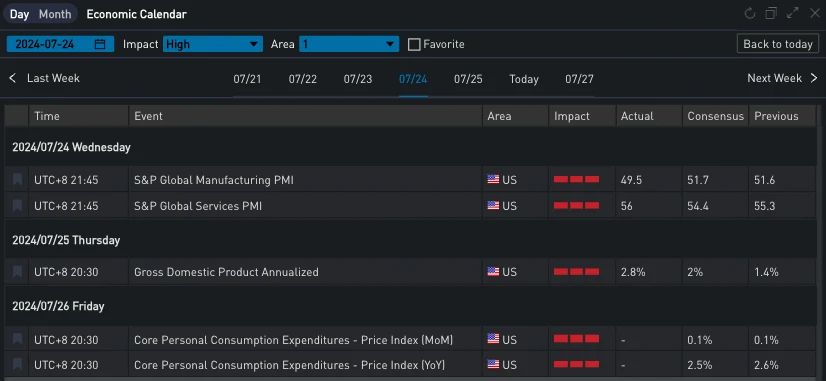

In the past two days, concerns about the impact of the AI investment bubble in the traditional market on technology stocks have caused a collective decline in US stock indices and also put pressure on cryptocurrency prices. In addition, strong GDP data from the United States (recorded at 2.8%, expected 2%) and allegations of market manipulation against Bitfinex and Tether have cast a shadow over bullish sentiment.

Source: SignalPlus Economic Calendar

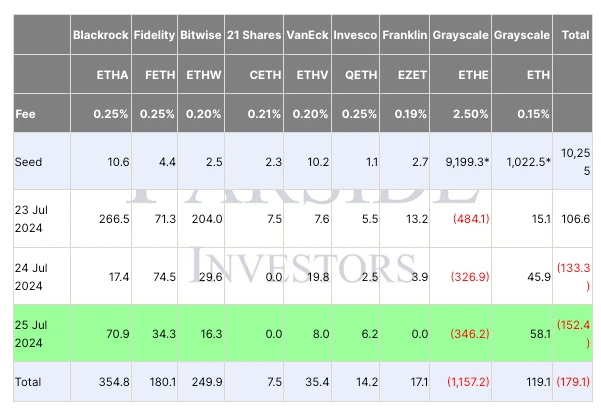

These past two days have been particularly difficult for ETH. Despite the inflow of funds from the three giants on the first day of the ETF listing offsetting the selling pressure from Grayscale, the selling of ETHE has not slowed down in the past 48 hours, and the inflow of funds from other products has been diverted, resulting in net outflows of $152 million and $133 million, respectively. ETH once dropped to around 3070, giving back nearly half of the gains from the rebound in early July, and has rebounded slightly today to around 3250. However, some analysts are optimistic about the eventual inclusion of the collateral function for ETH Spot ETF, believing that this will enhance the attractiveness of the ETF and prompt the market to reconsider and balance the possibility of short-term risks and potential long-term returns.

