Layer3 can capture value while disrupting the historical relationship between advertising networks and products.

Author: JOEL JOHN AND SIDDHARTH

In March 2022, I first wrote an article about the aggregation theory in the context of cryptocurrency. Since then, I have closely observed the performance of aggregation platforms in several investment portfolios.

- Hashflow's trading volume has exceeded $18 billion.

- Gem was acquired by OpenSea.

- Layer3 has expanded to 4.5 million wallets.

Layer3 is particularly special because it was the last transaction I processed from LedgerPrime before the FTX collapse. I wish I could claim this was the result of a highly prescient prediction, but in reality, it was somewhat random. However, in hindsight, it is worth re-examining the aggregation theory and exploring the patterns that founders can leverage to scale their businesses.

In today's story, we are excited to collaborate with Layer3. They have generously opened up their internal dataset and provided us with the opportunity to connect with venture capital firms and their top users. Over the past few weeks, we have studied how a company can become an attention absorber, much like Google in the early 2000s. In today's article, I will first refute some of the points I made in 2022 and then explain the different efforts aggregation platforms must make when building scale.

We often think that consumer applications in cryptocurrency cannot scale. However, as a product, Layer3 has 4.5 million wallets and has completed 100 million tasks. In the process, they have driven nearly 120 million on-chain operations. The scale is here, it's just that these stories have not been widely disseminated or studied.

Today's article will take you through the internal workings that produce similar results.

The Power of Aggregation

Before the internet, the most challenging aspect of building any product or service was reaching customers. If you were making a consumer product, you could only sell it through physical stores. This inherently limited the number of consumers you could reach. The key advantage of the internet is its ability to aggregate global demand.

This aggregation has given rise to many well-known giants today: Google, Netflix, Amazon, and Meta, all of which follow some (if not all) aspects of the aggregation theory.

The supply chain has three key elements: suppliers, distributors, and consumers.

- Suppliers: networks seeking distribution, such as Google and Meta's advertisers, Amazon's retailers, and Netflix's content creators

- Distributors: channels through which the supply reaches the end consumers

- Consumers: the demand side of the network, the ultimate purchasers of the suppliers' products or services

Aggregation theory refers to integrating supply, distribution, and demand to improve processes, reduce costs, and increase efficiency. Aggregators have three characteristics:

- Directly related to consumers: platforms directly own consumers' time and attention. For example, consumers visit Amazon to purchase goods or visit Netflix to consume content.

- Zero marginal cost of serving new users: as more users join the platform, the platform does not incur incremental costs. For example, Spotify or Netflix can distribute their content to 100 or 1 million users without additional costs (excluding service infrastructure).

- Network effects: users go to the aggregation platform, making suppliers more willing to post on the platform, attracting more users due to increased supply. For example, users go to Amazon to purchase goods, which attracts manufacturers to sell through Amazon, which in turn attracts more users due to the diversity of supply.

Not all aggregation platforms have each characteristic. For example, although Amazon is an aggregation platform, it incurs marginal costs for serving each new user.

Ultimately, aggregation platforms gain immense value because they improve the efficiency and user experience of both sides of the market.

Now, let's turn our attention to cryptocurrency to understand emerging aggregation platforms. Its supply chain is as follows:

- Suppliers: the supply side in the crypto space consists of Layer 1 or Layer 2 blockchains and dApps with native tokens. The former seeks block space distribution, while the latter provides products to consumers. These participants are all pursuing efficient distribution to reach and acquire users.

- Distributors: distributors are any channels directly related to consumers. This includes wallets, exchanges, and emerging models we will further discuss below.

- Consumers: developers, institutions, or retail users with demand for block space or on-chain applications are consumers.

The market supply side is increasingly decentralized, with hundreds of Layer 1 and Layer 2 public chains and thousands of dApps. Many of these projects have raised tens of millions of dollars in venture funding and have funds worth hundreds of millions of dollars. These assets will be used for distribution, as all projects are vying to reach their target audience.

