On the afternoon of July 29th, AICoin researchers conducted a live graphic and text sharing session titled "Maximizing Profits: Advanced Contract Grid Strategies (with Membership Giveaway)" in the AICoin PC-end Group Chat Live. Below is a summary of the live content.

I. Bitcoin Breaks Through the $70,000 Threshold

1. Bitcoin Market Trends

Bitcoin has successfully broken through the $70,000 mark and is heading towards the fast lane with no significant upward pressure.

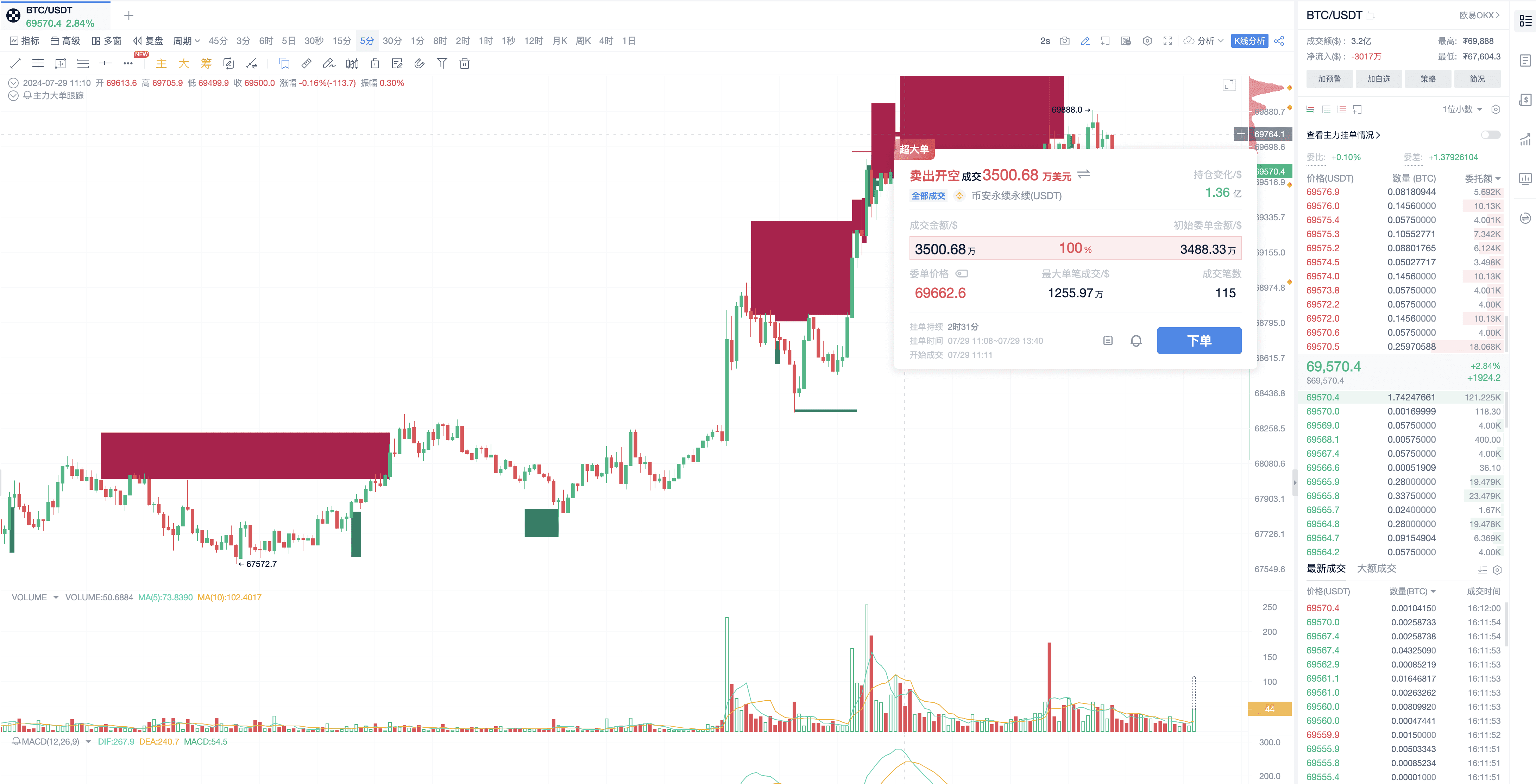

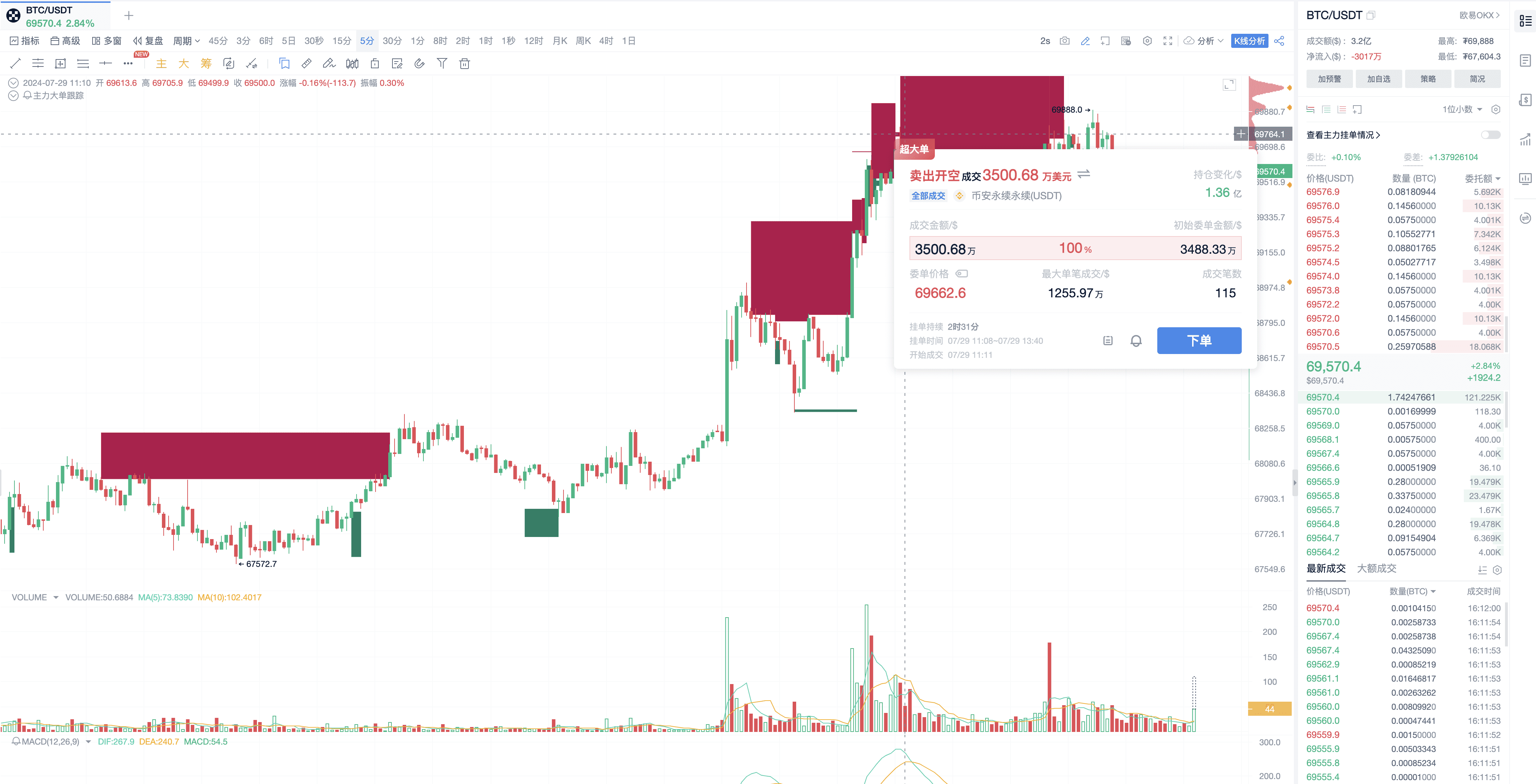

However, before reaching $70,000, a large single short position appeared in the market, which is expected to bring some pressure. Just after reaching 70,000, a large single short position of over 30 million appeared. This indicates that the market may need more support from funds and positive news at this price level to continue the breakthrough.