Source: TradingView; Farside Investors

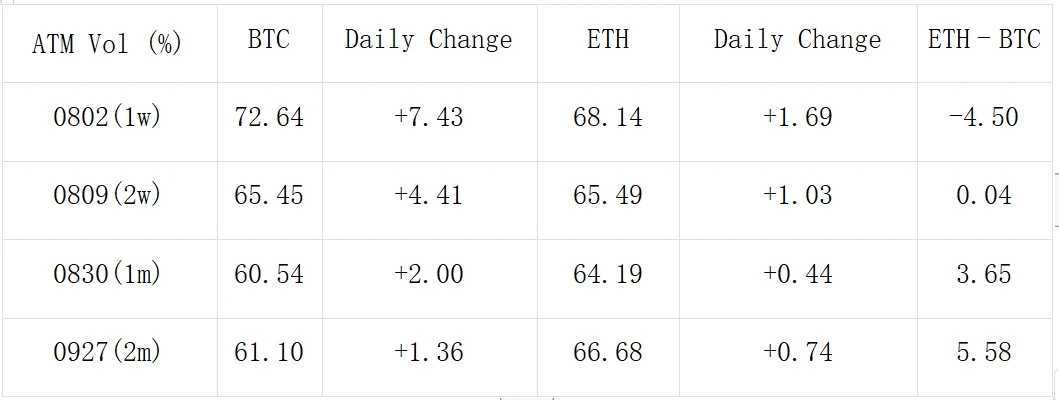

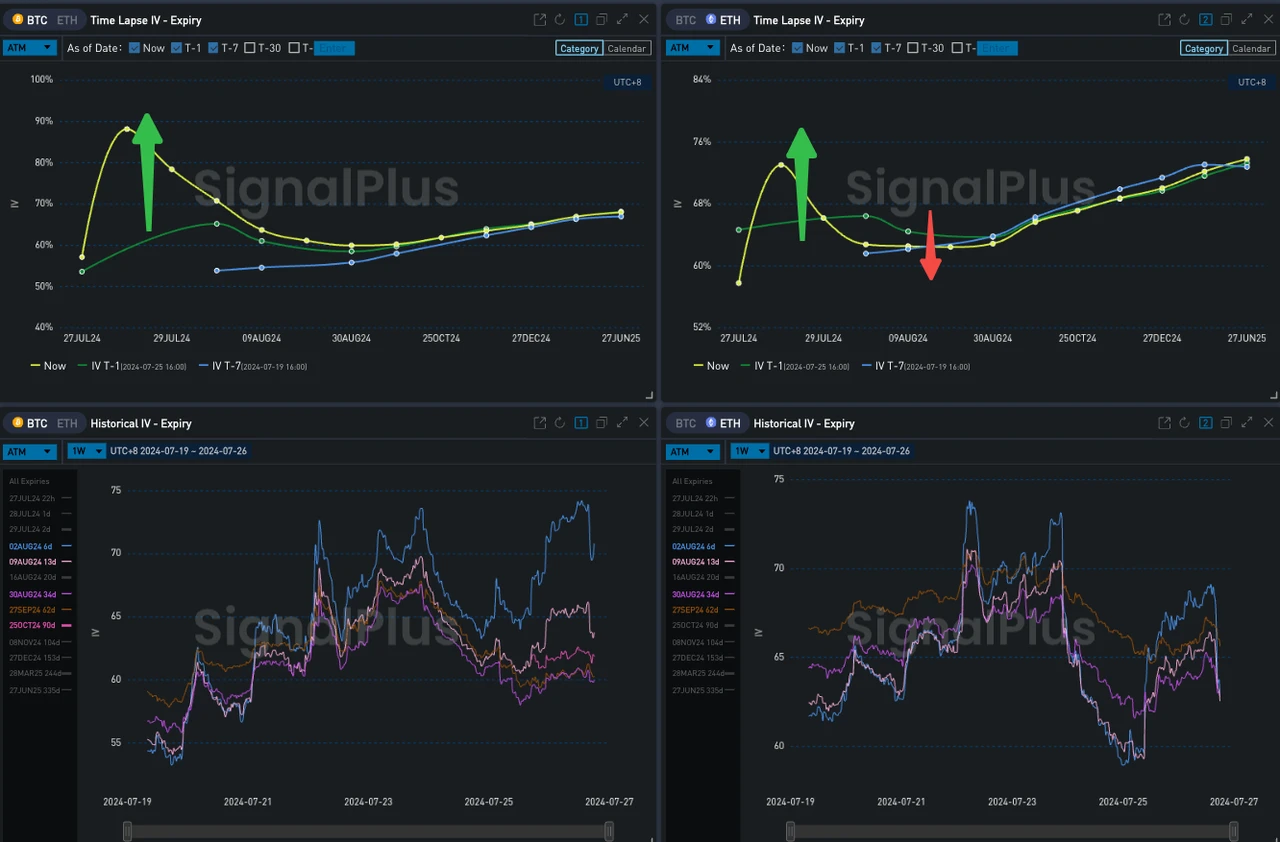

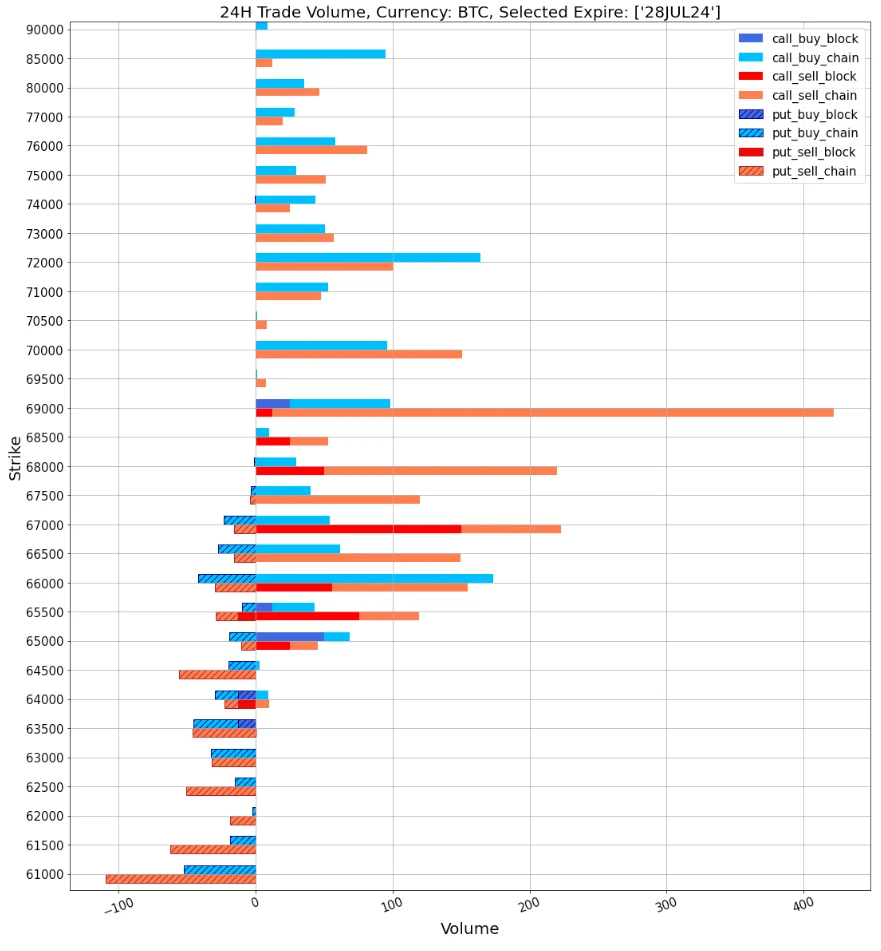

In terms of options, the 28JUL24 options that were settled on the day of the 2024 Bitcoin Summit were well received by the market as soon as they were launched. The market priced in extremely high volatility expectations into the Forward IV for that day, with ATM VOL priced at a high point of 90%. At the same time, the curve of Vol Skew surged significantly due to the market's positive expectations, leaning towards call options. However, such a high Vol Premium also attracted the attention of traders, and there was intense selling of the 67000/68000/69000 calls (see trading distribution in the image below).

Source: Deribit (as of 2MAY 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