In a panel discussion in 2019, Chamath Palihapitiya pointed out that in venture capital, for every $1 raised, $0.40 flows to Google, Facebook, or Amazon. We believe this phenomenon will be replicated in the crypto space, except most teams will distribute their native tokens instead of cash. Another way to think about the total addressable market (TAM) is to look at the value of native tokens in protocol team treasuries.

As of June 2024, the top 20 blockchain ecosystems collectively hold tokens worth over $25 billion, specifically for distribution to users and stakeholders. With thousands of projects issuing their own tokens in the coming years, this value is expected to grow.

As the market value of these tokens rises, they will become the primary incentive tool on the internet.

We also believe that a few applications have the potential to become the primary distribution channels for such spending.

Today's article focuses on a company at the core of these factors. In our research process, we have spoken with several top users who explained that Layer3 has become the "Google of the crypto world" in the eyes of many new users. Users bookmark their page to find new products or simply find the right links they use frequently. In other words, this product has crossed the chasm of needing to retain users and has developed into a habitual product within the user base—a feat that few startups in the industry can achieve today.

Behind these behavioral patterns are some very robust business fundamentals. To understand these fundamentals, we need to go back to the beginning of 2022.

Wild Times

Before the collapse of Luna, 3AC, and FTX, the industry once believed it had crossed the chasm. Buying stadium naming rights was seen as a way to break into the mainstream. However, in user acquisition, the experience was quite fragmented.

Despite the public acceptance of cryptocurrency, most projects could not directly advertise on Twitter or Google. Product discovery still heavily relied on Twitter users discussing products.

The emergence of tokenized ownership has brought new dynamics to the industry. In the crypto space, tokens effectively act as customer acquisition costs (CAC). As the industry has evolved, these tokens have been used in various ways to acquire users. Initially, users were acquired through ICOs, then rewarded through airdrops, and finally incentivized through liquidity mining. However, these methods have proven to be inefficient.

New distribution channels, such as Layer3, have emerged and seek to distribute tokens in a more efficient way to attract users. This is where "task platforms" come into play. Their value proposition is simple: brands no longer spend money on advertising, but instead directly reward users.

Early adopters simply go to the task platform and spend their time when looking for new products. The more products users engage with, the higher the token rewards they receive.

Founding of Layer3

Layer3 was founded by Brandon Kumar and Dariya Khojasteh in 2021. For those who remember, Layer3's initial landing page read "Earn cryptocurrency by doing things." The basic premise was to create a protocol marketplace to leverage its token to coordinate user behavior. Interestingly, the website was built using the no-code platforms Webflow and Airtable and raised seed funding.

The platform has since expanded to become one of the fastest-growing aggregators in the industry. Driving this growth is a technology stack that addresses pain points in user identification, asset allocation, and user ownership.

Before joining Layer3, Brandon was an investor at Accolade Partners, a multi-billion-dollar asset management firm and one of the world's largest VC and PE capital allocators. His experience as an investor enabled him to manage the business's supply side well. Building relationships with protocol builders and cross-selling across dozens of VC-backed portfolios ensured a strong supply side for the network. Of course, this requires a world-class product, and this is where Dariya comes in.

Dariya is an experienced app developer who has previously developed and scaled multiple consumer apps. He has the ability to design the acclaimed user experience that Layer3 enjoys today. The thoughtful gamification and effective user experience strategies he implemented have brought an attractive and addictive consumer experience.

Essentially, Brandon focuses on the B2B aspects of the business, handling access to protocols, while Dariya focuses on the B2C aspects, attracting consumers. This complementary approach is key to building Layer3 into a leading aggregation platform.

Solving the Cold Start Problem

In the early days of Layer3, there was a classic "chicken or egg" problem. A discovery platform only has the ability to control prices once it has scale. Similar to aggregators in the traditional world, your ability to control value depends on what you have on the demand side. Amazon can negotiate better prices with suppliers because it has a large user base.

