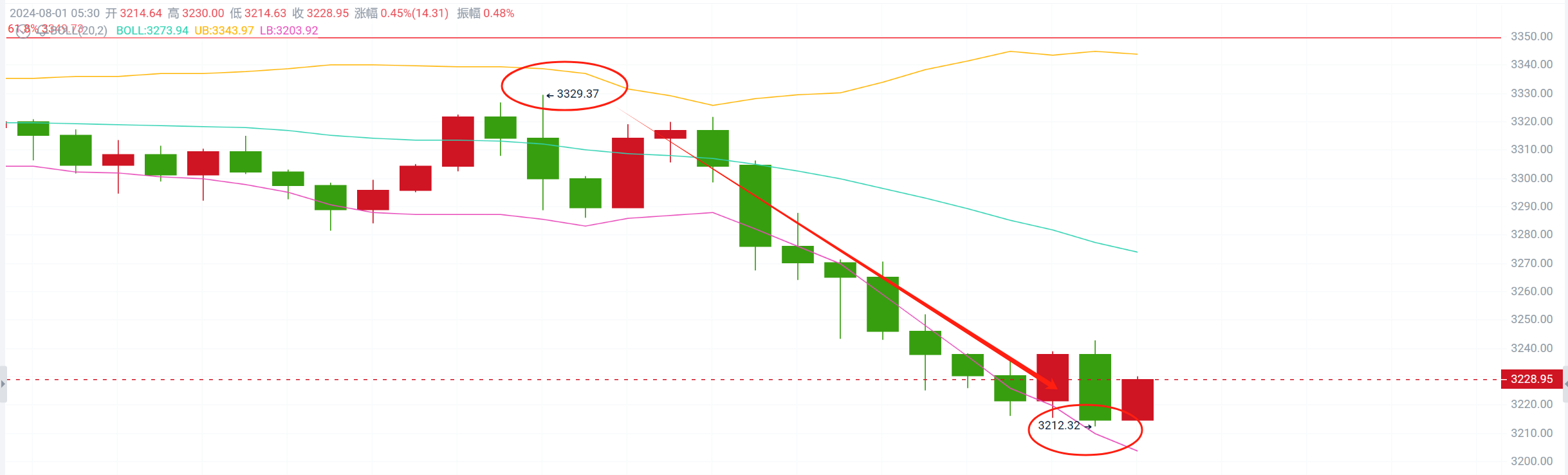

Currently, from the daily chart perspective, Bitcoin retraced after testing the 69500-70000 level, forming a double-pin topping pattern. It continues to test the support at 66500-65500 before entering a short-term consolidation phase. Ethereum remains in a downward trend, continuously testing the support at 3250, with resistance still seen at 3350. From the 4-hour chart perspective, Bitcoin's resistance is expected to adjust to the 65500-66000 level, while Ethereum's resistance is at 3280-3300.

The Federal Reserve's interest rate decision at 2 a.m. basically met expectations. In the current economic context, a rate cut is unlikely in the short term, so it has little impact on the overall market. Therefore, the pressure to short near the resistance level is once again emphasized. Short positions for Bitcoin are at 66800-67300, with a target of 65500-64500, and for Ethereum at 3330-3360, with a target of 3280-3200. The market has basically met expectations, and short positions have once again accurately taken profit. Further layout can be considered based on the situation at the resistance level.

Trading strategy: Continue to short at high levels!

Short Bitcoin at 65500-66000, with a target of 64500-63500 and a stop loss above 66500.

Short Ethereum at 3260-3290, with a target of 3200-3150 and a stop loss above 3320.

The strategy is time-sensitive, and real-time guidance is the main focus!

Professional team and top analyst Ruoyu, focusing on contract trading guidance. Follow the WeChat public account "币圈若渝" for real-time market analysis and trading strategies!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。