promising; I'll continue to hold and observe.

July 16th, BTC: Heavy Rain to Clear

Indeed, those who get the news first can steadily reap profits. It's difficult for latecomers to catch up. As other exchanges gradually listed $FIGHT, my profits continued to double. Today's increase was as high as 230.89%. I'll hold a little longer and reconsider tomorrow.

July 17th, BTC: Overcast

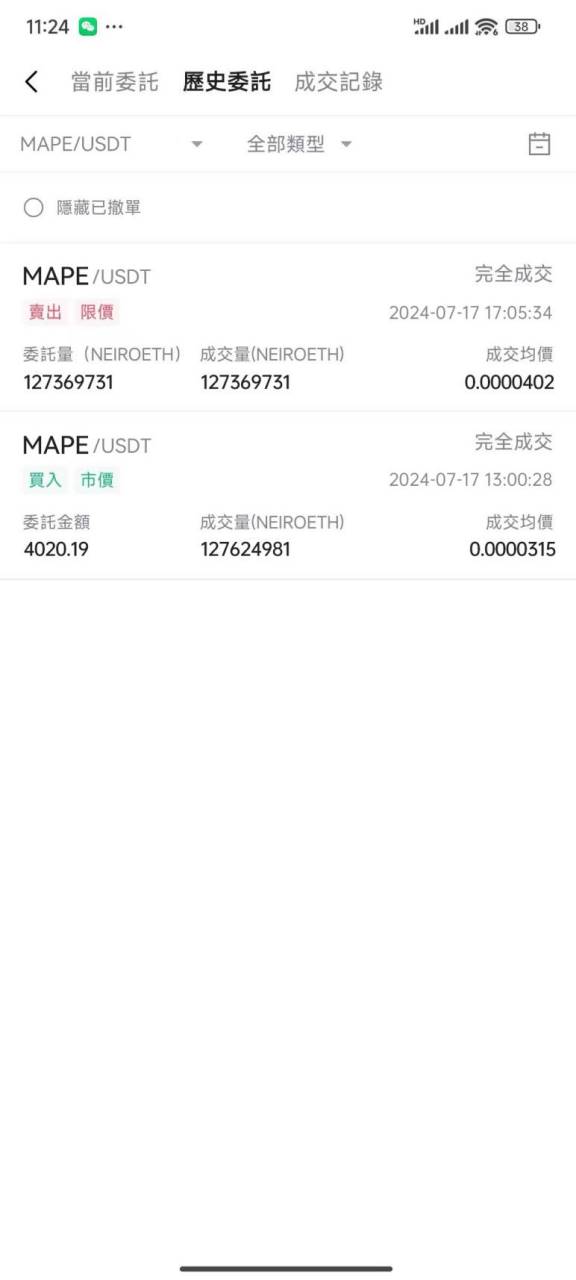

Today's operations were complex. Here's a rundown: I held onto $FIGHT until today. When I saw that the global debut of $MAPE was scheduled for 13:00, I chose to sell $FIGHT at 12:00 for 0.081, a sevenfold return.

I bought $MAPE at 13:00 for 0.0000315. Shortly after buying, I saw that $FEARNOT was set to debut at 17:30. Because this is closely related to Trump, I chose to sell $MAPE at 17:00 for 0.0000402, a 27.62% profit.