But what do you do when you don't have users? How do you compete in a field with multiple existing businesses? This was the challenge Layer3 faced in its early days. They knew that it would be difficult to control pricing before having enough users. Therefore, their initial focus was on guiding core believers.

Layer3's early tasks focused on newly launched protocols—applications of these protocols were still in their infancy, and users were exploring out of pure curiosity.

The initial tasks at Layer3 were about discovering and showcasing new products before they hit the market. The focus was on curation, not monetization. Users quickly flocked to the product because they knew it was a reliable source for finding cool things on-chain. A similar pattern emerged in the mid-2000s.

As users went online, Google gradually became the homepage for many users. Why? Because remembering websites is cumbersome.

You just visit Google and type in a query like "Face Book" to find the social network. In the process of researching this article, we encountered multiple users whose primary motivation for using Layer3 was to discover new protocols in a secure and enjoyable way.

One early strategy adopted by Layer3 was to run tasks specifically for certain protocols and then reach out to them to pitch the Layer3 product. This often caught the attention of founders as they noticed a large influx of users from third-party products, making them more inclined to collaborate with Layer3.

Unique data from Optimism Chain

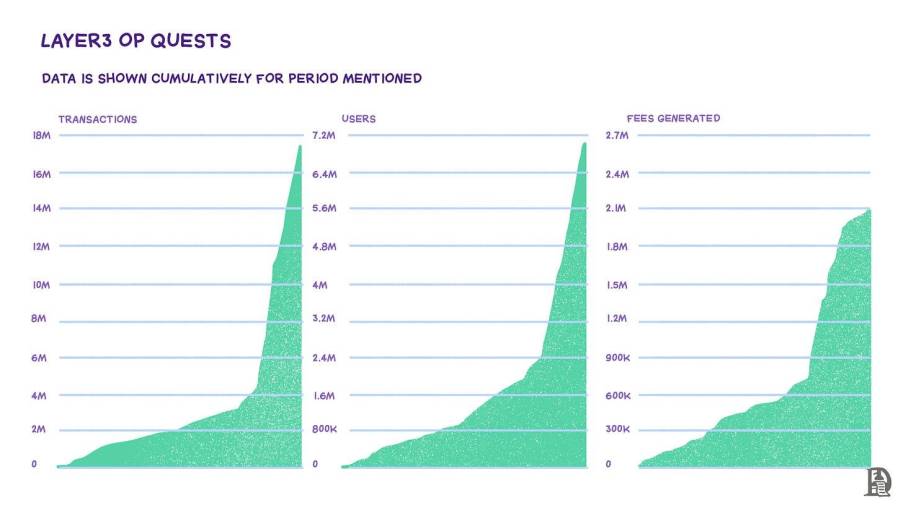

As of writing this article, Layer3 is one of the most used applications on Arbitrum, Base, and Optimism. As of June 29, they have helped users from 120 countries complete over 120 million on-chain operations. Nearly 4.5 million wallets have interacted with the product.

Today, Layer3 has driven the growth of 31 different chains and over 500 protocols, involving gaming, AI, DeFi, and NFTs.

According to the team, they receive interest from 60-90 protocols every month that are interested in joining their distribution network.

As mentioned above, without demand, it is impossible to attract the supply side of the network. Now, let's focus on user behavior and Layer3's relationship with the end consumers.

