With the landing of more high-quality applications and the conversion of user traffic, TON is expected to occupy a place in the global payment market and become an important force in the field of blockchain payments.

Author: Satou

In the blockchain field, The Open Network (TON) has gradually emerged in the payment track with its unique advantages and deep user base. In 2024, the TON ecosystem has shown strong growth in many aspects. According to the latest data, as of July 21, 2024, the USDT issued on the TON network has exceeded 730 million, becoming an important driving force for the development of the TON payment ecosystem. In addition, TON game platforms such as Notcoin, Hamster Kombat, and Catizen have also achieved significant success, attracting 35 million, 230 million, and 25 million users respectively.

As TON ecosystem continues to mature and expand, its prospects for applications in various fields such as DeFi, GameFi, and SocialFi are becoming increasingly clear. The CGV research team delves into TON's "ambition" in the payment track, discussing how it can use its advantages to overcome challenges and achieve long-term development in the field of cryptocurrency management and DeFi.

Unique Advantages of TON: Backed by Telegram's Vast User Base

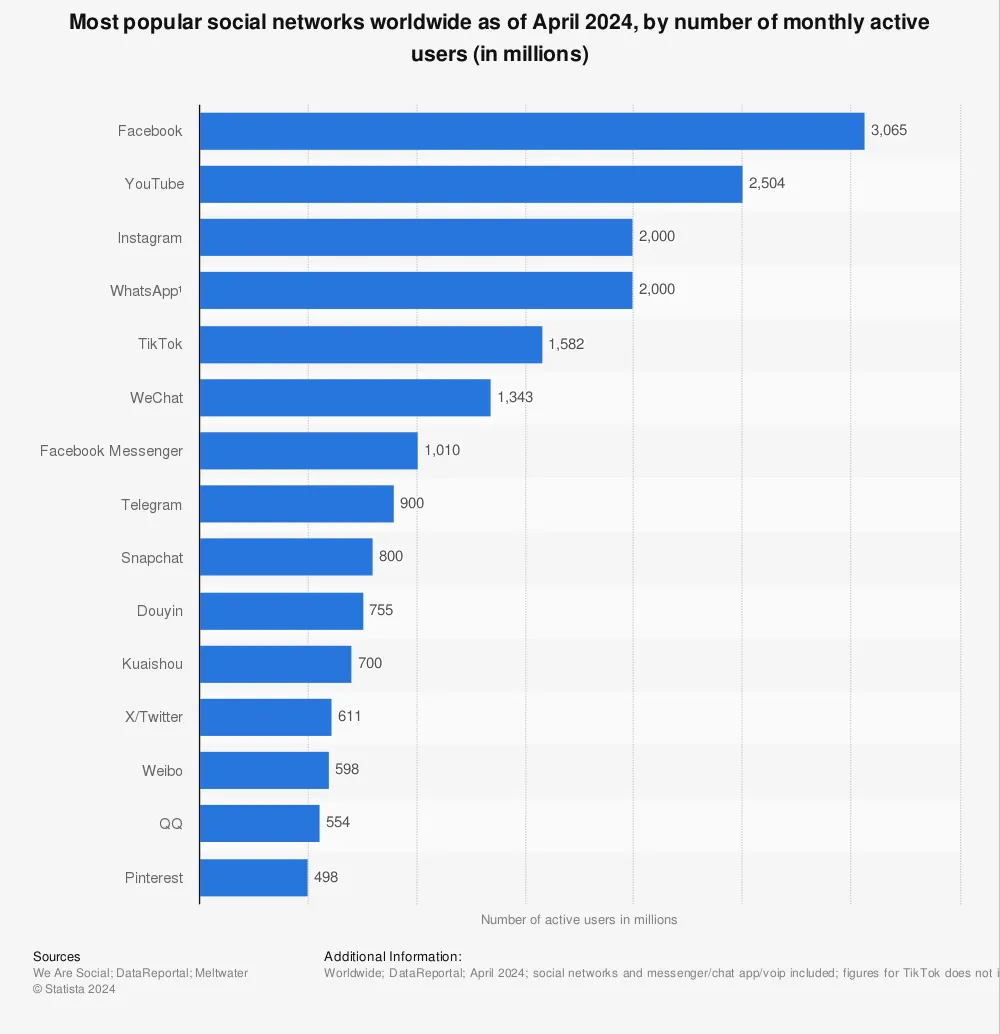

According to Statista data, as of April 2024, Telegram had 900 million monthly active users, ranking eighth in the global social network list. In comparison, according to Token Terminal estimates, the public chain with the highest number of monthly active addresses is Solana, with 14 million monthly active addresses, which is less than 2% of Telegram's users.

