Title: AICoin

Daily market news analysis, cryptocurrency market analysis, and data research.

Let's first take a look at this week's macroeconomic calendar. This week, the focus is on the early Thursday release of the US Federal Reserve's interest rate decision and Powell's speech. On Friday evening, the US will release the non-farm payroll data for July. Additionally, on Tuesday and Wednesday afternoon, the Eurozone's second-quarter GDP and July CPI data will be released. These economic data will all affect the trend of the US dollar and the US Federal Reserve's interest rate policy, thereby impacting the cryptocurrency market priced in US dollars. Therefore, we need to pay close attention to these developments.

In addition, Microsoft, Apple, Amazon, and Meta will sequentially release their financial reports this week. As leaders in the US stock market, their reports may cause significant fluctuations in the stock market. Since the launch of ETFs for trading on the US stock market, the inflow and outflow of funds have had a significant impact on the cryptocurrency market. Therefore, the volatility of the US stock market will also have a linked impact on the cryptocurrency market, which also requires our attention.

Today, the hot topic in the cryptocurrency industry is undoubtedly the transfer of nearly 30,000 BTC by the US government. Let's review the timeline of this news:

First, last Sunday, which was the day before yesterday, former US President Trump mentioned at the Bitcoin 2024 conference that if elected, he would prevent the US government from selling Bitcoin. Influenced by this news, BTC maintained overall strength over the weekend.

However, just past midnight last night, according to on-chain data alert, the US government transferred 29,800 BTC, approximately $20.2 billion. Prior to the transfer, within a few hours after the opening of the stock market, BTC had already started to drop from over $70,000 to around $67,670, followed by a slight rebound. After the transfer, it dropped from a low of $68,190 to around $65,860.

During the relatively panicked market in the early morning, some analysts believe that the US government marked the address to transfer BTC to a new address, with the original address used to store a portion of the tokens seized from Silk Road in November 2020, totaling 69,369 coins, with the last operation being four months ago. This operation may be for selling, or it may just be a routine fund transfer, as there was also a wallet fund transfer operation on April 2. The situation will need to be monitored for further developments.

According to subsequent tracking by Arkham, of the 29,800 BTC transferred by the US government, 10,000 coins were deposited into institutional custody services, while the remaining 19,800 coins were distributed to new addresses, and it remains to be seen whether they will be sold in the future.