Aggregating Demand

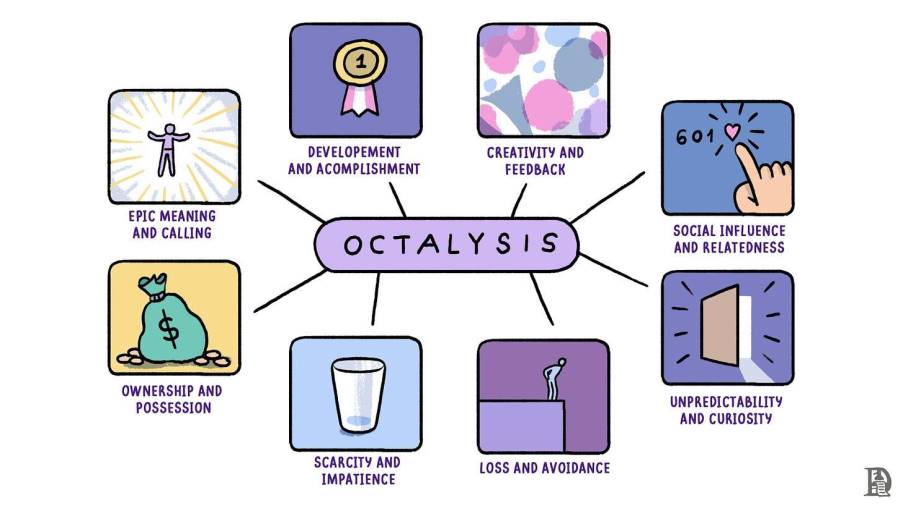

Layer3's impressive growth and engagement metrics did not happen overnight. In 2022, the company raised far less funding than its peers, but its thoughtful gamification allowed it to quickly scale. Layer3's platform heavily draws from the Octalysis framework, setting the benchmark for creating a leading consumer experience in the industry.

The Octalysis framework, developed by Yu-kai Chou, breaks down the complexity of gamification into eight core drives that inspire human behavior. It forms the basis for the Layer3 team's thinking about their product.

First, Layer3 inspires people's pursuit of epic meaning and mission by allowing users to own protocols and projects. This gives users a sense of contributing to something greater than themselves. The drive for development and accomplishment is addressed through the platform's XP system and reward center, where users can accumulate experience points by completing activations (tasks, contests, and winning streaks) to maintain a competitive edge and unlock more opportunities.

The drive for creativity and feedback is addressed by strategically using gems in the platform store to promote creativity and strategic planning. Ownership and possession are a significant focus, and Layer3 ensures that users have a strong sense of ownership over their digital assets and identity through CUBE and ERC-20 tokens. This will be detailed later.

This sense of ownership deepens user engagement and loyalty.

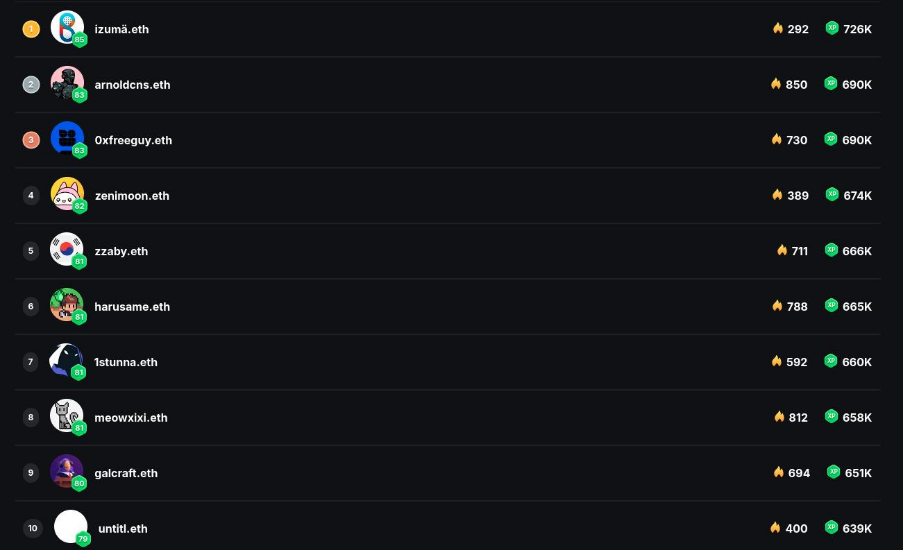

Layer3 Leaderboard. During the writing of this article, we interviewed several of their key users to understand their perspectives on the platform.