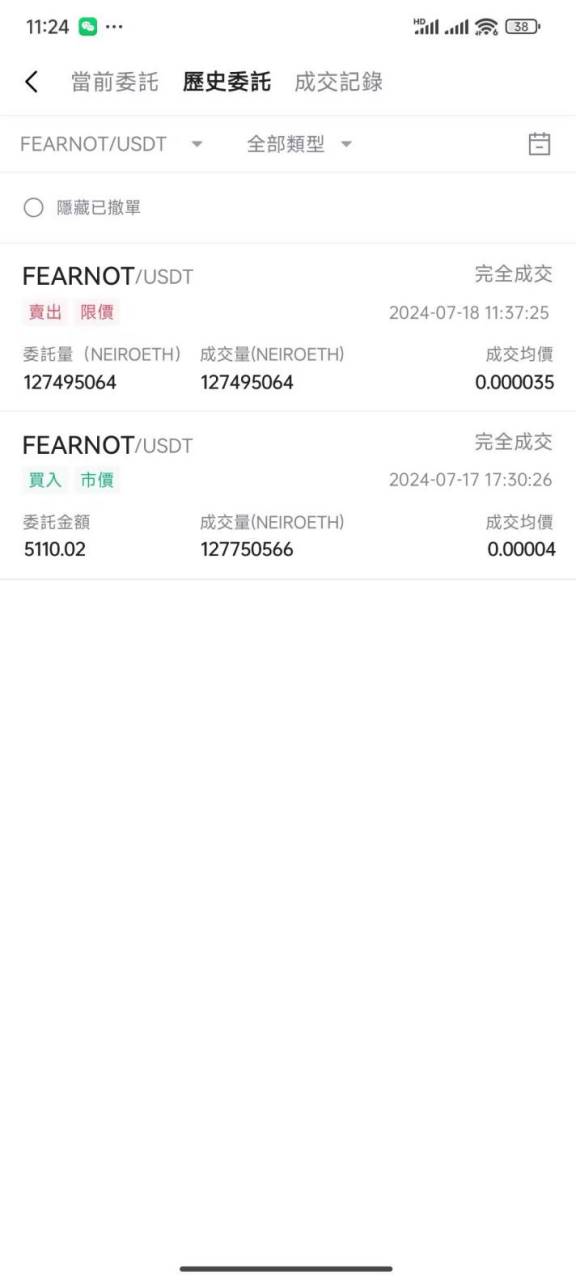

At 17:30, I bought $FEARNOT at 0.00004, but this time the price kept dropping.

July 18th, BTC: Unsettled

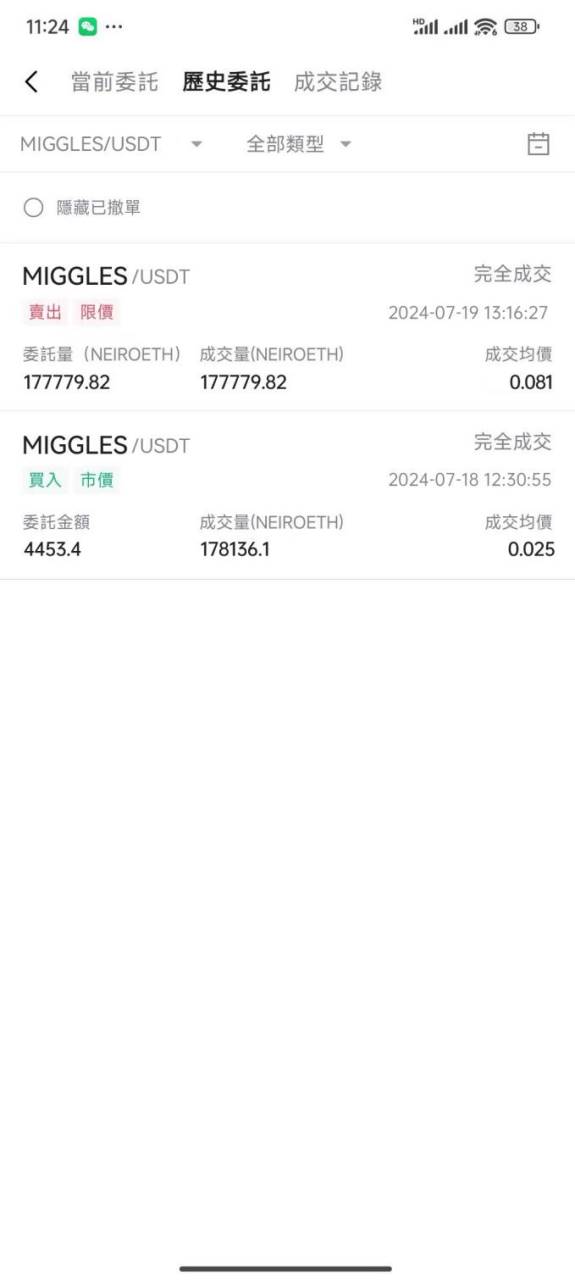

Today, a new coin was listed. Since $FEARNOT had dropped significantly, I chose to switch to $MIGGLES at 12:30. Selling $FEARNOT at 0.000035 resulted in a 12.5% loss.

I bought $MIGGLES at 0.025. Although LBank listed $SWAG at 13:00, I noticed that the market was clearly more interested in $MIGGLES, so I chose to hold onto $MIGGLES. (Side note: As soon as I sold $FEARNOT, it doubled. How annoying.)

