First, review the article from yesterday. The master placed a short position in the 70,000-70,400 range. The market surged to around 70,081 in the evening and then dropped to around 66,300 in the early morning. The first target of 69,200 and the second target of 68,700 mentioned in the article for long positions were both accurately reached, resulting in a profit of 1,300 points from the pre-set short position.

Master's Hot Topics:

According to on-chain data, the U.S. government transferred 29,799 bitcoins from the Silk Road wallet to a new address, worth about $2.02 billion.

Many people interpreted this transfer as a sell-off, but it was actually the U.S. Department of Justice transferring the bitcoins to Coinbase for safekeeping.

In addition, the Ethereum spot ETF attracted $1.183 billion in inflows last week, but due to large-scale outflows from the Grayscale fund, the overall net outflow was $338 million.

The market's recent decline was mainly due to market panic triggered by the news of the U.S. government transferring bitcoins.

However, in reality, the U.S. did not sell bitcoins; it simply transferred them to Coinbase for safekeeping.

Looking at the data for Bitcoin and Ethereum spot ETFs, funds are still continuously flowing in.

Master's Trend Analysis:

BTC 4-hour chart:

After breaking through the high point last night, Bitcoin failed to hold its ground and experienced a significant pullback.

Currently, a large bearish candle has formed on the 4-hour chart, as it failed to stabilize after breaking through the high point. The price has returned to the range, reducing the likelihood of further rebound.

Therefore, when the price rebounds, it is necessary to pay attention to the trading volume and maintain the view of consolidation after the decline.

Resistance Levels:

First Resistance Level: 67,150

Second Resistance Level: 68,200

In the current downtrend, it is necessary to determine whether it is a correction phase. The price needs to rebound to the first resistance level.

If there is no trading volume during the rebound, there may be another pullback near the first resistance level. In the short term, the master expects a slow rebound.

Support Levels:

First Support Level: 65,700

Second Support Level: 64,000

A short-term rebound near the first support level is also a favorable short-term buying position. If the current selling pressure cannot be overcome, the possibility of further decline will increase. It is also possible to consider entering a position below the 120-day moving average and the ascending channel.

If the price threatens to drop to 66k, the master believes that it may further decline to 65k, so a smaller stop-loss should be set during the rebound.

Today's Trading Suggestions:

In today's trading suggestions, due to the strengthening of the bearish trend, the bulls need to wait for a short-term price stabilization before entering positions.

The chart is still within the ascending channel, so the view of a rebound can still be maintained. However, the RSI indicator shows a possible further entry into the oversold zone, so it is better to wait for a favorable buying position after the price drops.

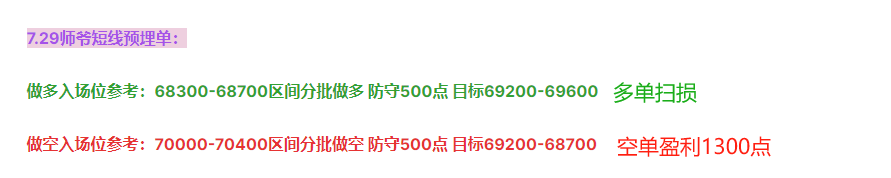

7.30 Master's Short-term Pre-set Orders:

Long Entry Reference: 64,000-64,400 range, staggered long positions, defend 500 points, target 65,700-67,000

Short Entry Reference: 68,200-68,600 range, staggered short positions, defend 500 points, target 67,150-66,000

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you need to learn more about real-time investment strategies, how to get out of a predicament, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. I hope to help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% following the trend; daily updates on macro analysis articles across the network, technical analysis of mainstream coins and altcoins, and spot medium to long-term replay price prediction videos.

Friendly reminder: Only the column public account (as shown in the picture above) is written by Master Chen. The end of the article and other advertisements in the comment section are not related to the author. Please be cautious in distinguishing between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。