Social influence and affiliation are leveraged through the leaderboard feature, showcasing top users and creating a competitive environment where users strive to improve their rankings and gain recognition. Scarcity and impatience are created by implementing time or participant-limited tasks, contests, and limited season durations, encouraging users to take quick action to earn rewards.

Layer3 also utilizes unpredictability and curiosity, introducing treasure chests and loot boxes to entice users to continue interacting with the platform to discover the rewards they may unlock. Finally, the daily streak feature addresses the drive for loss aversion and avoidance, incentivizing users to return to the platform regularly to avoid losing progress.

Some of the platform's oldest users continue to use the product for over two and a half years, driven by the fear of losing their lead.

The Google of Crypto

When the internet first emerged, its profit potential was not yet clear. In the late 1990s, analysts speculated that the number of times people viewed a Microsoft loading page would be used to assess the likelihood of placing ads on that page. Attention was becoming digital, but the mechanisms to measure its value did not exist. As a large number of users began to concentrate on a few platforms, solutions emerged.

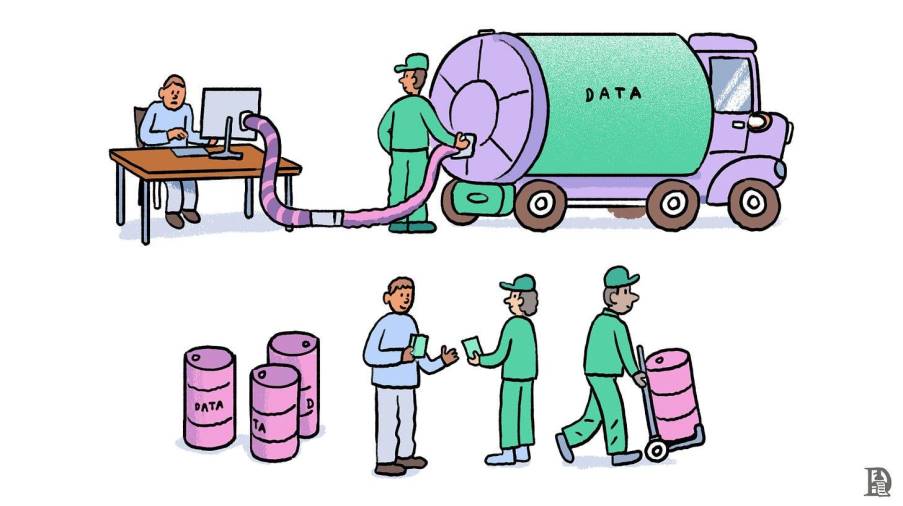

Google, Facebook, and Amazon created vast data islands that could predict users' emotions, preferences, and curiosities.

These datasets were isolated, and developers could not openly access and target users. Online advertising was like a tax paid to the platforms to attract users. The longer users spent on Facebook, the more likely Facebook was to show them ads. The more ads they saw, the more likely they were to make a purchase. Facebook had an incentive to keep users addicted for longer, as their revenue depended on it.

From 2010 to 2020, the internet became a honeypot for attention, keeping us glued to our screens.

Blockchain as a payment network enables advertisers to directly reward users

Incentive mechanisms often explain why systems operate the way they do. On Meta's Instagram, WhatsApp, or Facebook products, we shared the most intimate details. In the mid-2010s, we checked into restaurants, shared photos, and detailed our emotional states.

What we didn't know was that the platforms were incentivizing us to give up data, and we were completely unaware of what was happening.

As mobile devices became more powerful, the internet no longer needed us to log into their products. We leaked our data through Google searches, GPS coordinates, and sometimes even conversations.

Layer3 disrupts this model in two powerful ways.

Users Own Their Data

Unlike traditional advertising models, consumers on Layer3 own their data through CUBEs. These credentials are portable and permanently held by the users. Once issued, Layer3 cannot revoke them. CUBEs are ERC-721 tokens that users receive when they complete activations on Layer3. Each CUBE contains custom metadata that unifies a user's on-chain session data. This allows users to own their on-chain footprint and helps protocols better target suitable users.