In terms of user distribution, in addition to Russia and Ukraine, the birthplaces of the Telegram software, and the diverse population structure of the United States, Telegram users are mainly distributed in developing countries in Southeast Asia, Africa, and Latin America.

Based on user profiles, Telegram has a large user base, but the average income of its users is relatively low, making Telegram more suitable for carrying out business related to traffic rather than serving high-net-worth individuals.

Compared to other social network projects, Telegram launched its own encrypted public chain very early and tightly integrated the public chain with the social network.

In 2017, Telegram's founders Pavel Durov and Nikolai Durov began developing a blockchain project called Telegram Open Network (TON) and planned to launch its native cryptocurrency Gram.

In 2018, they raised about $1.7 billion through an ICO, but this also attracted the attention of the U.S. Securities and Exchange Commission (SEC).

In 2020, due to regulatory issues, Telegram announced its withdrawal from the TON project, returning the development work to the community. It was taken over by the TON Foundation, the project was renamed "The Open Network," and the token name was changed to Toncoin, and the ICO funds were refunded.

After many twists and turns, in 2023, the official announcement from Telegram stated that the TON blockchain would be the preferred infrastructure for its Web3, and it planned to integrate it into the Telegram App interface. In contrast, Facebook's launch of the Libra (Diem) cryptocurrency network, after facing various setbacks and regulatory pressures for two and a half years, announced that it would not be launched.

In addition, Telegram's privacy protection and unregulated nature make it more friendly to cryptocurrencies and to some extent also carry out gray industries that cannot pass regulatory scrutiny. These gray industries were the widespread application scenarios of cryptocurrencies in the early days, so Telegram carries a large number of cryptocurrency users.

Overall, the TON ecosystem, with the help of Telegram, has had the first-mover advantage in developing cryptocurrencies from the beginning.

Monetizing Traffic: Overview of the Current Status of TON Mini Games

Compared to the "Fully Onchain Game" that was once popular on Ethereum, the recent popularity on TON may be the "Fully Offchain Game," some casual (even slightly juvenile) mini-games that attract users through economic incentives. The "Fully Onchain Game" on Ethereum adopts a grand narrative of an autonomous world, attracting users through potential cultural identity, but often fails to attract a large number of users. The mini-games on TON are more pure, where you can open your phone, tap the screen a few times, and then earn 1 point, which can be exchanged for tokens with real value in the future.

Recently, the popularity of TON game projects seems to show the unlimited potential of the industry.

Notcoin has a very simple gameplay, where users earn coins by tapping the screen on their phones, and these coins can be exchanged for Notcoin tokens. It has attracted over 35 million game users and was first listed on Binance and OKX. After listing, the token price soared, reaching a peak market value of nearly 3 billion.

Hamster Kombat also uses the Tap to Earn model, and in addition, it provides ways for players to earn rewards through purchasing/synthesizing cards, daily check-ins, social media tasks, and referrals. It has gained over 230 million registered users in less than four months.

Catizen is a casual cat-raising game that directly establishes cash flow through game monetization and airdrops, with over $10 million in revenue and over 25 million players, and has converted 1.4 million on-chain users.

Notcoin has opened up the imagination of the track, while Hamster Kombat has taken the lead in traffic, and Catizen is more refined and sustainable, representing the future direction: it is not just about clicking, but about building a cash flywheel from day one.

On one hand, the simple game design allows more users to participate in the game, thereby achieving better user data. On the other hand, due to the simplicity of the game design, the cost of increasing traffic is low, and there may be a significant amount of water in the data.

In the future, the mini-game projects in the TON ecosystem will inevitably need to shift from competing for simple user traffic to competing for the conversion rate of user traffic. This not only requires better game design, but also requires a sophisticated monetization system to obtain continuous cash flow and maintain sustainable development capabilities.

Peeking into the Development Focus from Official Channels

According to the TON official website, Mini Apps, GameFi, and DeFi are the key product types that the official wants to onboard.

In the TON Foundation's Grants program, it is also explicitly mentioned to support these categories, and specific product examples are given for each category. The following are the key statements excerpted from the Grants program.