I continued to hold onto $MIGGLES and waited for the next opportunity. During this time, $MIGGLES peaked at 0.1, but I didn't sell and continued to hold.

July 19th, BTC: Clear

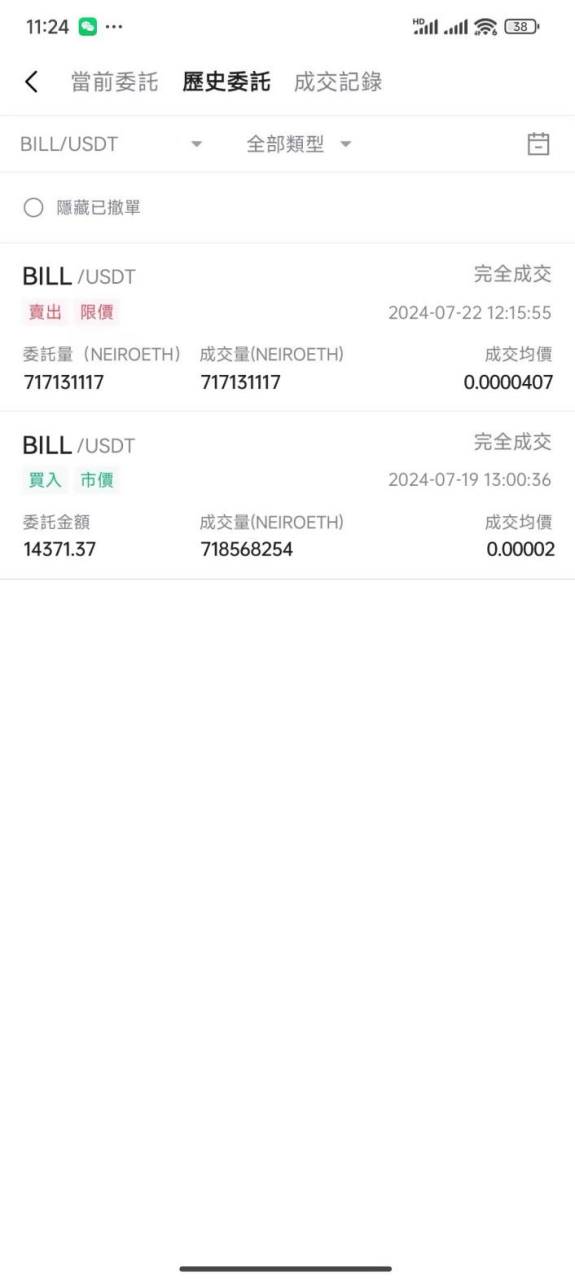

At 13:00 today, LBank had another global debut. At this time, $MIGGLES was priced at 0.81. I decisively switched to $BILL and bought at 0.00002. I successfully obtained a 2.24x return on $MIGGLES.

I continued to repeat this operation: whenever there was a global debut, I would liquidate the previous token and go all in on the new coin.