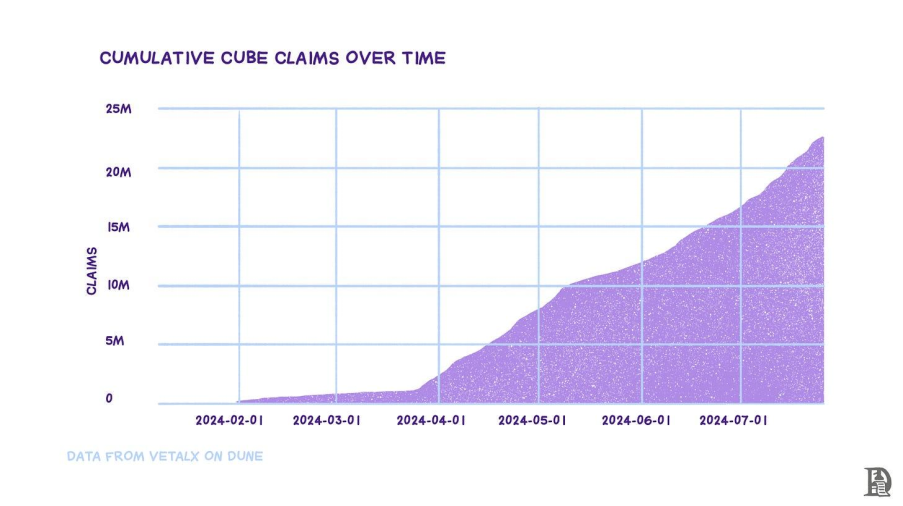

According to Growthepie.xyz (as of June 17, 2024), CUBE is the most popular NFT in Base, Optimism, Arbitrum, and zkSync, with over 1.5 million wallets owning Cube NFTs across the chains.

Cubes are on-chain credentials granted to users for performing certain actions

Good Unit Economics for Consumers

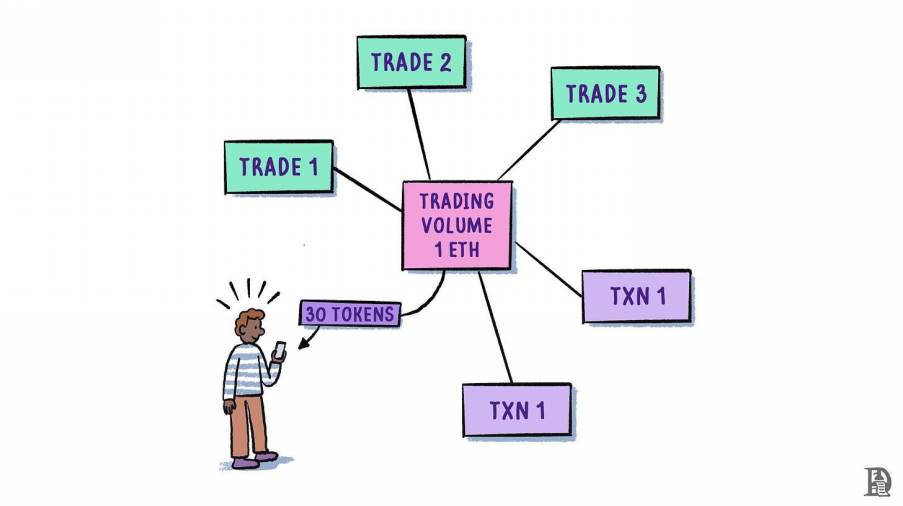

In addition to owning their data, users actually gain ownership of the protocols they use through Layer3. For example, if a consumer completes an activation on Optimism through Layer3, they receive OP. If they complete an activation on Arbitrum through Layer3, they receive ARB. This process is facilitated by Layer3's distribution protocol, which dynamically rewards users based on their on-chain footprint.