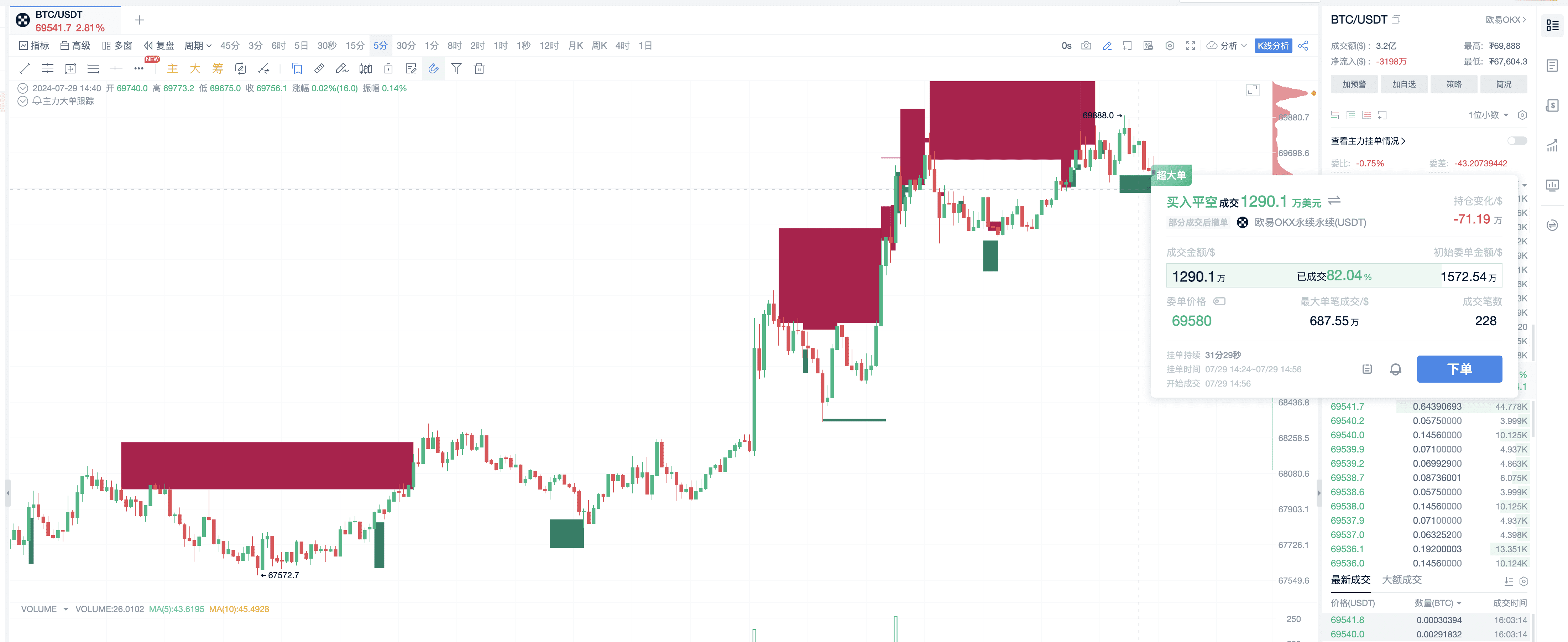

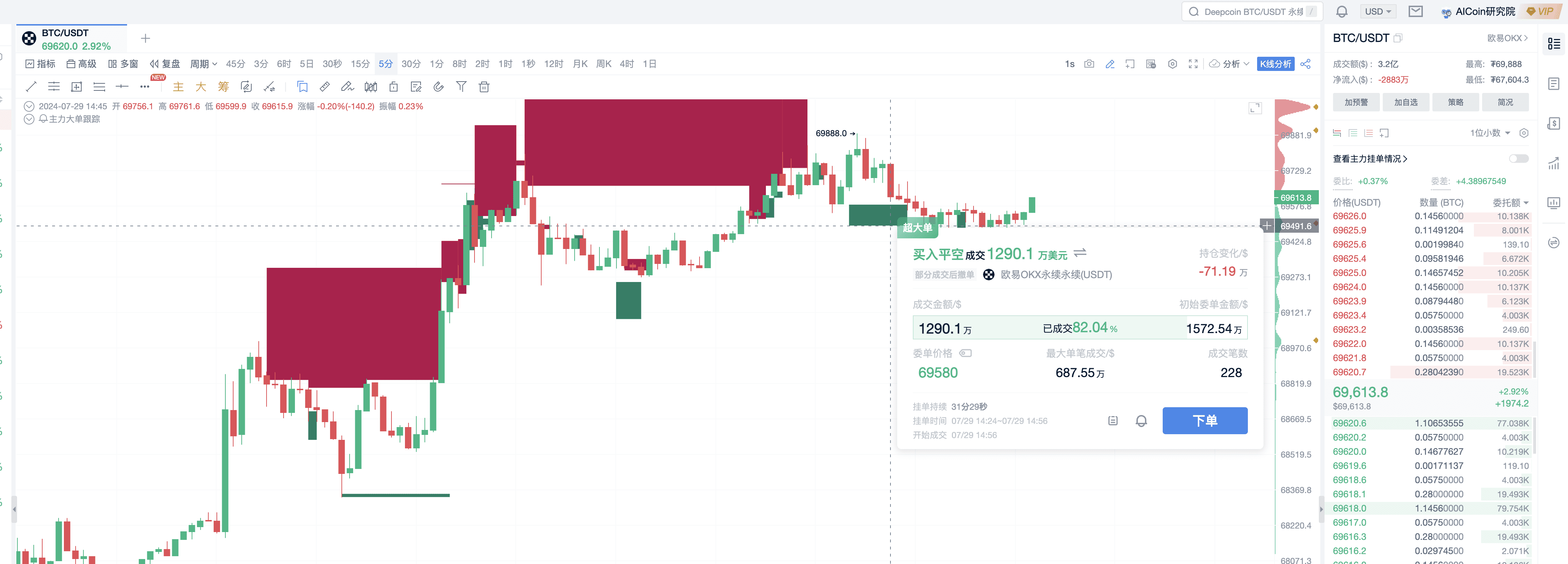

Currently, several large short positions in the market have made some profits and have chosen to partially exit, but the amount of exit is not very large. A total of over ten million funds have exited, indicating that the market is still actively adjusting.

2. Importance of Analyzing Large Single Positions

Having tools for analyzing large single positions, as I have demonstrated, can help investors identify the situation of the pressure from large single positions as Bitcoin is about to break through $70,000. This helps everyone avoid impulsive trading and stay calm.

By observing the closing actions of large single positions, investors can identify the best timing for chasing the rise. Currently, the main force has closed some positions, indicating that there will be further market operations around $70,000. We can use this to profit from market fluctuations.

II. Grid Trading Strategies

Grid trading is divided into contract grid and spot grid.