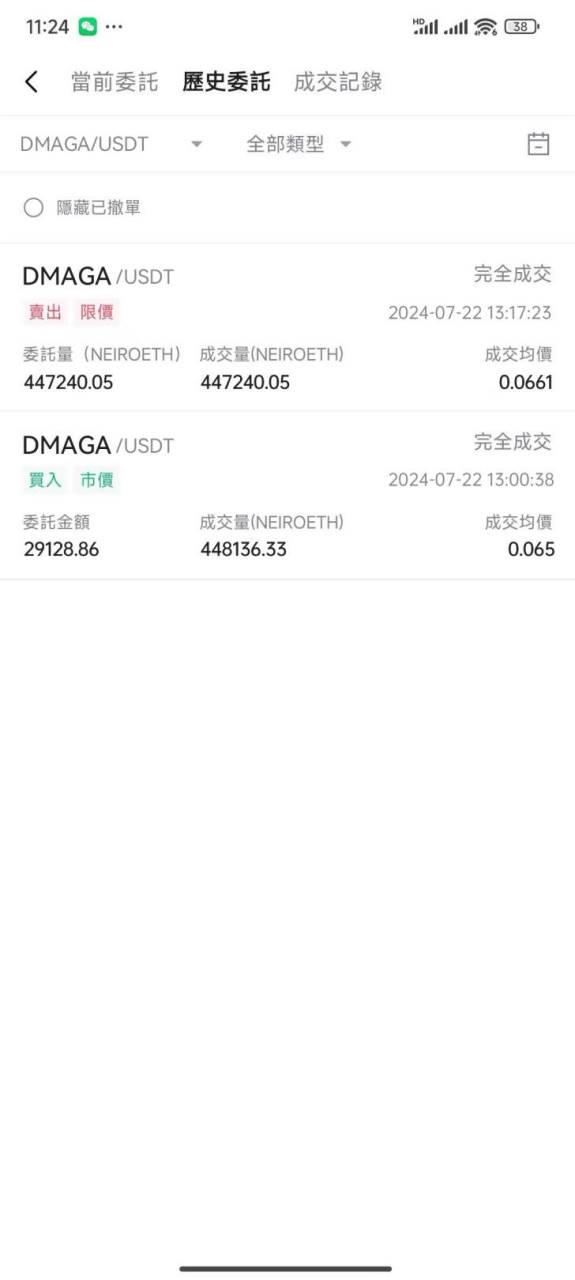

On July 22nd at 13:00, I switched to $DMAGA, which resulted in almost no profit or loss.

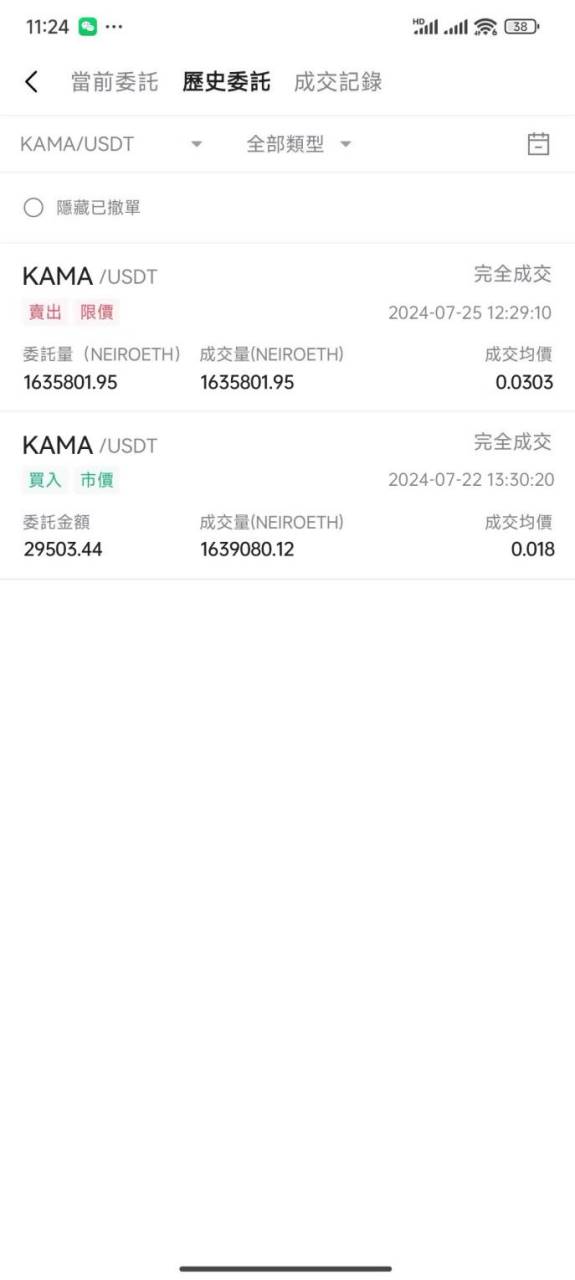

On July 22nd at 13:30, I switched to $KAMA, which yielded a 68.3% profit.