SocialFi: Creator economy

E-commerce: Trading markets for electronic or physical goods

Utility: Daily tools embedded with Web3 elements

Community & Brand management: Tools for managing Telegram communities

Onboarding platforms: Bringing new users to @wallet or sub-custodial TON wallets through simple scenarios

Telegram Mini Apps: Social Web3 Use Cases

Lending protocols

Derivatives DEXs

DEXs with weighted pools (like Balancer.fi)

Yield aggregators

Liquidity layers

Restaking

We are always happy to support web3 games with easy onboarding, viral social mechanics, referral programs, elements of competition (squads, leaderboards, group challenges) and exciting gameplay.

DeFi

GameFi

Based on the above content, the Social Web3 use cases supported by the Mini App built into Telegram will be the focus of development. For DeFi, the TON ecosystem hopes to enrich the application types of the DeFi ecosystem. For GameFi, the TON ecosystem can provide assistance to games in user onboarding, viral social propagation, invitation systems, and competitive social gameplay.

Predicting the Near Future of the TON Ecosystem

Why [Temporarily] Not DeFi

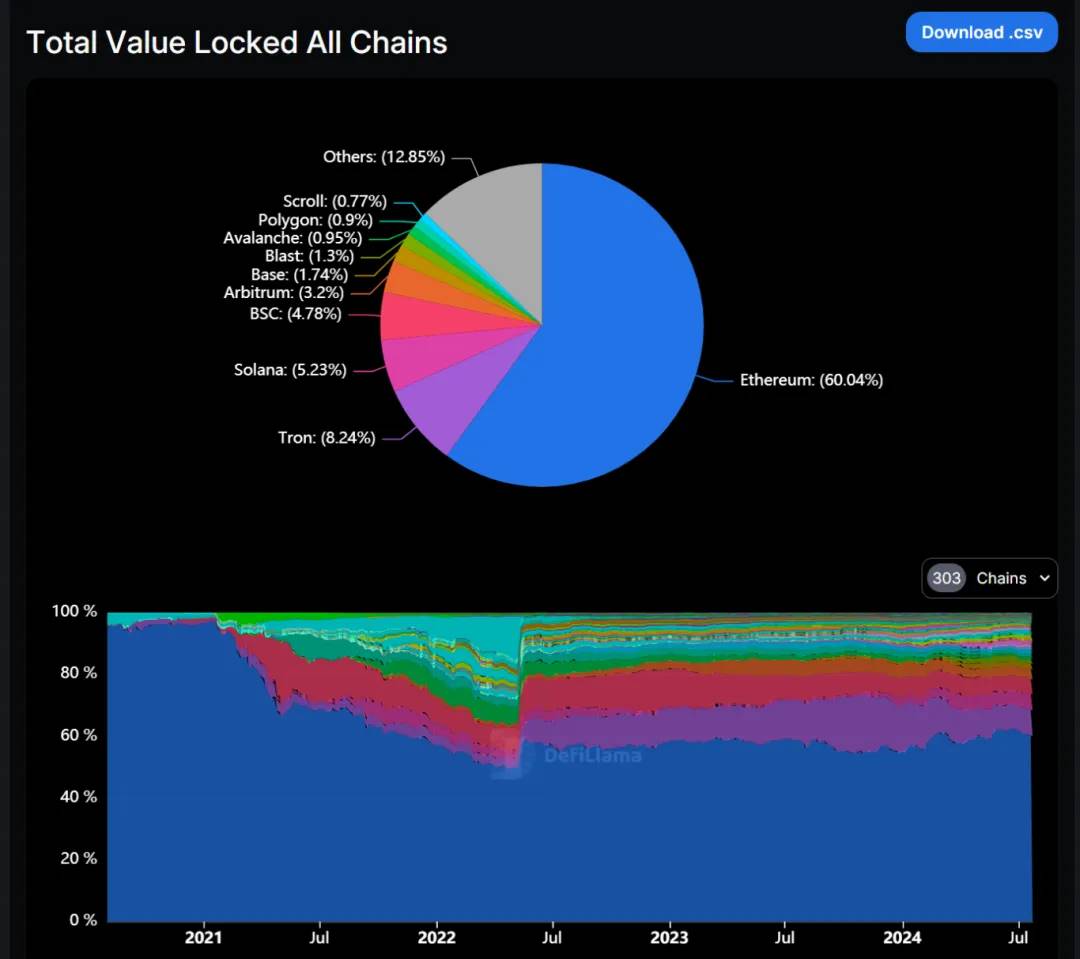

A key indicator of whether the DeFi track is erupting is TVL. From the current data of public chains, Ethereum is far ahead, with a DeFi TVL of 60 billion, surpassing the total DeFi TVL of all other public chains. One reason is the high value of Ethereum's native asset ETH, which has led to a surge in DeFi TVL. Another reason is the completeness of the DeFi ecosystem, with almost all DeFi innovations happening on Ethereum. Ethereum has also introduced a large amount of wBTC through Wrapped Token, which has supplemented DeFi liquidity. Finally, Ethereum's introduction of staking and restaking mechanisms has led to the issuance of a large amount of LST/LRT, creating a significant TVL.