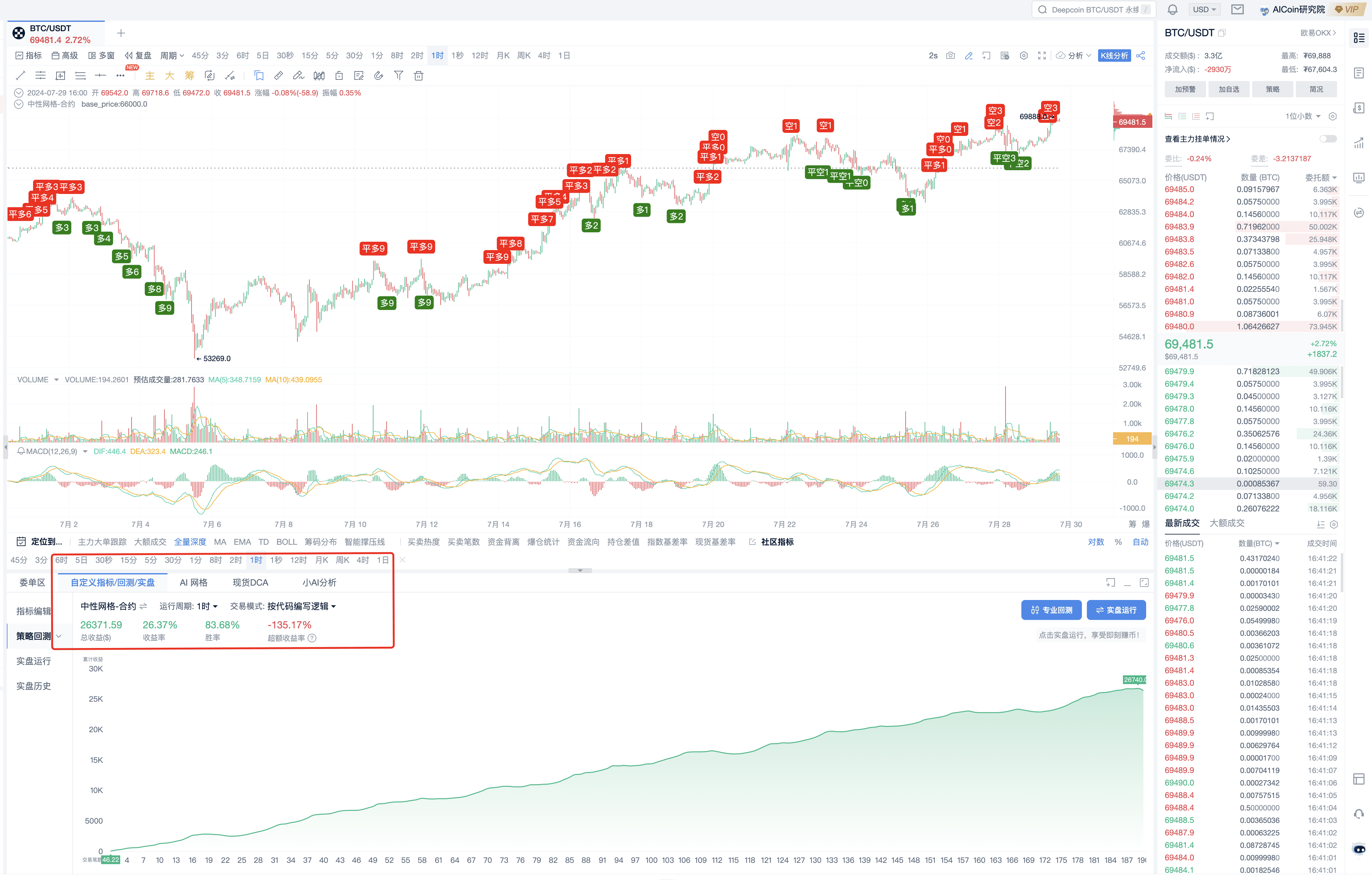

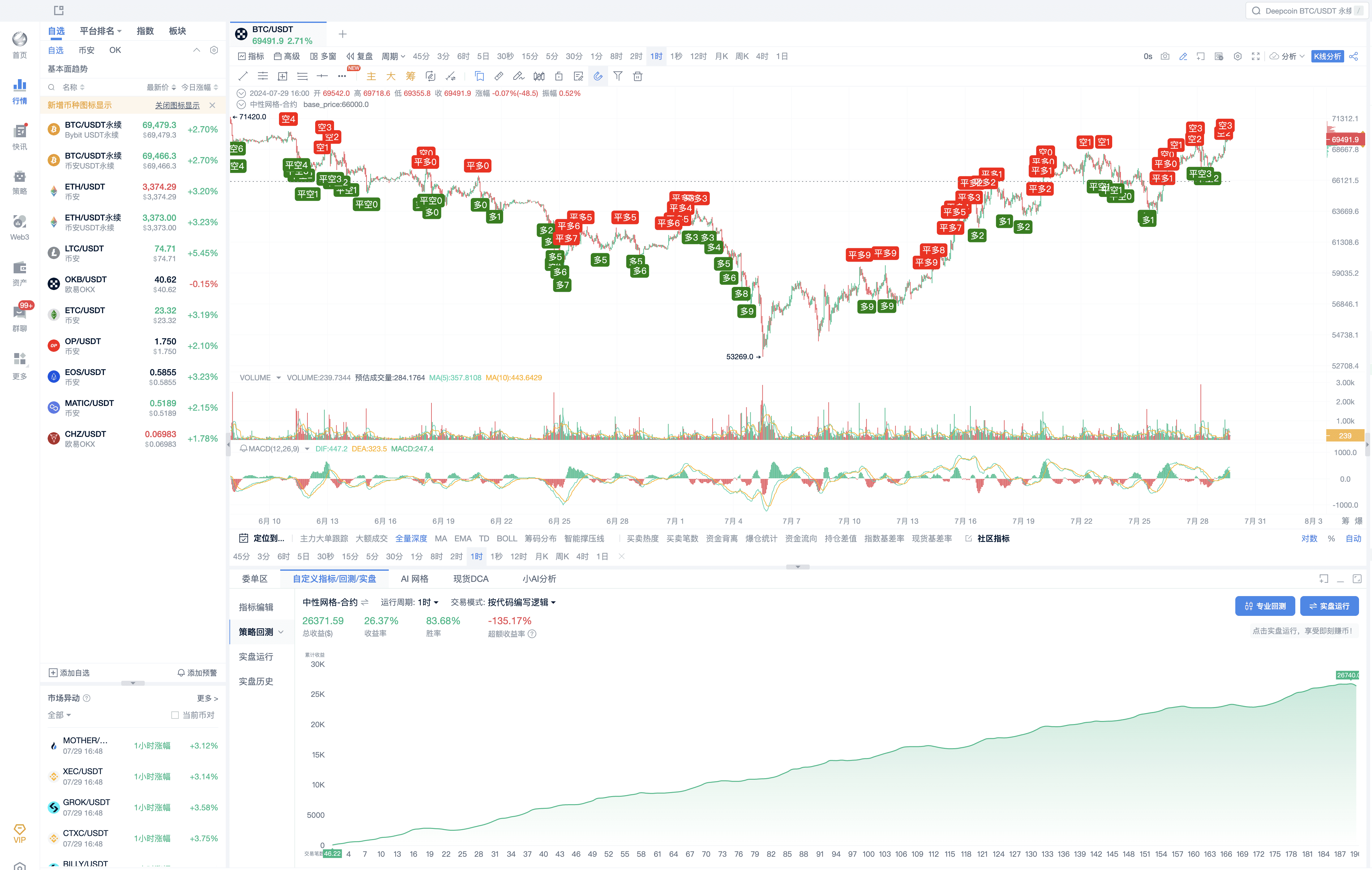

To better explain this concept, the AICoin Research Institute specifically implemented a test grid a few days ago.

The institute used BTC's contract grid, created on July 26 and lasted for over 2 days. A simple analogy for grid trading is to profit from each price grid. The price curve is drawn as horizontal lines, and a long or short position is opened at each price line. The institute is running a neutral contract grid, meaning positions are opened on both sides, maintaining a neutral balance for easy understanding.