We will discuss this specific dynamic in the next section.

The result is a strong moat built around consumer adoption and attention, allowing Layer3 to attract a large audience and enable them to onboard more protocols, thus attracting an even larger audience.

A few years ago, Jesse Walden published a blog post titled "The Ownership Economy". The basic premise is that as individual contributions to platform value creation become more widespread, the next evolution is towards software built, operated, funded, and owned by users. This ownership is unlocked through tokens.

We believe in this future, but also acknowledge that it has not been realized until recently due to the lack of effective ownership distribution infrastructure. Mechanisms like airdrops and liquidity mining attempted to address this issue but performed poorly overall.

One of Layer3's core value propositions for protocols is to provide a more effective way to distribute tokens to acquire users. The protocol routes tokens through Layer3 to reach the right users at the right time.

The Milestones feature allows developers to require users to complete a series of actions over time to earn rewards

Furthermore, last month, Layer3 launched a product called Milestones. The product observes user behavior over time and rewards users not for a single transaction, but for multiple activities. For example, users may need to lock funds in a smart contract for 30 days or make five trades on Uniswap within a month.

Unlike traditional airdrop models focused on a single event or cumulative transactions, Layer3's Milestone product allows developers to mix and match on-chain interactions that drive value.

To me, this highlights a key difference between scaled enterprises in Web2 and scaled enterprises in cryptocurrency. Unlike Google or Meta, Layer3 has almost no monopoly on its users' data. As mentioned earlier, anyone can query it. They don't even monopolize how users gain value. Anyone can query CUBE holders and send them tokens. Layer3 accumulates value through two primary means:

Long-term User Relationships: Transactions on the blockchain cannot be forged. Layer3 is able to manage users through its platform's exploration of years of transaction data, which is an important moat.

Planning the Best Products: Their ability to plan the best products comes from their user scale. In the early days, they had to reach out, but today, products reach out to them. In multiple user interviews we conducted, users often mentioned their trust in Layer3 as a product discovery engine. As of the writing of this article, Layer3 has partnered with nearly 500 different products.

Users benefit greatly from this model.

In the Web2 advertising model, users benefit very little from the multitude of products they face. They spend the most scarce asset—time—hoping to find relevant content. Layer3's approach is the opposite. Products compete for token rewards to attract user attention. The more valuable the user, the higher the reward.

This bidding for users also happens in Web2, but most of the value is captured by platforms like Google rather than the end users.

In contrast, Layer3 passes most of the value to the end users. Now, you might ask, "What sets Layer3 apart from other similar products?" Remember when I explained the community theory in crypto needs communities? That's a major factor. In products that form large communities, part of the reason users keep coming back is their loyalty and relative status within the community. This translates into long-term, timestamped proof of on-chain activity by users.

Of course, you can find a million active wallets using tools like Etherscan. But to find a carefully curated list of users with timestamped proof that they were early adopters of new products and have a platform where they can be found, you need a platform. That's where Layer3 currently stands.

While researching this article, I stumbled upon a blog post by one of Layer3's founders. Dariya wrote an article on his personal website titled "Attention Is All I Have." In a paragraph at the end of the article, he detailed the reasons for Layer3's moat.

Attention, coordination, and distribution are all interconnected. Can you touch a crowd and get them to do things that are beneficial to your ecosystem? Several analogies can reinforce this point: attention is oil, distribution is kerosene, coordination is gasoline. On the internet, value usually only accumulates on platforms that aggregate your attention.

But at Layer3, our goal is to disrupt this phenomenon. You own the network, you accumulate value. Projects directly or indirectly distribute value to you, as demonstrated by Layer3 users capturing 20.4% of the entire Arbitrum airdrop. In the past sixty days, over twenty projects have directly distributed rewards through the protocol.

In other words, Layer3 can capture value while disrupting the historical relationship between advertising networks and products. To me, this is the definition of a disruptor.