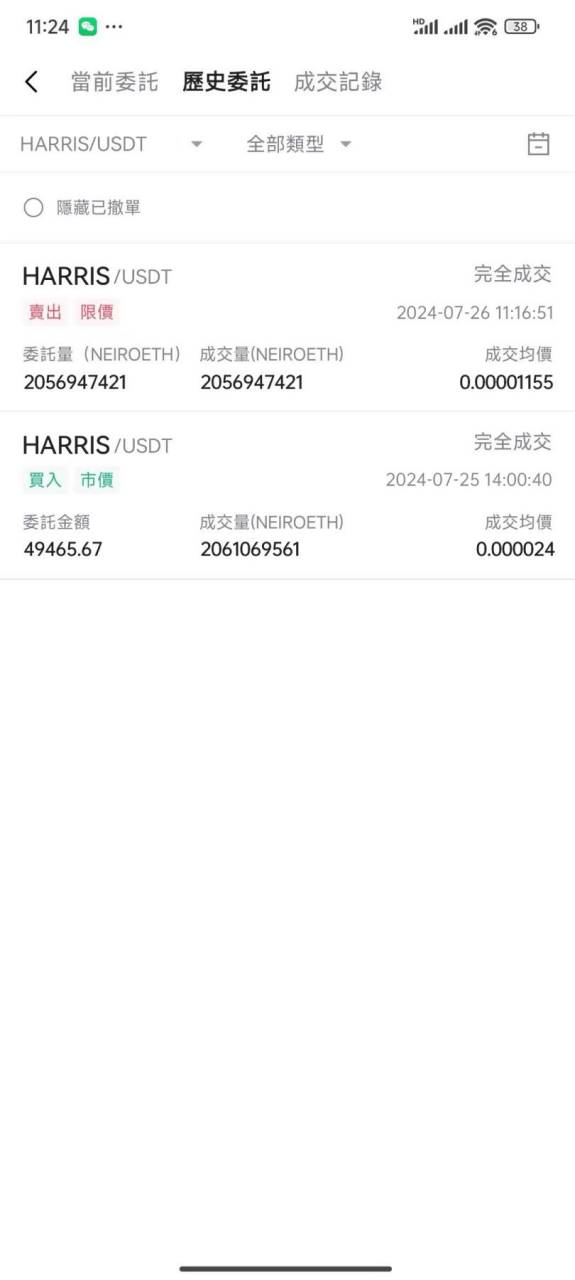

On July 25th at 14:00, I switched to $HARRIS, resulting in a significant loss of half, a 51.88% loss.

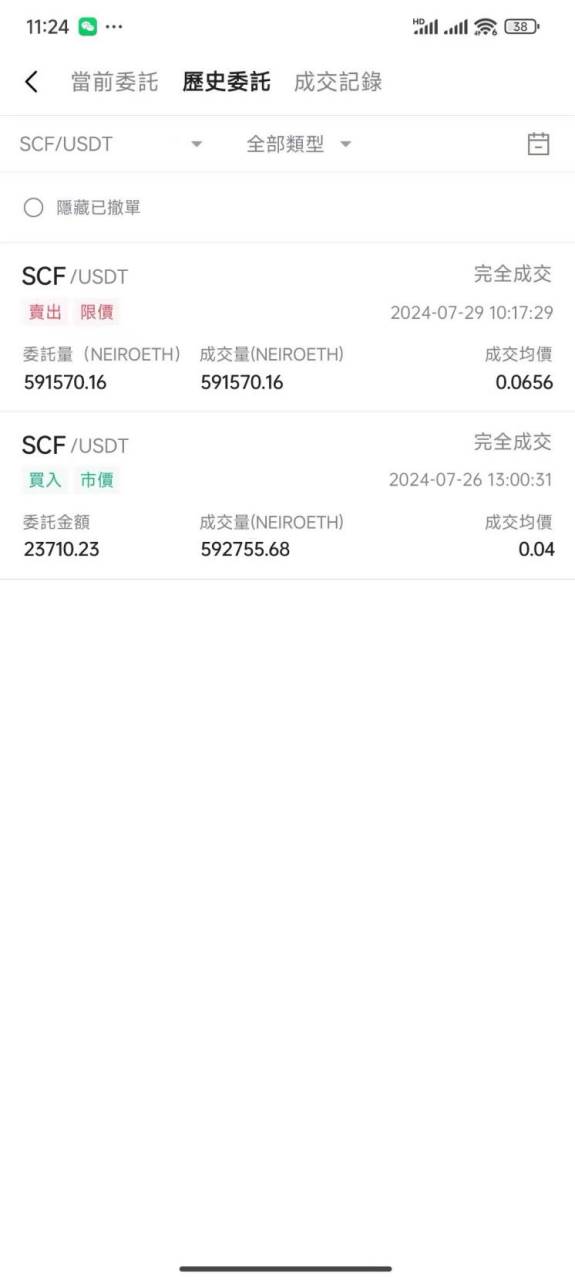

On July 26th at 13:00, I switched to $SCF, which yielded a 64% profit.