III. AICoin's Grid Tools

1. Tool Introduction

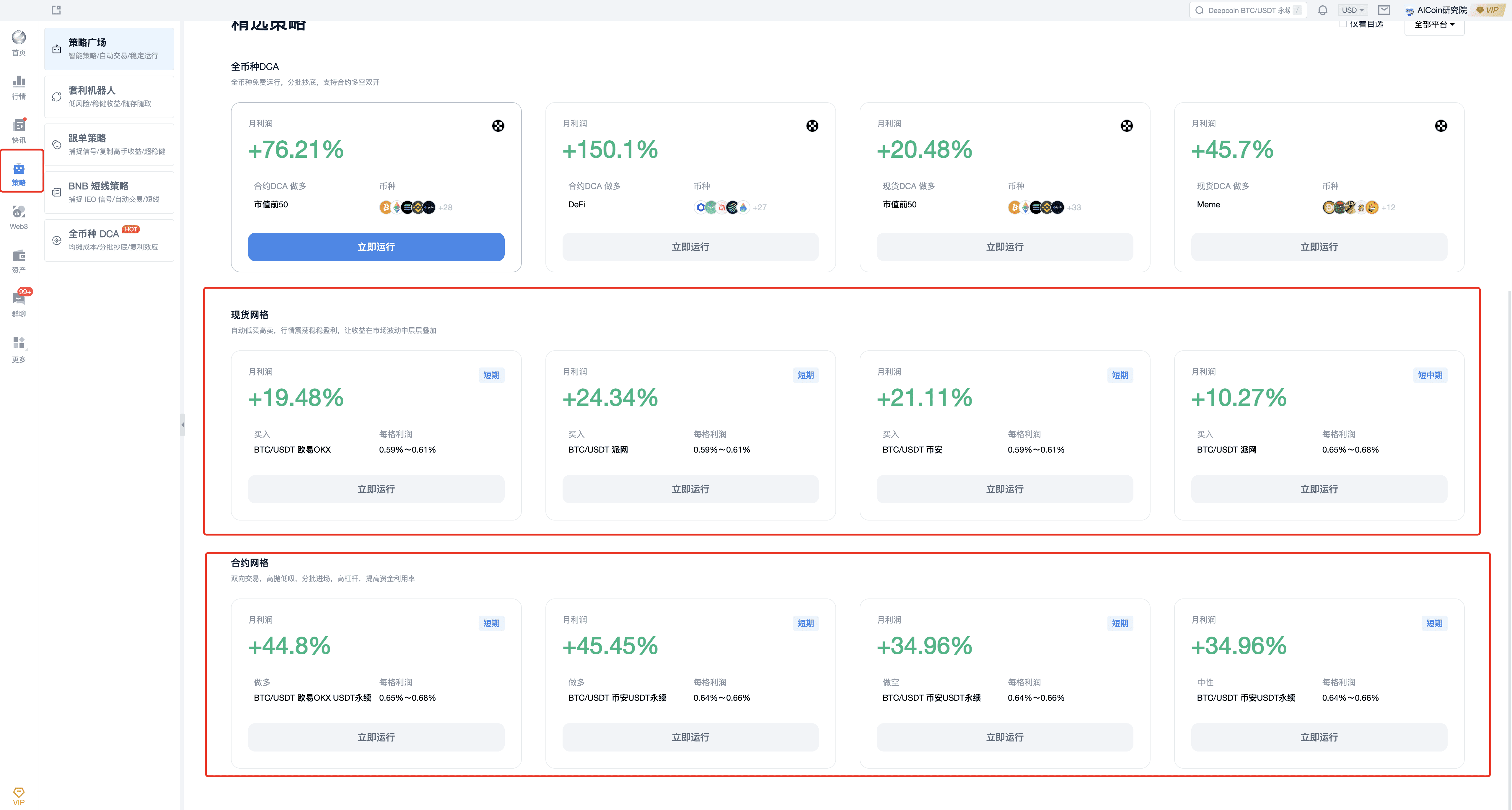

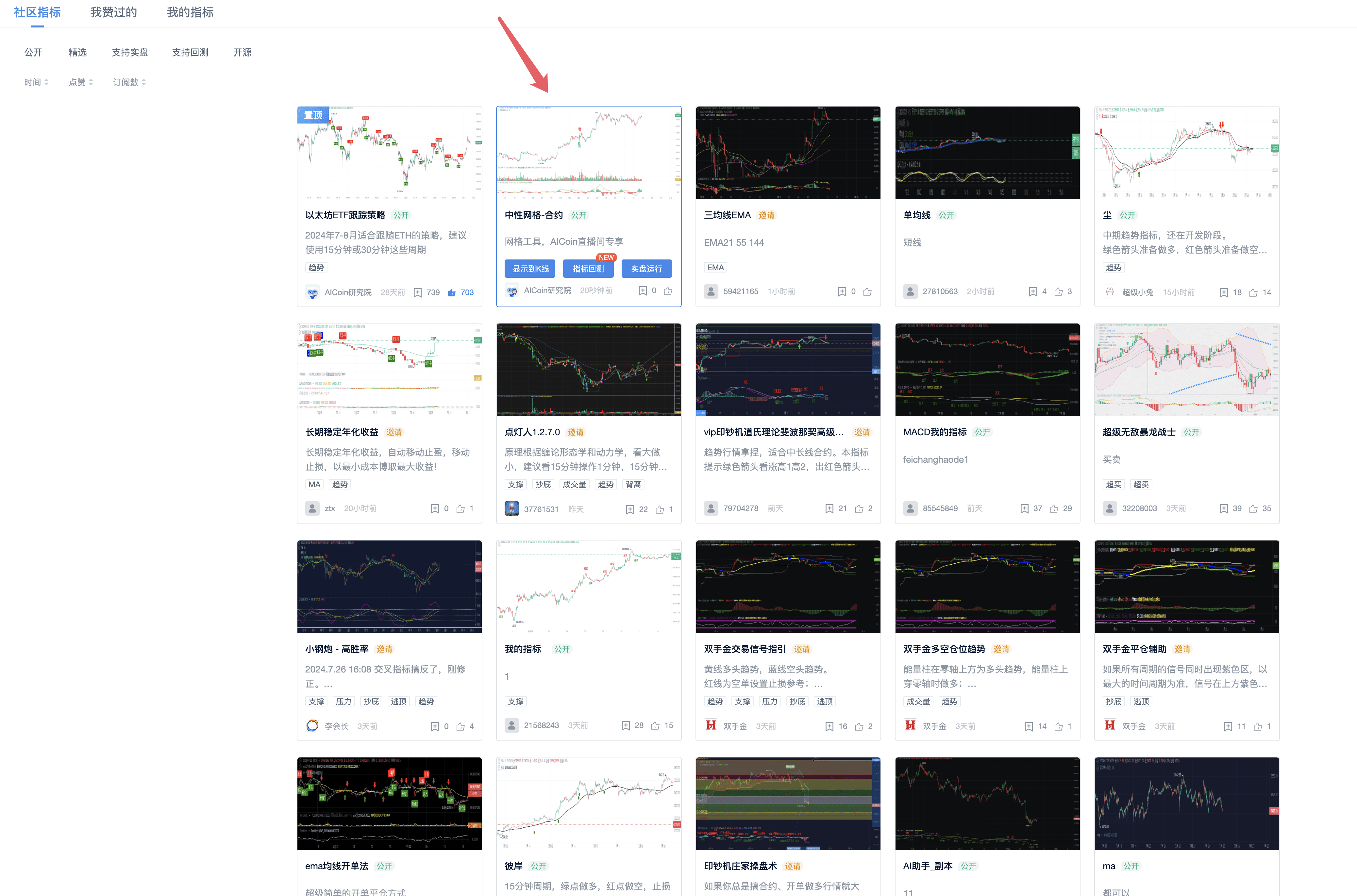

AICoin provides three types of grid tools: spot grid, contract grid, and custom indicator grid.

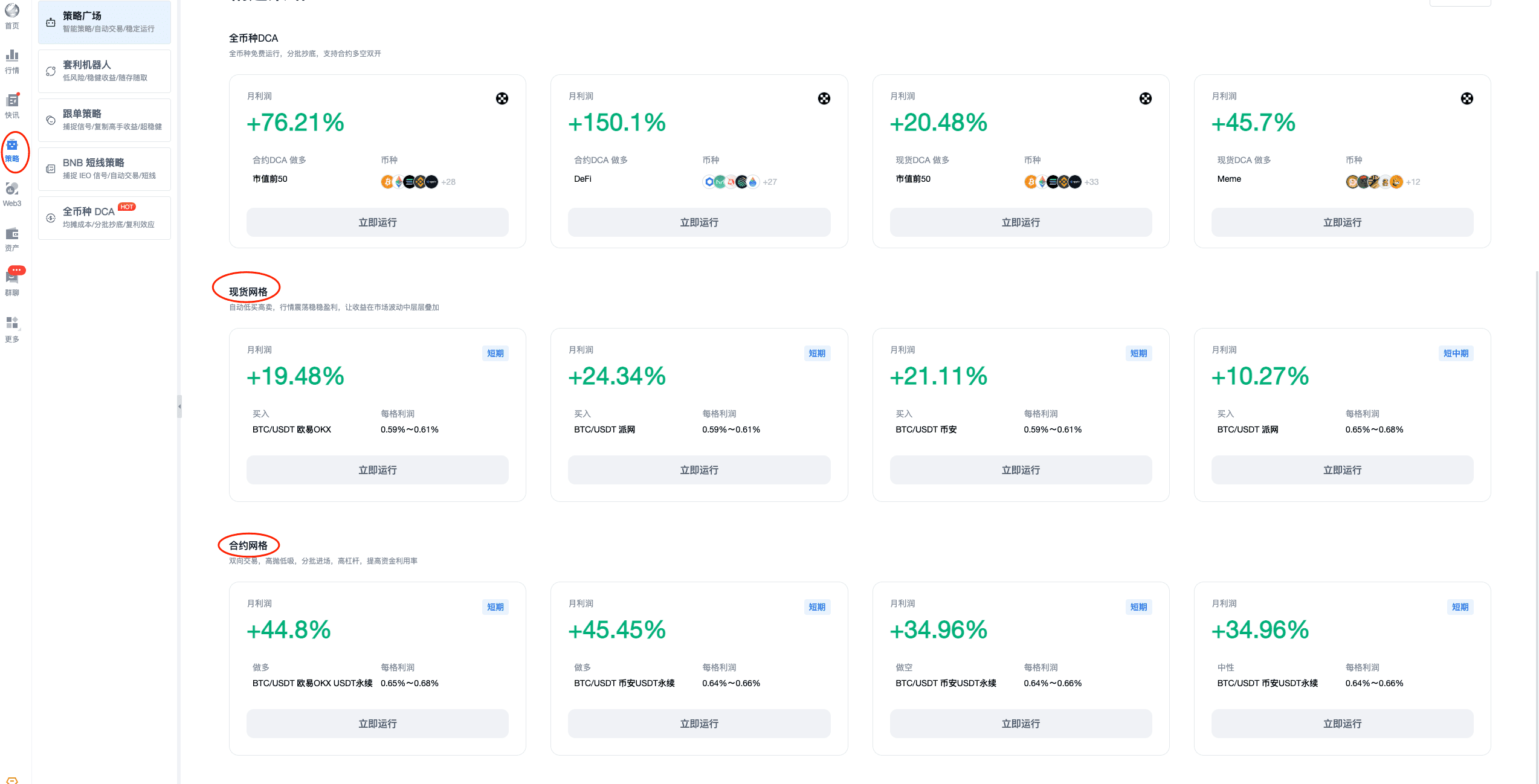

Users can see several grid strategies recommended by the AICoin platform on the strategy page, which are based on short-term backtesting results and have good reference significance.