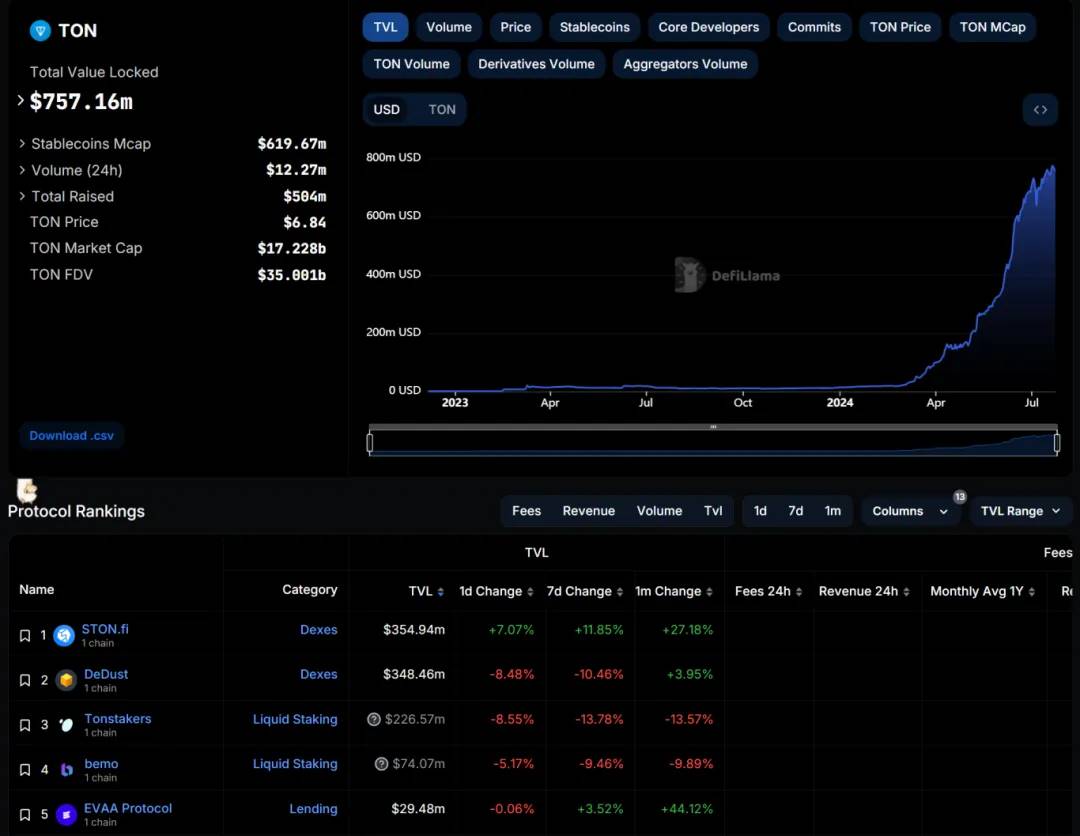

For TON, the largest asset on the chain is Toncoin, with a market value of approximately 17.5 billion, and the second largest asset should be the USDT authorized issuance by Tether, which exceeded 730 million on July 21, ranking fifth among all blockchains. According to data from DefiLlama, the current TVL of the TON ecosystem is 757 million, showing a significant shortfall.

In the view of the CGV Research team, the outbreak of DeFi in the TON ecosystem still lacks the following conditions:

- Onboarding of assets such as BTC, ETH, etc.: The assets with the largest trading volume in CEX are usually BTC, ETH, and other large-cap blue-chip assets. Therefore, it is necessary to rely on high-security, low-slippage, and low-cost BTC, ETH asset cross-chain bridges to bring a large amount of BTC and ETH into the TON ecosystem. However, the current cross-chain bridge infrastructure on TON is still under construction.