Moats, Value, and Habits

In my years of writing, I've come to understand that cryptocurrency will become a value network. The core of blockchain is facilitating value transfer. The primary use case is transactions that can occur globally. Layer3 serves 4.5 million wallets in nearly 120 countries/regions, making it the most fully functional and scalable "value transfer network" I've seen.

During the evolution of the network, advertising was a necessity to enable billions of users to use the internet. But we've moved past that stage. Users are here today. What we need now is a better form of monetization and targeting. Layer3 happens to be at the intersection of this transition—from an attention network to a value network. We're transitioning from a time when users contributed time and data to a time when users own data and derive economic value from it.

If users can gain value (in the form of tokens or NFTs), then platforms will inevitably have to compete to provide the best returns. This is where Layer3's business model has a strong moat.

With the number of people currently using their product, Layer3 will be able to continue attracting users and building incentive mechanisms for them. Large protocols like Uniswap may not have the incentive to work with new task platforms with fewer than 100,000 users. But what if you can target 5 million wallets?

In terms of scale, that's the size of the entire DeFi market in 2021. That's where Layer3 is positioned. Similar examples are the front pages of Google Play or Steam in early 2012.

This will change how developers view releasing applications. Products released in the form of cryptocurrency often face the cold start problem—finding the initial sticky user base to collect data is very difficult. Historically, products would work with well-known networks like Polygon or Solana to address this issue. However, with platforms like Layer3 providing distribution from day one, the reliance on networks is greatly reduced.

Developers can use Layer3 to conduct advertising campaigns, find core user groups, and reward them for being early adopters. In my view, this is the Google Ad Manager moment for cryptocurrency—developers realize they can effectively allocate resources to platforms that provide meaningful targeting, rather than investing in KOLs.

Of course, such targeting also has its advantages. Layer3's operational scale means they can expand into their own product verticals. They can integrate with exchanges, with hundreds of millions of dollars flowing back and forth as users exchange tokens within their product. They can even launch their own exchange or launch platform.

High attention is greater than liquidity. Layer3 largely aggregates the former. The more transactions users conduct within their ecosystem, the larger the surface area of their increased lifetime value. The natural extension is to expand into verticals where users have demand. For example, Jupiter will extract 1% from token supply to issue new tokens.

What's stopping Layer3 from doing the same? It will create a flywheel, where users flock to use the product, hoping to participate in new projects early, and new projects will use Layer3 to help achieve scale.

Around 2003, Google decided to only do web indexing. Over the next five years, they went public, launched GMail, acquired YouTube, and acquired Android. These moves laid the foundation for the internet as we know it today. Google's drive was that more and more attention was flowing into the network and waiting to be monetized. Google's positioning helped identify these acquisitions through recognizing trends. That's the advantage of positioning.

Layer3 is also in a similar advantageous position. They have the incentive to expand into new verticals because they can clearly see where users are spending the most time and resources. While blockchain data is public and anyone can see it, not everyone can activate the same user groups because they lack a direct relationship with users like Layer3.

Layer3 has the distribution capability needed to launch new product lines and expand value. The only thing missing is time and the compounding effect that comes with it.

When I met Brandon at TOKEN2049 in Dubai, one of the issues we discussed was how many of today's protocols will continue to exist in the next ten years. This perspective reflects Brandon and Dariya's view of their business. Most founders are concerned about the price of their tokens next quarter; these people are playing a game that lasts for ten years.

This doesn't mean that Layer3's future is all rosy. Building a value network requires developers to accept token incentives in exchange for usage—a mature business model that has not yet been widely reported. As other consumer areas like artificial intelligence gain public attention, the on-chain user market may shrink, or the number of protocols willing to work with Layer3 may saturate.

All of these are real challenges. But if there are any signs from Layer3's operations over the past two years, I bet Brandon and Dariya will continue to exist in the next ten years, continuing to realize their vision of tokenized attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。