2. Practical Methods for Grid Trading

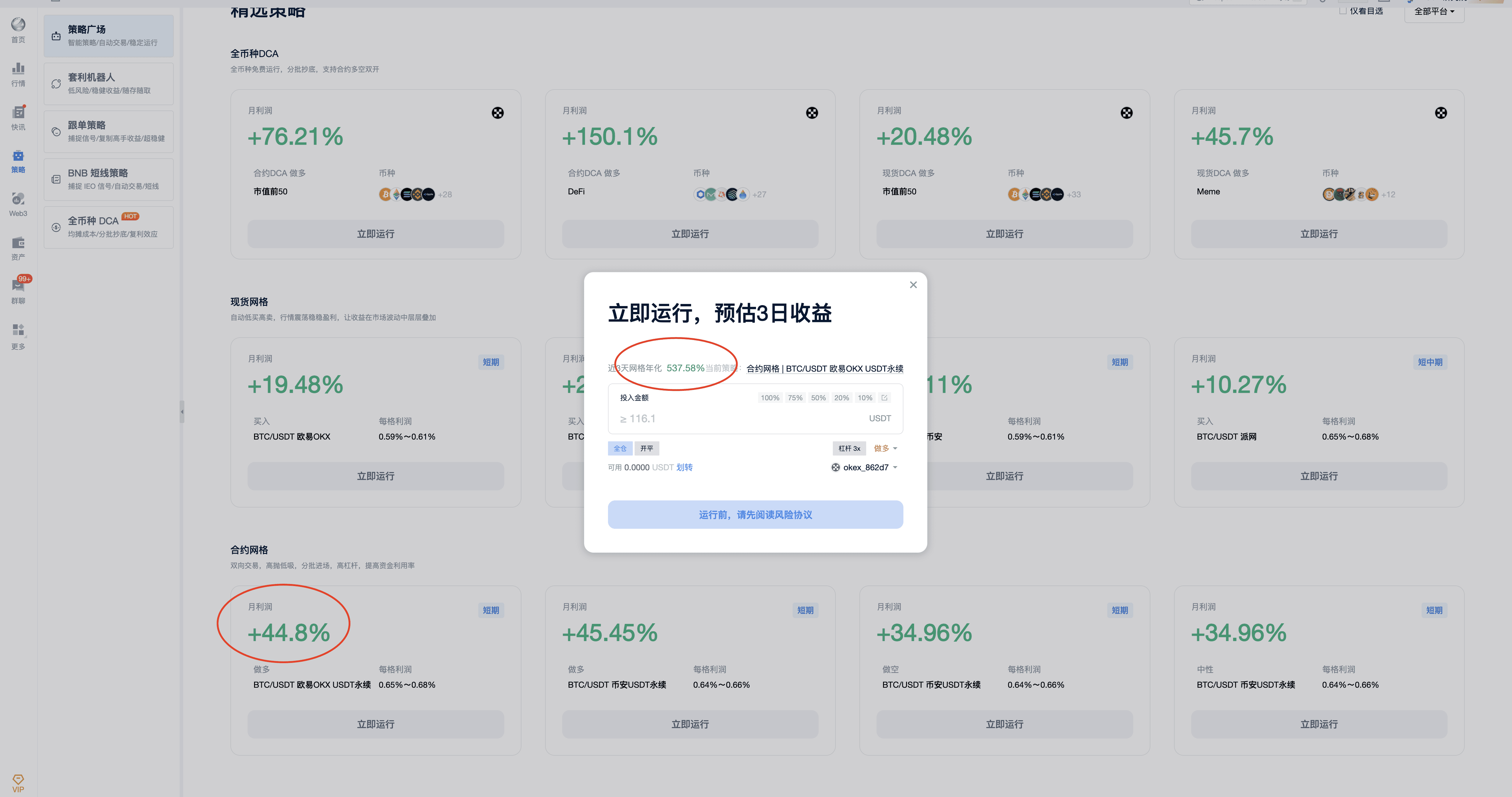

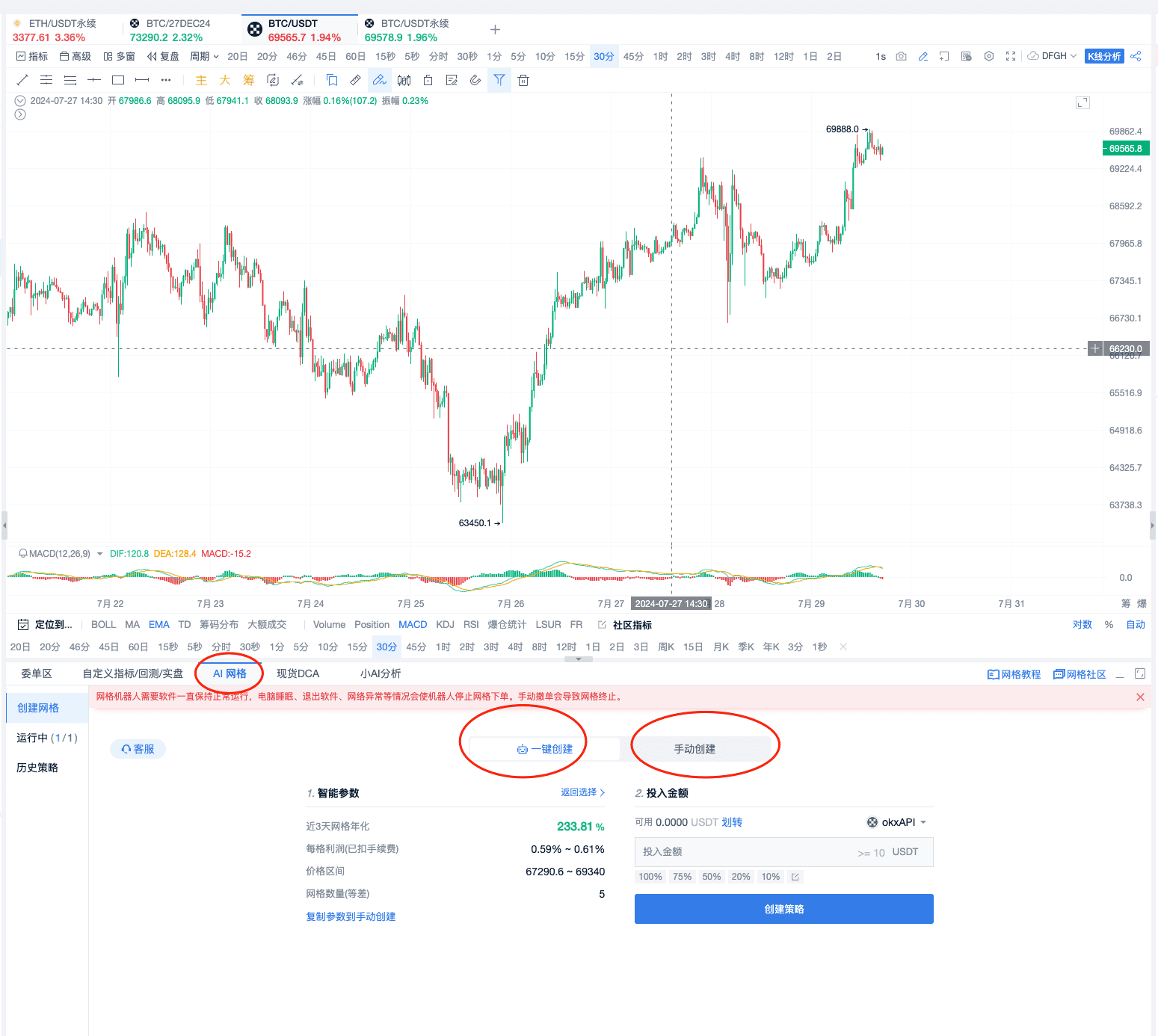

Select the first option in the strategy section, and the platform will immediately calculate reference data such as monthly profit and annualization for user convenience.