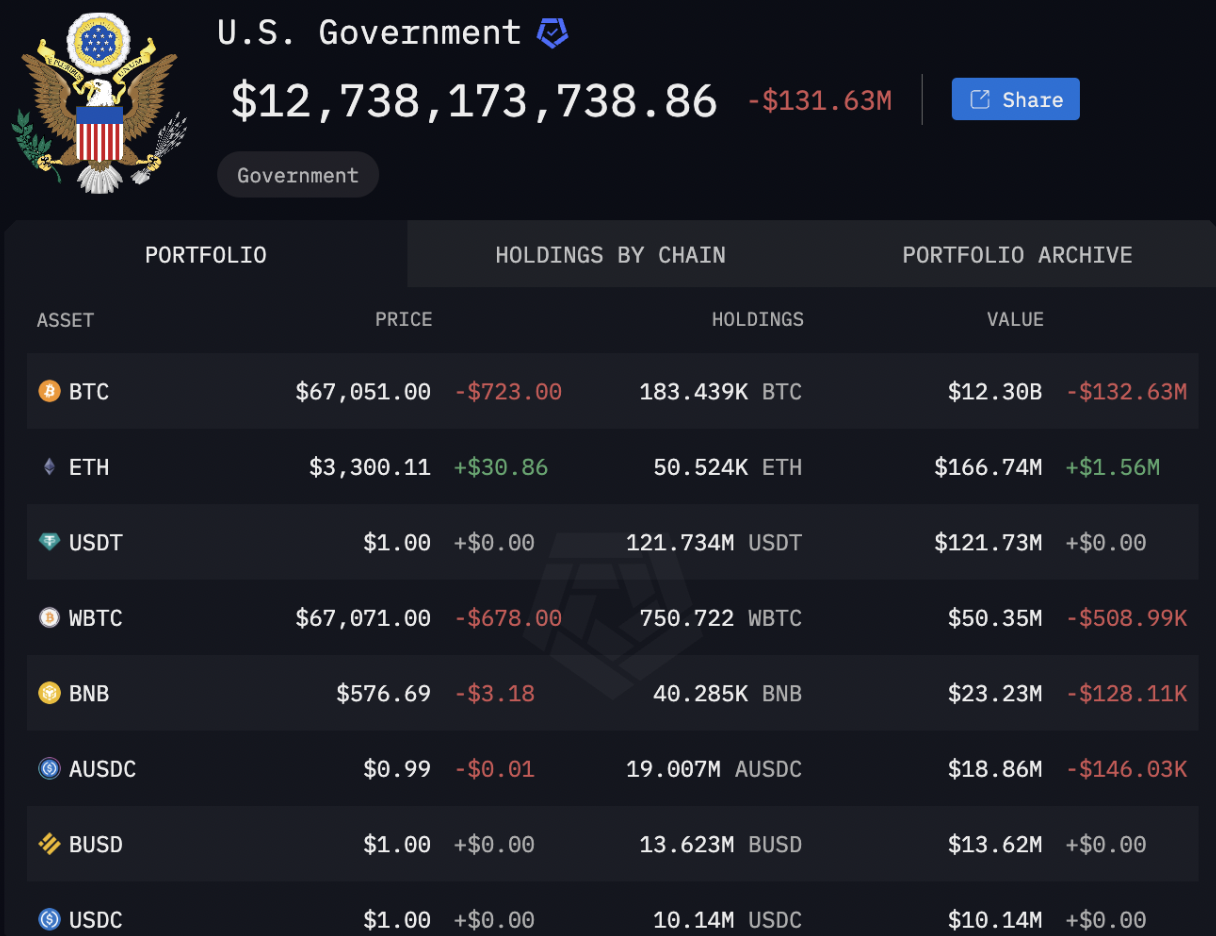

In addition, after the transfer, the US government's address still holds 183,439 BTC, approximately $12.35 billion. In addition to BTC, the US government also holds 50,000 ETH, 121 million USDT, 40,000 BNB, and over 10 million USDC.

This is the complete process of this event, which has also led to significant fluctuations in the cryptocurrency market. What's ironic about this is that just after Trump said on Sunday that he wouldn't allow the US government to sell any Bitcoin, the US government swiftly transferred nearly 30,000 coins the next day, which indeed seems to mock Trump. Furthermore, even if Trump were to be elected again, he does not have the power to decide whether the US government will sell, as the relevant authority lies with Congress, which is embroiled in a partisan struggle. Overall, judging from the market performance of this event, it seems that people are not buying into Trump's speech at the Bitcoin 2024 conference, which seems more like an empty promise, and the market enthusiasm has correspondingly cooled down.

After discussing the market hot topic, let's also take a look at the technical trend. Combining the current hot topics to analyze the market's path before and after: BTC has experienced significant fluctuations recently, more influenced by news. For example, last week, it rose due to positive expectations for the BTC 2024 conference, rising to the resistance below the previous important downtrend line and then falling back. In addition, the US government's large transfer behavior has created a certain level of panic in the market, accelerating the decline. Currently, there is a slight rebound near the lower end of the rising trend line at $65,860. In the evening, we will pay attention to the US government's subsequent actions and the gains and losses near the rising trend line. If the market stabilizes here in the future, there is a possibility of continuing the rebound trend, testing the historical highs of $70,800 and $73,777. However, if it breaks below the support of the rising trend line since $53,485, which is near $65,860, it indicates a temporary end to the uptrend and entry into a period of adjustment, with support below at around $63,500 and $62,400. In terms of trading strategies, we tend to go short and long in the large range of $63,500 to $70,800, closely monitoring the gains and losses of the trend line. If there are short-term trading opportunities, we will update them in the community.

Follow me: AICoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。