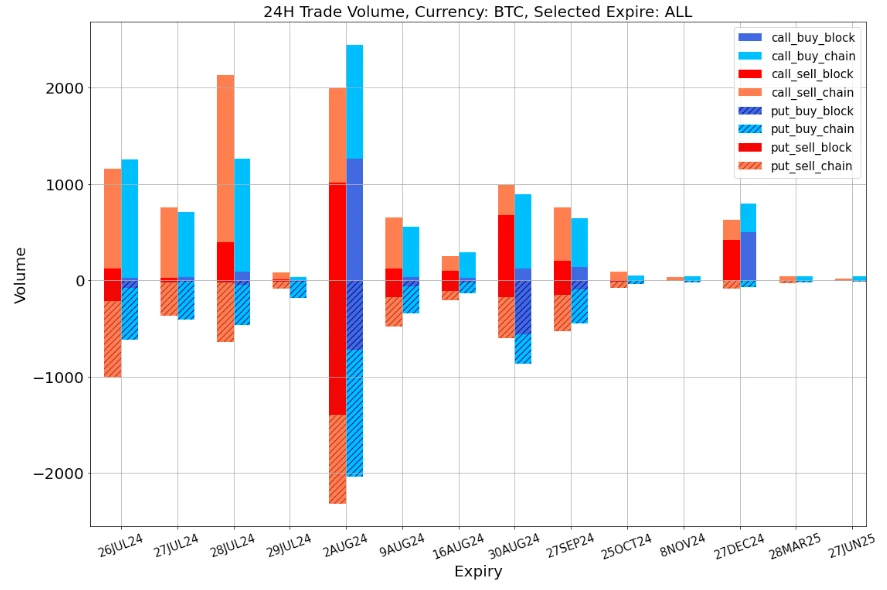

Data Source: Deribit, BTC Overall Trading Distribution

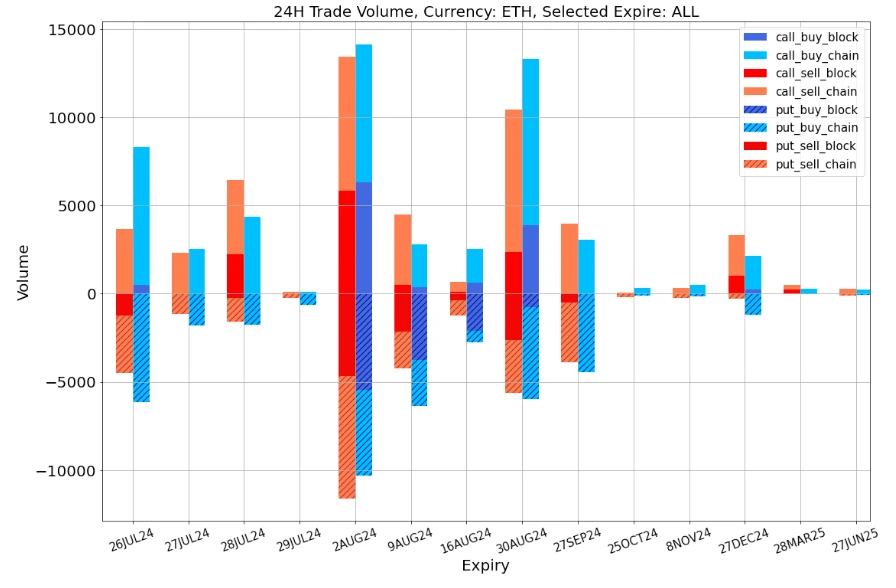

Data Source: Deribit, ETH Overall Trading Distribution

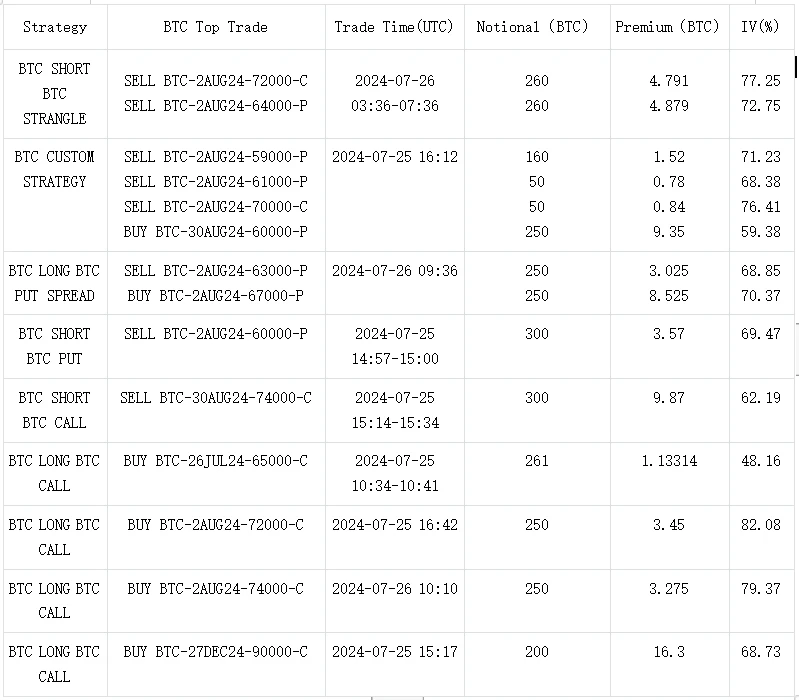

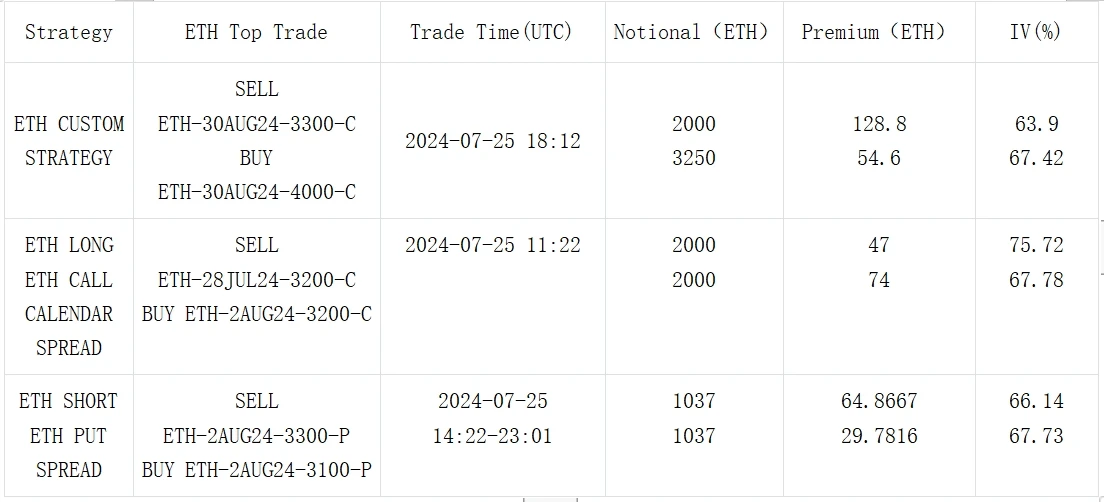

Source: Deribit Block Trade

Source: Deribit Block Trade

You can use the SignalPlus trading compass feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。