During this period, Bitcoin has been oscillating between $62,000 and $70,000;

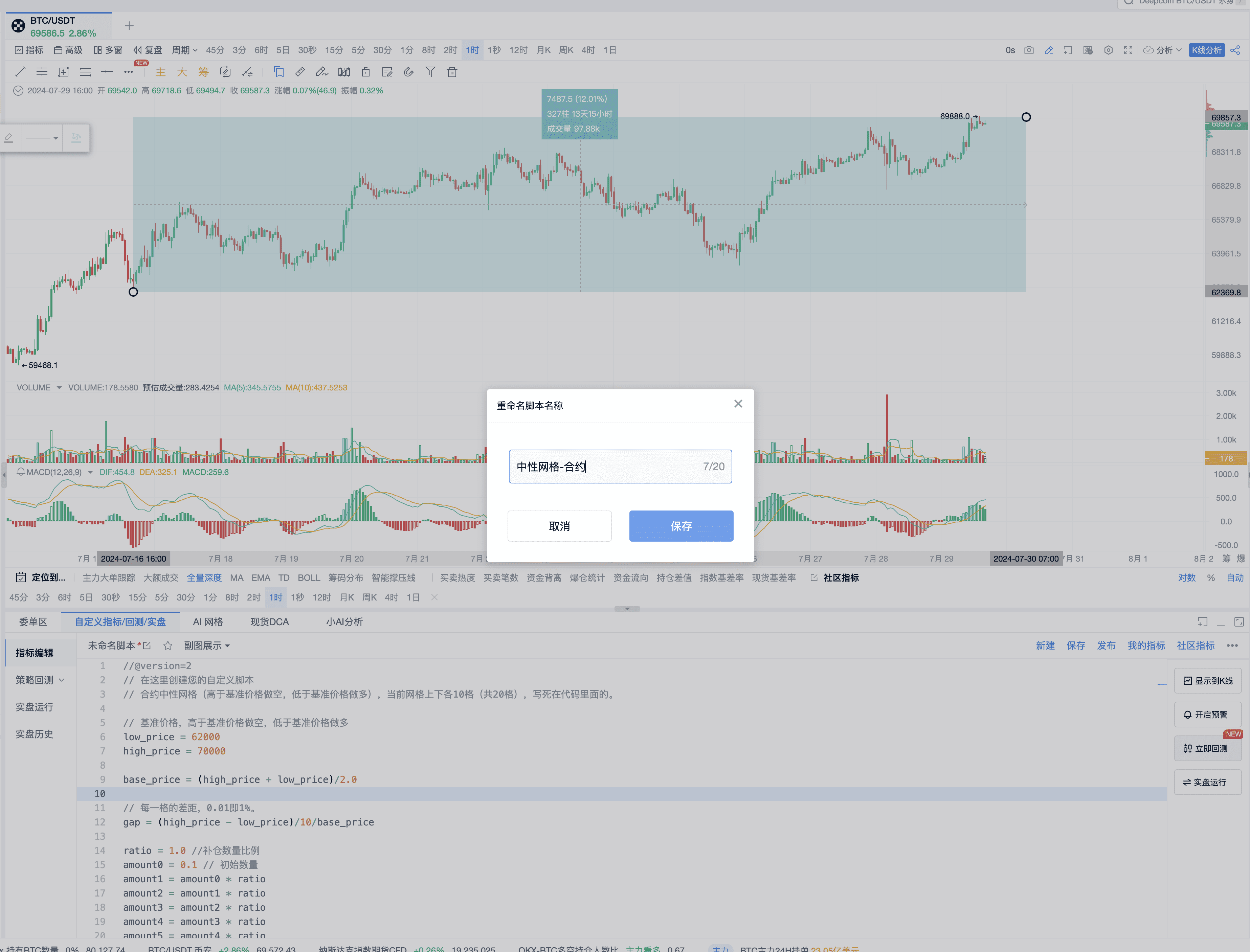

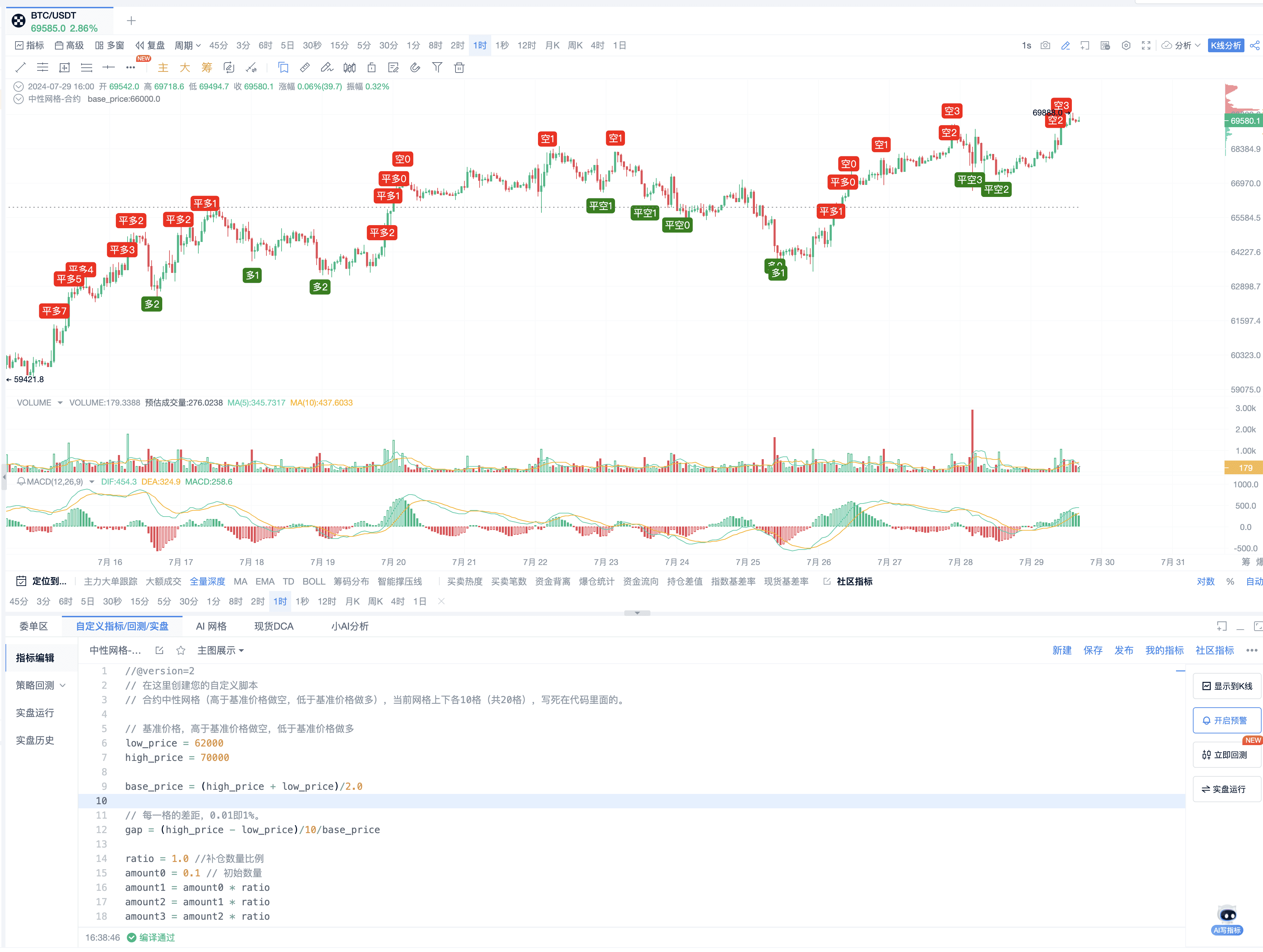

So, let's write a similar grid algorithm to see where the signals on the candlestick chart are and whether it can make money:

After writing the indicators, we can see that it can basically be achieved, buying at low points and selling at high points;

Next, let's backtest to see if it can make money. The backtesting results show that the profit curve has been consistently upward;

From the backtesting results, it's not 100% guaranteed, but the success rate can reach 83%. The data from backtesting and actual running indicate that the current market conditions are very suitable for running grids, and running grids means making profits.