- More diverse liquidity staking products: TON has transitioned from PoW to PoS, and the initial supply allocation was given to miners and the team. This has resulted in a low staking rate of less than 10% after the transition to PoS. Therefore, more liquidity staking products need to be introduced to increase the staking level, enhance the chain's security, and increase TVL.

- More secure wallet infrastructure: The @wallet wallet built into Telegram is a custodial wallet, and combined with Telegram's unregulated nature, large holders often do not trust the security of TON. TON needs to introduce more secure wallet infrastructure, including MPC wallets, and undergo thorough audits to gain the trust of high-net-worth users.

These conditions are not related to Telegram's biggest advantage—user traffic, which is equivalent to giving up its biggest moat, possibly resulting in less effective efforts.

Why Payment

Native USDT is being issued on the TON network at an extremely high growth rate. As mentioned earlier, as of July 21, 730 million USDT had been issued. Currently, the chain with the most USDT issuance is Tron, with TRC20-USDT issuance exceeding 60 billion. From Tron's data, we can glimpse the enormous potential of the stablecoin payment track.

The TRON network has over 235 million users, with a transaction volume exceeding 7.8 billion transactions, generating $450 million in annual fees (network fees), with an average of 2-3 million user account transfers of over $10 billion per day. Most USDT holders on TRON are "retail" or small holders. There are 52.6 million holders with balances below $1,000, and this number is still growing, even during the bear market in 2022. In contrast, the $1K-$10K group has 359,000 holders.

From the on-chain activity, Tron's on-chain transactions are mainly USDT transfers, with relatively low DeFi adoption and almost no NFTs. Other public chains' popular LST/LRT and Memecoin are virtually non-existent, yet they still support a transaction volume of 78 billion. It can be said that Tron is a public chain born for stablecoin payments.

The reason Tron can achieve such a large-scale adoption of stablecoin payments is primarily due to:

- Tron's network transaction fees are lower than Ethereum, with faster speed and higher TPS.

- Early adoption has led to a network effect, creating a two-way flywheel between users and merchants.

- Long-term stable service has earned user trust.

In comparison, the payment business on TON has the following advantages over Tron:

- Higher TPS: After enabling sharding, TON can support a maximum TPS in the millions, with lower fees than TON.

- Closer to users: The TON wallet is directly built into Telegram, making it more convenient to use and with richer scenarios, similar to WeChat Pay.

- More diverse on-chain activities: TON has more application scenarios for on-chain funds, rather than just simple fund transfers.

The TON Foundation is also actively promoting the application of USDT on TON:

- 5 million TON is used to reward the USDT Farming Pool, where depositing USDT can earn up to 50% APY in Toncoin rewards.

- On July 1, Tether partnered with Web3 shopping and infrastructure company Uquid, allowing Filipino citizens to use USDT to pay social security funds on TON.

- Transferring USDT on Telegram using the built-in wallet is free, instant, and can be sent directly to friends without the need for an address.

- Products such as subscriptions, VPNs, game platforms, and eSIM on Telegram can directly use USDT on TON for payments.

At the same time, payment will also serve as a key primitive to empower Telegram Mini Apps, serving various types of Social Web3 Use Cases. For example, the creator economy (SocialFi) requires payment to complete subscription and tipping functions, while e-commerce requires payment to complete purchases. More importantly, Telegram Mini Apps are expected to become the Web3 version of the App Store, and the App Store requires payment functionality to manage paid applications. In the future, Telegram may emulate Apple and charge fees for paid services for applications logging into its App Store, further diversifying its revenue model.

Currently, TON has integrated multiple third-party payment service platforms, allowing merchants to accept payments in various ways.

Of course, compared to WeChat Pay, the payment business in the TON ecosystem still has its risks. The most critical of these is that Telegram's privacy protection and unregulated nature may prevent a large number of physical businesses from accessing TON payments due to compliance factors. However, the TON Foundation is actively seeking countermeasures, one of which is that the TON USDT Farming Pool requires KYC to receive rewards, indicating TON's attitude towards compliance.

In conclusion, the CGV Research team believes that the rise of TON in the payment track is not accidental, but the result of the combined effects of its strong user base, technological advantages, and ecosystem strategy. Although it still faces many challenges, such as regulatory issues and user trust, TON has demonstrated strong growth potential with its innovative payment solutions and ecosystem closely integrated with Telegram.

In the future, with the landing of more high-quality applications and the conversion of user traffic, TON is expected to occupy a place in the global payment market and become an important force in the field of blockchain payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。