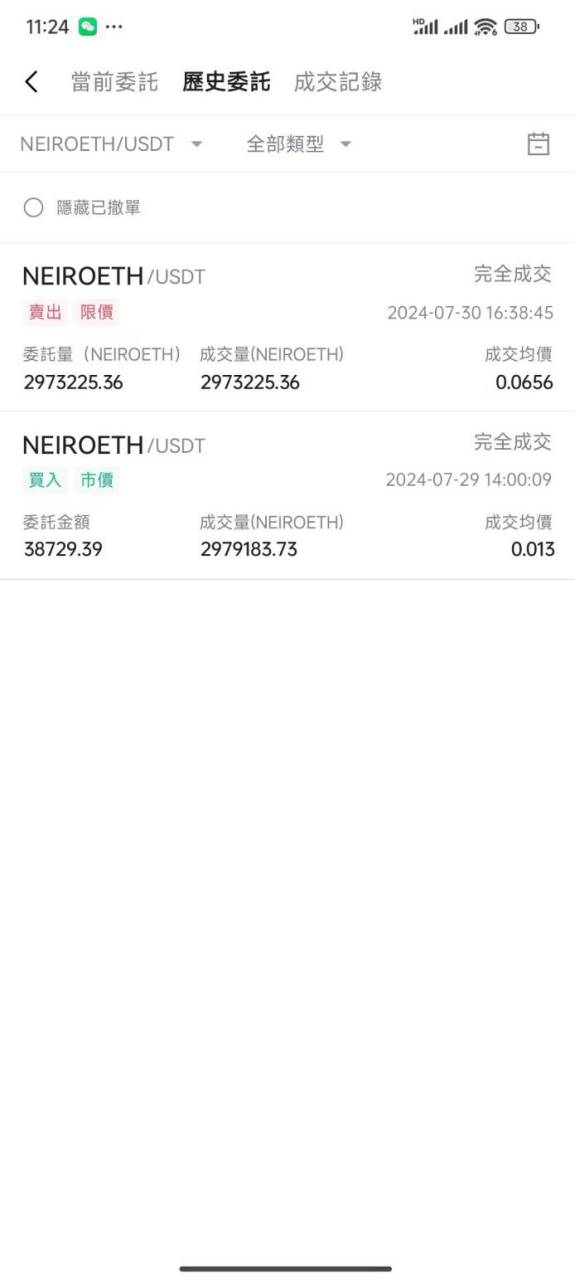

On July 29th at 14:00, I switched to $NEIROETH, resulting in a 404.62% profit.

Starting with 100U, my current account balance is 187,532.03U, equivalent to 1,365,233 RMB.

Now everyone should understand why I chose LBank, right? The fluctuation of MEME coins in the early market is very intense. Through my trading cycle, everyone should be able to see that the most important thing to make money in the MEME coin field is the time difference. The time difference is reflected in the form of the exchange listing early or late. LBank is very quick in listing MEME coins and has a large quantity, which provides the opportunity for rapid wealth accumulation.

Too many Confucius, too few Luban

Compared to cooperating with a wallet today and having another sponsorship tomorrow, I would rather choose a platform with fewer words but more action. In this industry, there are still too many Confucius and too few Luban. Before sharing this, I actually thought for a long time about whether to share these things so bluntly. Because when it comes to stories of wealth, most people have been hearing them from 2018 until now, and their ears are calloused, and their eyes are almost dry. But when I see my account balance increasing, the joy and sense of accomplishment are indescribable. Perhaps for many people in this industry, this 1 million may not be much (at least that's how it feels from what everyone says), but it is indeed something I have achieved step by step.

As an ordinary trading user, the high-profile nature of the platform often has little to do with us (to be honest). But I also understand that as the platform becomes more and more involved, whether it's user costs or platform activities, many platforms are becoming less relevant to retail investors and care more about the interests of large investors and fee contributions. Furthermore, I find it quite exaggerated that many exchanges, in order to improve depth and liquidity, choose not to list many MEME alpha coins, and only choose to list them after they have a certain amount of volume. Then what is the fundamental significance of retail investors trading coins? Looking back at the experience of these short twenty days, from the initial cautious exploration to the later mindless purchase of new coins, it all relied on information asymmetry. LBank brought me information asymmetry.

In the coin circle, there are many opportunities, but information asymmetry is really important. MEME is very promising, and exchanges should focus on providing good services to users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。