In addition, to help everyone better understand grids, our institute has also specially produced a video. If you have the opportunity to watch YouTube, you can subscribe to our AICoin channel: https://www.youtube.com/watch?v=Y6cLey8qnqU

We have made a video explanation that is easy to understand:

3. Classification of Grid Trading Strategies

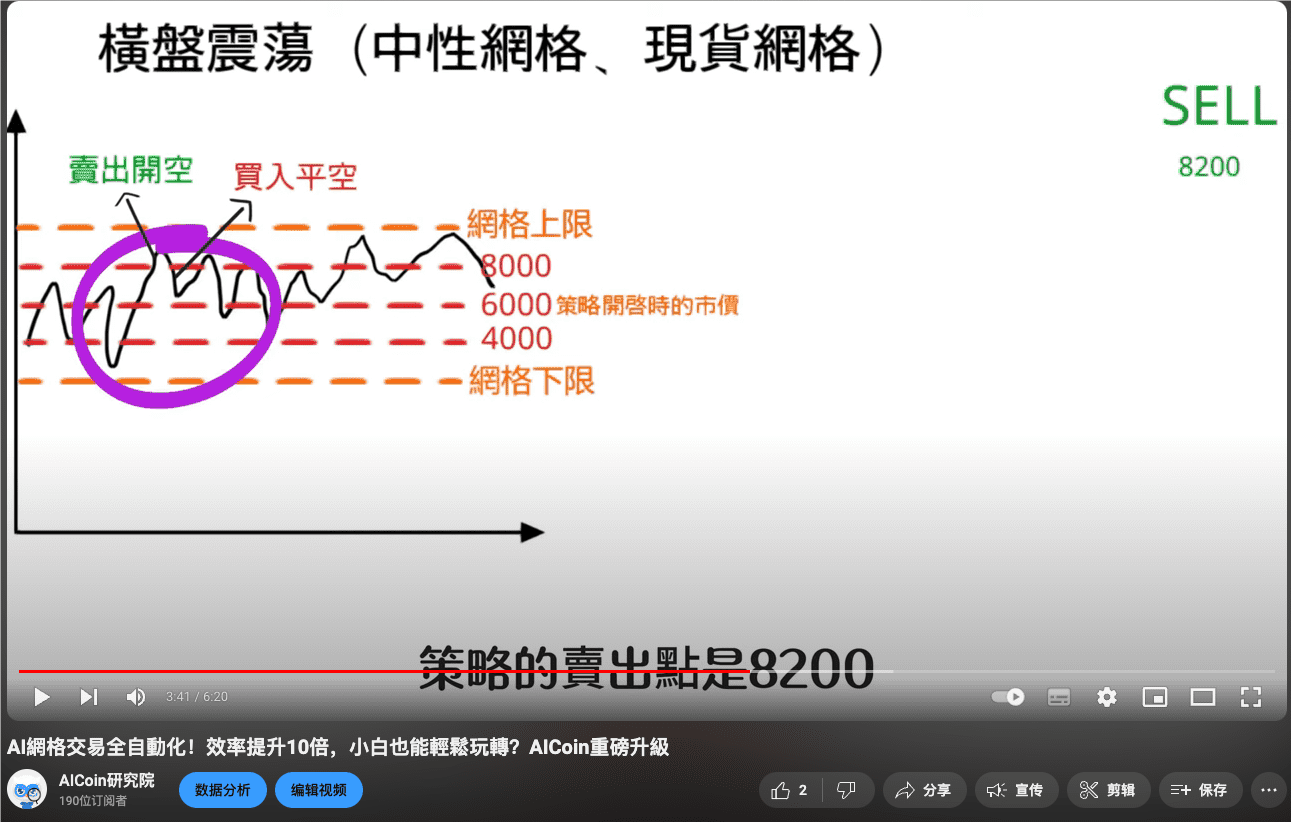

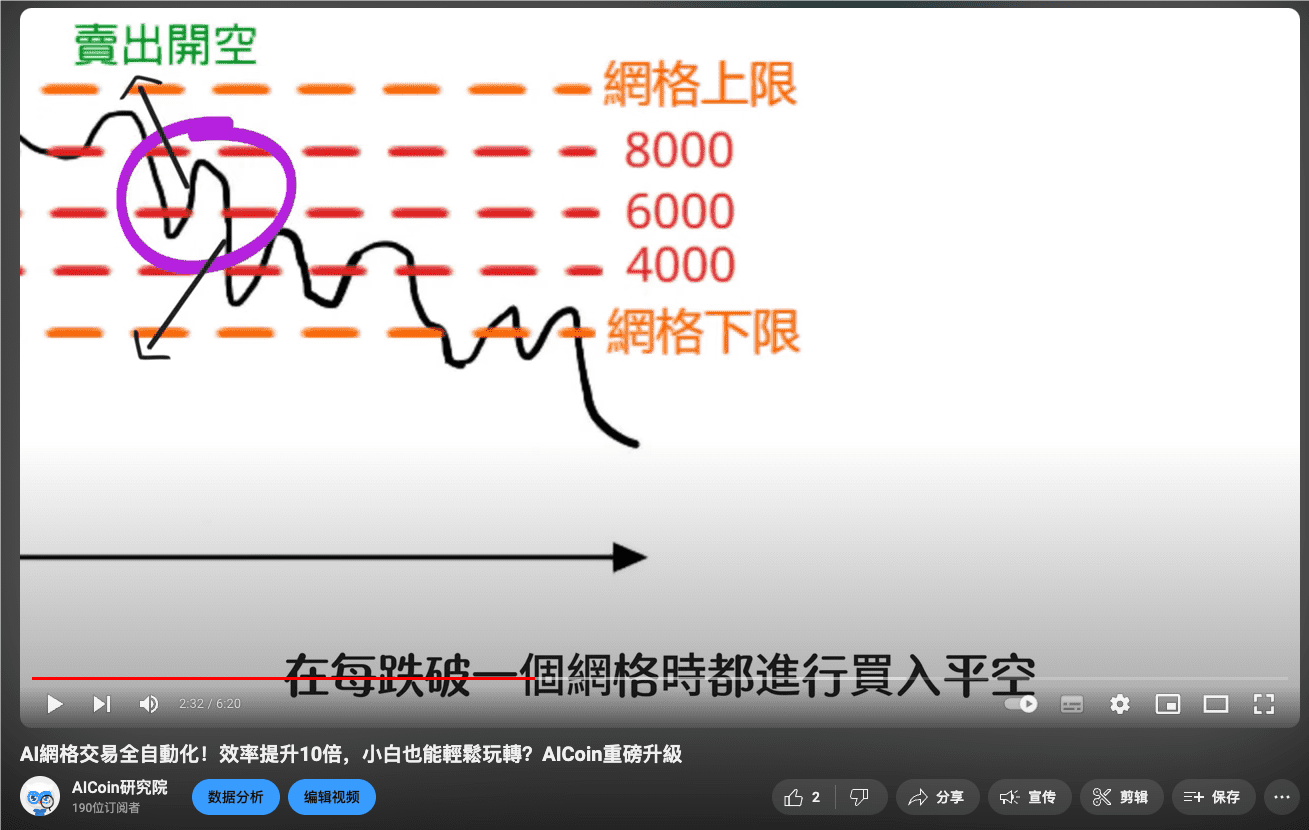

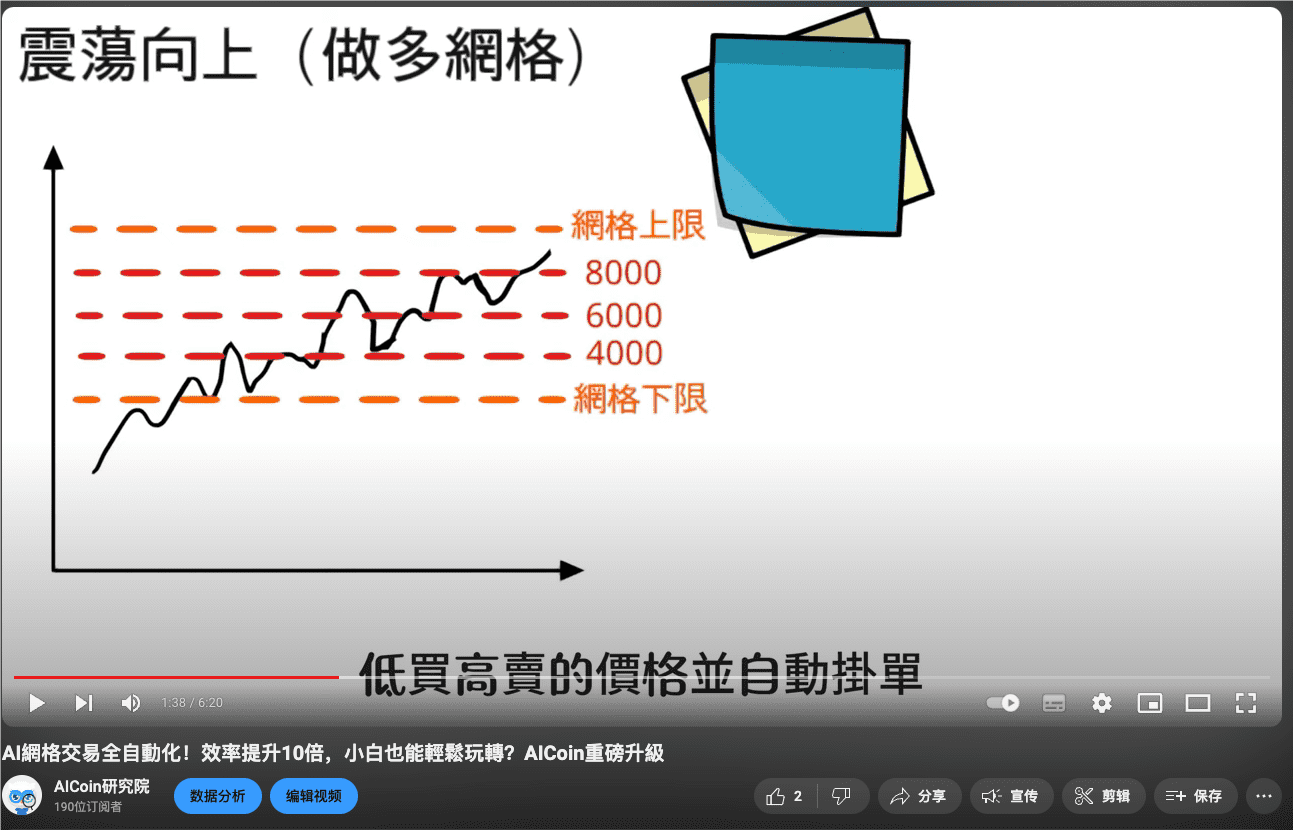

Grid strategies are divided into three categories, and different grid strategies are suitable for different market environments:

Long grid: suitable for bullish trends

Neutral grid: suitable for oscillating markets

Spot grid: suitable for stable returns

Because recently, BTC has been oscillating between 60,000 and 70,000, if you run within this range, it's basically profitable, which is the neutral grid. Some trend grids can also be created by yourself. For example, if you are optimistic about the positive impact of the US election on the cryptocurrency market, you can create a bullish grid that automatically goes long on dips. AICoin's grid tools will automatically help you with position management. If you are a novice, it is recommended to use default parameters; if you already have some understanding, you can try adjusting parameters and do some backtesting.

4. Reasons for Recommending Grid Tools

① Through research and extensive backtesting, we found that grid profits are consistently upward with minimal drawdowns;

