Today's View: Bitcoin currently has the opportunity to form a high-level multi-level range trap, and long positions need to be cautious. If shorting, be prepared to make 2-3 attempts.

Bitcoin

Medium and Long-term Trend:

Bitcoin is currently running a rebound from the high level (starting at 63400). Continue to pay attention to whether the high-level rebound has ended, when it will end, and the sustainability of the uptrend.

Two possible trends to follow:

- The high-level rebound ends around 70000, followed by a high-level downtrend, testing support around 63000-64000.

- Strong buying (after building the center of this level), testing the 72000-74000 level upwards.

Short-term Trend:

There is a chance that the intraday uptrend at this level will end, and a subsequent downtrend at this level will be observed. If the downtrend does not break below 66600, then the uptrend starting at 63400 will end, and a high-level downtrend will follow, testing 63000-64000. If it does not break, a retracement at this level will form a center and continue to test the high point.

Ethereum:

Medium and Long-term Trend:

Short-term Trend:

The intraday uptrend of Ethereum is still ongoing, with 3400-3450 being a relatively strong resistance level.

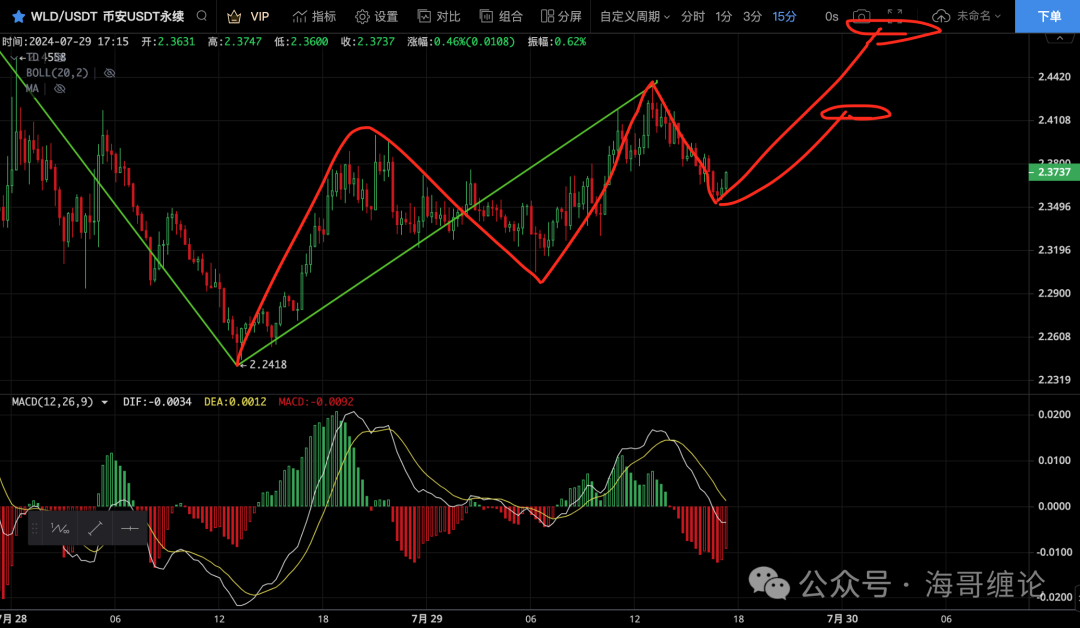

WLD:

Short-term view of WLD suggests a pullback, followed by choosing a direction, with support at 2.25.

SOL:

On a large scale, it may reach a relatively high level in the near future, with 200-210 being a resistance level.

The short-term intraday uptrend does not show divergence internally, and there is a chance for it to continue and test 200.

Ordi

It is not suitable to chase the rise at the current position of Ordi. Patience is needed for a retracement. If accompanied by a major Bitcoin retracement, Ordi presents an opportunity for a triple sell.

Disclaimer: Short-term market analysis is time-sensitive and is for reference only. Trade at your own risk. +\/-: haigechanlun888

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。