② After real trading tests, grid tools are very suitable for retail investors and also for lazy investors, making money relatively simple.

③ The current market is in an uncertain stage, still in a long-short game, running a neutral grid, which means a mode of opening both long and short positions in oscillating markets, presents a greater opportunity for profit.

Please note that a one-sided trend is not suitable for using grid strategies. It requires regular adjustments to the upper and lower limits to ensure profit opportunities. However, it can help you automatically make money. Based on the current price trend, it is suggested to use the grid between 65,000 and 75,000, which offers greater opportunities for profit.

As for the principles, everyone should pay attention to our YouTube channel, where we will release a lot of educational tools: https://www.youtube.com/watch?v=Y6cLey8qnqU

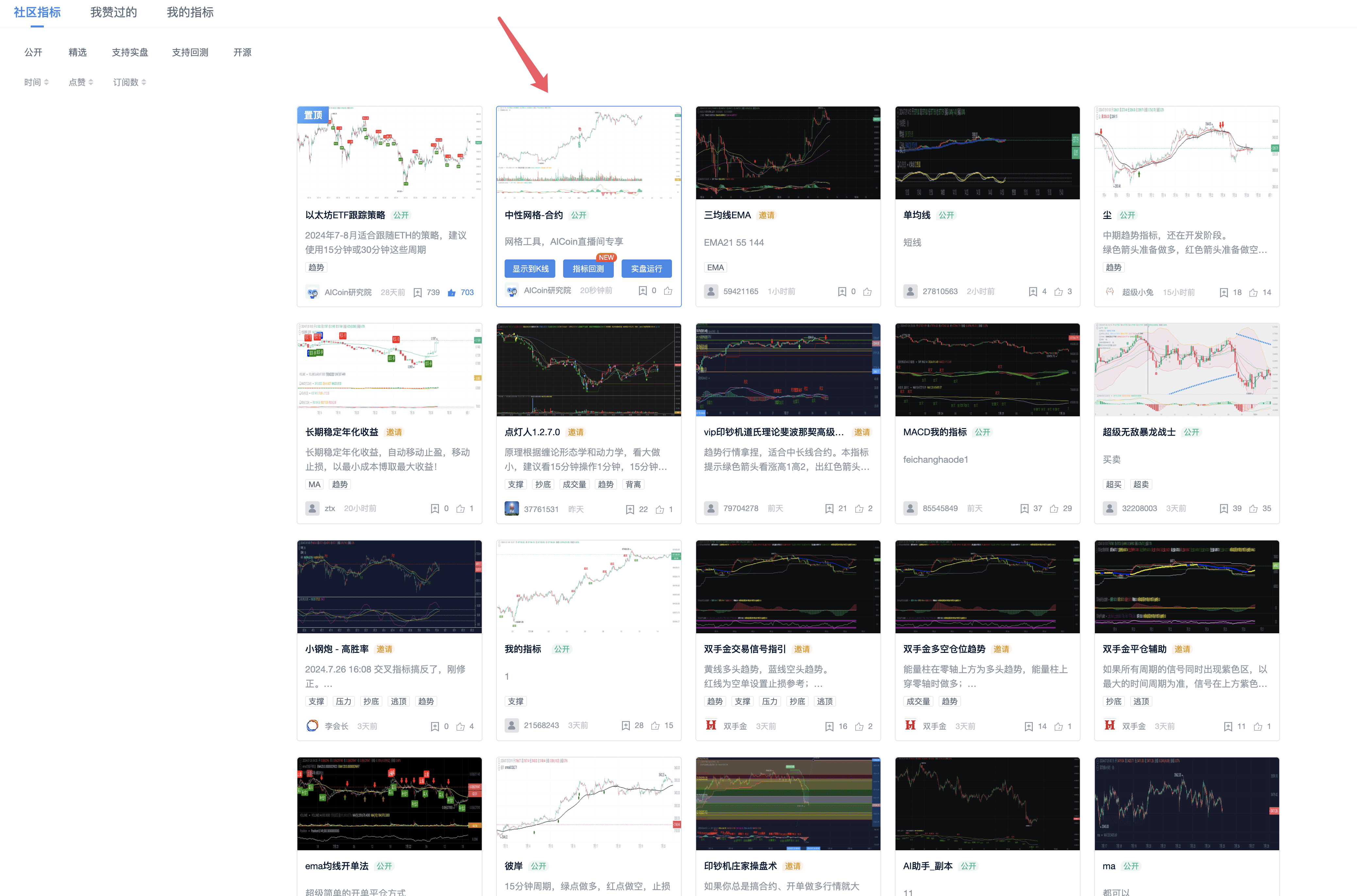

The grid code and tools have been released to the community. Feel free to subscribe to get more resources.

5. Position of AICoin Grid Tools

For any currency pair, AI grid:

Under the strategy module, spot contract grid:

In addition, the AICoin Research Institute has written a set of custom indicator backtesting analyses for everyone to analyze signals and backtest.

Feel free to subscribe to our YouTube account, where there will be many video tutorials for everyone to learn from:

https://www.youtube.com/watch?v=Y6cLey8qnqU

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。